December 2024

Rigid Bulk Packaging Market (By Material: Plastic, Metal, Wood, Others; By Product Type: Pails, Drums, Intermediate Bulk Containers, Boxes, Others; By Application: Food & Beverages, Pharmaceutical & Chemicals, Industrial, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

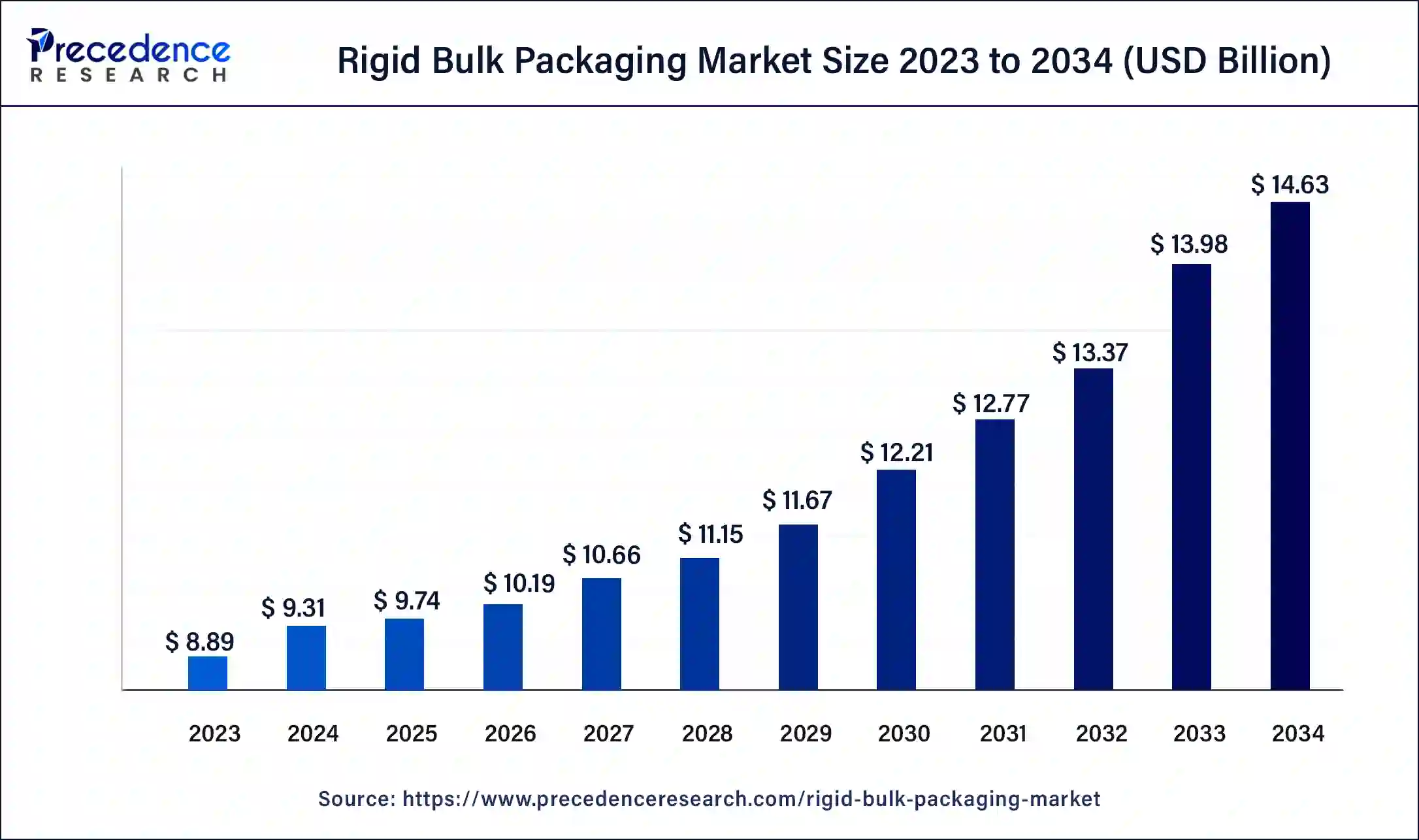

The global rigid bulk packaging market size was USD 8.89 billion in 2023, calculated at USD 9.31 billion in 2024 and is expected to reach around USD 9.31 billion by 2034, expanding at a CAGR of 4.63% from 2024 to 2034. Increasing emphasis towards the protection of shipping goods is driving the rigid bulk packaging market growth.

Rigid bulk packaging uses sturdy containers to carry and transport bulky goods. The main purpose of these containers is to ship, store, and maintain the quality of the goods in them. Some of the container types include large crates, drums, boxes, pails, and intermediate bulk containers (IBCs) manufactured using materials like metal, wood, and plastic.

Rigid bulk packaging containers are usually known for their strength and ability to protect the goods while transporting them in the long run. These boxes are widely used in the food and beverage industry for transporting packaged goods as they help to protect the products from any external damage. The increasing trade connectivity between the regions is increasing the demand for the rigid bulk packaging market.

The rigid bulk packaging market is gaining significant popularity due to the increasing need for the safety of products during transportation. Rapid urbanization in developing regions is considered to be one of the major factors that contribute to market growth. Further, the company’s manufacturing focus on sustainability is increasing the demand for biodegradable materials, which is projected to boost the shares of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.63 Billion |

| Market Size in 2023 | USD 8.89 Billion |

| Market Size in 2024 | USD 9.31 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Product Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in e-commerce

The increasing digitalization has led to many changes in the business environment; many countries are witnessing a rapid boost in online shopping, which is increasing the need for reliable and strong packaging solutions to cater to the rigid bulk packaging market demand. In recent times, the consumer demand for digital services has risen because they find it convenient and trustworthy to use. People using e-commerce often get reviews through the data available on the platforms, which provides a clear image to consumers before they purchase the product. These factors increase the demand for rigid bulk packages, making them an important growth factor in the market.

