September 2024

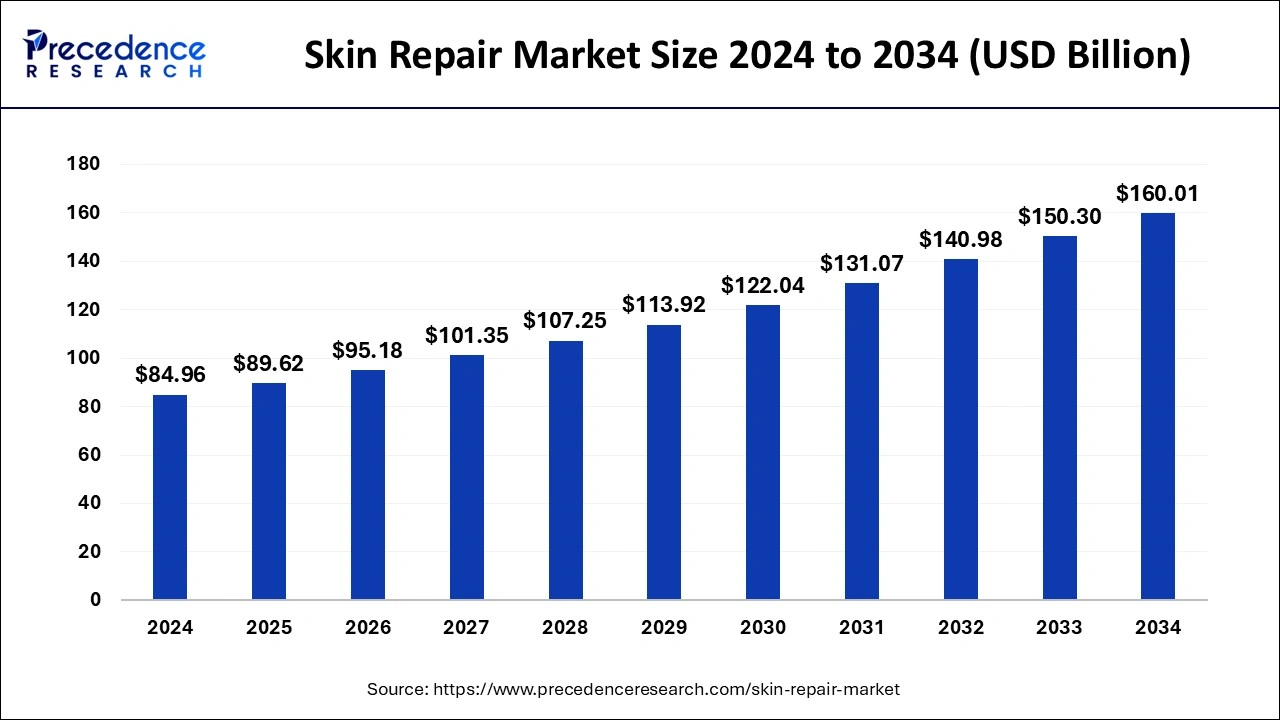

The global skin repair market size is calculated at USD 89.62 billion in 2025 and is forecasted to reach around USD 160.01 billion by 2034, accelerating at a CAGR of 6.54% from 2025 to 2034. The North America skin repair market size surpassed USD 33.13 billion in 2024 and is expanding at a CAGR of 6.67% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global skin repair market size was estimated at USD 84.96 billion in 2024 and is predicted to increase from USD 89.62 billion in 2025 to approximately USD 160.01 billion by 2034, expanding at a CAGR of 6.54% from 2025 to 2034.

