August 2024

Technical Ceramics Market (By Raw Material: Alumina Ceramics, Titanate Ceramics, Zirconate Ceramics, Ferrite Ceramics, Aluminium Nitride, Silicon Carbide, Silicon Nitride; By Product: Monolithic ceramics, Ceramic coatings, Ceramic matrix composites; By Application: Electrical equipment, Catalyst supports, Electronic devices, Wear parts, Engine parts, Filters, Bioceramics, Others; By End-Use) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

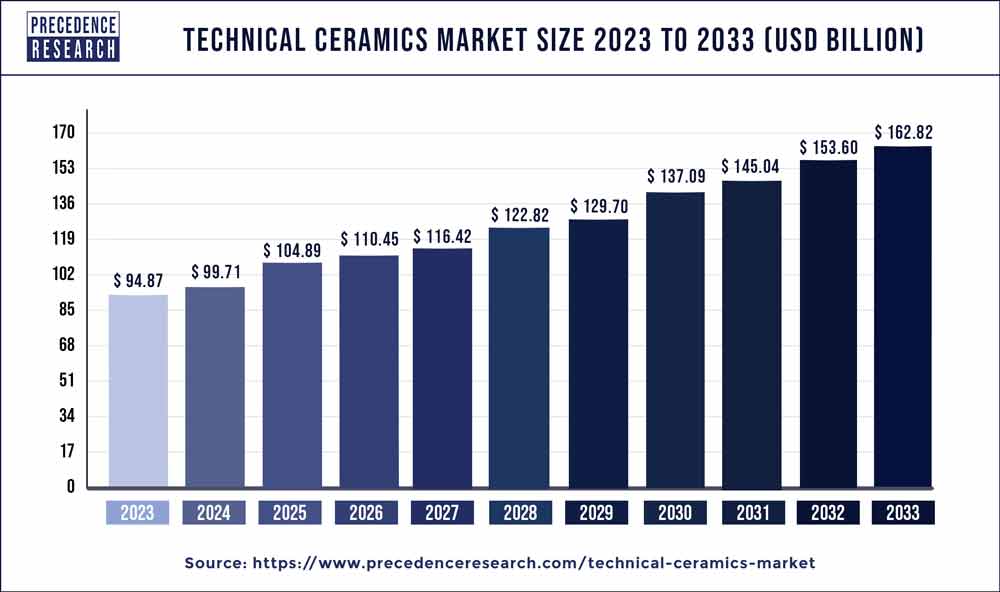

The global technical ceramics market size is expected to hit around USD 162.82 billion by 2033, increasing from USD 94.87 billion in 2023 and poised to grow at a CAGR of 5.60% from 2024 to 2033.

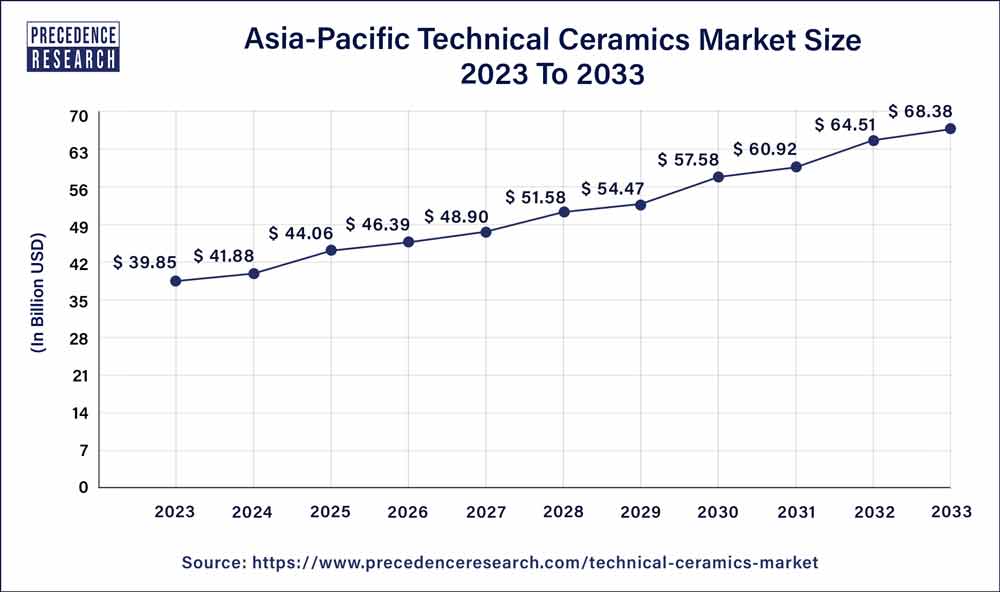

The Asia Pacific technical ceramics market size was valued at USD 39.85 billion in 2023 and is expected to reach around USD 68.38 billion by 2033, growing at a CAGR of 5.60% from 2024 to 2033.

