December 2024

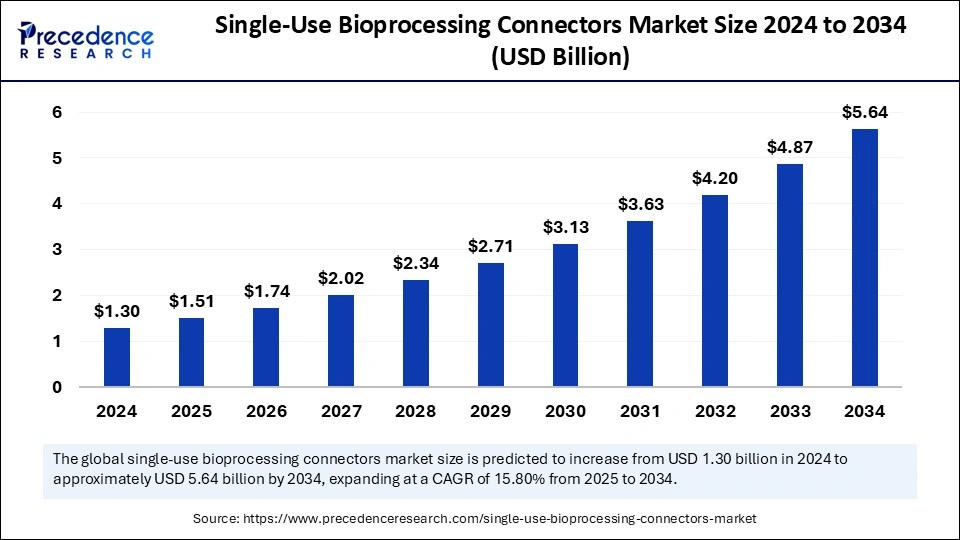

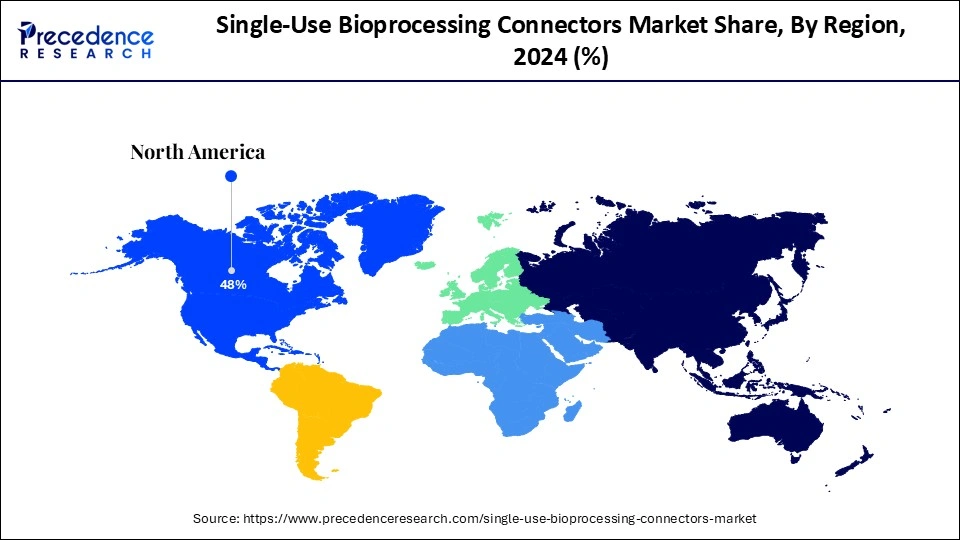

The global single-use bioprocessing connectors market size is calculated at USD 1.51 billion in 2025 and is forecasted to reach around USD 5.64 billion by 2034, accelerating at a CAGR of 15.80% from 2025 to 2034. The North America market size surpassed USD 620 million in 2024 and is expanding at a CAGR of 16.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global single-use bioprocessing connectors market size was estimated at USD 1.30 billion in 2024 and is predicted to increase from USD 1.51 billion in 2025 to approximately USD 5.64 billion by 2034, expanding at a CAGR of 15.80% from 2025 to 2034. Rising use of single-use bioprocessing systems is the key factor driving market growth. The surge in the production of biologics and biosimilars, coupled with innovations in the design of connectors, can fuel market growth further.