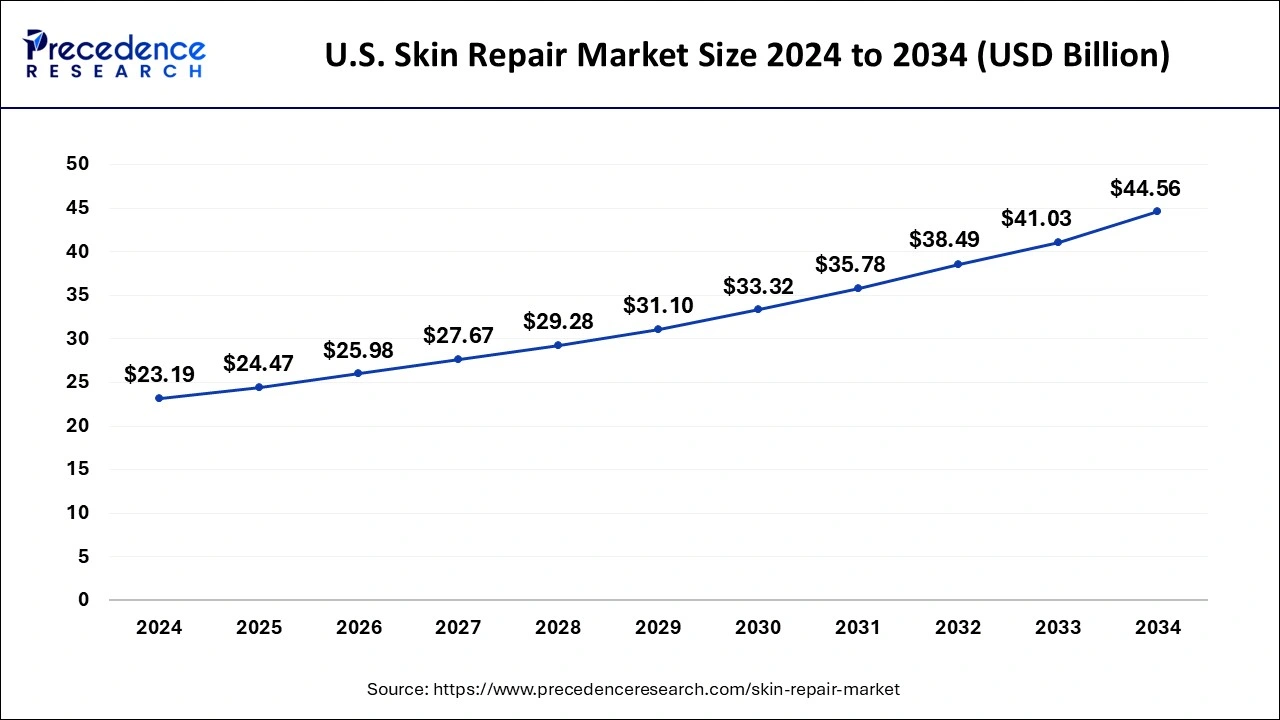

The U.S. skin repair market size reached USD 23.19 billion in 2024 and is anticipated to reach around USD 44.56 billion by 2034, poised to grow at a CAGR of 6.75% from 2025 to 2034.

