Privacy-enhancing Computation Market Size and Forecast 2025 to 2034

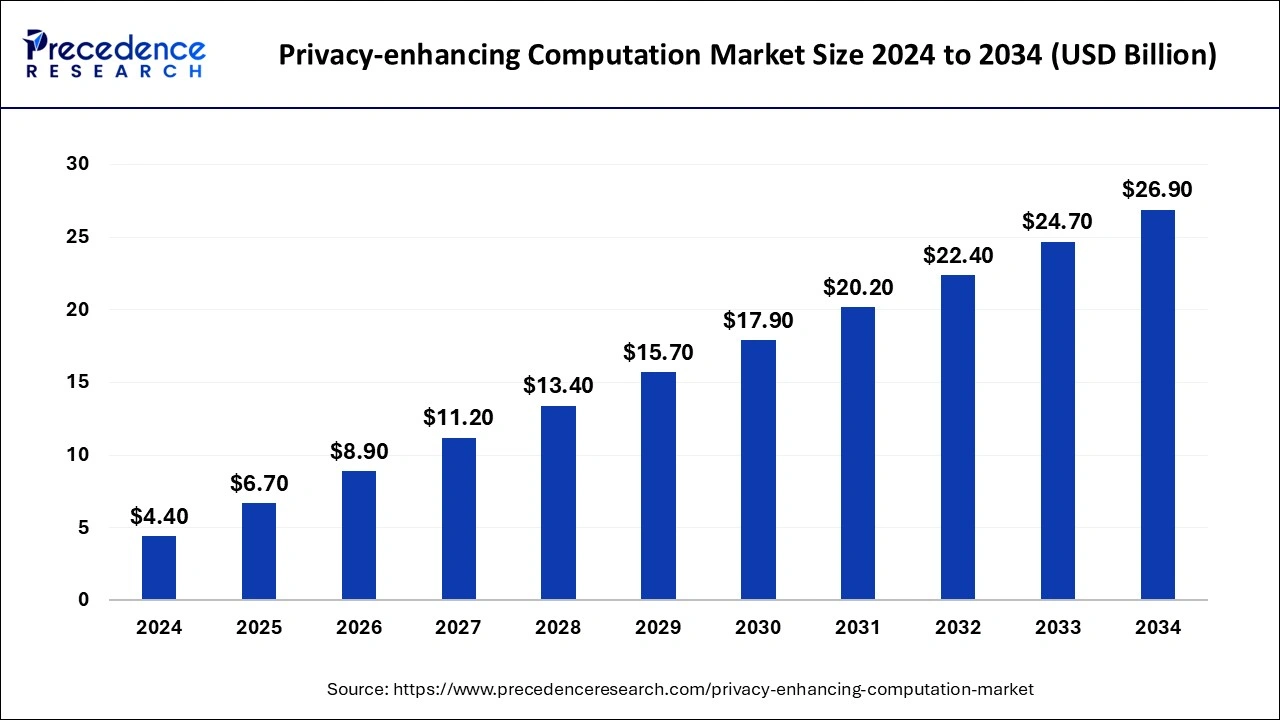

The global privacy-enhancing computation market size was estimated at USD 4.40 billion in 2024 and is predicted to increase from USD 6.70 billion in 2025 to approximately USD 26.90 billion by 2034, expanding at a CAGR of 19.85 from 2025 to 2034.

Privacy-enhancing Computation MarketKey Takeaways

- In terms of revenue, the global privacy-enhancing computation market was valued at USD 4.40 billion in 2024.

- It is projected to reach USD 26.90 billion by 2034.

- The market is expected to grow at a CAGR of 19.85% from 2025 to 2034.

