November 2024

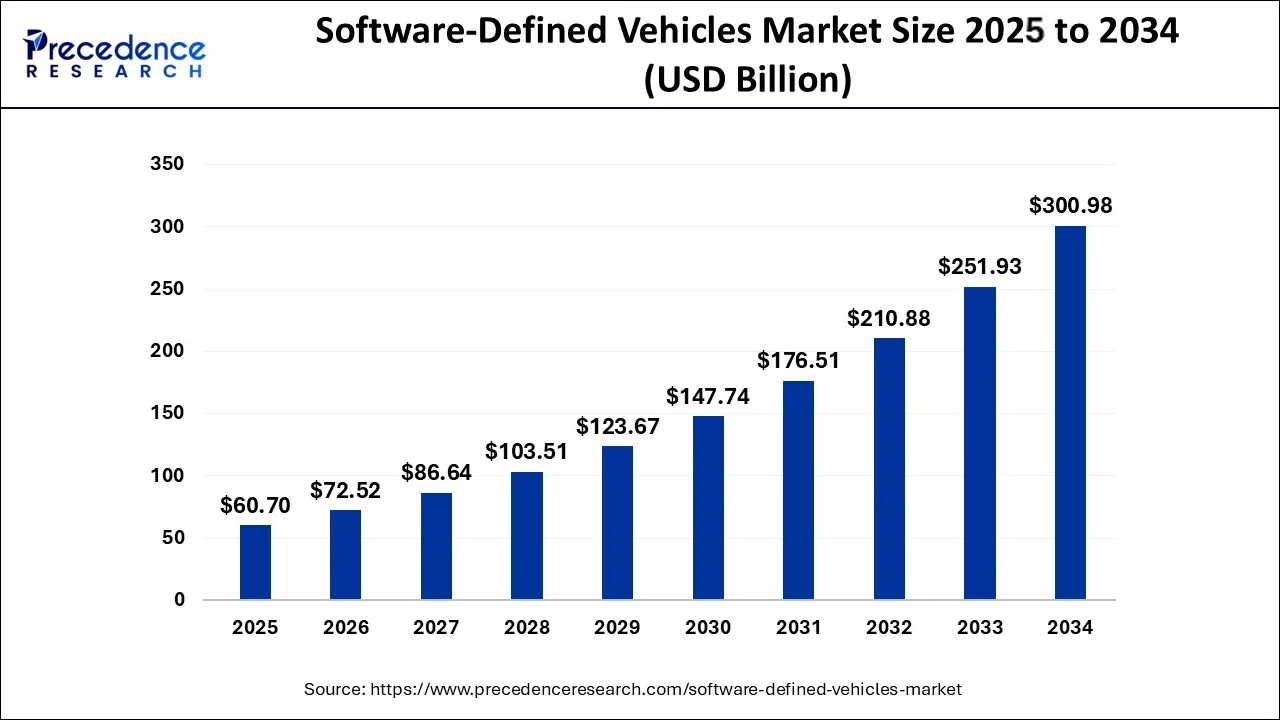

The global software-defined vehicles market size is estimated at USD 50.81 billion in 2024, grew to USD 60.7 billion in 2025 and is predicted to surpass around USD 300.98 billion by 2034, expanding at a CAGR of 19.47% between 2024 and 2034.

The global software-defined vehicles market size accounted for USD 50.81 billion in 2024 and is anticipated to reach around USD 300.98 billion by 2034, growing at a CAGR of 19.47% from 2024 to 2034.

The Software-Defined Vehicles Market refers to the use of software-defined networking (SDN) and software-defined architecture (SDA) technologies to enhance the functionality, safety, and efficiency of vehicles. This technology is becoming increasingly popular in the automotive industry as it allows vehicles to be more connected, customizable, and secure. It also allows for more efficient communication between the various systems within the car, such as the engine, braking, and safety systems. Some of the key drivers of the software-defined vehicles market include the increasing demand for connected and autonomous vehicles, the growing need for improved safety features, and the rising demand for more efficient and environmentally friendly vehicles.

SDVs enable customers to receive firmware patches, enhancements to infotainment, tuning, and monitoring of key functional capabilities like vehicle and powertrain dynamics, and feature-on-demand comfort services via over-the-air (OTA) updates.

| Report Coverage | Details |

| Market Size in 2024 | USD 50.81 Billion |

| Market Size by 2034 | USD 300.98 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 19.47% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Propulsion, By Application, By Vehicle Type and By Level of Autonomy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase safety and upgradation

Software-defined vehicles are easier to upgrade and have enhanced features by utilizing over-the-air software as per the need of the driver. SDVs have the potential to significantly reduce the number of accidents caused by human error. The vehicle also has an anti-collision and driver assistance feature for enhanced safety. The updates are independent of the model of the vehicle as well as the speed and agility of the vehicle.