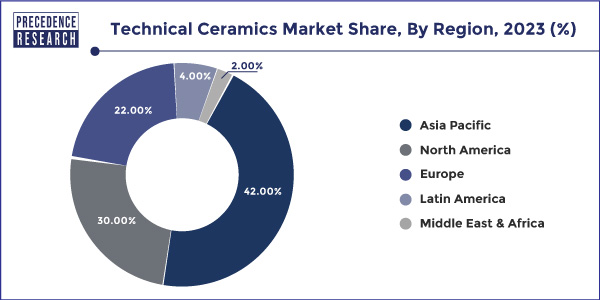

Asia-Pacific holds a share of 42% in 2023 due to robust industrial growth and increased demand from key sectors. The region's flourishing electronics and automotive industries, coupled with a surge in manufacturing activities, drive the need for advanced materials like technical ceramics.

Moreover, the expanding healthcare sector's reliance on bioceramics further boosts the market. As a manufacturing hub and a hub for technological advancements, Asia-Pacific remains a pivotal player, with China, Japan, and South Korea emerging as key contributors to the region's dominance in the technical ceramics market.

North America is set for swift growth in the technical ceramics market owing to strong demand in pivotal industries. The region's advanced manufacturing prowess, especially in aerospace, electronics, and healthcare, propels the increased use of technical ceramics. The commitment to technological advancement and the presence of major industry players contribute to the market's expansion. Moreover, heightened investments in research and development, coupled with a growing understanding of the advantages of technical ceramics, establish North America as a significant contributor to the market's rapid growth in the foreseeable future.

Meanwhile, Europe is experiencing notable growth in the technical ceramics market due to several factors. The region's focus on technological advancements, particularly in automotive, aerospace, and healthcare industries, has increased the demand for high-performance materials like technical ceramics. Stricter environmental regulations have also spurred innovation, driving the adoption of these materials.

Moreover, the emphasis on sustainable energy and the expansion of electronic manufacturing contributes to the rising demand. As Europe continues to prioritize advanced technologies and sustainability, the technical ceramics market in the region is witnessing significant expansion.

Technical Ceramics Market Overview

Technical ceramics, also termed advanced ceramics or engineering ceramics, represent a specialized category of high-performance materials crafted for distinct industrial applications necessitating exceptional mechanical, thermal, electrical, or chemical attributes. These ceramics transcend the conventional realm of pottery and aesthetics, finding crucial roles in sectors such as electronics, aerospace, automotive, and medical technology. Characterized by their outstanding hardness, wear resistance, thermal stability, and electrical insulation properties, technical ceramics find application in manufacturing components like cutting tools, bearings, sensors, and insulators.

The versatility of technical ceramics arises from their ability to withstand extreme conditions, offering solutions for demanding environments where conventional materials may fall short. As a result, technical ceramics play a pivotal role in advancing technological innovation by enabling the development of robust and efficient solutions across various engineering disciplines.

Technical Ceramics Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.60% |

| Global Market Size in 2023 | USD 94.87 Billion |

| Global Market Size by 2033 | USD 162.82 Billion |

| Asia-Pacific Market Size in 2023 | USD 39.85 Billion |

| Asia-Pacific Market Size by 2033 | USD 68.38 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Raw Material, By Product, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Increasing demand from the medical industry

The surge in demand from the medical industry is a driving force behind the escalating market demand for technical ceramics. These advanced ceramic materials play a pivotal role in the medical sector due to their unique properties, such as biocompatibility, chemical inertness, and durability. Medical devices, implants, and diagnostic equipment increasingly incorporate technical ceramics to leverage these qualities, contributing to the rise in market demand. As advancements in medical technologies persist, technical ceramics become indispensable in spearheading innovations in fields such as prosthetics, dental implants, and diverse surgical instruments. This surge not only underscores the growing dependence on technical ceramics but also emphasizes their indispensable role in shaping the landscape of cutting-edge medical solutions.

Restraint: Brittleness and fragility

The brittleness and fragility of Technical Ceramics present significant constraints on the market demand. While these ceramics boast exceptional hardness, their inherent brittleness makes them susceptible to fractures and breakage under certain conditions. This limitation restricts their application in scenarios where resistance to mechanical stress and impact is paramount, hindering their adoption in high-stress environments and applications that demand durability.

Moreover, the fragility of technical ceramics complicates handling, transportation, and installation processes, adding to the overall challenges associated with their utilization. Industries that require materials capable of withstanding dynamic forces or sudden impacts may opt for alternative materials with greater toughness. To address this restraint, ongoing research and development efforts in material engineering aim to enhance the toughness of technical ceramics without compromising their other advantageous properties, thereby expanding their suitability across a broader spectrum of applications and reducing the impact of brittleness on market demand.

