February 2025

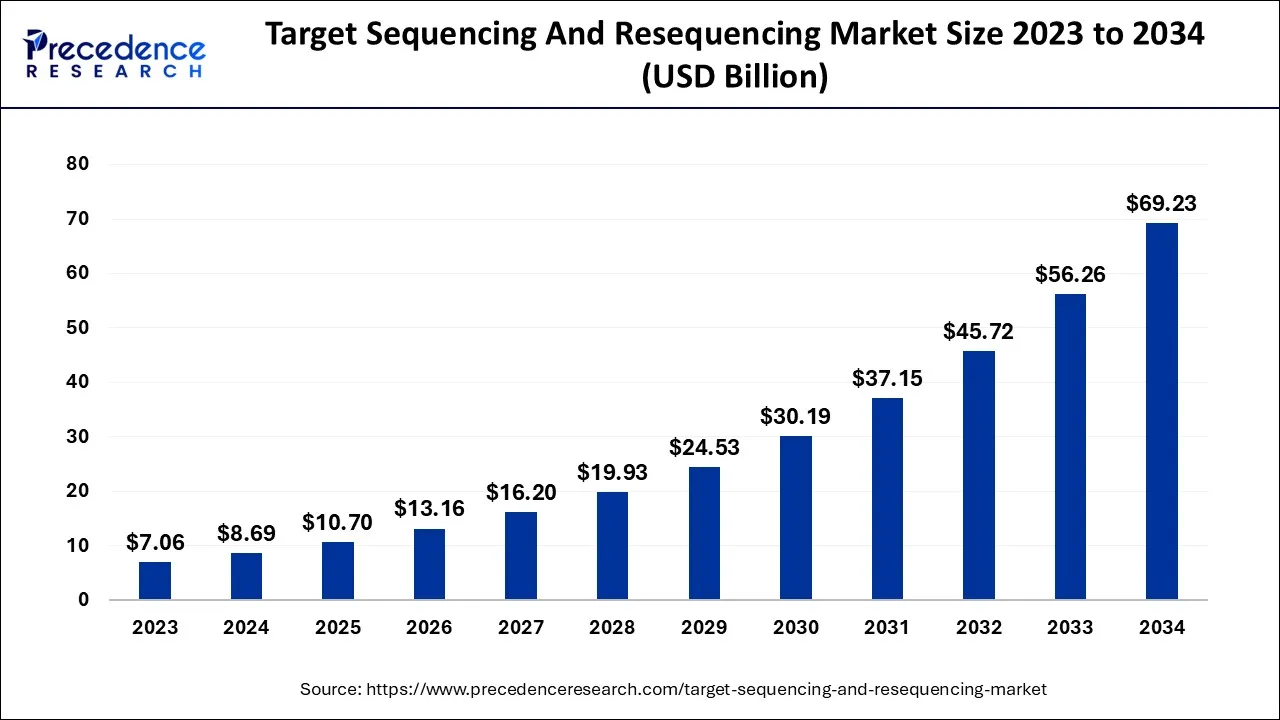

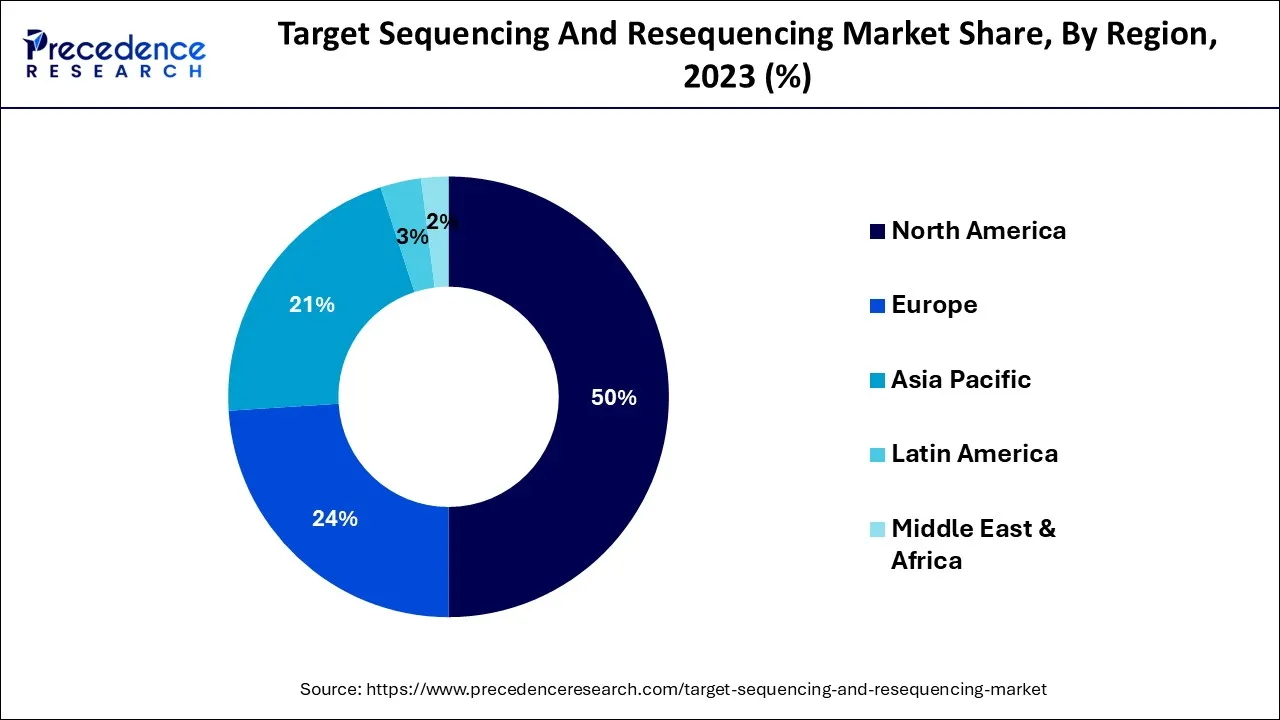

The global target sequencing and resequencing market size accounted for USD 8.69 billion in 2024, grew to USD 10.70 billion in 2025 and is expected to be worth around USD 69.23 billion by 2034, registering a CAGR of 23.06% between 2024 and 2034. The North America target sequencing and resequencing market size is calculated at USD 4.35 billion in 2024 and is estimated to grow at a CAGR of 23.19% during the forecast period.

