February 2025

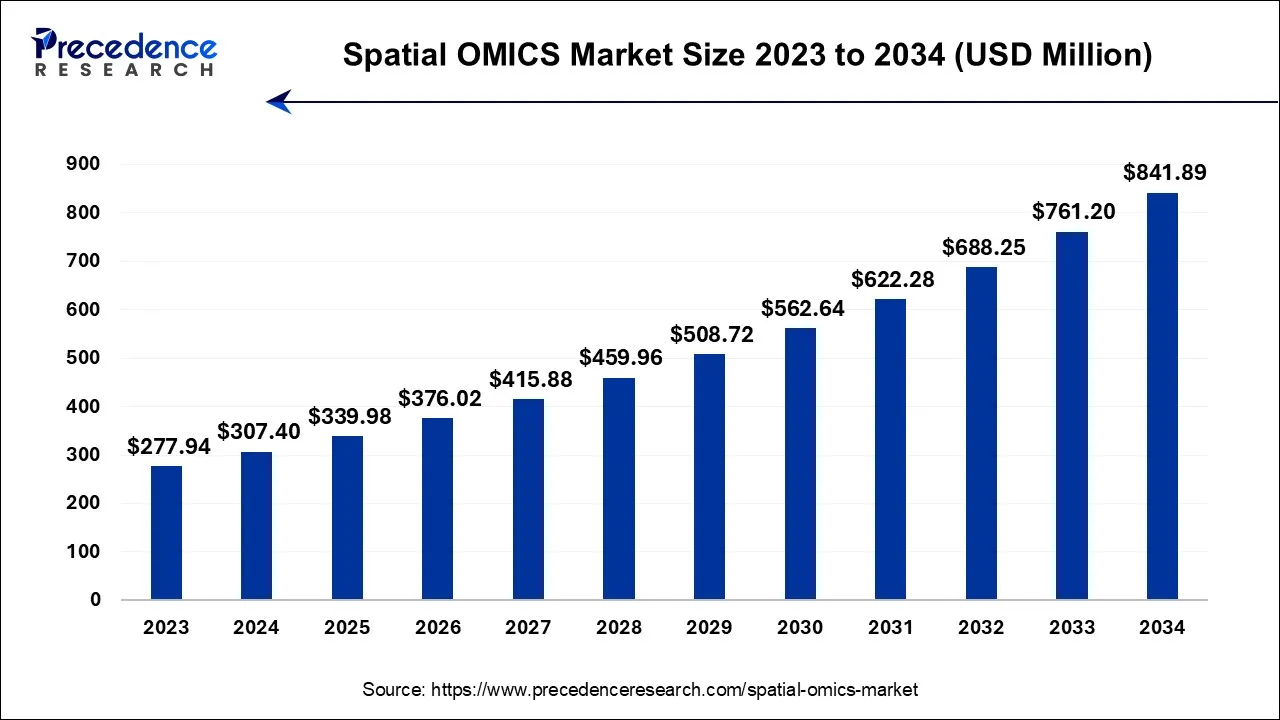

The global spatial OMICS market market size is calculated at USD 339.98 million in 2025 and is forecasted to reach around USD 841.89 million by 2034, accelerating at a CAGR of 10.6% from 2025 to 2034. The North America spatial OMICS market market size surpassed USD 125.07 million in 2024 and is expanding at a CAGR of 10.7% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global spatial OMICS market market size was estimated at USD 307.40 million in 2024 and is predicted to increase from USD 339.98 million in 2025 to approximately USD 841.89 million by 2034, expanding at a CAGR of 10.6% from 2025 to 2034.

