August 2024

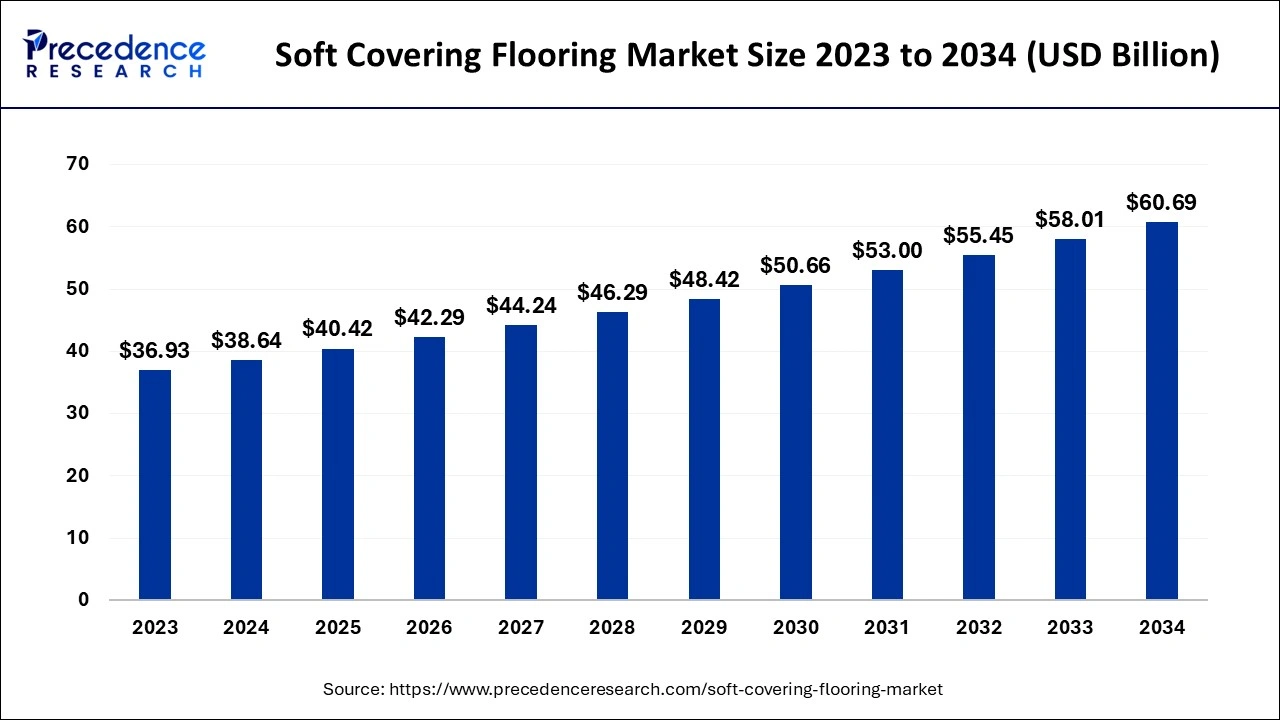

The global soft covering flooring market size accounted for USD 38.64 billion in 2024, grew to USD 40.42 billion in 2025 and is expected to be worth around USD 60.69 billion by 2034, registering a CAGR of 4.62% between 2024 and 2034. The North America soft covering flooring market size is evaluated at USD 15.84 billion in 2024 and is projected to grow at a CAGR of 4.73% during the forecast period.

The global soft covering flooring market size is calculated at USD 38.64 billion in 2024 and is predicted to hit around USD 60.69 billion by 2034, expanding at a CAGR of 4.62% from 2024 to 2034. Growing demand for carpet tiles is the key factor driving the growth of the market. Also, the implementation of stringent regulations related to carbon emissions along with the increasing recycling of post-consumer carpets can fuel market growth shortly.