The global target sequencing and resequencing market size is calculated at USD 8.69 billion in 2024 and is projected to surpass around USD 69.23 billion by 2034, growing at a CAGR of 23.06% from 2024 to 2034.

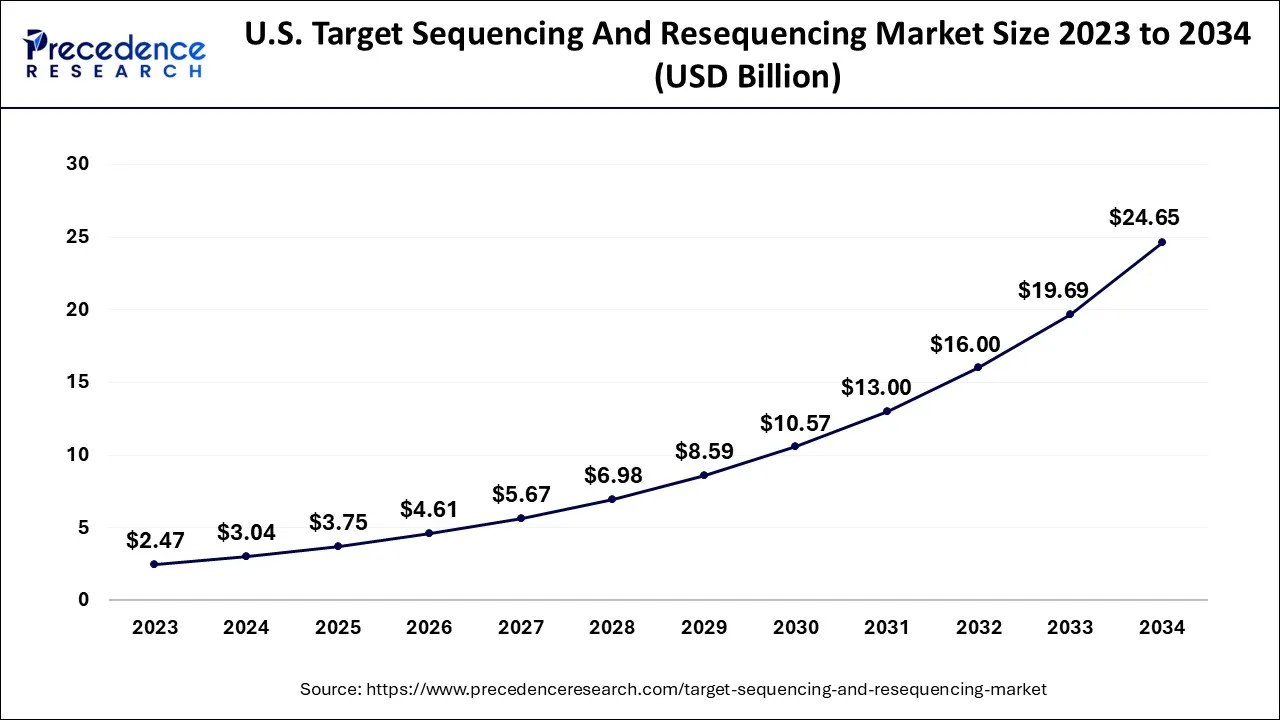

The U.S. target sequencing and resequencing market size is exhibited at USD 3.04 billion in 2024 and is projected to be worth around USD 24.65 billion by 2034, growing at a CAGR of 23.27% from 2024 to 2034.