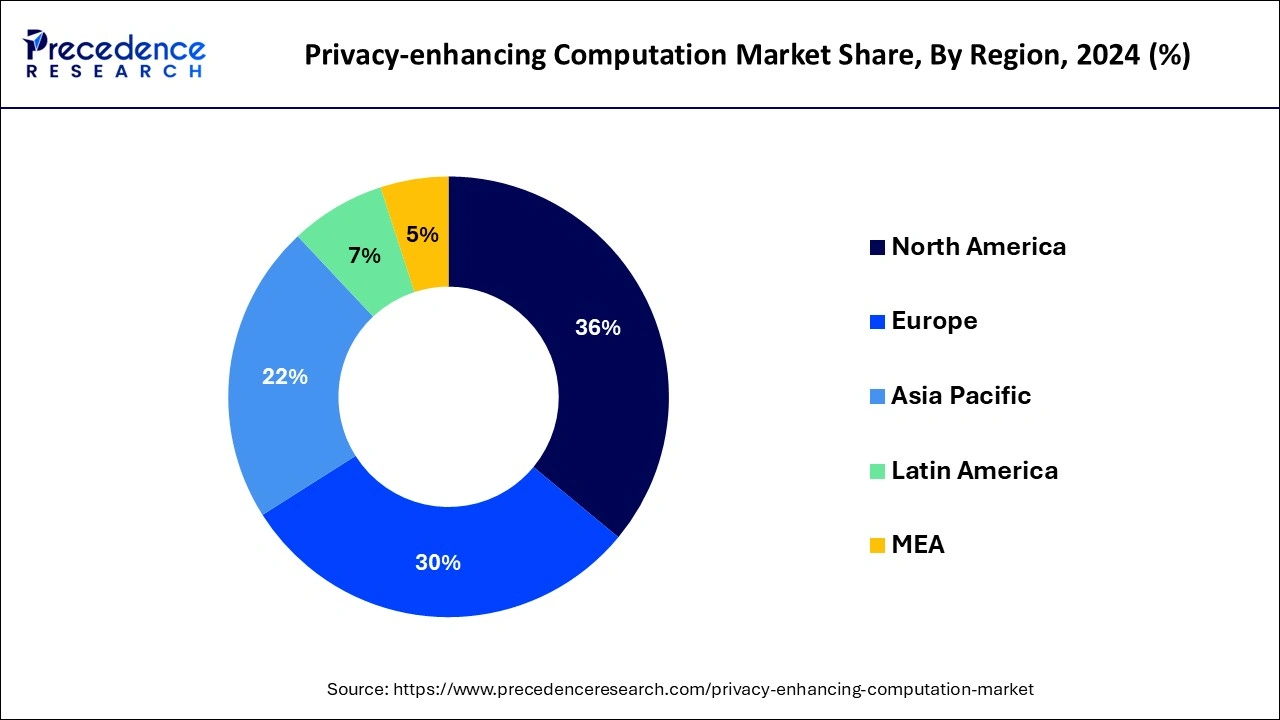

- North America dominated the global market with the largest market share of 36% in 2024.

- Europe region is forecasted to be a significantly growing regional market.

- By product, the homomorphic encryption segment held the largest segment of the privacy-enhancing computation market while contributing 34% of the market share in 2024.

- By product, the Personal Data Store (PDS) is expected to witness substantial growth at a CAGR of 32.9% during the forecasted period.