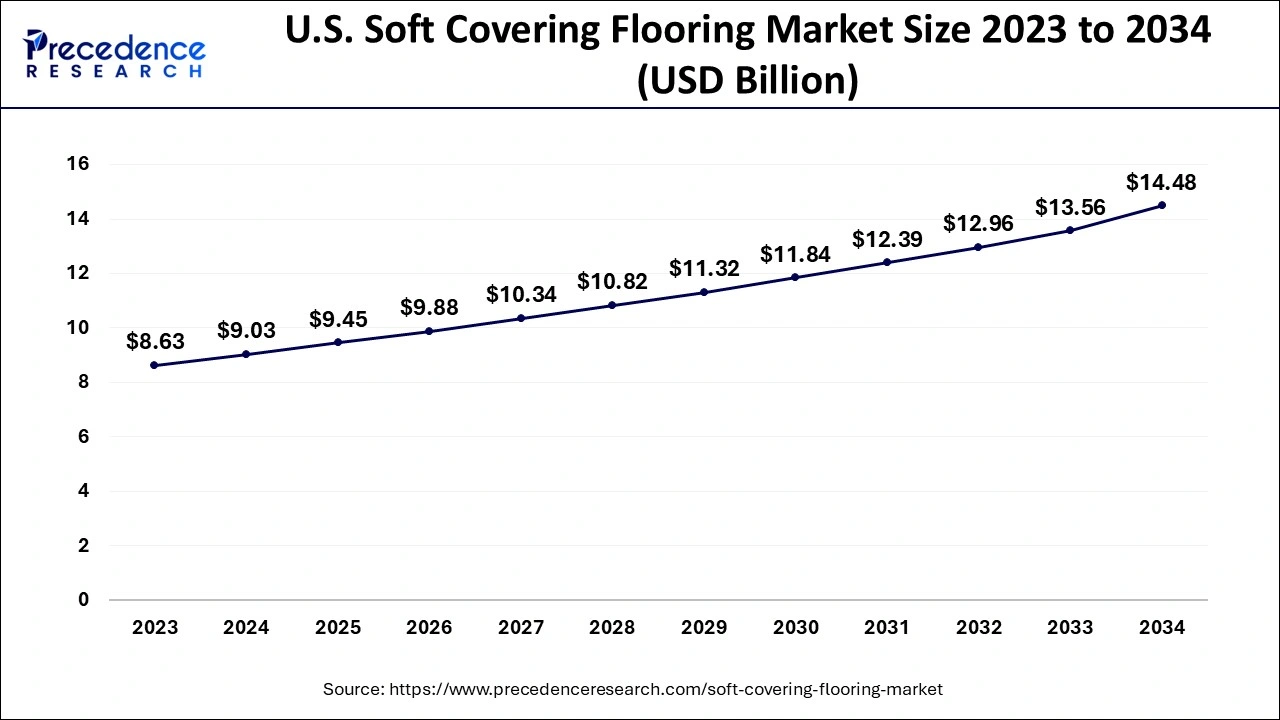

The U.S. soft covering flooring market size is exhibited at USD 9.03 billion in 2024 and is anticipated to reach around USD 14.48 billion by 2034, growing at a CAGR of 4.81% from 2024 to 2034.