With a market share of 50% in 2023, the targeted resequencing and sequencing market was dominated by the North American region. The expansion of the regional market has been aided by the existence of industry participants like Illumina, Roche, and Life Technologies, who are engaged in the development of quick and high-throughput sequencing capabilities. These firms are engaging in a number of tactical attempts to increase their presence in the market in the nation.

By advancing the commercialization and clinical validation of specific immunology diagnostic tools, NGS, and mass spectrometry, for instance, Mayo Clinic and Thermo Fisher worked together to bring revolutionary solutions to patients in April 2021.

Due to rising R&D spending and the availability of cutting-edge technologies for drug discovery and development, the Asia Pacific market is predicted to experience the quickest rate of growth in the coming years. Also, there has been tremendous potential for growth due to breakthroughs in China and Japan that integrate NGS technologies with frameworks of clinical development from growing nations like Australia and India. Illumina stated in August 2022 that it was developing a new manufacturing facility in China to produce gene sequencing products as part of an effort to increase its regional presence.

Targeted sequencing, often known as resequencing, is a technique for sequencing a sample's partial genome or specific sections of interest. It needs a DNA preparation pre-sequencing stage called Target Enrichment in which target DNA sequences are either amplified (using amplicon or multiplex PCR-based methods) or captured (using hybrid capture-based methods), and then afterward sequenced using DNA sequencers.

The market is anticipated to increase as a result of the ongoing technological advancements in genome sequencers and the widespread use and adoption of NGS technology. Additionally, it is projected that the growing use of precision medicine and next-generation sequencing (NGS) in molecular diagnostics would open up new market expansion prospects.

Together with transplant medicine, invasive prenatal testing, and pharmacogenomics, NGS is anticipated to see growing use in the treatment of numerous medical conditions and infectious diseases. Targeted gene panels and qPCR-based gene expression profiling continue to be the two most popular uses for sequencers of NGS in a pathology lab. NGS is still primarily used in oncology in clinics, although pathologists anticipate using it in other settings as well in the upcoming years. These elements should accelerate market expansion during the anticipated time frame.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.69 Billion |

| Market Size by 2034 | USD 69.23 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 23.06% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, Type, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The demand for personalized medicine, the rising incidence of genetic disorders, and the expanding uptake of NGS (Next Generation Sequencing) technology are some of the drivers that are driving demand for targeted sequencing and resequencing. Due to the rising need for precision medicine and the accessibility of cutting-edge sequencing technologies, the market is anticipated to expand over the next years.

The high cost of data analysis and sequencing is one of the biggest problems facing the targeted resequencing and sequencing sector. Nonetheless, it is anticipated that the development of new technology for sequencing and bioinformatics tools would address these issues and spur market expansion.

In 2023, the targeted resequencing and sequencing market share was dominated by the sequencing sector with 72% of the market. More businesses are integrating NGS into clinical applications as costs of sequencing continue to drop and throughput capability improves. Sequencing is continuing to gain traction in several applications. Hence, market prospects in applications like average risk NIPT and liquid biopsy are anticipated to promote continued rapid NGS penetration in the clinical context in the upcoming years.

To increase the reach and use of its TruSight Oncology pan-cancer assay, Illumina announced several oncology agreements including Merck, Kura Oncology, Myriad Genetics, and Bristol-Myers Squibb in January 2021.

The re-sequencing market is anticipated to expand significantly throughout the forecast period. Next-generation sequencing is used in targeted approaches, which allow researchers to concentrate resources like money and time on particular study areas of interest.

In 2023, the market for targeted resequencing and sequencing was dominated by the clinical application sector. The prevalence of chronic diseases like cancer, infectious diseases, and diabetes is rising, which is driving demand for NGS technologies and related data analytic tools. The Somatic Reference Samples (SRS) initiative, which the medical device innovation consortium (MDIC) started in August 2022, aims to verify and create publicly available genomic datasets and samples that are clinically relevant to advance NGS-based cancer diagnostics.

In the upcoming years, it is anticipated that the drug development sector will experience profitable expansion. The segment's development has been facilitated by a number of market participants advancements. For instance, QIAGEN and Neuron23 worked together in September 2022 to create NGS companion diagnostics for a drug used to treat Parkinson's disease.

