January 2025

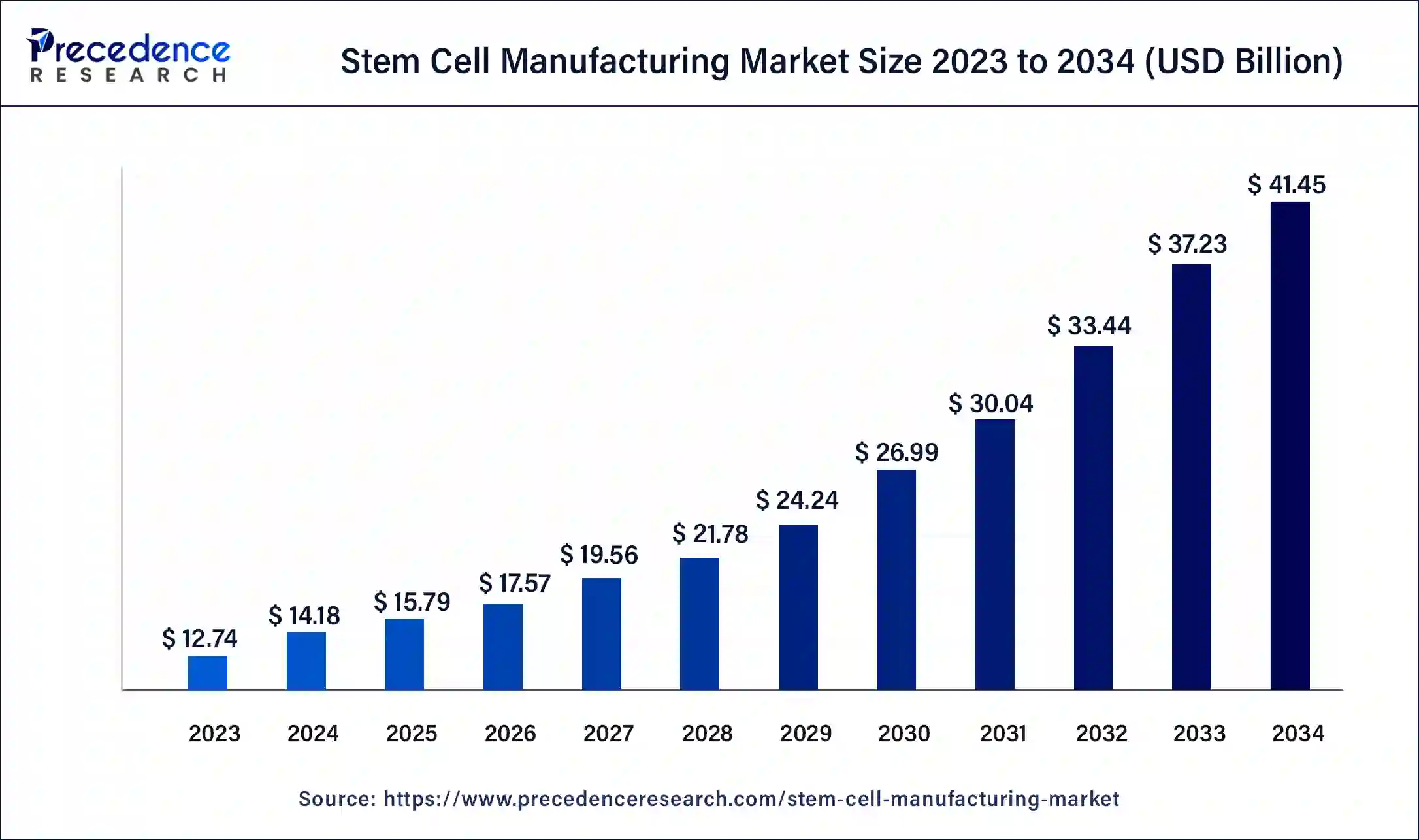

The global stem cell manufacturing market size was USD 12.74 billion in 2023, calculated at USD 14.18 billion in 2024 and is expected to be worth around USD 41.45 billion by 2034. The market is slated to expand at 11.32% CAGR from 2024 to 2034.