Artificial intelligence is poised to transform the single-use bioprocessing connectors market by improving manufacturing efficiency and ensuring high-grade standards integration in the production process can help to decrease human error, optimize production processes, and enhance the overall traceability of products. Furthermore, AI also streamlines production workflows by providing real-time monitoring, which improves regulatory compliance.

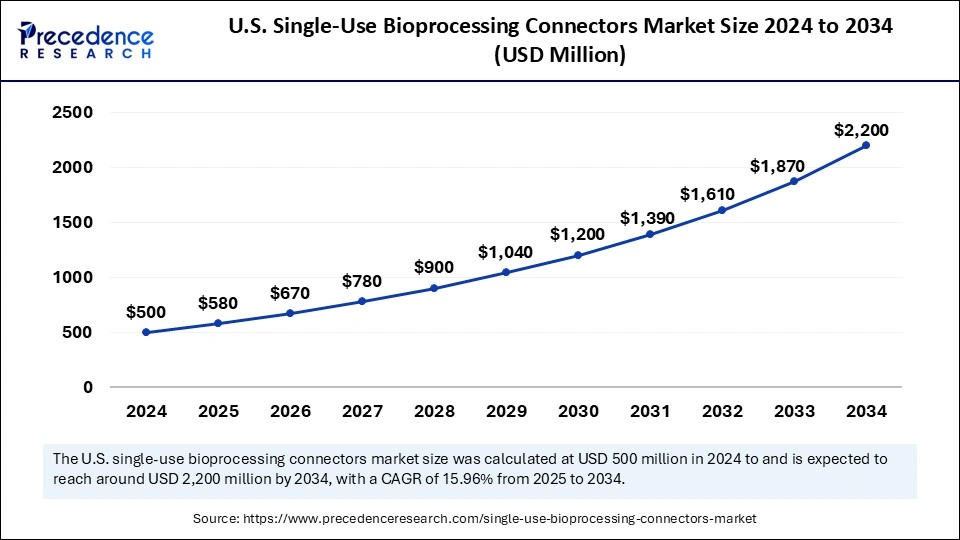

The U.S. single-use bioprocessing connectors market size was exhibited at USD 500 million in 2024 and is projected to be worth around USD 2,200 million by 2034, growing at a CAGR of 15.96% from 2025 to 2034.

North America dominated the market in 2024. The dominance of the region can be attributed to the growth of the pharmaceutical and biotechnology sectors, coupled with the innovations in product offerings and increasing incidence of diseases like cancer. Furthermore, the growing funding and investments in drug discovery research play a key role in market expansion.

U.S. Single-Use Bioprocessing Connectors Market Trends

In the North American region, the U.S. led the market owing to the strong presence of large-scale production settings for biopharmaceuticals. This sector is regarded as the most R&D-intensive in the U.S., leading to market growth in the country further.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be credited to the expanding biopharmaceutical industry in emerging nations like China, Japan, and India. Increasing investments by the pharmaceutical and biotechnology companies can lead to market growth in the region further.

China Single-Use Bioprocessing Connectors Market Trends

China's market is rapidly growing due to the increasing demand for biopharmaceuticals. Many market players have been strengthening their production footprint in this country by forming new collaborations with China-based entities.

Europe's single-use bioprocessing connectors market is expected to grow at a lucrative rate over the foreseeable future. This growth is linked to the various summits and events addressing advancements in the field of bioprocessing in the region.

U.K. Single-Use Bioprocessing Connectors Market Trends

In the European region, the U.K. dominated the market due to the ongoing government investments to help market players and create an advantage against major global players. Contract service providers are increasingly investing in cutting-edge technologies, driving regional growth further.