The targeted resequencing and sequencing market share held by the DNA-based category was the largest in 2023. Sequencing panels that are DNA-based targeted comprise key genes or gene regions linked to a phenotype or disease and are predesigned. The targeted gene panels minimise the need for data analysis by focusing on the genes that are most likely to take part in a given situation. Due to the greater use of targeted gene panels, DNA-based targeted sequencing attributed a bigger share in comparison to RNA-based targeted sequencing.

Due to the increasing demand for analysis of differential expression, the RNA-based segment is anticipated to experience significant expansion over the projected time frame. The estimated market share can be ascribed to the use of RNA-Seq technology, Amplicon, for targeted RNA sequencing for the detection of Schizophrenia and other disorders.

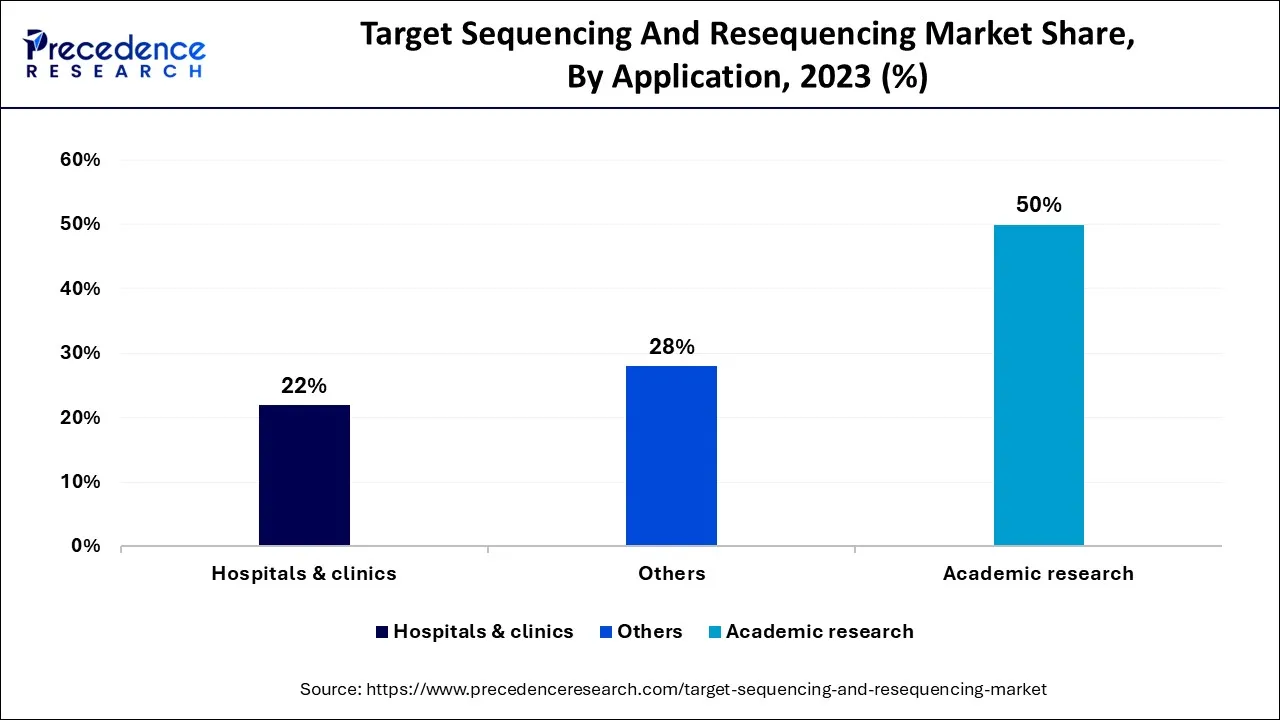

In 2023, the academic study segment had the highest market share, at 50%. The sizeable share of this market can be ascribed to the use of NGS solutions in research studies that are conducted in universities and research facilities. Furthermore, it is expected that the availability of scholarships for PhD studies in NGS will increase demand for NGS-related goods and services.

The category of hospitals and clinics is predicted to experience significant expansion as more individuals choose individualized care. The segment has grown as a result of an increase in the use of NGS services in clinics and hospitals to gauge the degree of disease progression and scale up the ideal treatment plan for chronic illnesses. In the upcoming years, it is projected that the provision of clinical services by top market players like Illumina, which comprises molecular diagnostic testing for cystic fibrosis, tests that are CLIA-certified for predisposition screening, and postnatal cytogenetics, would increase revenue.

Segments Covered in the Report

By Technology

By Application

By Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2023

January 2025

October 2024