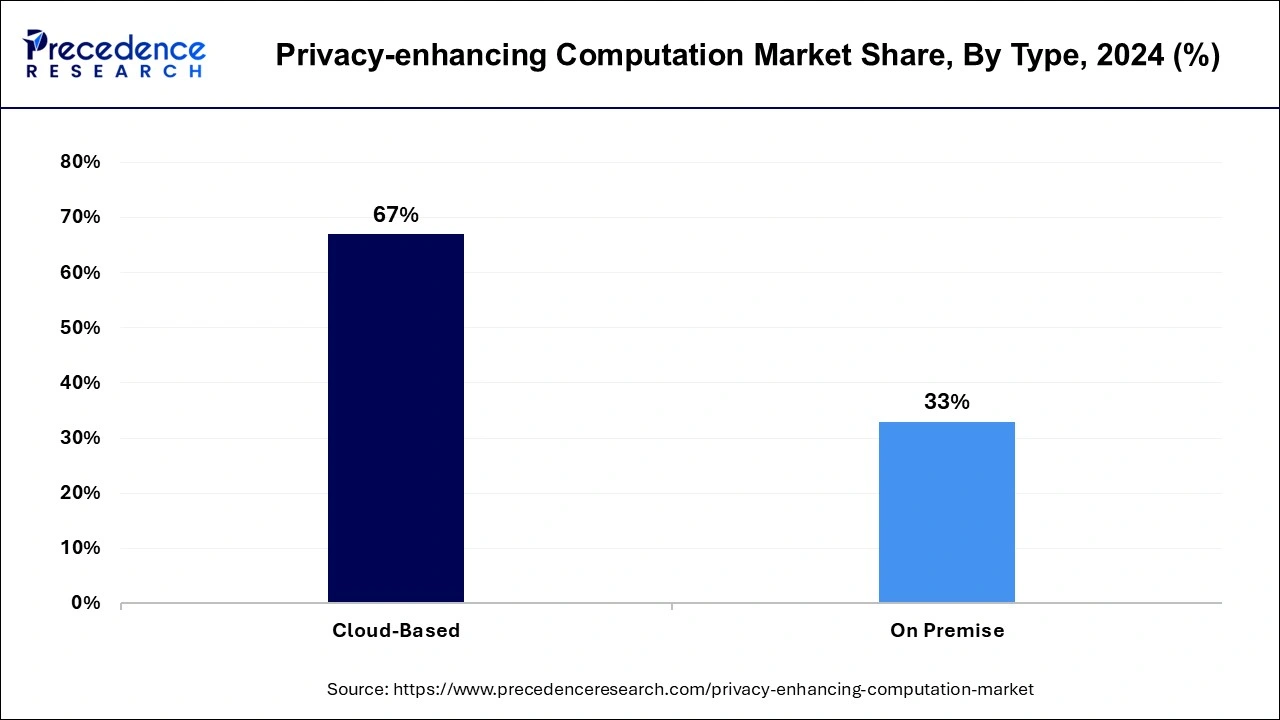

- By type, the cloud-based segment dominated the market with 67% of the market share in 2024.

- By type, the on-premise segment is anticipated to experience the fastest growth rate during the forecast period.

- By end user, the IT and telecom segment held the largest share of 33% in 2024.

- By end user, the healthcare segment is expected to witness the fastest CAGR of 31.6% over the forecast period.