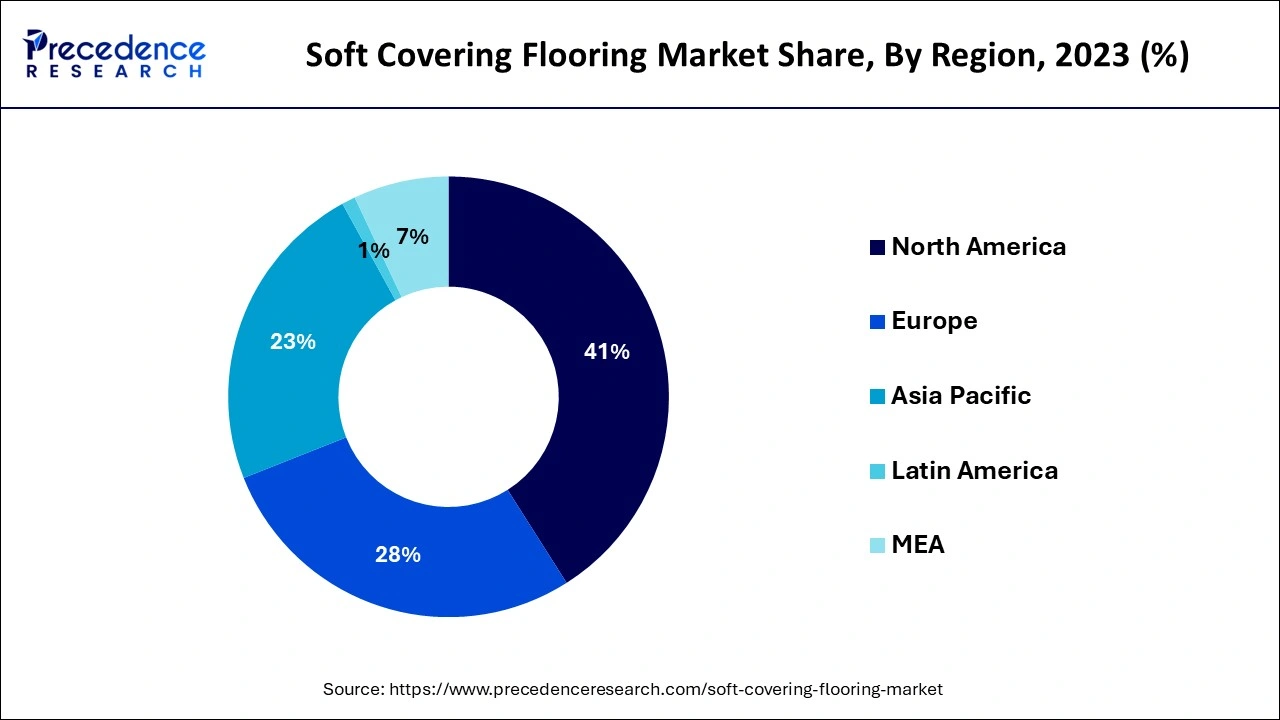

North America dominated the soft covering flooring market in 2023. The dominance of the segment can be attributed to the increasing penetration of the product in commercial and residential buildings because of the easy installation process and high durability. Furthermore, rising commercial buildings and retail outlets on account of increasing urbanization in countries like Mexico are likely to fuel the expansion of the soft covering flooring market in the region. Growing consumer inclination towards the construction of residential buildings, along with the growing per capita income, can impact market growth significantly.

The Middle East and Africa region is expected to grow at a significant rate over the projected period. The growth of the region can be driven by increasing demand for bleach-resistant, stain-proof, and anti-microbial carpet tiles for utilization in the hospitality industry and healthcare facilities is estimated to propel growth. However, the growing need for a replacement market, mainly from the offices, hotels, and mosques in the Gulf countries, can create lucrative opportunities for the region's market.

The soft covering flooring market covers a wide range of products designed to offer practicality in commercial and residential spaces coupled with aesthetic appeal. The market includes materials like carpet rugs and other flooring options, which are all valued for their ability to improve indoor acoustics and underfoot softness. Consumers increasingly prefer design and comfort in their living atmosphere, driven by innovation in home renovation and interior design.

Role of AI in the Soft Covering Flooring Market

AI-powered automated crafted tools play an important role in making designs and allowing customers to visualize how various flooring options will look in a virtual environment. This is possible because of the use of augmented reality (AR) or virtual reality (VR), which allows users to see how some floors appear in their existing decor. Furthermore, In the flooring industry, predictive maintenance uses AI to foresee future failures before they happen. This is vital because the machinery in flooring production, including cutters, presses, and finishing equipment, is highly catering and expensive.

| Report Coverage | Details |

| Market Size by 2034 | USD 60.69 Billion |

| Market Size in 2024 | USD 38.64 Billion |

| Market Size in 2025 | USD 40.42 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

