November 2024

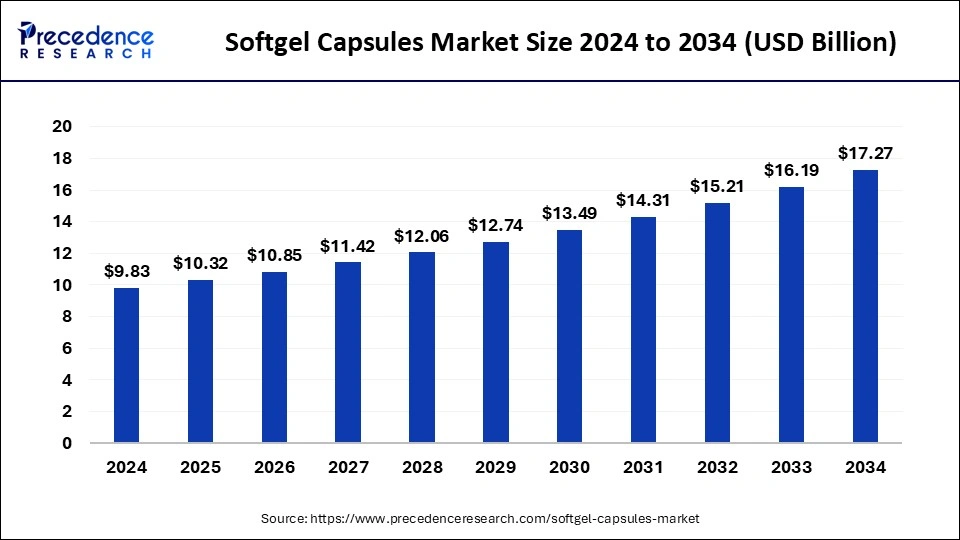

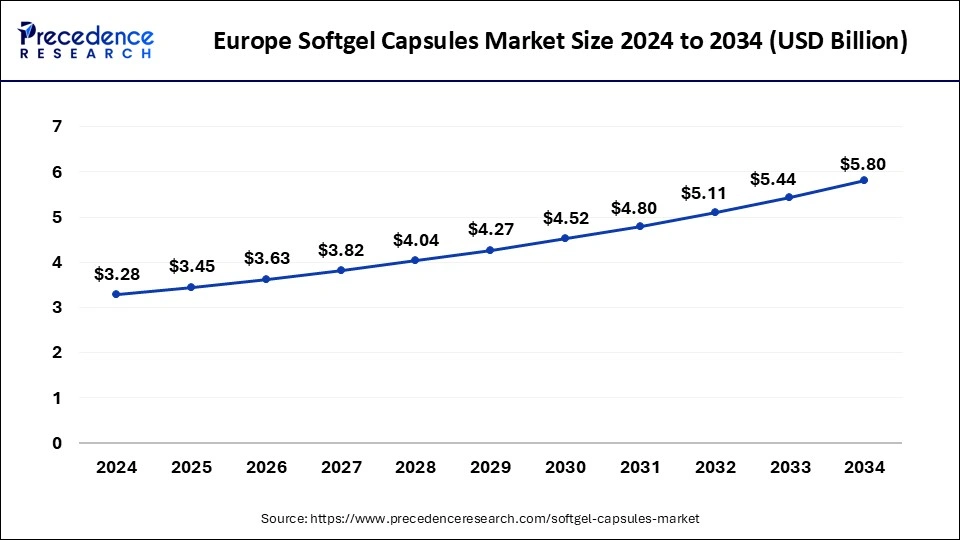

The global softgel capsules market size accounted for USD 10.32 billion in 2025 and is forecasted to hit around USD 17.27 billion by 2034, representing a CAGR of 5.90% from 2025 to 2034. The Europe market size was estimated at USD 3.28 billion in 2024 and is expanding at a CAGR of 6.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global softgel capsules market size was calculated at USD 9.83 billion in 2024 and is predicted to increase from USD 10.32 billion in 2025 to approximately USD 17.27 billion by 2034, expanding at a CAGR of 5.90% from 2025 to 2034.

The Europe softgel capsules market size was exhibited at USD 3.28 billion in 2024 and is projected to be worth around USD 5.80 billion by 2034, growing at a CAGR of 6.00% from 2025 to 2034.