Single-use bioprocessing is a process of producing biopharmaceuticals that utilize disposable, single-use equipment rather than conventional stainless-steel equipment. The single-use bioprocessing connectors market has many benefits, such as reduced setup time, decreased contamination risk, and enhanced flexibility. The single-use bioprocessing connectors reduce cost and control build-in system redundancy. It can also allow the manufacturing of multiple drugs within a single setting.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.64 Billion |

| Market Size in 2025 | USD 1.51 Billion |

| Market Size in 2024 | USD 1.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing demand for biologics

The increasing need for biological therapeutics due to the growing prevalence of chronic disorders like autoimmune disorders and cancer fuels the market growth. Biologics such as monoclonal antibodies, vaccines, and antibodies are a key part of the pharmaceutical industry. In addition, they can offer targeted patient treatments, improving the efficacy of drug products.

Adverse environmental impact

The main hurdle for the market is the negative environmental impact caused because of the utilization of single-use plastics. The frequent use of plastics raises the carbon footprint which is hard to recycle. This poses a negative effect on the environment, hampering market growth. However, the leakage of the leachable and extractable from the plastic surface can be harmful to the patients.

Increasing preference for precision medicine

The single-use bioprocessing connectors market is creating lucrative opportunities in the future due to the rising preference for personalized medicines. Also, precision medicine is at the top of the manufacturing sector and drug development which has witnessed substantial growth in recent years due to an increase in cell and gene therapy. Furthermore, after producing a particular therapeutic, this equipment can be discarded, saving costs and time for manufacturers.

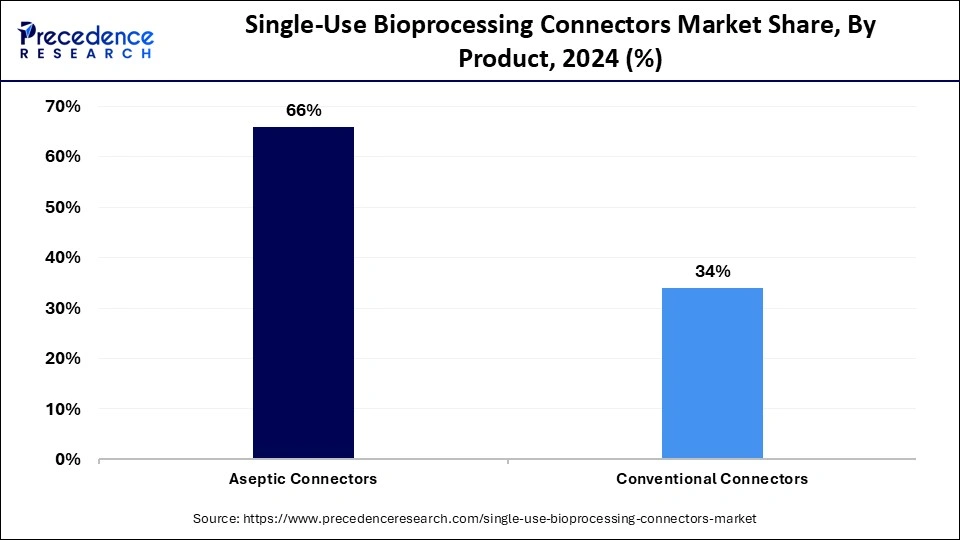

The aseptic connectors segment dominated the single-use bioprocessing connectors market in 2024. The dominance of the segment can be attributed to the increasing use of aspects connectors in vaccine and biopharmaceutical production. These connectors are used in filtration, mixing, fluid transfer, and storage in these facilities. Additionally, they enable contamination-free and secure connections in single-use systems, enhancing process efficiency.

The conventional connectors segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the cost-effectiveness of these connectors as compared to aseptic connectors. Conventional connectors are a type of single-use connectors that optimizes fluid transfer but cannot offer full aseptic assurance. They are commonly used in low contamination-sensitive applications.