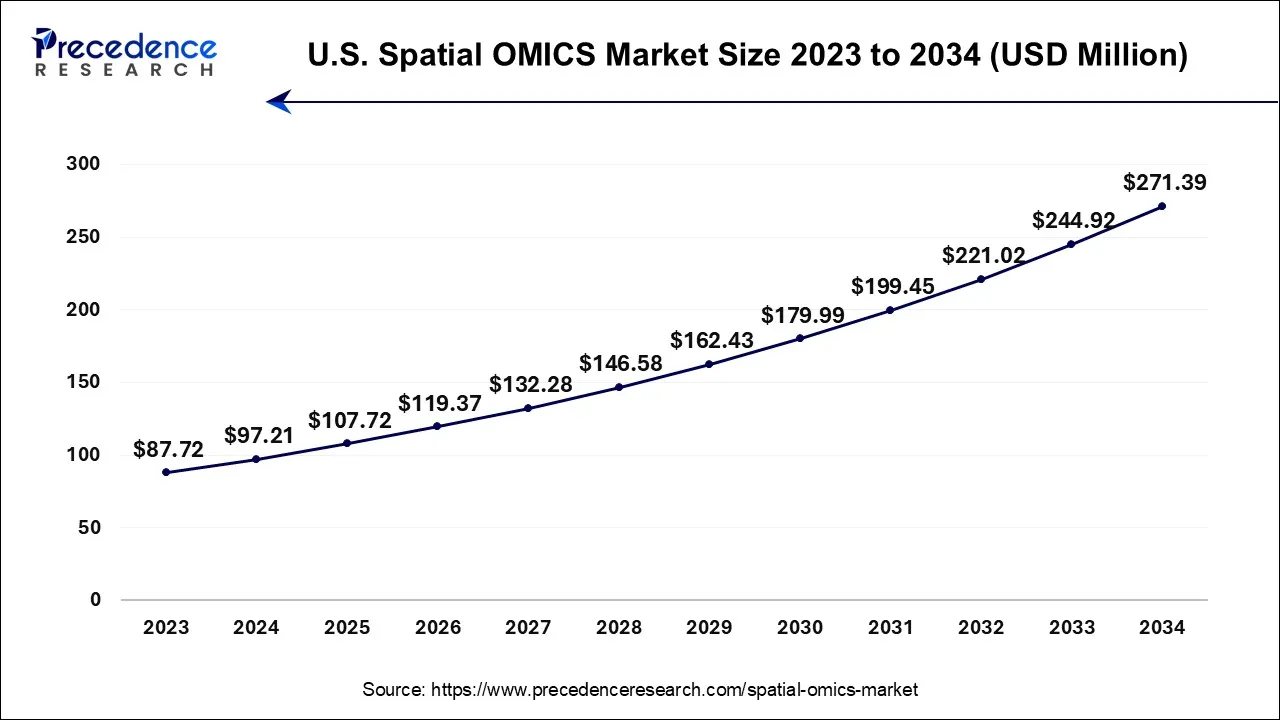

The U.S. spatial OMICS market size is accounted for USD 97.21 million in 2024 and is projected to be worth around USD 271.39 million by 2034, poised to grow at a CAGR of 10.8% from 2025 to 2034.