Opportunity: Expanding electronics and semiconductor industries

The expansion of the electronics and semiconductor sectors is generating significant prospects for the technical ceramics market. With these industries advancing and unveiling novel technologies, there is an increasing need for sophisticated materials like technical ceramics. Renowned for their superior electrical insulation, thermal resilience, and corrosion resistance, technical ceramics are applied across diverse areas, including electronic components, circuitry, and the production of semiconductors. Their contribution to enhancing the dependability and effectiveness of electronic devices positions them as indispensable components in our progressively interconnected and technologically sophisticated global landscape.

The alumina ceramics segment had the highest market share of 37% in 2022. The alumina ceramics segment in the technical ceramics market refers to products derived from aluminum oxide, known for its high hardness and chemical resistance. These ceramics find application in diverse industries, including electronics, automotive, and aerospace, due to their superior properties. Recent trends in this segment indicate a growing emphasis on the development of advanced alumina ceramics with enhanced thermal conductivity and mechanical strength. As industries demand materials capable of withstanding extreme conditions, alumina ceramics continue to evolve, catering to the rising need for durable and high-performance technical ceramics.

The titanate ceramics segment is anticipated to expand at a significant CAGR of 5.12% during the projected period. Titanate ceramics, a significant segment in the technical ceramics market, are materials derived from titanate compounds. These ceramics exhibit unique properties, including high dielectric constants and low thermal expansion coefficients. In recent trends, the titanate ceramics segment has seen increased demand due to their applications in electronic components, capacitors, and sensors. The growing focus on miniaturization in electronics and the expanding electronics industry contribute to the upward trend in the utilization of titanate ceramics, emphasizing their role as crucial raw materials in the technical ceramics market.

The monolithic ceramics segment has held 85% market share in 2023. Monolithic ceramics represent a category within the technical ceramics market, characterized by homogeneous structures formed from a single ceramic material. These ceramics offer excellent mechanical and thermal properties, finding applications in various industries. The monolithic ceramics segment includes components like cutting tools, bearings, and wear-resistant parts. In the technical ceramics market, a trend is observed towards increased utilization of monolithic ceramics in manufacturing processes due to their superior performance in harsh conditions. The demand for monolithic ceramics is rising, driven by their durability and versatility across diverse industrial applications.

The ceramic matrix composites (CMCs) segment is anticipated to expand fastest over the projected period. Ceramic Matrix Composites (CMCs) represent an advanced category within the technical ceramics market. These materials consist of ceramic fibers embedded in a ceramic matrix, combining high-temperature stability with enhanced mechanical properties. A notable trend in the CMC segment involves their increasing adoption in aerospace and automotive industries for applications like turbine components and lightweight structural parts. The demand for CMCs is driven by their ability to offer superior performance in extreme conditions, contributing to the growing prominence of these composites in cutting-edge engineering applications.

The electronic devices segment has held 47% market share in 2023. The electronic devices segment in the technical ceramics market encompasses the application of ceramics in various electronic components such as insulators, capacitors, and sensors. Key trends in this segment include the increasing miniaturization of electronic devices, driving the demand for smaller and more efficient ceramic components. Additionally, the rising adoption of advanced technologies like 5G and IoT necessitates high-performance ceramics to meet the stringent requirements of these applications, contributing to the growth and innovation within the electronic devices segment of the technical ceramics market.

The bioceramics segment is anticipated to expand fastest over the projected period. In the technical ceramics market, the bioceramics segment refers to a specialized category used in medical and dental applications. Bioceramics exhibit properties such as biocompatibility and bioactivity, making them suitable for implants, prosthetics, and dental restoration materials. A notable trend in this segment involves continuous research to enhance the performance and integration of bioceramics within the human body. Advancements focus on improving the materials' durability, reducing toxicity, and expanding their applications in regenerative medicine, reflecting a growing emphasis on innovative solutions in the medical field.

The electrical & electronics segment has held 55% market share in 2023. In the technical ceramics market, the electrical & electronics segment refers to the application of ceramics in electronic components, circuitry, and semiconductor manufacturing. Trends in this segment involve the increasing demand for technical ceramics due to their exceptional electrical insulation, thermal stability, and resistance to corrosion. With the rise of technologies like 5G and IoT, there's a growing need for advanced materials that offer reliability and efficiency, positioning technical ceramics as vital contributors to the evolving landscape of electrical & electronics applications.

The medical segment is anticipated to expand fastest over the projected period. Within the technical ceramics market, the medical segment refers to the use of ceramics in healthcare applications. Technical ceramics, recognized for their compatibility with the human body and durability, are vital in medical devices like implants and diagnostic tools. A notable trend in this sector is the rising need for accurate and long-lasting components in advanced medical equipment. As medical technology advances, technical ceramics remain essential for improving the effectiveness and lifespan of crucial healthcare tools, showcasing a noticeable shift towards their incorporation in various medical applications.

Segments covered in the report

By Raw Material

By Product

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

August 2024

November 2024