March 2025

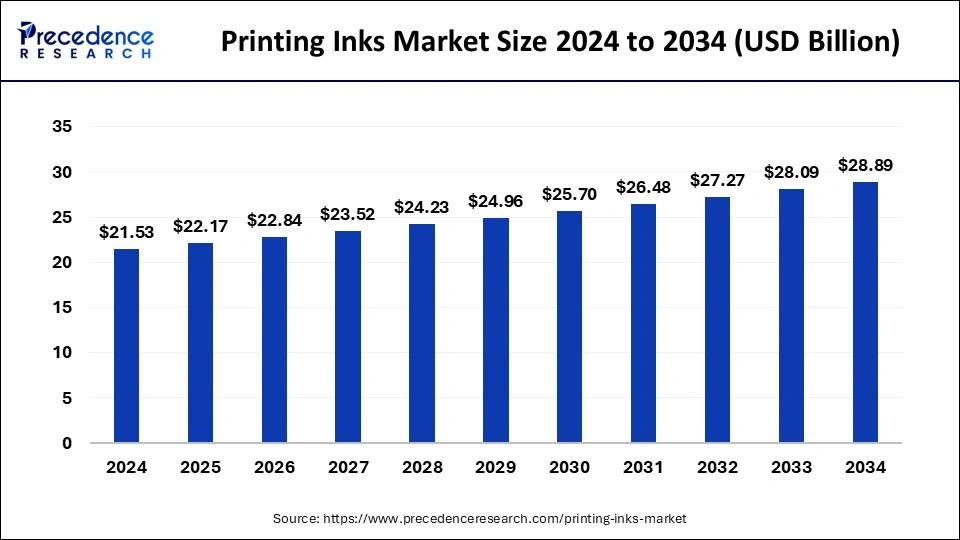

The global printing inks market size is calculated at USD 22.17 billion in 2025 and is forecasted to reach around USD 28.89 billion by 2034, accelerating at a CAGR of 2.98% from 2025 to 2034. The Asia Pacific printing inks market size surpassed USD 8.20 billion in 2025 and is expanding at a CAGR of 3.11% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global printing inks market size was estimated at USD 21.53 billion in 2024 and is predicted to increase from USD 22.17 billion in 2025 to approximately USD 28.89 billion by 2034, expanding at a CAGR of 2.98% from 2025 to 2034. The rising demand for printing ink from several printing applications is driving the growth of the market.

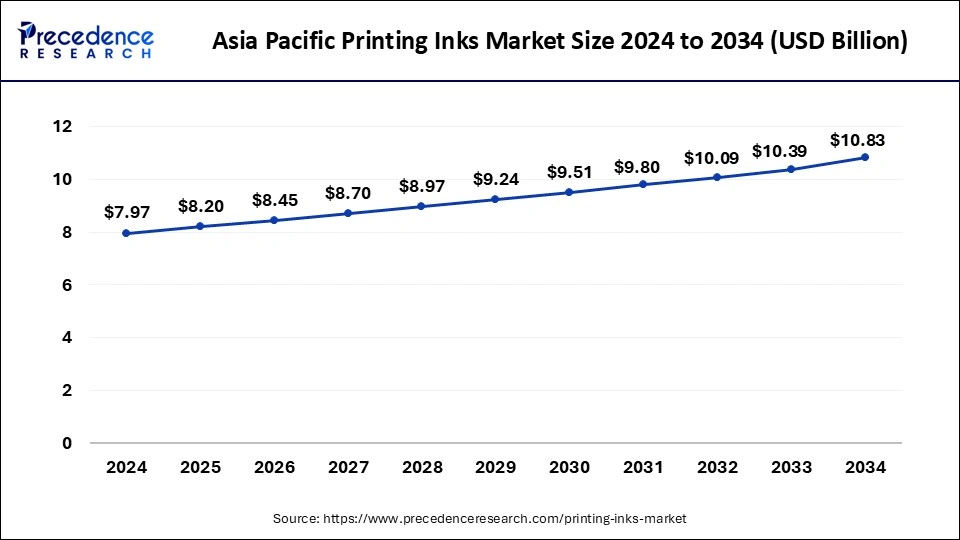

The Asia Pacific printing inks market size was estimated at USD 7.97 billion in 2024 and is predicted to be worth around USD 10.83 billion by 2034 with a CAGR of 3.11% from 2025 to 2034.