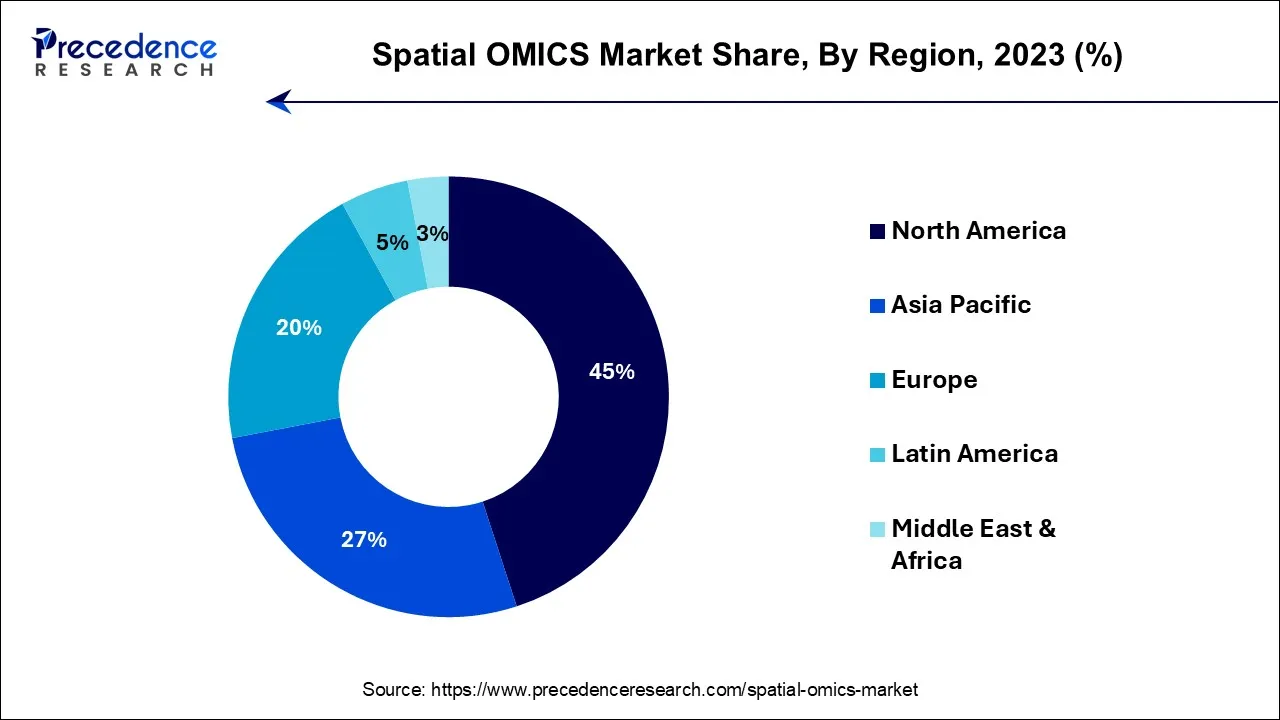

North America has held the largest revenue share of 45% in 2024. The North American spatial OMICS market showcases a trend of substantial growth driven by extensive research and development initiatives. Leading academic institutions, biotechnology companies, and pharmaceutical firms are heavily investing in this technology, particularly in precision diagnostics and drug discovery. The region benefits from a robust infrastructure for data analytics and interdisciplinary collaborations, further accelerating advancements in spatial OMICS applications.

Europe is estimated to observe the fastest expansion. In Europe, the spatial OMICS market is characterized by a strong emphasis on standardization and regulatory compliance. The region is focusing on developing standardized protocols for data collection and analysis, ensuring data accuracy and reproducibility. This commitment to standardization is crucial for fostering trust in spatial OMICS data and its adoption in clinical and regulatory settings. Additionally, European researchers are actively exploring applications in neuroscience and cancer research, contributing to the market's steady growth.

In the Asia-Pacific region, the spatial OMICS market is experiencing rapid growth, driven by increasing investments in healthcare and life sciences research. This dynamic region is witnessing a surge in precision diagnostics, biomarker identification, and applications in fields like agriculture. Governments and research institutions are actively collaborating to harness the potential of spatial OMICS, propelling advancements in disease understanding and treatment strategies.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.6% |

| Market Size in 2024 | USD 307.40 Million |

| Market Size in 2025 | USD 339.98 Million |

| Market Size by 2034 | USD 841.89 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application, By Solution Type, By Sample, and By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Precision medicine advancements and biotechnology advancements

Precision medicine, a cornerstone of modern healthcare, relies on tailoring medical treatment to individual patients based on their unique genetic, environmental, and lifestyle factors. Spatial OMICS technology plays a pivotal role in this paradigm by providing precise spatial information about biomolecules and cells within tissues. This granular understanding enables healthcare professionals to develop personalized treatment strategies.