Increasing industrial growth

Industrialization has set new levels in the packaging industry; it has contributed to the production of raw materials, which has increased production and transportation rates. Industrial growth, especially in developing economies, has generated multiple jobs for individuals, which helps in the overall growth of the region. This growth enhances the innovation in designing the containers and increasing their durability. It also increases the production of finished machinery and other industries goods, which increases the demand for strong containers like drums, IBCs, and many more. This mass production is expected to drive the growth of the rigid bulk packaging market.

Higher initial costs

Increasing industrial growth has led to growth in the rigid bulk packaging market, but there are still concerns that the higher costs would hamper the market growth. These higher costs are not only associated with packaging materials but also the equipment used while making these containers. This also increases the price of the containers and affects or slows down the growth in the market. Businesses should drive their focus towards tackling these issues, which would help to tackle the issues that would hamper growth.

Increasing focus on sustainability

The increasing awareness due to campaigns and government initiatives is driving the packaging industry towards adopting sustainability in the manufacturing process. Businesses are also bound to use biodegradable materials which reduces the environmental impact and stick to the regulations. The focus on developing eco-friendly packages will grab the attention of governments which will help them to grow their business.

Growth in smart packaging

The increasing technological advancements, including the growth of smart packaging, are expected to boost the growth of the rigid bulk packaging market. To maintain transparency, many companies are using NFC and RFID tags, which enable the receiver to get tracking details of their particular product; this helps maintain trust throughout the process. Active packaging in food and beverages helps the product to extend its shelf life with the help of products like moisture absorbers and oxygen scavengers. These technological advancements attract the audience and lead to the increasing adoption of packaging technologies.

The plastic segment dominated the market in 2023. The use of plastic is dominant because it provides a wide range of benefits that meet the requirements of a safe package. Plastics can be carried easily as they are foldable and easily carried. This makes it a perfect option for use in food and beverage and electronic items. The cost-effectiveness of plastic is expected to increase its demand in the upcoming years, leading to the growth of the rigid bulk packaging market.

The metal segment is expected to register the fastest growth in the rigid bulk packaging market during the forecast period 2024 to 2033. Metal packaging offers robust durability, which makes it the best option for transporting items like cans, aluminum blister packs, and many more, which require enhanced protection while transporting. The premium quality of these boxes attracts businesses to ensure safety and enhance the overall experience. These metal packages are gaining significant demand as they contain materials that can be recycled and promote sustainability.

The intermediate bulk containers segment held the largest share of the market in 2023. These containers are widely known for their efficient storage capacity in storing liquids and granulated products. IBCs are usually famous in the food and beverage, chemicals, pharmaceutical, and lubricant industries due to their outstanding durability and handling capacity. Reusable IBCs are gaining popularity due to the increasing need for packaging containers. This also helps reduce waste and promote sustainability throughout various sectors. Increasing global trade is increasing the need for IBCs, which would help the growth of the rigid bulk packaging market.

Grief, a leading industrial packaging company announced the expansion of their IBC manufacturing faculty in Dilovasi, Turkey. This expansion enhances their footprint in sustainable solutions in the food and chemical industries.

The boxes segment is projected to register the fastest growth during the forecast period. Boxes are gaining significant popularity among e-commerce, retail, electronics, and many more industries as they fulfill various consumer demands by carrying goods safely. They usually cost less compared to other materials, which reduces the overall transportation costs. Many of the boxes are recyclable, which contributes to sustainability. Increasing environmental awareness is leading to the adoption of eco-friendly boxes. The rapid boom in the e-commerce industry is projected to drive the growth of the rigid bulk packaging market in the upcoming years.

The food & beverages segment led the global rigid bulk packaging market in 2023. The growth of food and beverage is attributed to the increasing need for large quantities of packaged food items and materials. With the increasing need to maintain hygiene, there is a need for reliable packaging solutions, which boosts the demand for rigid bulk packages. It also enhances the shelf life of the product, which helps to protect the product from moisture and any physical damage.

The pharmaceutical & chemicals segment is projected to register the fastest growth in the market during the forecast period. The increasing prevalence of chronic diseases is increasing the demand for medical drugs. This whole process requires a huge amount of packaging solutions for the medical products required to make the medicine. The pharmaceutical and chemicals require enhanced safety, which is provided by rigid bulk packages. Additionally, the increasing need for chemicals in agriculture and healthcare is projected to increase the demand for these packages and contribute towards the growth of the rigid bulk packaging market.

North America dominated the global market in 2023. The market is experiencing growth due to the increasing industrialization in countries like the United States and Canada, which provide robust infrastructure for packaging solutions. The region is also one of the leading in the pharmaceutical industry, which increases the demand for rigid bulk packages for storing chemicals and medical drugs. The increasing food and beverage industry in the region is expected to drive the growth of the rigid bulk packaging market during the forecast period.

Asia Pacific is expected to register growth at the highest CAGR in the market during the forecast period. Countries like India, China, and Japan are witnessing industrialization, which is improving the connectivity between supply chains and manufacturers. The rapid increase in demand for food and beverages in developing regions is leading to the need for durable packaging solutions. The rapid increase in urbanization and digitalization is increasing the demand in the e-commerce sector. These factors will potentially drive the growth of the rigid bulk packaging market in the upcoming years.

Segments Covered in the Report

By Material

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

February 2025

January 2025