Greater accessibility

SDVs have the potential to provide greater mobility for people who are unable to drive due to physical disabilities or other reasons. With the help of advanced software and technology, SDVs are programmed to safely transport passengers with different mobility needs.

Increase cost as well as rising infrastructure

Software-defined vehicles are generally more expensive than traditional cars due to the different technology and components required, making them less accessible to some consumers. For software-defined vehicles to function properly, there needs to be a robust infrastructure in place to support them. This includes high-speed internet, 5G networks, and other technologies that may not be widely available in some areas.

During the transition to software-defined vehicles, conventional automobile manufacturers will face difficulties and challenges, as well as chances for new automotive industry players such as chip suppliers, software suppliers, and Internet companies. The transformation to software-defined vehicles will be an unstoppable trend driving the growth of the automotive business over the next 5-10 years. All businesses in the industrial chain must conduct comprehensive evaluations and forward planning in order to maintain initiative during the new industrial transformation.

Electric Vehicles (EVs) sector is anticipated to grow at the highest CAGR from 2024 to 2034. EVs use electric motors and batteries to power the vehicle. Software-defined EVs optimize battery usage, improve charging times, and provide more accurate range estimates. Electric vehicles are powered by electricity and have a battery that stores energy, while software-defined vehicles are equipped with advanced software that controls various aspects of the vehicle, such as performance, safety, and entertainment.

The internal Combustion Engine (ICE) Vehicles segment is anticipated to grow at the fastest CAGR from 2024 to 2034. These are vehicles that use a traditional gasoline or diesel engine to power the vehicle. In the case of internal combustion engines, software-defined vehicles are equipped with electronic control units (ECUs) that use various sensors to monitor engine performance and make adjustments to the fuel injection, ignition timing, and other engine parameters to optimize performance and fuel efficiency.

These adjustments are made in real-time, providing drivers with a smooth and efficient driving experience. ECUs are also used to diagnose engine problems and alert the driver when maintenance is required. This help prevents severe damage to the engine and saves the driver money on costly repairs. Overall, software-defined vehicles equipped with internal combustion engines provide drivers with greater control, performance, and efficiency while also helping to reduce emissions and improve the longevity of the engine.

ADAS sector is expected to grow at the highest CAGR during the projected period. ADAS technologies are designed to help drivers avoid accidents by providing warnings, alerts, and automated responses to potential hazards on the road. Some of the most common advanced driver assistance systems (ADAS) features include lane departure warnings, adaptive cruise control, automatic emergency braking, and blind-spot monitoring. Overall, the ADAS and safety segment of the software-defined vehicles market is expected to experience significant growth in the coming years as more automakers and consumers seek out advanced safety features to improve the driving experience and reduce the risk of accidents.

Body Control & Comfort Systems is the fastest-growing sector from 2024 to 2034. This segment encompasses all the systems that control various aspects of the vehicle's body and interior, including lighting, climate control, infotainment, and more. This growth is likely to be supported by ongoing advancements in software and technology, as well as increasing regulatory support for autonomous driving and other advanced vehicle features.

On the basis of vehicle type, the passenger car sector is anticipated to grow at the highest CAGR from 2024 to 2034. The growth of the segment is due to the cost-effective alternative being introduced, like natural ventilation as well as increasing passengers’ comfort. The car producers have increased recently, which is further anticipated to boost the growth of the passenger car industry. Along with this, the rising concern regarding fossil fuel emissions, energy security, as well as increasing competitiveness between sectors is anticipated to encourage the government to make investments and generate incentives in the automotive sector, thus expanding the market of the software-defined vehicle market.

On the other hand, the commercial vehicle sector is anticipated to grow at the fastest CAGR during the projected period. The expansion is due to the rising implementation of sports utility vehicles, mainly in emerging countries. The growth is also attributed due to development in the supply chain and logistics industries. Manufacturers of light industrial vehicles are moving toward an electric, sustainable, and clean world. Several OEMs are developing novel paradigms to transform conventional commercial vehicle base approaches.

The Level 3 sector is anticipated to grow at the highest CAGR from 2024 to 2034. In level 3, the vehicle is able to drive itself in certain situations, but the driver must be ready to take control when prompted. These are automated and are mainly used to avoid accidents.

Level 1 is anticipated to grow at the fastest CAGR during the projected period. This is also known as the driver assistance level; in this, the vehicle is able to assist with steering, braking, or accelerating, but the driver remains in control.

The North American region, which includes the United States and Canada, is expected to be a significant player in the software-defined vehicles market. The presence of major automotive manufacturers and technology companies in this region, along with the increasing demand for electric and autonomous vehicles, is expected to drive growth.

Europe is also expected to be a significant software-defined vehicle market player. The region has a strong automotive industry and is home to several major automotive manufacturers, making it a hub for innovation.

Segments Covered in the Report:

By Propulsion

By Application

By Vehicle Type

By Level of Autonomy

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2024

November 2024

January 2025