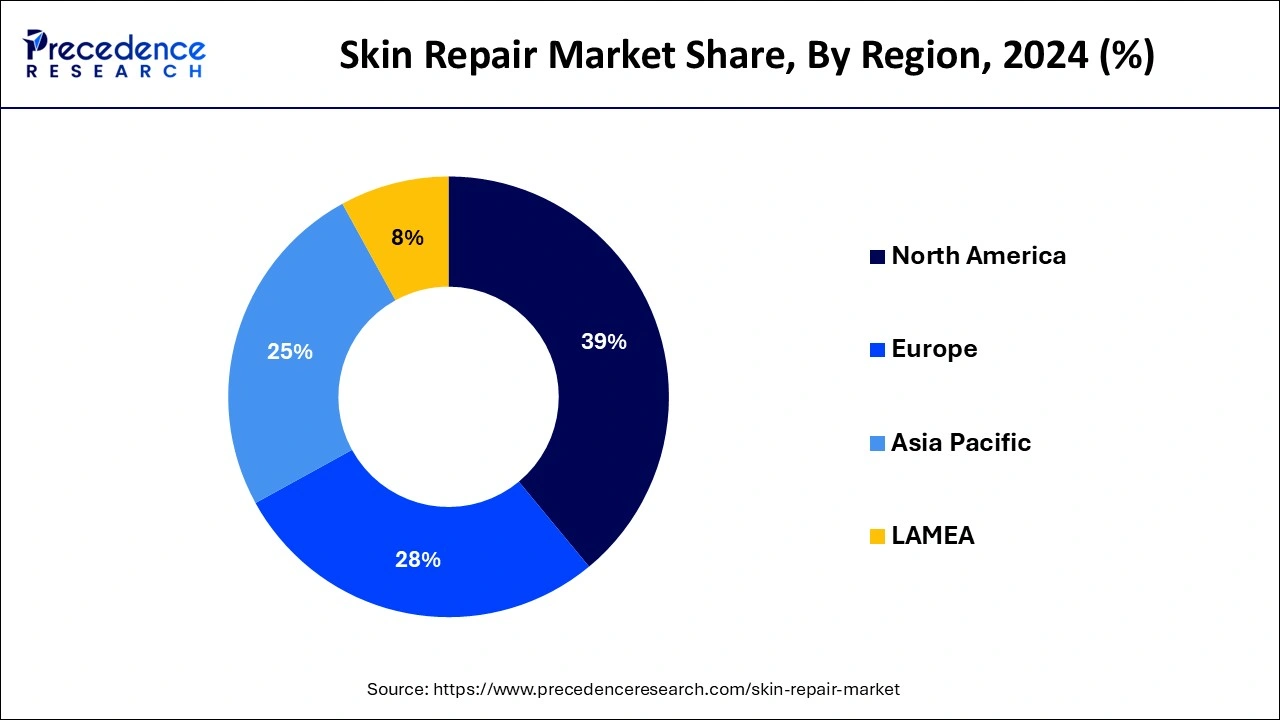

North America has its largest market share of 39% in 2024 in the skin repair market. To effectively reach consumers, skincare brands in North America significantly invest in marketing and distribution tactics. This covers social media influencers, internet marketing, dermatologists, and collaborations with aesthetic specialists. Technology is being used in skincare products and services more and more. Improving the overall patient experience and treatment results involves utilizing telemedicine platforms, tailored skincare products, and artificial intelligence.

Asia-Pacific is the fastest-growing in the skin repair market during the forecast period. Increased disposable income levels in numerous Asia-Pacific nations have given customers additional purchasing power for skin care products, notably those aimed at skin restoration. People will spend a large percentage of their income on skincare products that claim to treat skin issues and restore damage as they grow more self-conscious about their appearance and general health. These nations have a rich cultural history that highly emphasizes beauty and skincare. Due to this cultural influence, skincare businesses and products that provide cutting-edge formulations customized to address skin concerns, including repair, have increased.

The segment of the healthcare and cosmetics industries that concentrates on creating goods and services meant to restore and revitalize skin is known as the skin repair market. This market includes various goods, such as medical gadgets, skin care creams, lotions, serums, and ointments.

The goal is to provide customers with ways to enhance their skin's function, beauty, and health. This market caters to people who want to keep their skin appearing young and healthy and those with specific skin issues or illnesses that need to be treated by a doctor. To support healing, collagen synthesis, and general skin health, skin restoration products and treatments frequently work to hydrate, nourish, protect, and rejuvenate the skin cells.

Skin Repair Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Market Size in 2025 | USD 89.62 Billion |

| Market Size by 2034 | USD 160.01 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Product Form, By Application, By Distribution Channel, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness of skincare

Several variables have contributed to this increasing awareness, such as the ease with which information can be accessed via social media and the Internet and the growing emphasis on wellness and self-care. Customers are growing more informed about preserving good skin and guarding against aging, stress, and environmental damage. Because of this, there is a rising need for skincare products and procedures that cure current skin conditions, stop further damage, and advance general skin health. Innovative skincare formulas, cutting-edge treatments, and customized skincare routines catered to specific requirements have all been developed due to this trend. Thereby, the rising awareness of skincare is observed to act as a driver for the skin repair market.

