September 2023

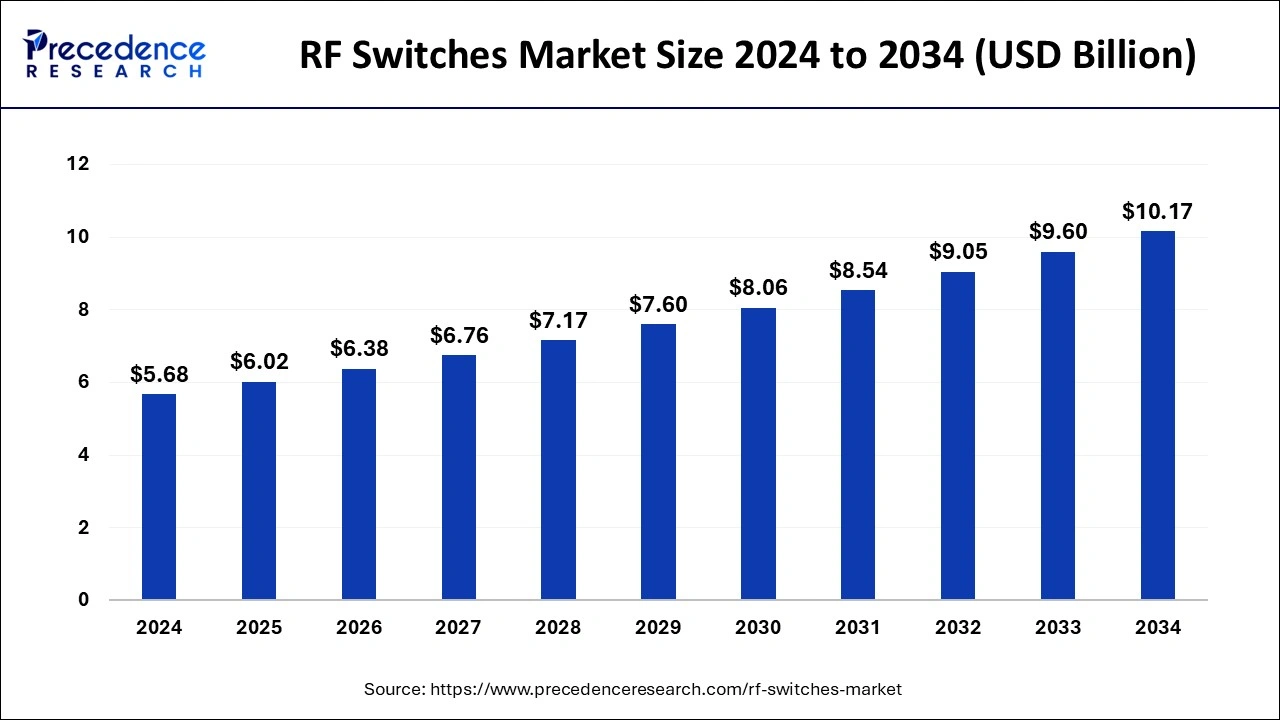

The global RF switches market size is calculated at USD 6.02 billion in 2025 and is forecasted to reach around USD 10.17 billion by 2034, accelerating at a CAGR of 6.00% from 2025 to 2034. The North America RF switches market size surpassed USD 2.27 billion in 2024 and is expanding at a CAGR of 6.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The RF switches market size was estimated at USD 5.68 billion in 2024 and is predicted to increase from USD 6.02 billion in 2025 to approximately USD 10.17 billion by 2034, expanding at a CAGR of 6.00% from 2025 to 2034.