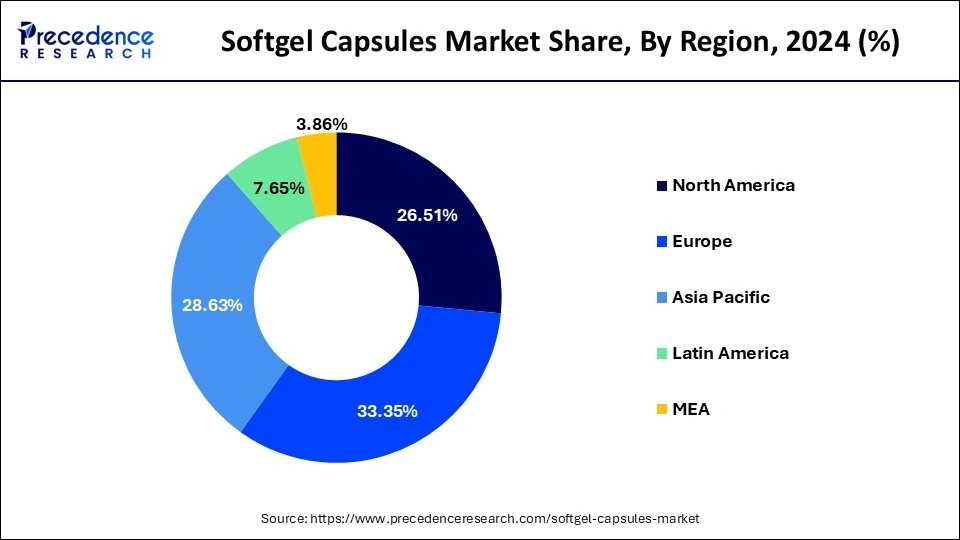

Europe led the global market with the highest market share of 33.35% in 2024. and observed to sustain the dominance during the forecast period owing to the presence of major manufacturers. These manufacturers have adopted various types of strategies to remain competitive in the market including product launches, acquisition, expansion, collaboration, investment and others.

Moreover, North America has a strong consumer focus on health and wellness, driving the demand for dietary supplements, vitamins, and other health-promoting products encapsulated in softgel form.

The Asia Pacific is expected to grow at the highest CAGR in the softgel capsules market during the forecast period. Its fast expansion may be attributed to a number of causes, including the large number of generic medication producers in China and India, the rising need for affordable treatments, the quickly improving economic conditions, and the rise in contract manufacturing organizations within the area. Increased spending on customized treatment and the use of advanced processing techniques to enhance softgel manufacturing are also anticipated to propel regional market expansion.

Softgel capsules, also known as soft gelatin capsules or softgels, are a type of oral dosage form used to encapsulate and deliver liquid or semi-solid substances in a convenient and easily ingestible form. They consist of a gelatin-based outer shell, typically composed of gelatin, plasticizers, and water, which encloses the active ingredients. The softgel capsules market offers materials for applications of softgel capsules including the delivery of vitamins, minerals, herbal extracts, essential oils, pharmaceuticals, and nutritional supplements. The versatility of softgel capsules makes them a popular choice for formulating a wide range of products in the pharmaceutical, nutraceutical, and cosmetic industries.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.90% |

| Market Size in 2025 | USD 10.32 Billion |

| Market Size by 2034 | USD 17.27 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Manufacturers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing need for softgel capsules in specialty & preventive healthcare

The softgel capsules market, especially in the nutritional supplement industry, is being driven by the rising awareness of health issues and the growing importance of preventative healthcare. The ageing population worldwide is a major factor in this since senior people frequently need medications and nutrients in an easily absorbed and easy form.

As a result, softgel capsules that address common health issues including menopause, vitamin deficiencies, eye health, and others have seen a noticeable increase in demand. Many softgel capsule manufacturers have responded to this increased demand by creating customized solutions that are meant to meet these particular health demands. Furthermore, the demand for these specialty softgel capsules is anticipated to continue growing in the predicted years due to the rising incidence of certain health issues.

Cost and preference of substitutes

Gelatin, which comes from animal collagen, is the main ingredient in softgel capsules. Variations in the price and availability of gelatin can have an effect on softgel capsule production costs, which can have an effect on pricing and profit margins. Furthermore, softgel capsules are not the only dosage form options; tablets, hard capsules, gummies, and liquid formulations are all competitive options. Thus, this is expected to hamper the softgel capsules market over the forecast period.

Growing trends of plant-based softgels

The increasing expenditures in the manufacturing of plant-based softgels are anticipated to fuel the growth of the softgel capsules market globally. Because these medications do not contain any animal products, they can be used by a wider range of patients. Plant-based softgels are easier for the body to absorb and don't include any undesirable components. They are also free of allergens like gluten and eggs, which makes them a great alternative for medication for those who avoid consuming anything that comes from animals.