U.S.Privacy-enhancing Computation Market Size and Growth 2025 to 2034

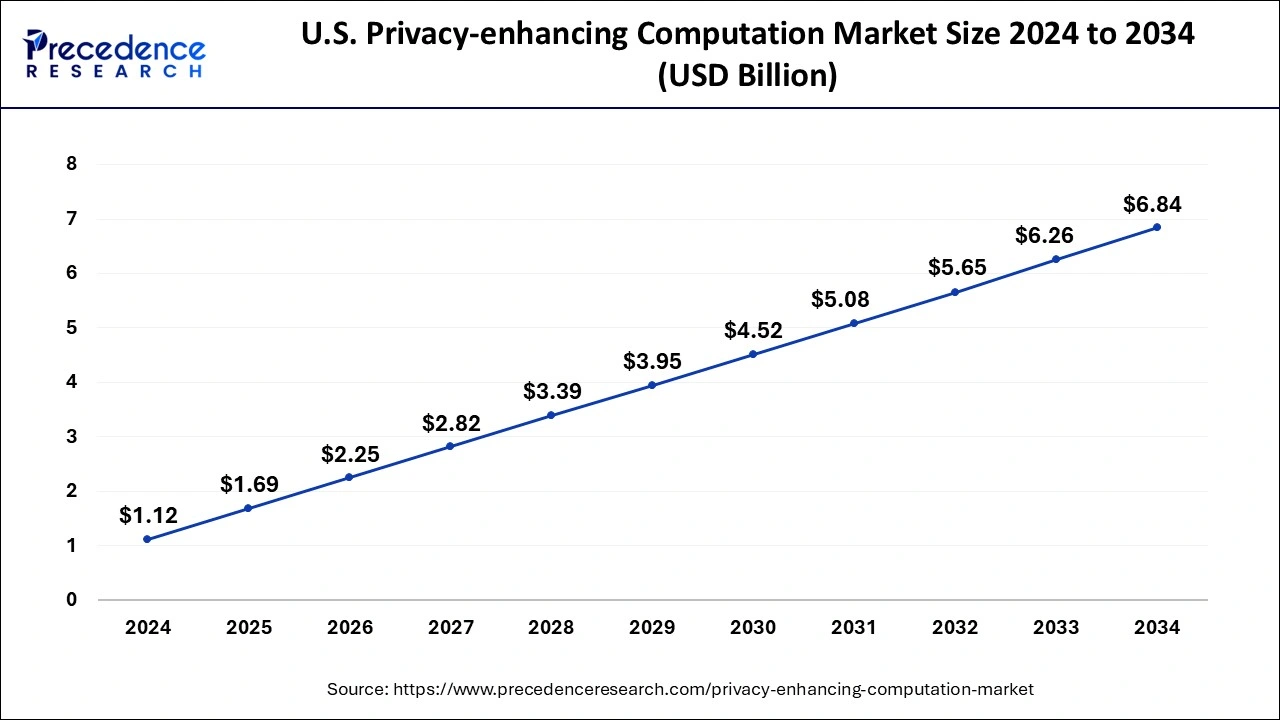

The U.S. privacy-enhancing computation market size was valued at USD 1.12 billion in 2024 and is anticipated to reach around USD 6.84 billion by 2034, poised to grow at a CAGR of 19.92% from 2025 to 2034.

North America held the largest share of 36% in 2024for the privacy-enhancing computation market driven by various factors shaping the data protection landscape. Stringent data protection regulations, such as GDPR and CCPA, compel organizations to adopt privacy-enhancing technologies to ensure compliance and mitigate legal risks. The region faces a heightened threat of cyberattacks, prompting businesses and government entities to invest in advanced security measures provided by privacy-enhancing computation. Growing awareness about data privacy concerns, coupled with technological advancements, contributes to the widespread adoption of these solutions.

North America's role as a technological hub fosters innovation in privacy-enhancing technologies, with key market players actively driving advancements. Vertical-specific adoption, particularly in finance, healthcare, and technology sectors, further propels the market's expansion. The convergence of regulatory requirements, cybersecurity imperatives, and technological innovation positions North America at the forefront of privacy-enhancing computation adoption across diverse industries.

The privacy-enhancing computation market in Europe is witnessing significant growth driven by the rising awareness of privacy concerns among individuals and organizations, combined with the need for innovative solutions, contributes to the widespread adoption of privacy-enhancing computation technologies. Europe's strategic focus on technological innovation and digital transformation further accelerates the adoption of these advanced privacy solutions.

Stringent data privacy regulations, such as the general data protection regulation (GDPR), have compelled organizations to adopt advanced privacy-enhancing technologies to ensure compliance and safeguard individual rights. Europe faces an increasing threat of sophisticated cyberattacks, making robust data protection measures a priority for businesses and government entities. The region's commitment to ensuring individual data protection and maintaining regulatory compliance positions Europe as a key driver in the global growth of the privacy-enhancing computation market.