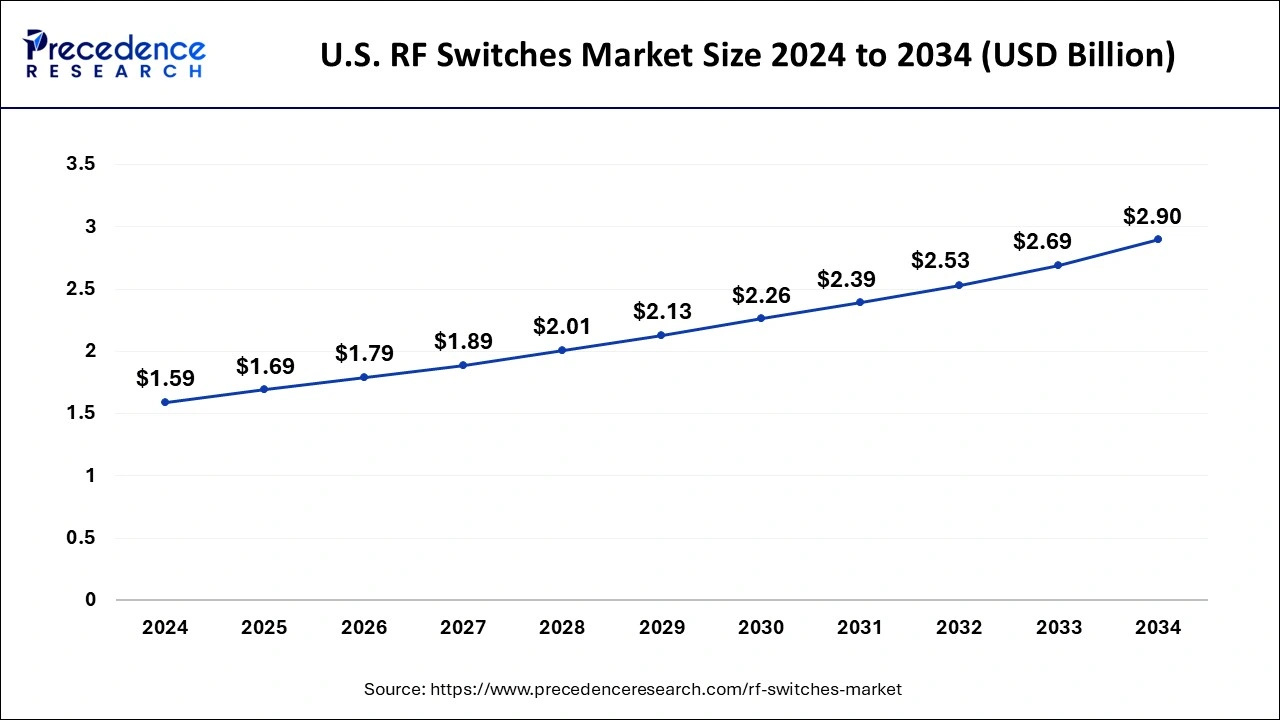

The U.S. RF switches market size was evaluated at USD 1.59 billion in 2024 and is predicted to be worth around USD 2.90 billion by 2034, rising at a CAGR of 6.19% from 2025 to 2034.