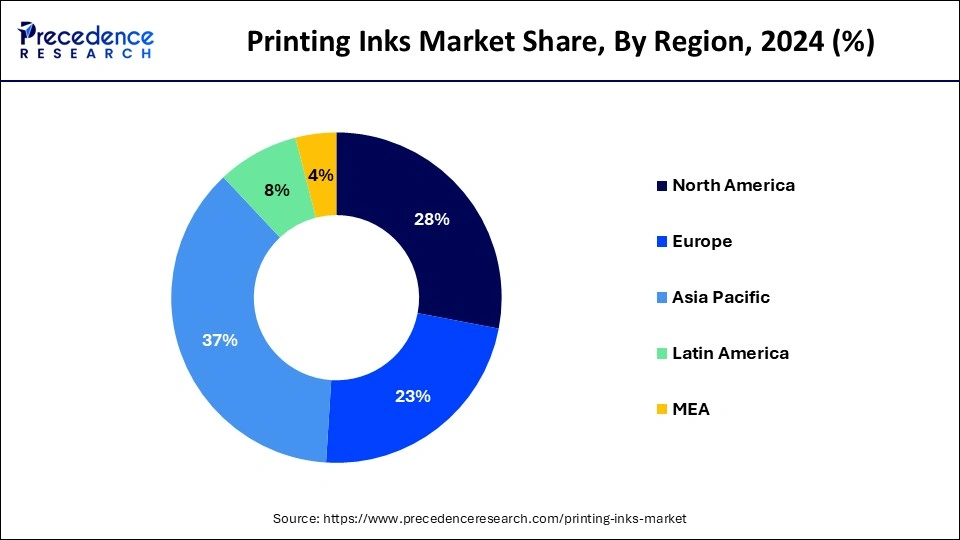

Asia Pacific led the printing inks market with the largest market share in 2024. The growth of the market in the region is attributed to the rising industrial development. The rising regional population is driving the demand for industries like consumer food and FMCG, which drives the demand for the high-end packaging industry that highly relies on printing ink for printing and labeling on the surface of the product, which contributed to the growth of the market in the region. The rising investment by the public and private sectors in industrial and manufacturing development drives the growth of the printing inks market in the region.

India is significantly contributing to the growth of the printing inks market. India is printing books, journals, and other products and exporting them to more than 129 countries. India is also investing in new technology to improve printing quality and quantity. India has some of the major organizations for printing, including IPAMA, and AIFMP. AIFMP, which is the world’s largest printing association, is contributing to the growth. Key players are also investing in India for growth and development.

North America is expected to witness the fastest growth during the forecast period. The growth of the market is owing to the well-developed industrial infrastructure and the rising demand for the packaging industry is contributing in the expansion of the market in the region. The availability of the major manufacturing hub in the countries like the U.S. and Canada is driving the growth of the printing inks market across the region.

Printing inks are specialized solutions or pastes that include binders, pigments, solvents, and additives. Printing ink is used in various applications like images, the printing process to transfer texts, and printing designs on cardboard, paper, packaging, fabric, and packaging materials. Printing ink depends upon three major factors: gloss, color, and transparency. Pigment ink, solid ink, dye-based ink, sublimation ink, and ribbon ink are some types of printing ink. The increasing demand for printing ink from various applications like packaging, digital printing, newspaper, commercial printing, specialty printing, and others is driving the growth of the printing inks market.

| Report Coverage | Details |

| Market Size in 2025 | USD 22.17 Billion |

| Market Size by 2034 | USD 28.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.98% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Resins, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand from the packaging industry

The expansion of the consumer goods and food and beverage industry is driving the demand for the packaging industry for packaging products. The packaging industry heavily depends on printing ink; printing ink plays an important role in providing information about the content, brands, usage instructions, manufacturing and expiry dates, and others. It is used to enhance the visual appearance of the product. Printing ink is used in a wide range of applications in the packaging industry, such as labelling, corrugated boxes, flexible packaging, and cartoons.

Additionally, printing ink is also important in newspaper and periodical printing. Newspapers provide clear and legible text and colorful images and are used to enhance the overall quality. Newspaper printing ink can maintain a high-speed printing process without smearing or smudging. Thus, the rising adoption of printing inks from several end-use applications like labeling printing, newspaper printing, and others is driving the growth of the printing inks market.

High prices

The increase in the price of printing ink due to the higher competition in the industry and the strict government regulations like the U.S. Food and Drug Administration and the Federal Food, Drug, and Cosmetic Act are restraining the growth of the printing inks market. Other factors that make the inks expensive are the research and development that is done to make high-quality inks that have features like water resistance, quick drying, and color accuracy. Also, organizations majorly use the razor and blade business model for selling inks in which they sell printers at a low cost, which ultimately leads to the high cost of inks for compensation for the loss.