Market Overview

Privacy-enhancing computation market offers a collection of technologies designed to enhance data security and privacy, ensuring robust protection for sensitive information in the modern era. Aligned with fundamental data protection principles, these technologies aim to empower individuals by effectively safeguarding their rights. Both hardware and software solutions are employed to extract valuable data for diverse purposes while establishing a secure foundation for subsequent processes. While the conceptual roots of these technologies date back decades, their practical applications have gained prominence in recent years, coinciding with the surge of the digital revolution.

As industries increasingly adopt privacy-enhancing computation, it plays a crucial role in upholding confidentiality and privacy standards for sensitive data across various domains. Organizations are increasingly acknowledging the significance of data privacy, leading to a growing adoption of privacy-enhancing computation solutions. This trend is evident in the market's uptake of various techniques, including homomorphic encryption, secure multi-party computation, and differential privacy.

The privacy-enhancing computation market offers technologies that empower organizations to conduct secure and private computations, ensuring that sensitive information remains confidential and protected. As data privacy concerns continue to gain prominence, businesses are actively seeking innovative solutions to uphold privacy standards and safeguard sensitive data throughout various computational processes. The adoption of privacy-enhancing computation reflects a proactive approach by organizations to address the evolving landscape of data protection and privacy in an increasingly digitized world.

Privacy-enhancing Computation Market Data and Statistics

- GDPR fines were estimated to exceed US$126 million between May 2018 and January 2020, underscoring the substantial impact such penalties can have on a business's existing plans and resource allocation. This highlights the critical importance for companies to prioritize data protection and implement robust strategies to avoid legal and financial repercussions associated with non-compliance. The implementation of global data protection laws like GDPR and CCPA compels organizations to establish measures for protecting consumer data. These measures act as a safety net, preventing businesses from suffering financial losses due to potential fines resulting from data breaches.

- The California Consumer Privacy Act (CCPA) and other significant data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the United States, highlight the importance of robust privacy measures. Providers of privacy-enhancing computation can customize their solutions to align with these regulations, helping organizations avoid substantial fines resulting from non-compliance. Adhering to these regulations is crucial for organizations to ensure data privacy, mitigate legal risks, and prevent financial penalties associated with violations.

Privacy-enhancing Computation MarketGrowth Factors

- The ongoing digital transformation across industries is generating vast amounts of data. As organizations leverage data for insights, the need to maintain privacy becomes critical. Privacy-enhancing computation enables secure data utilization without compromising privacy.

- Organizations are investing in privacy-enhancing computation to mitigate the risks associated with data breaches. Compliance with privacy regulations is a driving factor, as non-compliance can result in significant financial penalties.

- The broader demand for confidential computing solutions, where data remains encrypted even during processing, aligns with the goals of privacy-enhancing computation. As organizations prioritize data confidentiality, these solutions gain traction.

- With the increasing frequency and sophistication of cyber threats, there's a heightened focus on secure data processing. Privacy-enhancing computation provides an extra layer of security, making it an attractive solution in the face of evolving cybersecurity challenges.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.85% |

| Market Size in 2025 | USD 6.70 Billion |

| Market Size by 2034 | USD 26.90 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology, By Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Escalating global concerns over data privacy

The primary driver of privacy-enhancing computation market lies in the escalating global concerns over data privacy and the urgency to address regulatory compliance challenges. As stringent data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), mandate organizations to safeguard sensitive information, the demand for advanced privacy solutions has surged. Privacy-enhancing computation, incorporating technologies like homomorphic encryption and secure multi-party computation, allows organizations to perform computations on encrypted data, preserving privacy while deriving valuable insights.

The increasing sophistication of cyber threats and the growing emphasis on data security further propel the adoption of these privacy-centric technologies. This driver is reinforced by the continuous evolution of privacy regulations and the need for organizations to adapt to a rapidly changing digital landscape, ensuring the confidentiality and integrity of sensitive data throughout its lifecycle.

