January 2025

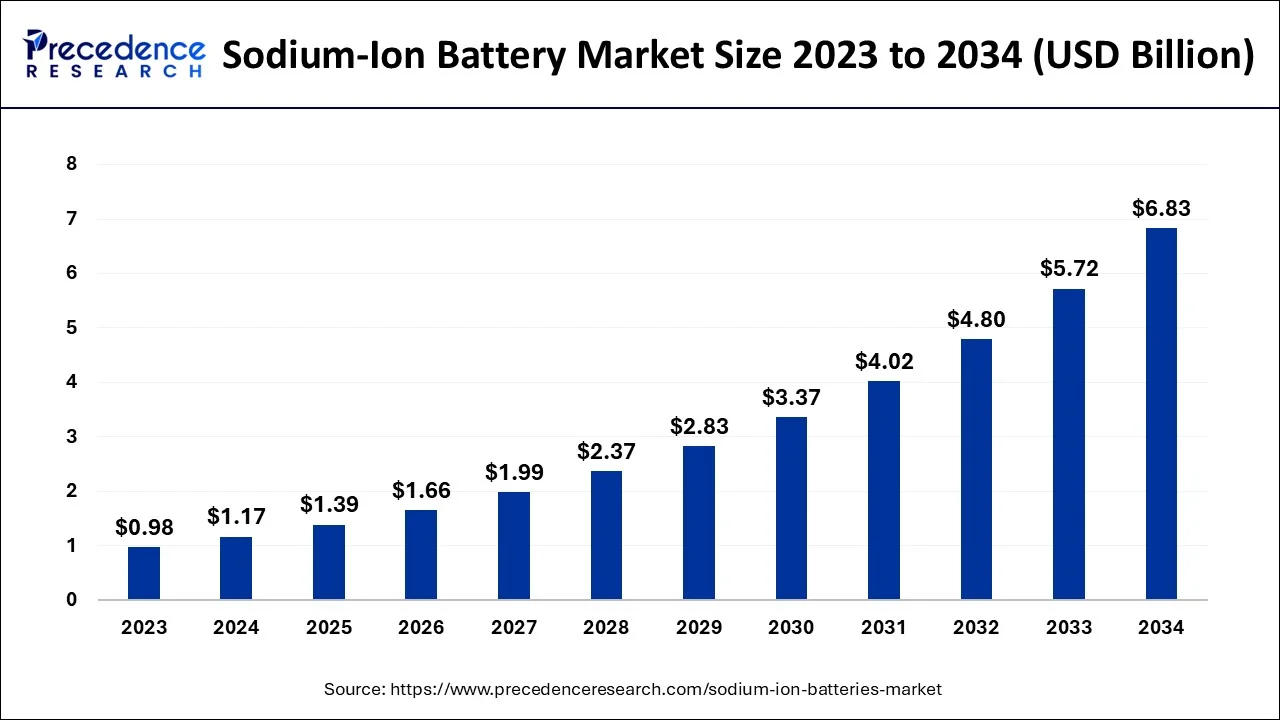

The global sodium-ion battery market size accounted for USD 1.17 billion in 2024, grew to USD 1.39 billion in 2025 and is predicted to surpass around USD 6.83 billion by 2034, representing a healthy CAGR of 19.30% between 2024 and 2034 .

The global sodium-ion battery market size is accounted for USD 1.17 billion in 2024 and is anticipated to reach around USD 6.83 billion by 2034, growing at a CAGR of 19.30% from 2024 to 2034. The operation of sodium-ion batteries is the same as that of other commercially available batteries, such as lithium-ion batteries. A sodium-ion battery is made up of a fluid electrolyte with sodium salts in polar molecules, an anode, and a cathode formed of any material containing sodium.