Consumers preference for non-invasive procedures

Customers worried about possible consequences or side effects may find non-invasive procedures more enticing than invasive surgeries because they usually carry less risk. Non-invasive procedures typically result in less pain or discomfort than intrusive surgeries, which can cause discomfort and anguish. This makes the experience for the patient more favorable.

Limited efficacy of current treatments

Despite developments in skin care products and medical technology, many of the current skin repair treatments, including creams, ointments, and even some medical procedures, frequently fall short of providing adequate results for various skin disorders and injuries. This insufficiency can be ascribed to multiple variables, including gaps in our knowledge of skin biology, individual differences in therapy responsiveness, and limitations in the efficacy of existing treatments.

Skeptical behavior of consumers about skin care products

As for prior skincare product failures to live up to expectations, consumers may be skeptical of skincare products' efficacy, particularly those that claim skin healing or rejuvenation. Consumer confidence can be undermined, and suspicion over the safety and effectiveness of skincare products can be increased by reports of dangerous substances, product recalls, or scandals within the industry. Many skincare products are available in the market, claiming to be the finest for repairing damaged skin. Customers may become overwhelmed by various options and become skeptical of the effective items. Such skepticism is observed to act as a restraint for the skin repair market.

Growing demand for anti-aging products

The demand for treatments that claim to lessen wrinkles, fine lines, and other symptoms of aging is rising as the population gets older and more mindful of keeping a young appearance. This trend, along with skincare technology improvements and an increased focus on personal hygiene and self-care, is driven by rising disposable incomes. Thus, by providing cutting-edge and potent anti-aging remedies, skin repair product manufacturers can profitably enter this attractive market niche. To capitalize on the increased customer interest in keeping youthful and bright skin, this involves creating products with components that have been scientifically proven to work, tailored formulas, and engaging marketing techniques.

Expansion of distribution channels

Diversifying distribution channels allows businesses to reach previously untapped geographic regions and underserved groups. These channels include pharmacies, specialty skincare boutiques, retail stores, and internet platforms. Increasing distribution networks makes it easier for businesses to enter new markets. For instance, breaking into untapped foreign markets or concentrating on specialty consumers with possible distribution preferences. It is more convenient for customers to obtain skin-healing items when there are several ways to buy them. This ease of use can potentially boost sales and foster brand loyalty.

The topical creams and ointments segment dominated the skin repair market with the largest share of 30% in 2024. Topical creams and ointments are made with active chemicals that specifically address dryness and skin irritation issues. Depending on the intended purpose, they frequently contain steroids, moisturizers, anti-inflammatory medicines, antibiotics, and antifungals. Because of its adaptability, customers can use a single product to treat various skin conditions. In addition to treating skin conditions, it provides cosmetic advantages such as hydration, wrinkle and fine line reduction, and skin tone and texture improvement. Customers looking for skincare products with both medicinal and cosmetic benefits are drawn to this dual purpose.

Topical creams and ointments provide targeted treatment by being administered directly to the afflicted area, in contrast to oral drugs or systemic therapies. Many customers choose them because of their tailored approach, which maximizes efficacy while minimizing systemic adverse effects, especially for people with mild to moderate skin conditions.

The wound care products segment acted as the second largest segment in the skin repair market. A healthy market for wound care products is required due to the high frequency of wounds and injuries. There is always a need for efficient ways to speed up the healing process, whether for small cuts and scratches or more significant injuries like burns and ulcers. Athletes who are vulnerable to sports injuries, older populations with a higher risk of chronic wounds, and people having surgery all contribute to this demand.

Furthermore, the need for enhanced wound care solutions has been fueled by the increased prevalence of chronic illnesses like diabetes, obesity, and vascular disorders. These illnesses frequently leave behind complicated wounds that need to be treated with specific techniques to avoid complications and promote healing. As a result, producers have concentrated on creating cutting-edge items designed specifically for long-term wounds, such as sophisticated dressings with attributes like moisture management, antibacterial capabilities, and prolonged release of medicinal ingredients.

