April 2025

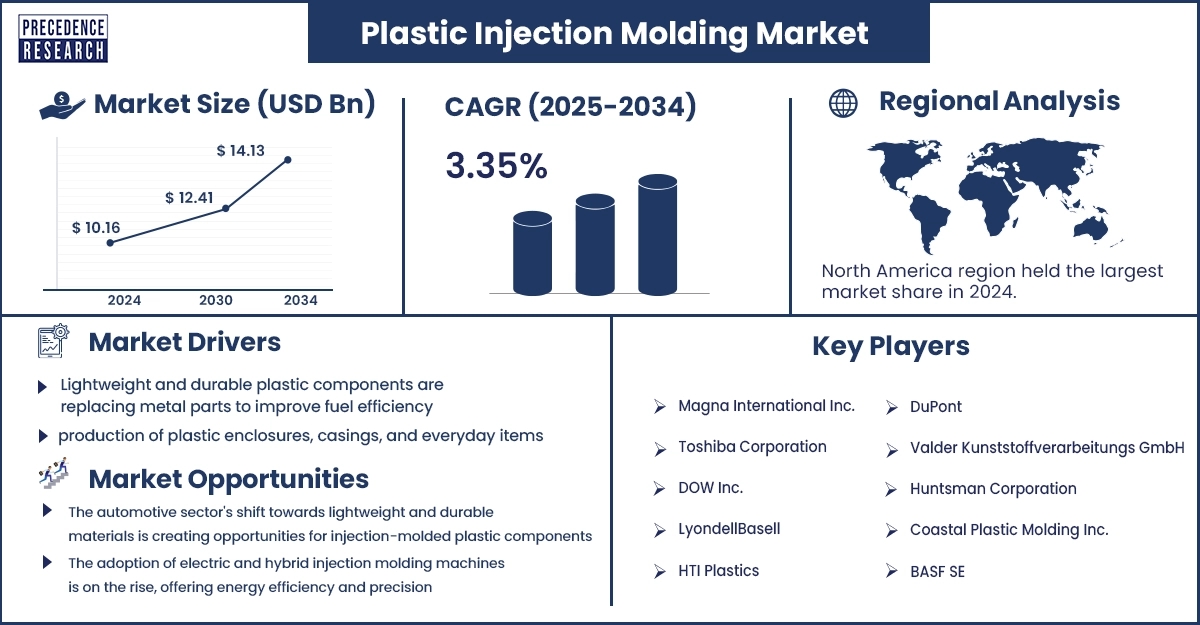

The global plastic injection molding market revenue reached USD 10.50 billion in 2025 and is predicted to attain around USD 13.70 billion by 2033 with a CAGR of 3.35%. The increasing demand for lightweight, durable, and recyclable plastic products is driving market growth.

The plastic injection molding market encompasses a wide range of applications, including automotive, packaging, consumer goods, healthcare, and electronics. High-precision components emerge through cost-effective and efficient manufacturing since molten plastic receives injection into molds. Rising market demand centers on lightweight, durable, and recyclable plastic products as a primary factor for market advancement. The industry benefits from modern technology that includes automated injection molding machines and artificial intelligence systems for quality assurance, which produce higher efficiency and sustainable practices.

The implementation of automation produces major advancements in production performance together with better product quality results. In 2023, 43% of the 2.18 million tons of bioplastics produced were utilized for packaging, emphasizing the increasing acceptance and application of bio-based polymers in this industry. According to European Bioplastics, the critical position of plastic injection molding throughout industries becomes evident as advancements continue to enhance innovation together with sustainability goals.

Raw Material Type Insights

Application Insights

Rising Demand for Sustainable Plastics

The global push for sustainability has forced manufacturers to substitute their resin production with environmentally friendly alternatives that support international sustainability targets. Forecasters predict biodegradable plastics will reach a demand of 550,000 metric tons during 2023 as sustainability alternatives gain more support worldwide. The U.S. Environmental Protection Agency (EPA) launched the National Strategy to Prevent Plastic Pollution in April 2023, aiming to prevent all plastic waste from reaching the environment by 2040.

Through technological innovation, companies produced materials such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) that industry sectors are utilizing because of their wide-ranging suitability. The packaging sector presently pursues biodegradable plastics as sustainable options to replace existing materials at a fast pace. The collaborative work between different organizations indicates a major global change in the direction of environmentally friendly plastic solutions.