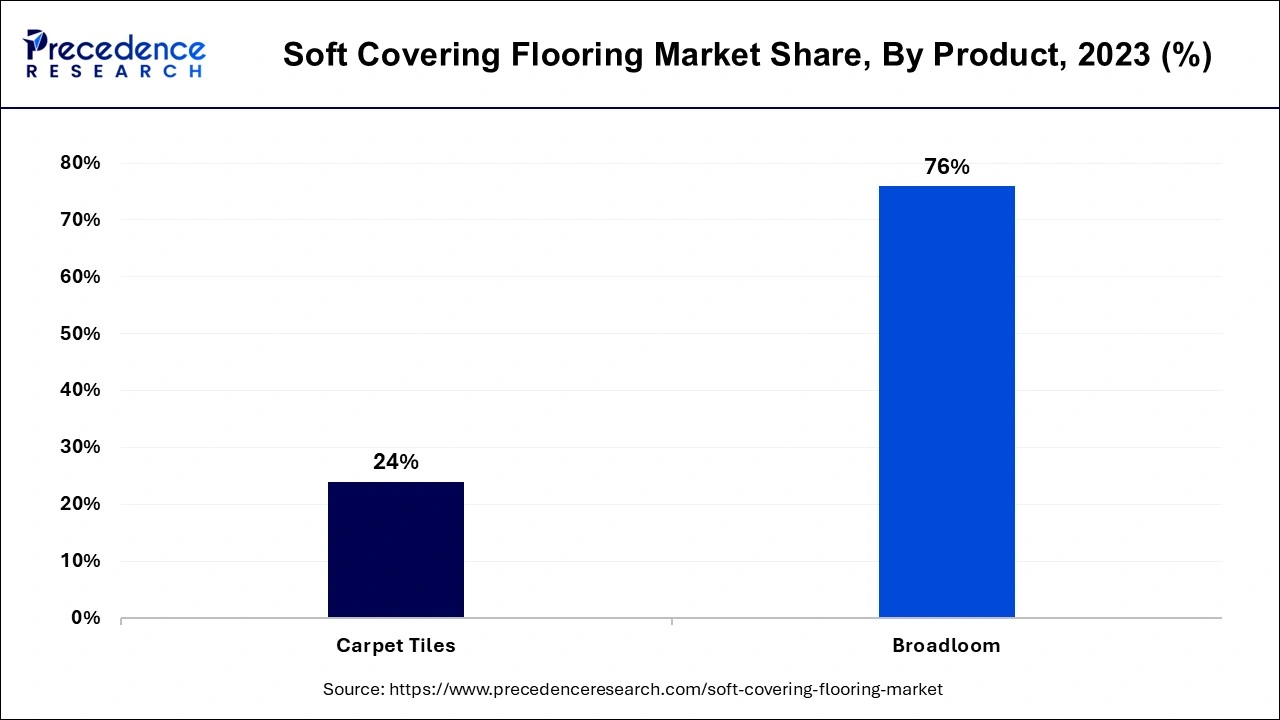

Increasing usage of soft covering flooring for carpet tiles and broadloom manufacturing.

Soft-covering flooring products are extensively involved in the production of numerous types of products like area rugs and carpets. Broadloom and carpet tiles are smooth covering floorings used for superior characteristics such as dimensional stability and flexibility. Additionally, the increasing need for soft covering flooring to produce broadloom and carpet tiles is anticipated to propel the soft covering flooring market growth in the near future.

Increasing need for multi-story buildings

There is a growing need for multistorey buildings in commercial and residential sectors. The demand for these buildings is driven by the growing population and consumer spending. Likewise, the growth of commercial multistorey buildings is credited to the rapid urbanization and industrialization in developing countries. Furthermore, the government's focus on developing smart cities is expected to fuel the demand for multistory buildings.

Maintenance and durability issues

Soft covering flooring often necessitates more maintenance as compared to hard floors because it can get stained easily and may harbour allergens. Hence, these concerns regarding maintenance can prevent some customers from choosing soft flooring, which can hamper the market growth. Moreover, price sensitivity among customers can influence the demand for soft covering flooring, especially in economically difficult times.

Surge in commercial usage and tourism expansion

The increasing demand for innovative designs and styles from end commercial applications is expected to fuel the demand for soft-covering flooring. The expansion of the commercial replacement market can also stimulate the growth of the soft covering flooring market. Furthermore, the growing tourism and hospitality industries, along with the rising investments in the real estate sector, can generate lucrative opportunities in the market over the forecast period.

Increasing demand for customization and personalization

There is a new trend towards the provision of customized soft-covering flooring solutions to consumers. Customers increasingly search for personalized textures and colors that reflect their special style prompting producers to provide more specific options. Also, the utilization of smart technologies in the market is an emerging market trend driving market growth.

The broadloom segment dominated the soft covering flooring market in 2023. The dominance of the segment can be attributed to the increasing implementation of broadlooms because of its key features like moisture resistance properties. Additionally, the superior aesthetics offered by broadloom flooring are anticipated to boost the segment growth further. Broadloom is the most popular and conventional carpeting choice in both commercial and residential sectors.