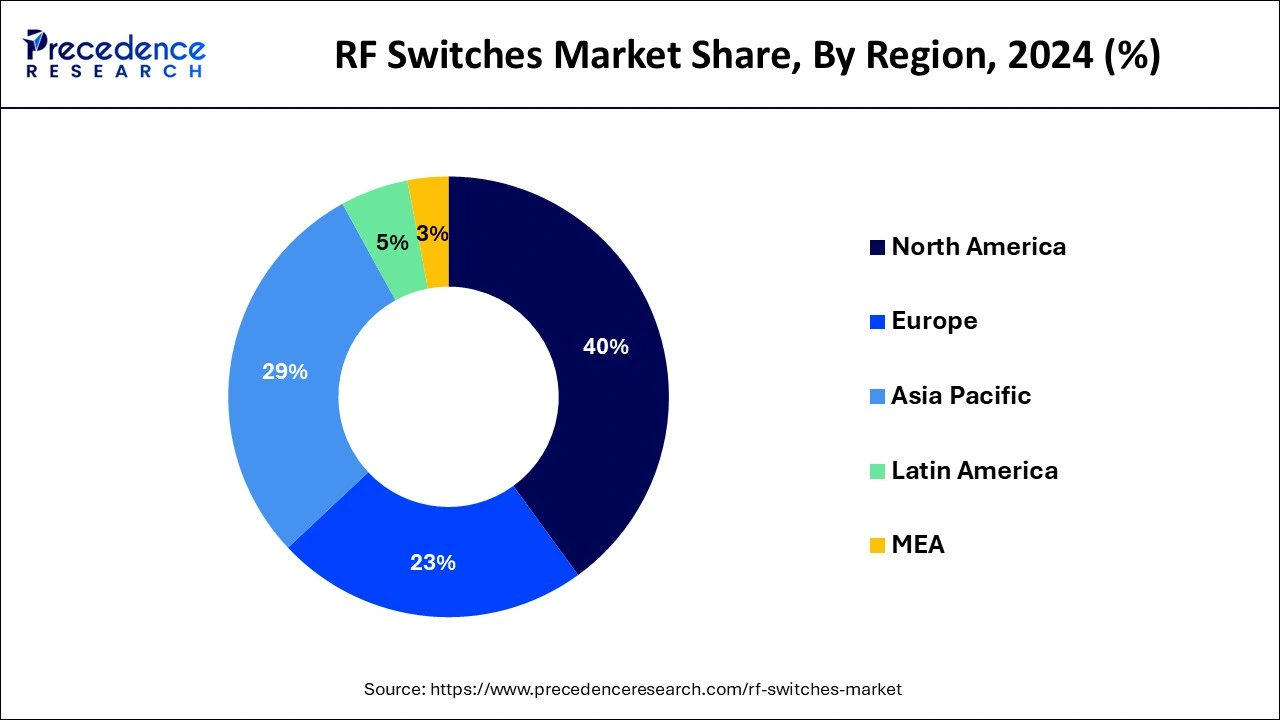

North America dominated the RF switches market with revenue share of 40% in 2024 due to various factors such as the widespread deployment of advanced communication networks, a thriving semiconductor industry, and the growing demand for connectivity solutions. Additionally, North America, particularly the United States, is a global hub for technology and innovation. The region boasts a sophisticated technological landscape, facilitating the development of cutting-edge RF switch technologies. The ongoing deployment and expansion of 5G networks are significant drivers in the North America RF switches market. The high-frequency bands associated with 5G require advanced RF switches for efficient signal routing and communication.

Asia-Pacific is poised for rapid growth in the RF switches driven by region's increasing demand for high-speed data connectivity, rising smartphone adoption, and the expansion of communication networks. The deployment of 5G networks is a significant catalyst in the Asia-Pacific RF switches market. Countries like China, South Korea, and Japan are at the forefront of 5G adoption, driving the demand for RF switches capable of handling the complexities of high-frequency bands and advanced communication protocols.

Meanwhile, Europe is growing at a notable rate in the RF switches market due to its technological innovation, a strong industrial base, and a growing demand for advanced communication solutions. The market dynamics in Europe are influenced by factors such as the expansion of wireless communication networks, advancements in industrial automation, and the deployment of 5G technology. Moreover, Europe is home to several technologically advanced countries with a robust semiconductor industry. This facilitates innovation in RF switch technologies, leading to the development of high-performance and reliable components.

The RF switches market is a dynamic and rapidly evolving sector within the broader field of electronic components. RF switches play a pivotal role in enabling or disabling the flow of radio frequency signals in electronic devices, facilitating seamless connectivity and communication. These switches are crucial components in various applications, including wireless communication systems, radar systems, medical devices, and test and measurement equipment.

The market is also influenced by the proliferation of Internet of Things (IoT) devices and the growing trend of smart homes and cities. As more devices become interconnected, the demand for RF switches that can handle complex signal routing and switching requirements rises. Furthermore, advancements in semiconductor technology contribute to the growth of the RF switches market. The development of miniaturized, high-performance switches with low power consumption is essential for portable and battery-operated devices, further expanding the application scope of RF switches.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.00% |

| Market Size in 2025 | USD 6.02 Billion |

| Market Size by 2034 | USD 10.17 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Deployment of 5G networks

The global deployment of 5G networks is a primary driver behind the escalating demand for RF (Radio Frequency) switches. As 5G technology continues to proliferate worldwide, the inherent characteristics of higher data rates, lower latency, and increased network capacity necessitate sophisticated RF switches to manage the intricate signal routing and switching demands. RF switches play a pivotal role in ensuring seamless communication across the spectrum of frequencies that 5G networks operate on, including millimeter-wave bands.