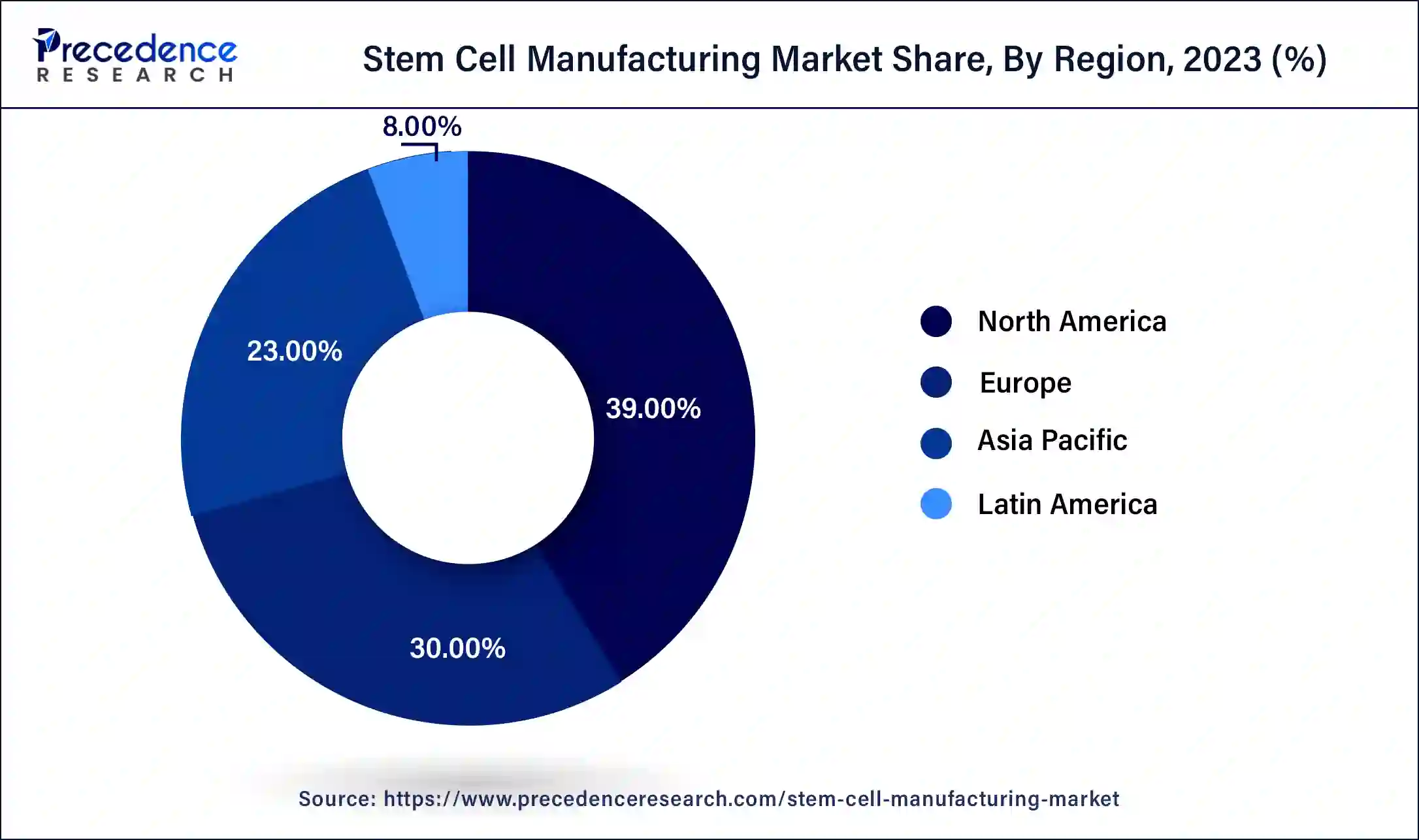

The global stem cell manufacturing market size is projected to be worth around USD 41.45 billion by 2034 from USD 14.18 billion in 2024, at a CAGR of 11.32% from 2024 to 2034. The North America stem cell manufacturing market size reached USD 4.97 billion in 2023. The stem cell manufacturing market is driven by the increasing prevalence of long-term illnesses like diabetes, cancer, and neurological conditions. It is the main factor propelling the market for stem cell production. Promising therapy options for various diseases are provided by stem cell-based therapies, which drive demand for their development and manufacture.