Restraint

Implementing and integrating the sophisticated technologies

Despite the promising advantages of privacy-enhancing computation, certain challenges and restraints hinder its widespread adoption. One key restraint is the complexity associated with implementing and integrating these sophisticated technologies into existing systems and workflows. Privacy-enhancing computation often requires specialized expertise, both in terms of understanding the underlying cryptographic techniques and adapting them to specific use cases. This complexity can pose challenges for organizations lacking the necessary skill sets, leading to slower adoption rates.

Additionally, the performance overhead introduced by privacy-enhancing computation methods may impact the speed and efficiency of data processing, influencing user experience and overall system responsiveness. Striking the right balance between robust privacy measures and maintaining computational efficiency remains a significant challenge, as organizations need to ensure that the adoption of these technologies does not compromise overall system performance. Overcoming these implementation and performance-related hurdles is crucial for the broader acceptance and integration of privacy-enhancing computation solutions across diverse industries.

Opportunity

Increasing emphasis on data privacy and regulatory compliance

The future of the privacy-enhancing computation market holds promising opportunities driven by the increasing global emphasis on data privacy and regulatory compliance. As governments worldwide continue to enact stringent data protection laws, organizations are recognizing the imperative need to invest in advanced technologies that secure sensitive information while complying with evolving regulations like GDPR and CCPA. The growing awareness among businesses and individuals about the importance of safeguarding privacy is expected to drive the demand for privacy-enhancing computation solutions.

With an ever-expanding digital landscape and the continuous generation of vast amounts of data, there is a substantial market opportunity for innovative technologies that can provide robust privacy protection without compromising data utility. Companies developing user-friendly and scalable privacy-enhancing computation solutions stand to capitalize on this growing demand, offering enhanced privacy assurances to individuals and enterprises alike. The evolving landscape of digital privacy regulations and the increasing value placed on data protection create a conducive environment for the continuous growth and evolution of the privacy-enhancing computation market.

Product Insights

The homomorphic encryption segment held the largest share of 34% in 2024 in the privacy-enhancing computation market. Homomorphic is a transformative technology that enables computation on encrypted data by third-party providers. This means that sensitive data can remain confidential while still being processed. In various sectors such as medical, banking, and work, individuals' private data is extensively used. Homomorphic encryption addresses privacy concerns by allowing data to be processed in its encrypted form. Essentially, it enables specific computations on encrypted data without requiring access to the private information itself. Access to perform different computations on the data is granted only to those with the specific keys, ensuring that the required portions of data can be decrypted securely. This innovation significantly enhances data privacy and security across different industries.

The personal data store (PDS) is expected to witness a substantial growth at a CAGR of 32.9% during the forecasted period and grants individuals general access to their personal data, allowing them to upload, share, modify, or delete this information as the data owners see fit. This includes various details such as addresses, phone numbers, passport information, bank account histories, electronic health records, and more. The primary objective of a personal data store is to empower individuals with control over their own data.

It provides the capability to add or remove private data on the side of third-party providers. This technology offers several advantages for businesses, including more effective data gathering and storage, reduced legal risks associated with unauthorized disclosure of private data, and easy data updates. Our experienced developers possess advanced skills and can tailor appropriate solutions to enhance data protection processes for your business, implementing privacy-enhancing technologies effectively.

Type Insights

The cloud-based segment dominated the privacy-enhancing computation market while carrying 67% of the market share in 2024. Businesses widely embraced cloud computing due to its scalability, flexibility, and cost-effectiveness. With the increasing migration of critical corporate operations and data to the cloud, the demand for robust security measures has become paramount. Cybersecurity mesh deployed in the cloud facilitates the distributed and scalable securing of cloud environments, ensuring a consistent application of security measures across all cloud resources.

The on-premise segment is anticipated to experience growth in its CAGR. Many organizations store critical resources and sensitive data in on-premises environments. Protecting these assets from unauthorized access, data breaches, and insider threats is imperative. Implementing cybersecurity mesh in on-premises environments enables businesses to apply security rules directly to specific endpoints and devices, offering granular protection for vital assets and mitigating associated risks.