The upstream bioprocessing segment led the single-use bioprocessing connectors market in 2024. The dominance of the segment can be linked to the advantages of upstream bioprocessing, like lowered operational costs, shortened timelines, and decreased cleaning needs. Moreover, this segment involves mixers, containers, disposable bioreactors, sampling systems, and probes/sensors.

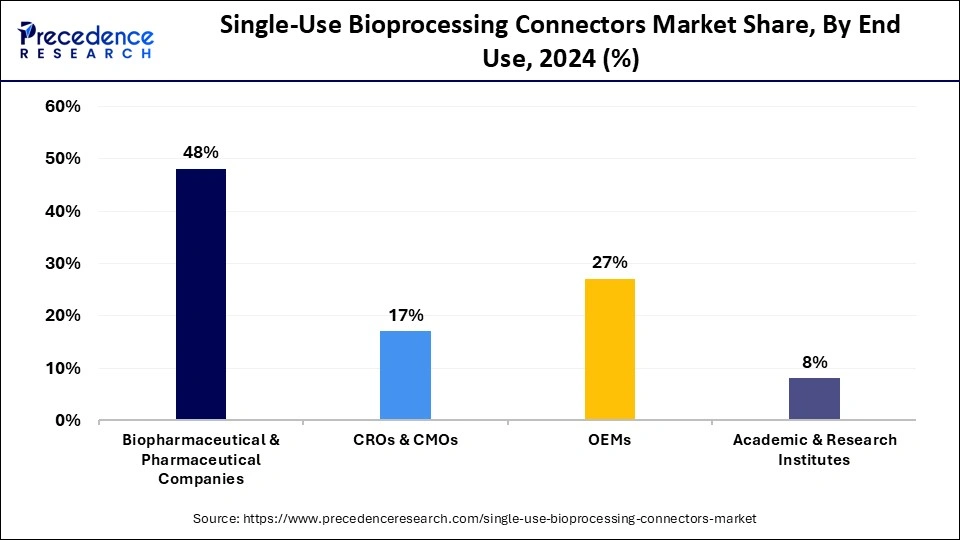

End Use Insights

The CMOs and CROs segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is due to the increasing trend of outsourcing services to Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs), which has positively impacted the growth of the segment. Also, biopharmaceutical market players are seeking innovative technologies to improve the efficiency of their manufacturing process.

In 2024, the biopharmaceutical and pharmaceutical companies segment led the single-use bioprocessing connectors market by holding the largest market share. The dominance of the segment is owing to the growing adoption of single-use bioprocessing connectors, the increasing need for cell & gene therapies, and individualized medicine in upstream & downstream processing.

The CMOs and CROs segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is due to the increasing trend of outsourcing services to Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs), which has positively impacted the growth of the segment. Also, biopharmaceutical market players are seeking innovative technologies to improve the efficiency of their manufacturing process.

In June 2025, Diatech Pharmacogenetics announced an expansion of its collaboration with Merck Serono Middle East Ltd., affiliates of Merck KGaA ("Merck"). The collaboration aims to improve patient access to RAS biomarker testing in the Middle East and Africa (MEA). Colorectal cancer is the third most common cancer worldwide, accounting for approximately 10% of all cancer cases.

In February 2025, Danaher announced an investment partnership with Innovaccer Inc., a healthcare AI company, through its subsidiaries Danaher Diagnostics and Danaher Ventures. The partnership aims to enhance patient outcomes through digital and diagnostic solutions. Innovaccer has developed software solutions that create unified patient records to identify care gaps and at-risk patients.

In October 2024, Thermo Fisher Scientific announced the establishment of a Bioprocess Design Centre in Genome Valley, Hyderabad, in collaboration with the Government of Telangana. This facility will cover 10,000 square feet and is expected to commence operations in early 2025.

In April 2023, Merck announced the launch of Ultimus Single-Use Process Container Film to provide extreme durability and leak resistance for single-use assemblies used for bioprocessing liquid applications.

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

January 2025

November 2024