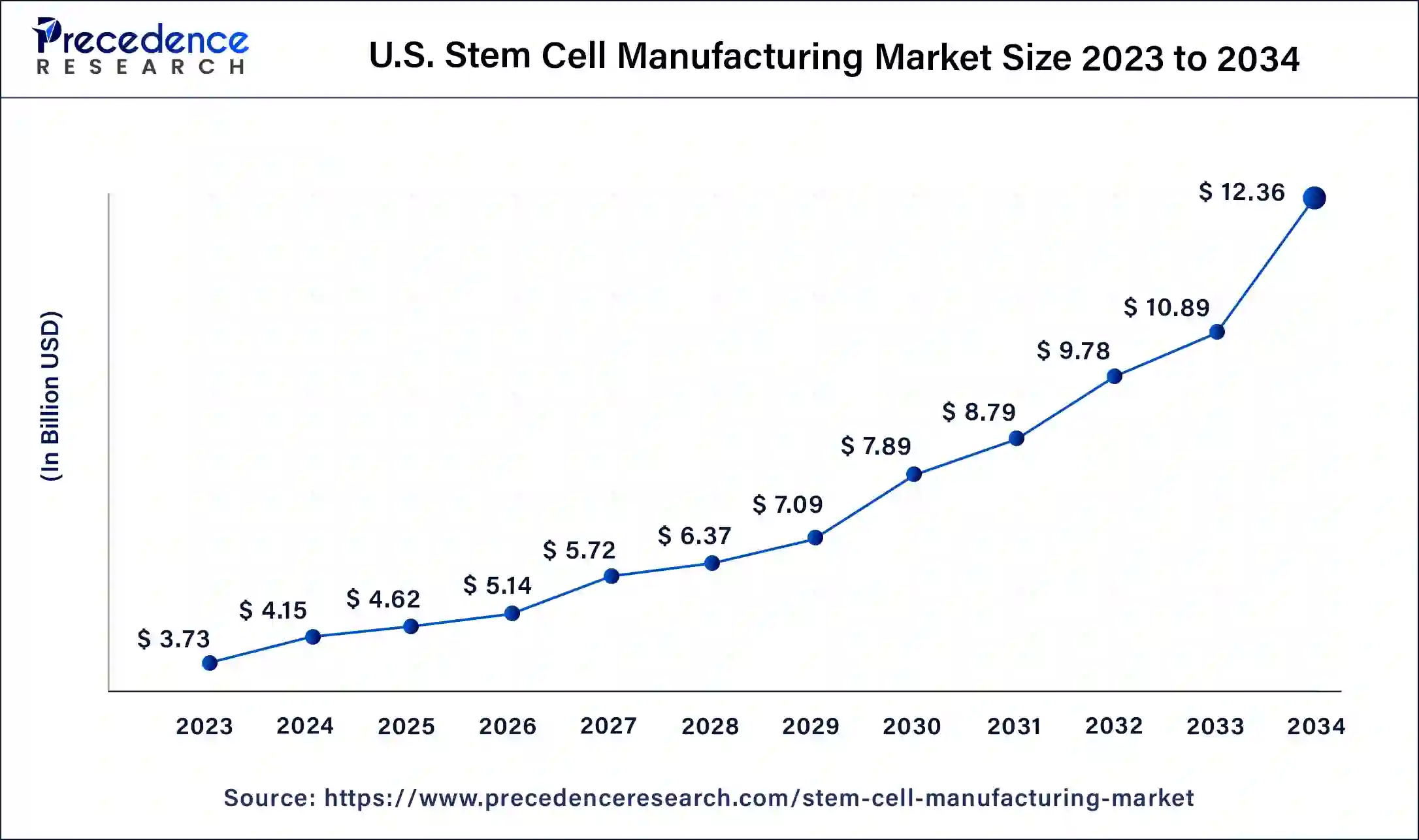

U.S. Stem Cell Manufacturing Market Size and Growth 2024 to 2034

The U.S. stem cell manufacturing market size was exhibited at USD 3.73 billion in 2023 and is projected to be worth around USD 12.36 billion by 2034, poised to grow at a CAGR of 11.50% from 2024 to 2034.

North America accounted for the biggest market share of 39% in 2023. North American institutions, particularly those in the United States, have been at the vanguard of stem cell research. Innovations in adult and embryonic stem cells have paved the way for improvements in industrial processes. The Food and Drug Administration (FDA) of the United States plays a crucial role in establishing guidelines for stem cell therapy and production procedures. The FDA's regulatory structure is strict, yet it offers precise rules supporting efficacy and safety.

Asia-Pacific is observed to be the fastest growing in the stem cell manufacturing market during the forecast period. Countries such as China, South Korea, Japan, and India have significant investments from both the public and private sectors in stem cell research and development. The general infrastructure for stem cell manufacturing, clinical applications, and scientific research are to be improved. Asia-Pacific's biopharmaceutical market is increasing, and many businesses are concentrating on biomanufacturing, including the generation of stem cells. Substantial biopharmaceutical industry expansion provides the infrastructure and know-how required for the stem cell manufacturing market to expand.

The ability of stem cells to self-renew is fantastic. In the early stages of life and growth, they can differentiate into various cell types in the body. In regenerative medicine, stem cells are essential to replace or repair damaged tissues and organs. For this sector to advance, efficient stem cell manufacturing is necessary. The strict ethical and legal guidelines that control stem cell research and treatments also make the market noteworthy. The legitimacy and acceptance of stem cell-based therapies depend heavily on adherence to these norms.

How is AI is revolutionizing the cell manufacturing industry?