The carpet tiles segment is expected to grow at a significant rate in the soft covering flooring market over the forecast period. The growth of the segment can be linked to the ease of replacement and rotation offered by the carpet tiles made of nylon, linoleum, polypropylene, and other synthetic fibers. However, carpet tiles stimulate access to subfloor air delivery systems and electrical and computer wirings with lower disruption; hence, its demand is rising. Carpet tiles also remove the bad appearance and damage caused by conventional carpet cutting during connections and disruption.

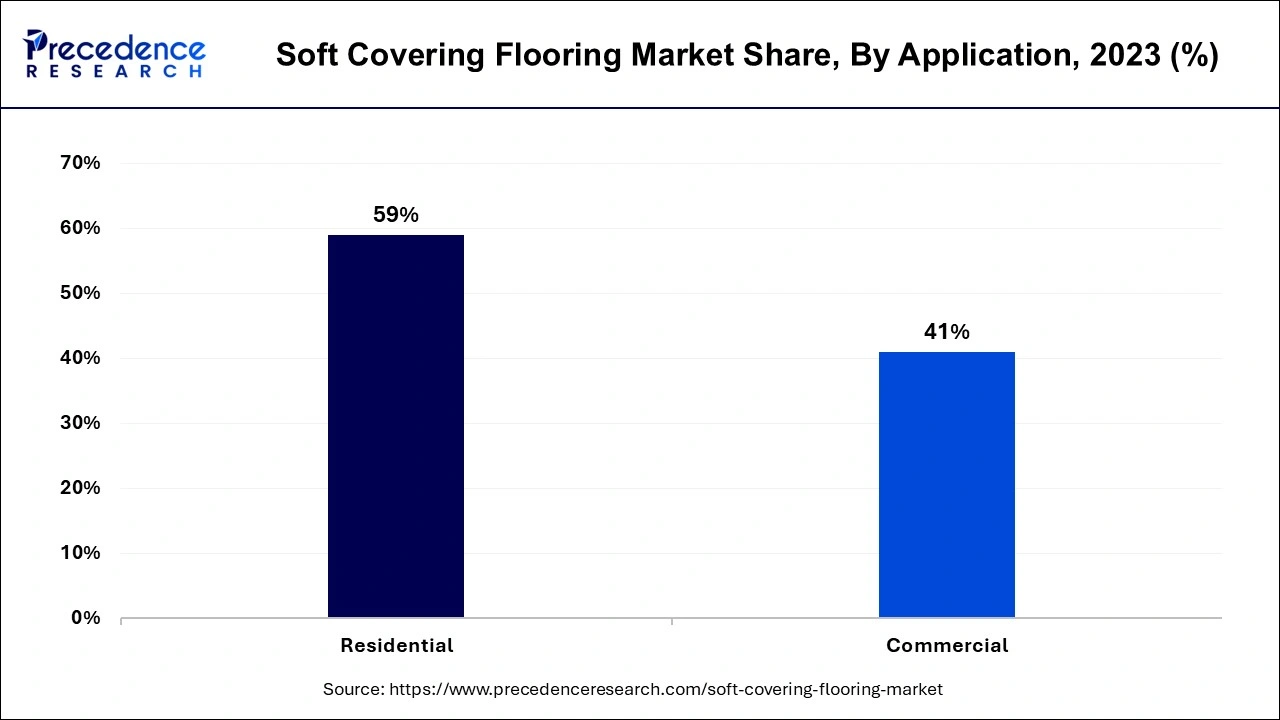

In 2023, the residential segment led the soft covering flooring market by holding the largest market share. The dominance of the segment can be credited to the growing refurbishing and replacement activities along with the surge in production. Furthermore, the increase in the number of nuclear families globally is anticipated to propel the demand from the residential segment during the projected period. Most nations around the world have exhibited an innovative trend in existing structures to reduce the building's energy consumption.

The commercial application segment is estimated to grow at a significant rate over the studied period. The growth of the segment can be driven by the increasing demand for products from health care, retail facilities, education, airports, and offices. Moreover, the increasing demand for advanced designs and styles from the high-end commercial domain and the surge in the commercial replacement market are anticipated to facilitate the growth of the soft covering flooring market.

Recent Developments

Segments covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

March 2025

July 2024