Rising demand for eco-friendly printing inks

The rising concern about environmental pollution is driving the demand for eco-friendly printing inks. There is rising research on the development of eco-friendly printing ink, like vegetable-based inks, made from renewable resources like linseed and soybean oil. Vegetable-based printing ink is biodegradable and reduces VOC emissions, which makes it the ideal choice in terms of lowering environmental pollution. However, there are more environmentally friendly printing inks that are gaining popularity, like water-based inks and UV-curable inks, which have less VOC emission and are easier to clean compared to traditional inks. Ongoing research and development of more eco-friendly printing ink options are driving the growth opportunity in the printing inks market.

The lithographic segment dominated the printing inks market with the highest market share in 2024. The growth of the segment is attributed to its use in large-scale printing production. Lithographic printing is offered in materials like foil, cloth, plastic, paper, and cardboard. It is generally done on flat surfaces. There are several benefits of using lithographic printing, such as high-quality prints that are produced using several coatings and finishes. The machines used in this type of printing are capable of using six colors, including metallic inks. It provides a large quantity of packages that can be printed in a short time. It is also economically better in the long run.

The gravure printing segment also has a significant share of the printing inks market. Gravure printing is being used more and more in various product applications, such as food packaging, cosmetics, and tobacco products. This type of printing can be done on materials like paper, cardboard, foils, labels, and plastics. This printing style is used for printing large volumes of catalogs, magazines, and other products that need to be printed in large numbers. This printing is capable of providing continuous tone images with consistent print quality. The procedure is automated, which requires less human interaction and causes fewer human errors.

The polyurethane segment is projected to grow at the fastest rate during the forecast period. The increasing use of polyethylene in the production of several types of printing inks drives the demand for the segment in the market. The ink made from polyethylene is used in various end-use industries like textile, automotive, and packaging. Polyethylene ink has exceptional durability and flexibility over cracking, peeling, and blending and resists all environmental conditions. It has properties like adhesion, high resistance to chemicals and abrasion, rapid curing time, and longer color vibrancy. It offers excellent flexibility in terms of printing on materials like cloth, paper, plastics, cardboard, and others. It is also an ideal choice for environmental impacts; it emits low VOC compared to traditional ink. Thus, the higher adoption of polyurethane due to its eco-friendly and cost-affordable properties is driving the growth of the segment in the printing inks market.

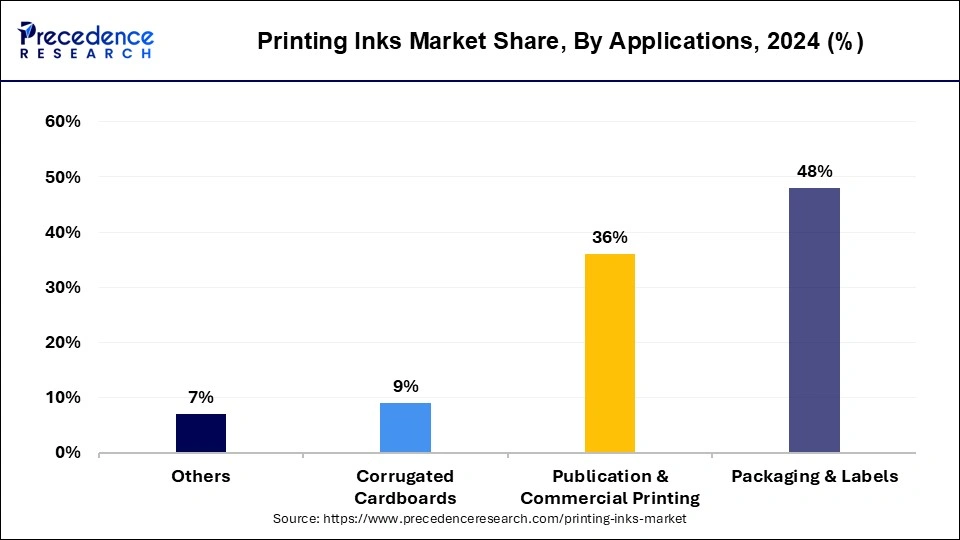

The packaging & labels segment dominated the printing inks market with the largest market share in 2024. The growth of the segment is attributed to the rising global population that tends to the higher demand for package products due to the shifting lifestyle preferences and disposable income that drives the consumer goods industry, which impacts the growth of the demand for packaging and labels.

Printing ink plays an important role in the packaging and labeling of the product; it clearly shows the information and brand awareness of the product. Thus, the rising demand for convenience packaged products is due to demand from packaging and labeling applications, driving the growth of the printing inks market.

By Product

By Resins

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

December 2024

November 2024