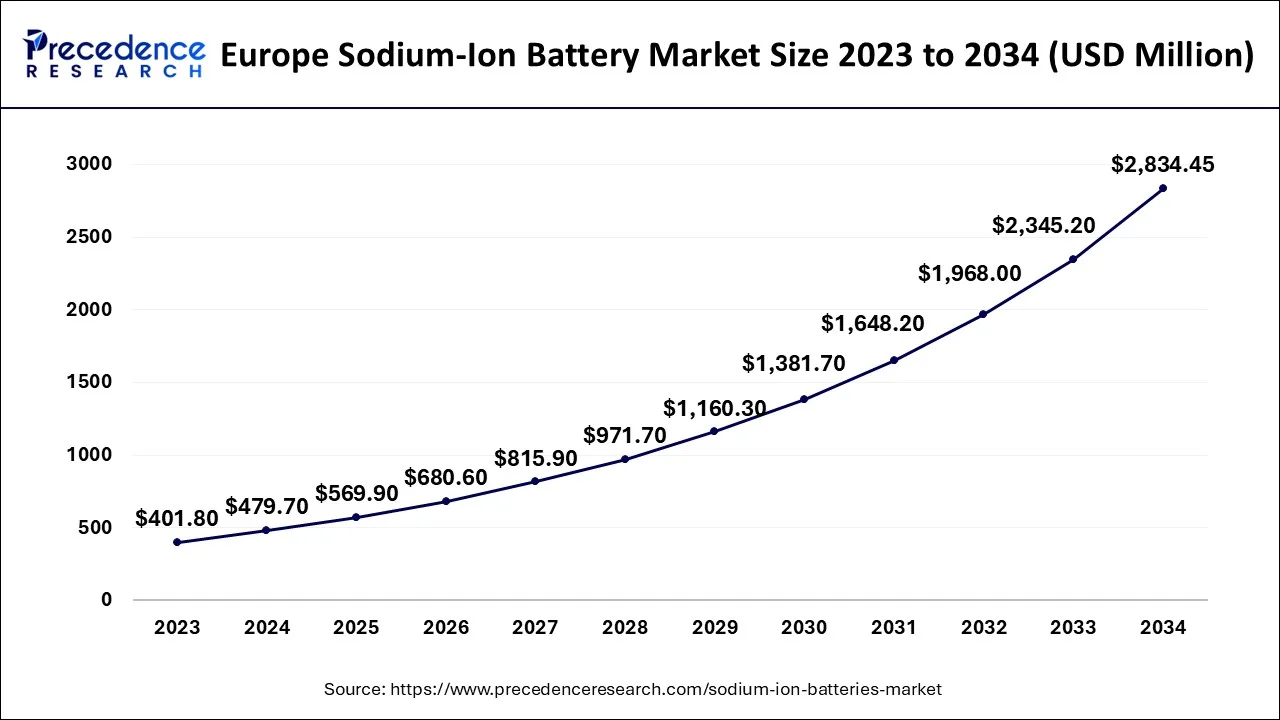

The Europe sodium-ion battery market size is evaluated at USD 0.48 billion in 2024 and is predicted to be worth around USD 2.83 billion by 2034, rising at a CAGR of 19.47% from 2024 to 2034.

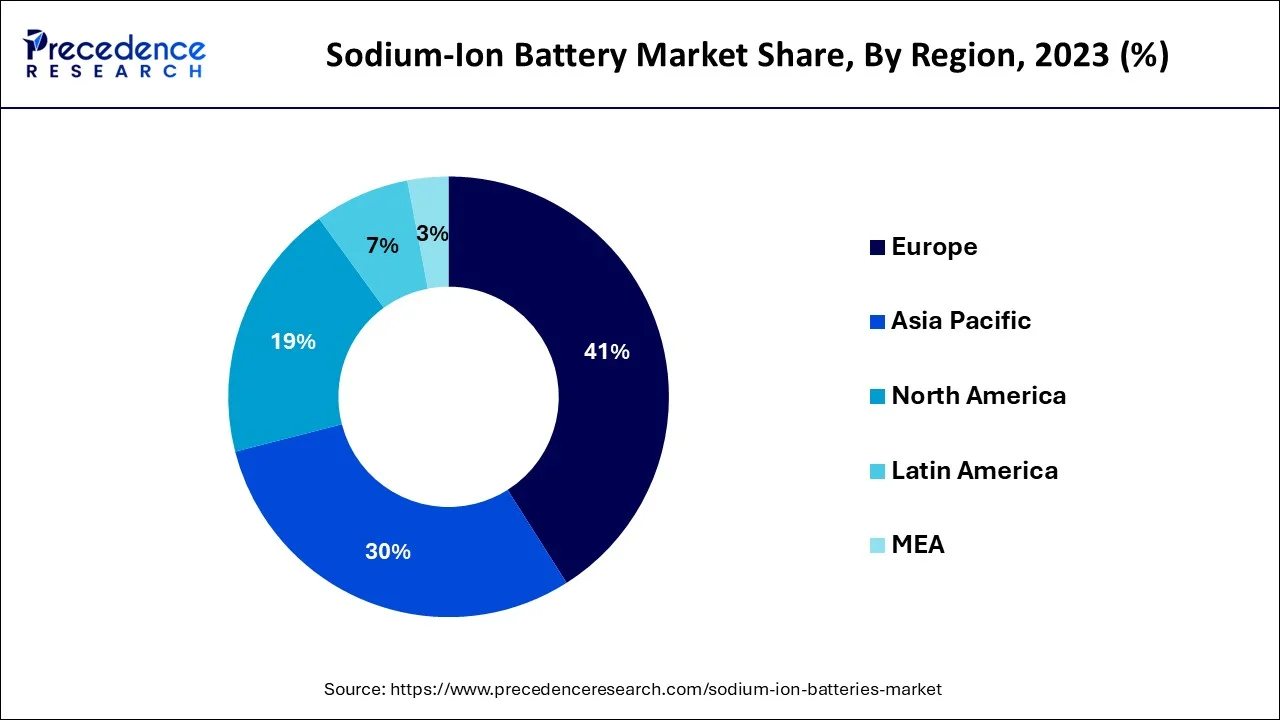

Due to plans for future major capacity extensions of wind and solar power as well as growing sales of electric vehicles in the area, the sodium-ion batteries industry in North America is predicted to be lucrative. Poor power distribution networks exist in certain Latin American nations, notably those in the Caribbean Islands, Venezuela, Columbia, and Chile. Local governments in the aforementioned nations, as well as Uruguay and Brazil, are concentrating on increasing solar capacity to fulfill the region's rising need for electricity. The expansion of the sodium-ion batteries market in the area is anticipated to be fueled by the increase in solar capacity in the area.