The gelatin-based/animal-based segment held the dominating share of the softgel capsules market in 2024. Gelatin provides softgel capsules with flexibility and elasticity. This property allows the capsules to withstand handling, transportation, and potential deformation without breaking or cracking. Moreover, gelatin-based softgel capsules have excellent sealing capabilities.

The gelatin shell effectively encapsulates liquid or semi-solid contents and prevents leakage, ensuring the stability and integrity of the encapsulated material. Furthermore, the growing gelatin-based product grant by regulatory bodies is anticipated to propel the segment growth over the projected period.

When softgels are subjected to certain active ingredients or unfavorable storage circumstances, crosslinking takes place, which results in the formation of molecular linkages inside the capsule shell. The breakdown is impeded by these molecular connections.

Besides, the non-animal-based capsules segment is expected to grow at a rapid rate over the projected period in the softgel capsules market. Non-animal-based softgel capsules cater to consumers who follow vegetarian or vegan diets, addressing ethical and dietary preferences. These capsules are free from animal-derived gelatin, making them suitable for a broader range of dietary lifestyles.

The growing product offering by the market players propels the expansion of the market. In April 2023, a prominent producer of flavors, excipients, and functional ingredients for pharmaceuticals, biotechnology, and dietary supplements, IFF announced the introduction of a new pectin-based technology that will further broaden its line of vegan softgels. With the launch of VERDIGELTM SC, producers of vegan softgels may now provide carrageenan-free goods, which are highly sought after in several sectors.

Softgel Capsules Market Revenue, By Type, 2022-2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Gelatin-based Capsule | 8,147.6 | 8,501.4 | 8,874.0 |

| Vegetarian Capsules | 822.7 | 880.0 | 954.9 |

The vitamins and dietary supplements segment stood as a dominating segment of the softgel capsules market in 2024. When vitamins are made into pills or candies, they are vulnerable to oxidation and destruction by the atmosphere. Therefore, softgel capsules are the ideal formulation option since they protect against oxidation and UV light, extending the shelf life of the product.

Research indicates that vitamins taken as softgel capsules enter the circulation faster than those taken as tablets. Because of these benefits, vitamins are mostly offered as softgel capsules, which has led to their significant market share in the application area. The COVID-19 pandemic caused a roughly 89% increase in vitamin C and D supplement sales in nations like the United States and India compared to 2019.

Besides, the health supplements segment is expected to grow at a rapid rate during the forecast period. The softgel capsules market continues to thrive as the demand for health supplements rises globally. Consumer preferences for easy-to-swallow, bioavailable, and convenient dosage forms contribute to the sustained growth of softgel capsules in the health and wellness sector. Manufacturers are continually exploring new formulations and incorporating innovative ingredients to meet the evolving needs of consumers in the health supplements market.

Softgel Capsules Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Health & Dietary Supplement | 5,856.2 | 6,125.6 | 6,427.4 |

| Prescription Medicine | 2,533.3 | 2,651.0 | 2,770.8 |

| Others | 580.8 | 604.8 | 630.7 |

The nutraceutical companies segment held the largest share of the m softgel capsules market in 2024. Nutraceutical companies often choose softgel capsules as a preferred dosage form for delivering bioactive ingredients. Softgels protect these sensitive compounds from degradation and enhance their bioavailability, ensuring effective delivery to the body. Moreover, they are widely used by nutraceutical companies to encapsulate vitamins and minerals. This includes individual vitamins (such as vitamin D, vitamin E, and vitamin A) and minerals (like calcium, magnesium, and zinc) or combinations in multivitamin formulations.

The pharmaceutical companies segment is expected to grow at a substantial rate in the softgel capsules market over the forecast period. Softgel capsules are easy to swallow, making them a patient-friendly dosage form. This is particularly important for pharmaceutical companies when developing medications for pediatric and geriatric populations, as well as for patients who may have difficulty swallowing traditional tablets or capsules. Thus, this is expected to drive the segment expansion.

Softgel Capsules Market Revenue, By Manufacturers, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Pharmaceutical Companies |

2,466.4 | 2,584.8 | 2,712.2 |

| Nutraceutical Companies |

3,886.5 | 4,072.7 | 4,276.8 |

| Others |

2,617.4 | 2,723.8 | 2,839.8 |

By Type

By Application

By Manufacturers

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

June 2024