For instance, in oncology, spatial OMICS can help identify specific biomarkers within a tumor, guiding targeted therapies while minimizing side effects. As precision medicine gains traction and becomes more accessible, the demand for spatial OMICS grows, as it offers the crucial spatial data necessary for truly individualized care.

Continuous advancements in biotechnology, including OMICS technologies and molecular biology tools, are instrumental in propelling the spatial OMICS market. These advancements enable researchers to collect and analyze spatial data with higher precision and efficiency. Cutting-edge biotechnology tools enhance the depth and scope of spatial OMICS applications, from mapping neural circuits in neuroscience to dissecting complex cell interactions in cancer research.

As biotechnology evolves, so does the spatial OMICS field, opening up new possibilities for understanding complex biological systems and unraveling disease mechanisms, which, in turn, fosters a growing demand for this technology.

Data handling challenges and standardization issues

The spatial OMICS market faces significant restraints due to the complexities associated with handling vast and intricate datasets generated by this technology. Spatial OMICS generates a massive volume of multi-dimensional data, including spatial coordinates, gene expression levels, and cellular interactions. Analyzing and managing these data requires substantial computational resources, specialized software, and skilled data scientists.

The challenges in data storage, transfer, and analysis can be a considerable barrier, especially for smaller research institutions or companies with limited resources. These data handling challenges can result in delays, increased operational costs, and hindered decision-making processes, potentially limiting the market's growth.

Another restraint in the spatial OMICS market is the lack of standardized protocols and methodologies. Spatial OMICS technologies are relatively new and rapidly evolving, leading to a lack of universally accepted standards for data collection, analysis, and interpretation. This standardization gap can hinder data reproducibility and comparability between different studies, making it challenging for researchers to build upon each other's work.

Moreover, the absence of clear standards may raise concerns about data accuracy and validity, limiting the technology's adoption in clinical and regulatory settings. Addressing these standardization issues is crucial for fostering trust in spatial OMICS data and unlocking its full potential in various applications.

Precision diagnostics and biomarker identification

The spatial OMICS market experiences a surge in demand driven by its pivotal role in precision diagnostics. This technology empowers healthcare providers to delve deep into an individual's spatial molecular profiles, enabling the development of highly personalized diagnostic tests. It plays a crucial role in early disease detection, characterization, and monitoring, facilitating targeted treatment strategies. Precision diagnostics, made possible through spatial OMICS, offer the promise of more accurate and effective healthcare solutions, particularly in fields like oncology and immunology.

Patients benefit from improved diagnostic accuracy, reduced treatment side effects, and better disease management, which, in turn, fuels the market's growth as healthcare institutions increasingly adopt these cutting-edge techniques.

The market demand for spatial OMICS technology surges as it enables the identification of novel and highly specific biomarkers associated with various diseases. Researchers can explore the spatial distribution of molecular signals within tissues, uncovering unique biomarkers that can be utilized for early disease diagnosis and monitoring. This is especially significant in cancer research, where spatial OMICS allows for the identification of biomarkers that characterize tumor heterogeneity and guide treatment decisions.

Additionally, the technology has applications in neuroscience, identifying spatial biomarkers related to neurodegenerative disorders. The discovery of these biomarkers enhances disease understanding, drives therapeutic advancements, and fosters collaboration between research and clinical communities, elevating the demand for spatial OMICS solutions.

According to the application, diagnostics has held a 39% revenue share in 2024. In the spatial OMICS market, the diagnostics application focuses on utilizing spatial molecular data to develop highly precise and personalized diagnostic tests. It enables the identification of spatial biomarkers and molecular patterns associated with diseases. A significant trend in this segment is the increasing adoption of spatial OMICS for cancer diagnostics, where it provides insights into tumor heterogeneity, facilitating tailored treatment strategies. The technology is also being applied to infectious disease diagnostics, enhancing the accuracy and speed of detection, which is particularly valuable in pandemic response efforts.