The European Union is emphasizing the switch to renewable energy sources and supporting local governments in putting electric car infrastructure into place. Over the expected period, it is anticipated that rising sales of electric cars and the growth of the region's renewable industry would propel the sodium-ion batteries market. The Middle East region's capability for renewable energy has considerably expanded. Some of the main forces behind the expansion of renewable energy in Africa and the Middle East include installations in Saudi Arabia, the UAE, and South Africa. The sodium-ion batteries industry is predicted to grow as a result of the increased renewable energy potential in the area.

A solid and quickly growing market for renewable energy appears to exist in the Asia Pacific area. One of the main factors propelling the expansion of the region's renewable energy industry is capacity expansions in China, Japan, and India. Future sodium-ion revenue growth in the Asia Pacific area is predicted to be boosted by the rise of the renewables sector.

Due to the inherent advantages of sodium-ion batteries, the quick adoption of intermittent energy sources like wind and solar, as well as the rising popularity of low-speed electric vehicles like e-rickshaws and e-bikes, the market for sodium-ion batteries is predicted to expand at a healthy rate. The National Institution for Transforming India predicts that by 2030, India's need for grid storage batteries would reach 260-gigawatt hours (GWh).

By 2032, India wants to meet 50% of its energy demands with renewable energy, which would increase the demand for storage batteries. The International Energy Agency (IEA) also predicts that by 2050, solar photovoltaic (PV), wind, and hydro will produce around 80% of the world's power. The expanding solar and wind energy sectors are anticipated to generate large prospects for the sodium-ion batteries market since sodium-ion batteries are a significant energy storage technology with extra benefits. Globally, there is a growing need for cleaner energy as a result of rising greenhouse gas emissions. One of the main factors influencing the sector is this, together with the growing usage of sodium-ion batteries to store electricity produced by solar or wind energy. Furthermore, governments in numerous countries are encouraging the development of renewable energy to provide consistent power supplies and fuel diversification, which improves energy security, reduces the risk of fuel spills and reduces the demand for imported fuels. Aside from that, leading market players are heavily spending on research and development (R&D) activities to introduce improved stationary energy storage, which is projected to have a favorable impact on the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.17 Billion |

| Market Size by 2034 | USD 6.83 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 19.30% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

By Product, By Technology, By Application, and By Industry Vehicle |

Rising adoption of sodium-ion battery

Increased demand for electric vehicles

The market is split into two categories based on application: transportation and stationary energy storage. The worldwide sodium-ion batteries market was dominated by stationary energy storage in 2022, and it is anticipated that this dominance will throughout the whole forecast period. Renewable energy sources like solar and wind are producing more energy, therefore energy storage is essential to maintaining a steady supply of electricity. The stationary energy storage system can store energy when it's not needed and release it as electricity when it is. An array of batteries, an electronic control system, an inverter, and a thermal management system are typically found in stationary energy storage systems. The life cycle costs for stationary storage applications like grid-scale load shifting of fluctuating renewable energy or behind-the-meter home storage must be as cheap as feasible, even while volumetric energy density constraints are less strict than for other purposes.

A molten salt battery comprised of liquefied sodium and Sulphur is known as a sodium-sulfur battery. Good energy density, high charge or discharge efficiency, and a big lifespan are all characteristics of this kind of battery. It is built of inexpensive components.

The electrolyte of a sodium-salt battery is a saline solution. These batteries are less combustible than those created with poisonous or flammable components, and they are also simple to recycle. Recently, interest in sodium-oxygen batteries has grown. The sodium-oxygen battery which is rechargeable has a theoretical specific energy of around 1600 W h kg1 and the potential for equilibrium discharge of 2.3 V. It also has an enticing new metal-air battery architecture for uses in transportation.

The worldwide sodium-ion batteries market has been driven by the growing popularity of sodium-ion batteries, notably in the electronics sector. Compared to the more expensive lithium-ion batteries, sodium-ion batteries are a better choice since sodium is a plentiful and accessible metal found in the earth's crust. The price of the cathode, as well as electrolyte, has decreased to around 50 percent of the cost of the complete cell due to the ample availability of sodium, thus reducing the cost of the battery as a whole.

Batteries are now being made utilizing sodium-ion batteries due to the reduction of lithium resources and increased expenses associated with processing and mining lithium. It may be possible to process sodium-based compounds using the same machinery that is utilized to process lithium-ion materials and make the transition to sodium-ion batteries simpler for producers. The long-term durability of sodium-ion batteries is influenced by the availability of sodium metal, which helps to satisfy the market's increasing need for a dependable power supply.

By Product

By Technology

By Application

By Industry Vehicle

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

July 2024