The ointments segment dominated the skin repair market with a share of 30% in 2024. Ointments are designed to treat various skin conditions, such as psoriasis, eczema, burns, scrapes, and dryness. Because of their adaptability, they may be used to treat both mild and severe skin diseases, which appeals to a wide range of customers. In the skincare business, consumer perceptions of efficacy play a significant role in determining purchase decisions. Customers assume these can produce noticeable benefits because they are frequently linked to intense care and deep moisturization, particularly for complex skin concerns. This view is further reinforced by positive word-of-mouth experiences, which sustain demand for ointment-based goods. The capacity of ointments to retain moisture is a significant factor in their efficacy.

The creams segment is the fastest growing in the skin repair market during the forecast period. Cream-based formulas are quite popular among customers looking for efficient skin rejuvenation and repair options. Creams provide a practical and user-friendly way to address various skin concerns, from dryness and irritation to issues associated with aging, thanks to their smooth texture, ease of application, and quick absorption.

The dynamic evolution of cream-based skincare products is driven by strategic innovation in formulation technology and ingredients. Manufacturers engage in research and development activities to combine cutting-edge components known for their skin-repairing, moisturizing, and anti-aging qualities, such as retinoids, hyaluronic acid, peptides, and botanical extracts. These developments increase the effectiveness of the product and increase consumer confidence.

The diabetic foot ulcers segment is the fastest growing skin repair market during the forecast period. Millions of people worldwide suffer from diabetes, which has reached epidemic proportions. Foot ulcers are one of the most crippling effects of diabetes, and if left untreated, they can result in severe infections and even amputations. Diabetic foot ulcers are becoming more common as the number of people with diabetes rises, calling for efficient management techniques and therapies.

According to the National Library of Medicine, more admissions for diabetic foot ulcers occur than for any other diabetes condition. In the US, diabetes is currently the primary cause of non-traumatic amputations. In all, 5% of diabetic individuals get foot ulcers, and 1% must have their feet removed.

The hospital pharmacies segment dominated the skin repair market with the largest market share of 33% in 2024. Highly qualified pharmacists and medical specialists with an in-depth understanding of dermatological disorders and available treatments work in hospital pharmacies. Because of their experience, they can accurately determine the patients' skin-healing needs and recommend suitable goods or drugs. The prescription, dispensing, and monitoring procedures are streamlined by their frequent integration with electronic health record systems and other healthcare infrastructure. By enhancing coordination and communication amongst healthcare professionals, this integration improves patient outcomes when managing skin repair difficulties.

The retail pharmacies segment held the second largest share in skin repair market with share of 29% in 2024. Retail pharmacies are frequently found next to medical facilities, shopping malls, or residential areas. This convenience feature is crucial because it makes it easier for customers to purchase skincare products, including skin repair solutions, from these stores. Unlike specialty clinics or dermatological offices, which may have limited hours or require appointments, pharmacists usually provide convenient extended walk-in service, improving accessibility.

Customers can select from various formulations tailored to their skin concerns, such as moisturization, wound healing, scar reduction, or anti-aging, thanks to the market's diversity in the skin repair industry. Pharmacies satisfy consumer brand affinities and budgetary preferences by stocking branded and generic goods.

The hospitals and clinics segment dominated the skin repair market with a share of 53% in 2024. Many medical professionals, such as dermatologists, plastic surgeons, and wound treatment specialists, are usually found in hospitals and clinics. These doctors are skilled in diagnosing and treating complex skin disorders, from tiny abrasions to severe burns. A multidisciplinary approach is frequently used for skin repair, combining different medical specialties such as dermatology, plastic surgery, wound treatment, and nutrition.

Hospitals and clinics provide comprehensive treatment by giving patients access to many specialists and support services under one roof. It is essential for handling emergencies involving severe burns, traumatic injuries, and other urgent skin disorders that need to be treated right away. Their supremacy in the skin restoration industry is mainly attributable to their capacity to offer emergency care around the clock.

By Product Type

By Product Form

By Application

By Distribution Channel

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

November 2024

October 2024