The Translation Research segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. Translation Research in the spatial OMICS market involves bridging the gap between research and clinical applications. It focuses on translating spatial molecular insights into practical healthcare solutions. A prominent trend in this field is the integration of spatial OMICS data into clinical decision-making processes, allowing for the development of precision medicine strategies. Researchers are working on establishing standardized protocols and workflows to ensure the reproducibility of spatial OMICS findings, making them more clinically applicable and ensuring a seamless translation of research findings into improved patient care.

According to the solution type, instruments has held 42% revenue share in 2024. In the spatial OMICS market, instruments encompass cutting-edge hardware used for data acquisition and imaging. These instruments enable the spatial mapping of biomolecules within tissues. Recent trends show a shift toward more compact, user-friendly instruments, which reduce the barrier to entry for smaller research institutions. Additionally, there's a focus on multi-modal instruments that combine various imaging techniques, providing a holistic view of spatial data. The development of high-throughput instruments allows for faster data generation, enhancing the efficiency of spatial OMICS workflows.

The software segment is anticipated to expand at a significant CAGR of 11.5% during the projected period. Spatial OMICS software plays a crucial role in data analysis and interpretation. Trends in this segment include the development of user-friendly, intuitive software solutions that simplify complex data analysis processes. Integration with machine learning and artificial intelligence algorithms is also gaining prominence, enabling more advanced spatial data analytics.

Furthermore, there's an emphasis on cloud-based solutions for data storage and collaboration, facilitating remote access and data sharing among researchers and institutions. These trends aim to enhance the accessibility and analytical capabilities of spatial OMICS software.

Based on the Sample, DNA is anticipated to hold the largest market share of 52% in 2024. In the spatial OMICS market, DNA serves as a pivotal component for capturing spatial information. DNA mapping provides a comprehensive blueprint of the genomic landscape within tissues. Through spatial OMICS techniques, researchers can analyze the spatial distribution of genes, uncovering valuable insights into the intricate genetic patterns that exist within biological samples. This DNA-driven approach facilitates the understanding of tissue heterogeneity and gene expression variations, contributing to advancements in disease research, diagnostics, and precision medicine.

On the other hand, the RNA segment is projected to grow at the fastest rate over the projected period. RNA, specifically messenger RNA (mRNA), plays a crucial role in spatial OMICS by reflecting the active genes at a specific moment. Spatial OMICS technologies leverage RNA sequencing to profile the spatial distribution of gene expression within tissues. This approach provides researchers with detailed information about the functioning of genes in their specific spatial context. RNA analysis enables the identification of cellular processes, signaling pathways, and molecular interactions, offering valuable insights into disease mechanisms, biomarker discovery, and the development of targeted therapeutic interventions.

The integration of RNA data in spatial OMICS is fundamental to unraveling the dynamic molecular landscape of tissues and advancing various fields, including cancer research, neuroscience, and developmental biology.

In 2024, the biopharmaceutical and biotechnological companies’ segment had the highest market share of 48% based on the end user. Biopharmaceutical and biotechnological companies are key segments in the spatial OMICS market. They employ spatial OMICS to enhance drug discovery, target validation, and biomarker identification. A trend in this sector is the incorporation of spatial OMICS in clinical trials to gain deeper insights into drug mechanisms and patient responses. These companies also invest in technology development to create specialized spatial OMICS solutions, meeting the rising demand for precise diagnostics and therapeutics.

The academic and research institutions are anticipated to expand at the fastest rate over the projected period. Academic and research institutions in the spatial OMICS market are essential end users, contributing to advancements in spatial OMICS technology. They utilize this technology to explore spatial molecular interactions, map cellular dynamics, and uncover novel insights in various fields, including oncology, neuroscience, and developmental biology. A notable trend is the increased collaboration between academic institutions and biopharmaceutical companies to leverage spatial OMICS in drug discovery and development, fostering innovative research initiatives.

By Application

By Solution Type

By Sample

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025