December 2024

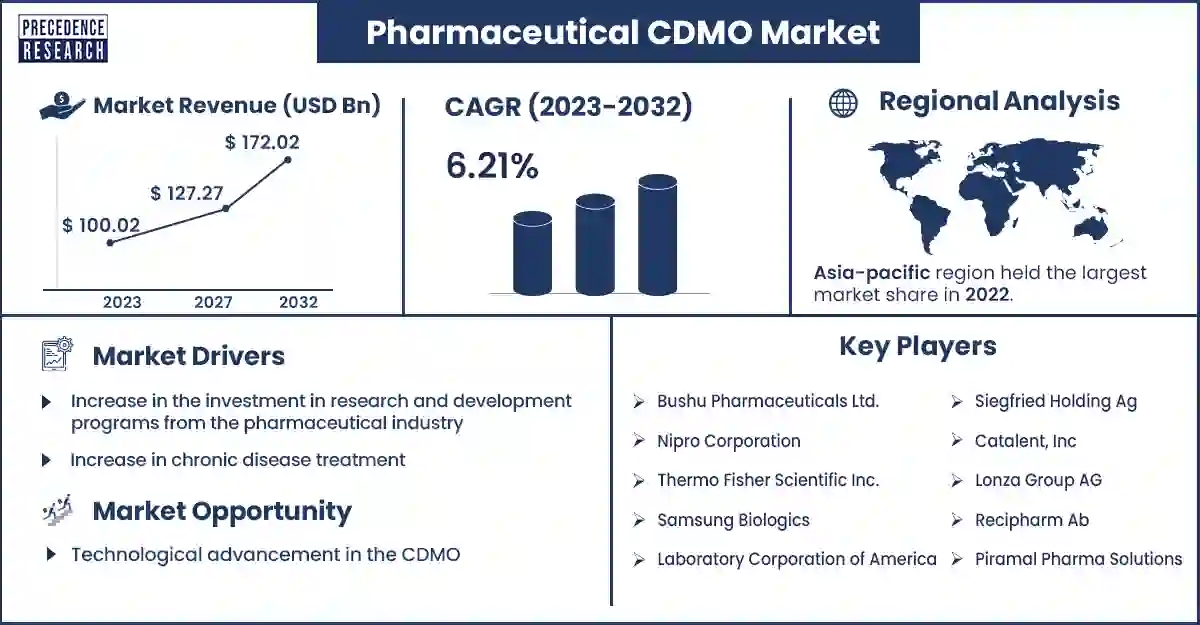

The global pharmaceutical CDMO market revenue was valued at USD 173.20 billion in 2023 and is expected to attain around USD 345.60 billion by 2033, growing at a CAGR of 7.2% during the forecast period. The increasing investments in drug development, rising demand for novel therapies, and genetic drugs, and the rising prevalence of cancer and age-related diseases boost the growth of the market.

Contract development and manufacturing organizations (CDMOs) offer a range of services, such as commercial manufacturing, packaging and labeling, research, and drug development, assisting pharmaceutical companies in developing drugs. Drug development is a complex procedure that requires substantial investments in additional infrastructure. However, partnering with CDMOs allows pharmaceutical companies to outsource the manufacturing process. CDMOs also help pharmaceutical and biotechnology companies create innovative formulas, ensuring products reach the market quickly.

The rising demand for biosimilars, biologics, orphan drugs, and personalized medicine significantly drives the pharmaceutical CDMO market. Outsourced services from CDMOs further allow pharmaceutical and biotechnology companies to save resources and focus on core areas, reducing costs associated with drug development. The increasing research and development activities and clinical trials by the pharmaceutical industry drive market growth. Moreover, various leading pharmaceutical companies are establishing CDMO facilities to meet the increased demand for outsourcing.

Asia Pacific dominated the pharmaceutical CDMO market with the largest share in 2023. This is primarily due to the increase in the number of clinical trials registered and the rise in demand for cell and gene therapies. China and Japan are major contributors to market expansion. With the increase in the prevalence of chronic diseases, the demand for personalized medicines has increased. In addition, a strong emphasis on drug discovery and development contributed to the region’s dominance.

On the other hand, Europe is projected to experience the fastest growth in the market during the forecast period. This is mainly due to the increasing demand for outsourcing services among pharmaceutical companies to reduce costs associated with drug development. There has been significant growth in R&D activities to discover novel drugs. Moreover, technological advancements, strict regulatory requirements, and high demand for injectable drugs contribute to regional market expansion.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 184.90 Billion |

| Market Revenue by 2033 | USD 345.60 Billion |

| CAGR | 7.2% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Service Type

By Research Phase

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2936

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025