Technological Advancements in Automation

The integration of AI and IoT-enabled systems is enhancing production efficiency, reducing waste, and improving quality control in the plastic injection molding market. The manufacturing sector began using Internet of Things devices in 2024 to remotely manage injection molding equipment, enabling real-time data acquisition, process optimization, and downtime reduction.

Facilities now use predictive maintenance systems developed through AI technology to foresee equipment breakdowns, which enables them to perform timely repairs, thus decreasing maintenance expenses and unanticipated downtimes. Information technology in manufacturing concurrent with AI and IoT development results in operational efficiency alongside sustainable outcomes that reduce waste while maximizing both material and operational resources.

Expanding Medical Applications

Medical applications are increasingly using precision-made injection-molded components for surgical instruments along with diagnostic devices and prosthetic devices because of their suitability for biomedical use. The U.S. Food and Drug Administration (FDA) accepted ASTM F2989-21 in 2023, as it defines standards for unalloyed titanium surgical implant components produced through metal injection molding.

The FDA acknowledgment of medical standards emphasizes ramping industry dependence on injection molding for developing high-quality medical products. The latest injection molding advancements drive the development of intricate customized prostheses, which extend benefits to patients by delivering improved results and better comfort. Injection molding capabilities enable developers to generate surgical instruments that minimize invasive procedures, which leads to accelerated patient recovery and better surgical accuracy.

Growth in Electric Vehicle (EV) Production

Degrees of lightweight high-performance plastic elements rise within the automotive industry since it shifts into electric vehicles (EVs) due to their usage across vehicle interiors and battery casings and structural components. Electric vehicles approached a global sales total of 14 million, which amounted to 18% of worldwide vehicle sector sales in 2023, and 95% of these sales originated from China, Europe, and the United States.

Manufacturing operations today introduce advanced plastic materials to decrease vehicle weight for better energy efficiency and longer driving capabilities. BMW i3 integrates carbon-fiber reinforced plastic (CFRP) within its framework, which lightens the vehicle while upholding its structural strength. Plastics maintain flexibility for creating new EV interior designs that enhance both performance and visual qualities. Advanced plastic materials play an expanding and crucial role in the EV market to achieve its performance and sustainability targets.

Asia Pacific led the global plastic injection molding market with the highest share due to rapid industrialization, expanding consumer markets, and government initiatives promoting sustainable manufacturing practices in countries such as China, India, and Japan. The Indian cabinet approved a budget of INR 229.19 billion (USD 2.68 billion) in March 2025 to develop electronic components manufacturing, which aimed to generate 92,000 direct jobs, especially for telecommunications, automobile, and energy sectors.

The Indian government eliminated the import tax on essential EV battery and mobile phone manufacturing materials in March 2025 while simultaneously supporting local production and export competitiveness. Private firms operating under India's key manufacturing scheme attracted USD 19 billion worth of investments, which led to USD 163 billion in products being produced during November 2024 while reaching 90% of its target for the 2024/25 fiscal year.

Japan will establish a 2040 strategy for decarbonization and industrial policy development during May 2024 to improve previous strategies and ensure predictable long-term investment opportunities and create enhanced competitiveness for domestic firms with economic growth objectives. The region demonstrates its dedication to sustainable industrial development through these initiatives as part of its economic expansion goals.

Europe is expected to host the most opportunistic plastic injection molding market during the forecast period, owing to its continued lead in sustainable plastics adoption, driven by stringent environmental regulations and increasing investment in circular economy initiatives. The 2020 European Commission Circular Economy Action Plan consists of detailed strategies to redesign products and develop circular material processing and encourage sustainable usage in order to maintain resources active within EU economic systems for maximum duration.

The European Union has established restrictions on purposefully added microplastics through the entry of REACH restrictions that start enforcing on October 17, 2023, to combat pollution. "The Circular Economy for Plastics – A European Analysis" presents its 2024 version, which explains European plastics production, including conversion, consumption, and waste management, and emphasizes both the evolution of recycling technology and the adoption of non-fossil-based resources. Multiple entities are working together to establish Europe as an active leader in developing plastic systems based on sustainability and circularity.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 10.50 Billion |

| Market Revenue by 2033 | USD 13.70 Billion |

| CAGR | 3.35% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Raw Material

By Application

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/1488

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

April 2025

December 2024

January 2025

April 2025