End User Insights

The IT and telecom segment emerged as the dominating segment while holding 33% of the market share in the privacy-enhancing computation market in 2024. The IT and telecom segment in the privacy-enhancing computation market is driven by the increasing reliance of the IT and telecom sectors on advanced technologies like cloud computing and virtualization. These technologies enhance agility, scalability, and cost-effectiveness, but they also introduce specific security challenges such as data privacy, multi-tenancy, and vulnerabilities in virtual machines.

Privacy-enhancing computation solutions, including techniques like homomorphic encryption, secure multi-party computation, and differential privacy, play a crucial role in addressing these challenges. Furthermore, the IT and telecom sector handles vast amounts of sensitive data, including customer information, communications, and proprietary business data. Compliance with data protection regulations, such as GDPR, has become a top priority. Privacy-enhancing computation technologies provide a means to ensure secure and private computations while adhering to stringent regulatory requirements.

The healthcare segment is expected to witness the fastest CAGR of 31.6% over the forecast period. The healthcare segment in the privacy-enhancing computation market is driven by various factors that reflect the unique challenges and requirements of the healthcare industry. One key driver is the critical need to secure and protect patient health records and sensitive healthcare data. The healthcare sector handles highly confidential information, including patient medical histories, diagnoses, treatment plans, and other personally identifiable information. Privacy-enhancing computation technologies, such as homomorphic encryption and secure multi-party computation, are essential in ensuring the confidentiality and privacy of this sensitive data. The healthcare industry is increasingly vulnerable to cyberattacks, including ransomware, data breaches, and targeted attacks.

The adoption of privacy-enhancing computation solutions becomes crucial in mitigating these cyber threats and safeguarding healthcare organizations' digital assets and infrastructure. Additionally, as the healthcare sector undergoes digital transformation and leverages technologies like electronic health records (EHRs) and telehealth, the demand for robust privacy-enhancing computation measures rises. Compliance with healthcare regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), further emphasizes the need for advanced privacy solutions in the healthcare segment.

Privacy-enhancing Computation Market Companies

- Microsoft Corporation (United States)

- IBM Corporation (United States)

- Google LLC (United States)

- Intel Corporation (United States)

- Cisco Systems, Inc. (United States)

- Symantec Corporation (United States)

- McAfee, LLC (United States)

- RSA Security LLC (United States)

- Palo Alto Networks, Inc. (United States)

- Fortinet, Inc. (United States)

- Check Point Software Technologies Ltd. (Israel)

- Trend Micro Incorporated (Japan)

- Kaspersky Lab (Russia)

- Sophos Group plc (United Kingdom)

- AVG Technologies (Netherlands)

Recent Developments

- In June 2023, the National Health Service (NHS) announced plans to establish a service incorporating privacy-enhancing technologies (PETs). The initiative, outlined in a market notice seeking supplier support, comes with a budget of up to £35 million for a seven-year contract. This strategic move aligns with the healthcare sector's growing recognition of the importance of privacy-enhancing computation solutions in safeguarding sensitive patient data and complying with data protection regulations.

- In June 2023, IQVIATM launched IQVIA RIM Smart Labeling, introducing an intelligent approach to global label management in the life sciences sector. This innovation aims to enhance efficiency and compliance by providing life sciences companies with a streamlined process for planning, tracking, and executing regulatory labels. The implementation of such intelligent solutions reflects the industry's commitment to leveraging advanced technologies for regulatory compliance and operational optimization.

Segments Covered in the Report

By Technology

- Homomorphic encryption

- Trusted execution environments

- Multi-party computation

- Differential privacy

- Personal data stores

By Type

- Cloud-Based

- On-Premises

By End User

- BFSI

- Healthcare

- IT and Telecommunication

- Government

- Retail

- Manufacturing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344