A recent work by a group of Northeastern University scientists shows how artificial intelligence may be used to produce pluripotent stem cells in large quantities. Numerous illnesses, including cancer, Parkinson's, Alzheimer's, spinal cord injuries, and age-related problems, can be cured by these cells. Researchers propose an AI framework for large-scale manufacturing of stem cells for regenerative medicine. Specific stem cells are born with the innate ability to divide into several cells and become unique, specialized cells like muscle, bone, or blood. These pluripotent stem cells, according to researchers, have great promise for developing cell treatments and regenerative medicine.

| Report Coverage | Details |

| Market Size by 2034 | USD 41.45 Billion |

| Market Size in 2023 | USD 12.74 Billion |

| Market Size in 2024 | USD 14.18 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing stem cell banking industry

As our understanding of possible uses for stem cells grows, more people and families realize the advantages of stem cell banking. As a result, the need for services related to stem cell storage has increased. More and more people see stem cell banking to preserve vital biological material for use in the future, functioning as a preventive healthcare measure.

The therapeutic uses of stem cells in fields such as neurology, orthopedics, cardiology, and oncology are expanding the potential market for stem cell production. The need for stem cell banking is fueled by the emergence of customized medicine, which adjusts therapies based on each patient's unique genetic profile. This drives the growth of the stem cell manufacturing market.

High cost associated with stem cell manufacturing

Stem cell manufacturing involves expanding and cultivating stem cells in a regulated setting. The process requires complex bioreactors, exact control of growing conditions, and frequent monitoring, which results in high operating costs. Strict testing and quality control procedures are also needed to guarantee the safety, efficacy, and purity of stem cells. Although these procedures are required to maintain patient safety and comply with regulatory standards, they come at a significant expense.

Manufacturing stem cells requires highly skilled workers, such as scientists, technicians, and quality control specialists. These employees' pay and experience levels increase the cost of production. This limits the growth of the stem cell manufacturing market.

Rise in the number of approvals partnerships relating to stem cell therapy

The market experiences a spike in demand for stem cell therapies as more are approved by regulatory agencies. Every approval frequently signals a novel therapeutic approach or progress in care, piquing the interest of patients and healthcare professionals. Improvements in manufacturing methods are typically required for the development of novel stem cell therapies. To create more reliable, scalable, and high-quality cells, businesses need to innovate. This is what propels the use of cutting-edge technology like automation, enhanced cell culture methods, and sophisticated bioprocessing.

The consumables segment dominated the stem cell manufacturing market in 2023. Stem cell production, differentiation, and analysis require growth factors, reagents, and culture media. Every stage of stem cell research and production frequently uses these items, which creates a steady and strong demand. Large consumables are needed for the development of stem cell therapies, from research to clinical trials and commercialization. As a result of this shift, the market size and value of consumables rise as more stem cell-based products go into commercial manufacturing.

Reputable consumables companies often form alliances with biotechnology companies and research organizations. Through these strategic collaborations, they can reach a wider audience and more successfully enter the market.

The instruments segment is observed to be the fastest growing in the stem cell manufacturing market during the forecast period. The governmental and corporate sectors have significantly increased their funding for stem cell research. As research advances, the requirement for sophisticated equipment to support increasingly complex and varied experiments increases. Modern instruments are in high demand because of funding for stem cell biology and regenerative medicine research and development projects. Strict legal regulations governing stem cells production need sophisticated tools to guarantee adherence to safety and quality requirements. There is a need for dependable, high-quality equipment since instruments must fulfill specific requirements for use in controlled conditions.

The clinical application segment dominated the stem cell manufacturing market in 2023. In regenerative medicine, stem cells play a crucial role by providing possible cures for various illnesses, such as spinal cord injuries, cardiovascular ailments, and neurodegenerative diseases. The significant money and effort put into creating stem cell-based treatments for these ailments boosts the clinical application market. Stem cell therapies have been applied in clinical settings to treat autoimmune disorders like multiple sclerosis and type 1 diabetes.

Clinical trials and therapy alternatives are driven by the capacity to control immune responses and restore damaged tissues. Developing specialized stem cell labs and medical facilities improves the generation and use of stem cell treatments. These facilities supply the required research, manufacturing, and therapy infrastructure, hence supporting the clinical application sector.

The pharmaceutical & biotechnology companies segment dominated the stem cell manufacturing market in 2023. Companies in the biotechnology and pharmaceutical industries are pioneers in research and development (R&D). They can perform state-of-the-art stem cell science research, including creating novel treatments and technologies, thanks to their strong R&D infrastructure.

Research like this frequently produces innovations and breakthroughs that propel the manufacture of stem cells forward. These businesses usually form strategic alliances with biotech companies, research organizations, and academic institutions. Such partnerships can facilitate the pooling of knowledge and resources and hasten the development of innovative stem cell technology. The commercialization of stem cell therapies and products is frequently the result of these collaborations.

Segments Covered in the Report

By Product

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

November 2024