The multi-frequency and multi-band nature of 5G requires RF switches that can efficiently handle complex signal paths, enabling the dynamic allocation of resources for optimal network performance. These switches facilitate the rapid transition between different frequency bands and paths, allowing for the seamless integration of diverse communication protocols. As the global rollout of 5G networks accelerates, the demand for RF switches is expected to further intensify, positioning them as critical components in the infrastructure and end-user devices that constitute the backbone of the next-generation wireless communication ecosystem. Manufacturers and suppliers in the RF switches market are poised to benefit significantly from this trend, catering to the evolving needs of telecommunications providers and fostering innovation in RF switch technology.

Cost sensitivity

Cost sensitivity emerges as a potential restraint for the RF (Radio Frequency) switches market, influencing the dynamics of demand across various industries. As the market strives to address the growing need for advanced wireless communication solutions, the cost of RF switches becomes a crucial factor. Industries and consumers, particularly in price-sensitive markets, may exhibit hesitancy towards adopting RF switches, especially those featuring advanced technologies or high-performance capabilities. The intricate design and manufacturing processes involved in producing RF switches, often incorporating cutting-edge semiconductor technologies, can contribute to elevated production costs. These costs may then be passed on to end-users, impacting the overall affordability of devices and infrastructure incorporating RF switches.

In sectors where cost-effectiveness is paramount, such as consumer electronics and certain IoT applications, the reluctance to invest in relatively expensive RF switches could limit their widespread adoption. Manufacturers face the challenge of striking a balance between delivering high-performance RF switches and maintaining competitive pricing to cater to the diverse needs of the market. Strategies involving economies of scale, technological innovations to reduce production costs, and efficient supply chain management become critical to mitigate the impact of cost sensitivity and ensure the sustained growth of the RF switches market.

IoT integration

The pervasive growth of IoT (Internet of Things) devices across diverse industries stands as a significant catalyst for the flourishing opportunities within the RF (Radio Frequency) switches market. As the IoT ecosystem continues to expand, encompassing smart homes, industrial automation, healthcare, and more, RF switches play a pivotal role in enabling seamless communication between interconnected devices. These switches are instrumental in managing the complex network of sensors, actuators, and communication modules that characterize IoT deployments.

In smart homes, RF switches facilitate the integration of various devices, enhancing the efficiency of home automation systems and contributing to the overall connectivity experience. In industrial settings, RF switches enable reliable communication between IoT devices, optimizing processes and improving operational efficiency. Healthcare applications, such as medical monitoring devices and wearable health tech, leverage RF switches for efficient data transmission and connectivity.

Furthermore, the versatility of RF switches allows them to accommodate diverse communication protocols and frequency bands, aligning with the varied requirements of IoT applications across industries. As the demand for IoT solutions continues to surge, the RF switches market stands to benefit from the increasing need for robust and efficient wireless communication components. Manufacturers in this space have the opportunity to innovate and tailor RF switches to meet the specific demands of evolving IoT applications, further solidifying their pivotal role in shaping the interconnected future of various industries.

The GaAs segment dominated the RF switches market in 2024; the segment is observed to continue the trend throughout the forecast period. GaAs technology involves using a compound semiconductor material (Gallium Arsenide) to fabricate RF switches. It is known for their high electron mobility, making them suitable for high-frequency and high-speed applications in telecommunications and satellite communication.

The MEMS segment is expected to grow at a significant rate throughout the forecast period. MEMS technology involves the integration of mechanical elements, sensors, actuators, and electronics on a small silicon chip. It is known for their small size, low power consumption, and capability for high-frequency operation. They find applications in consumer electronics, telecommunications, and medical devices.

The aerospace & defense segment held the largest share of the RF switches market in 2024. In the aerospace and defense sector, RF switches are critical components in communication systems, radar systems, and electronic warfare applications. It is used in various applications in aerospace & defense sector such as avionics, radar systems, satellite communication, and military communication equipment to ensure reliable and secure signal switching.

The industrial & automotive segment is expected to generate a notable revenue share in the market. RF switches find applications in industrial automation and automotive systems, supporting communication in smart factories and connected vehicles. It is primarily deployed in industrial sensors, automation equipment, and automotive communication modules to enable efficient data transmission.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2023

January 2025

October 2024