January 2025

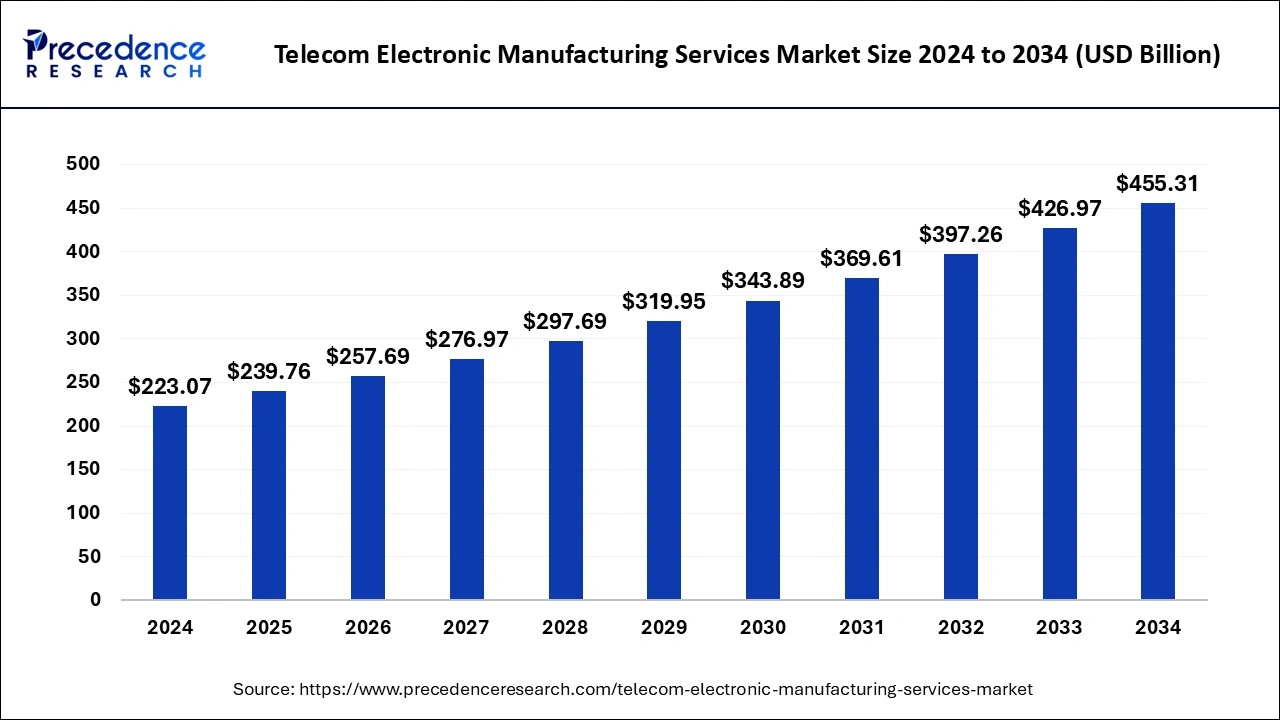

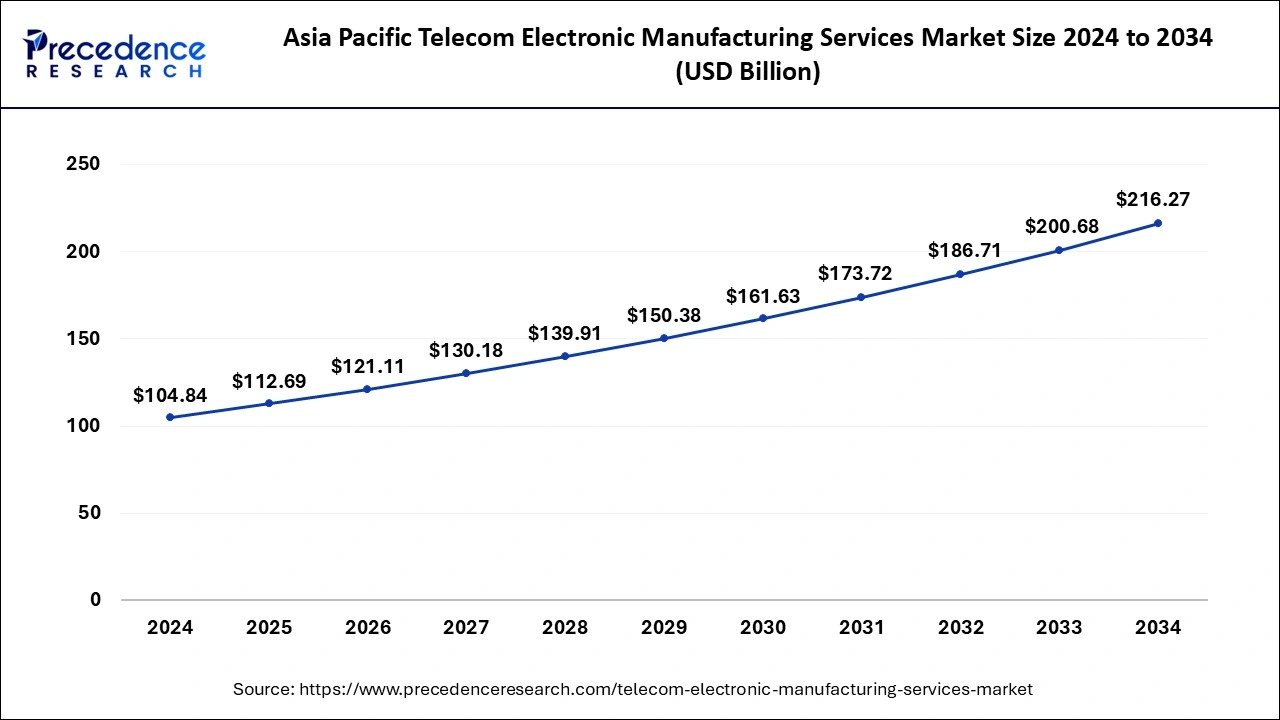

The global telecom electronic manufacturing services market size is estimated at USD 239.76 billion in 2025 and is predicted to reach around USD 455.31 billion by 2034, accelerating at a CAGR of 7.40% from 2025 to 2034. The Asia Pacific telecom electronic manufacturing services market size surpassed USD 112.69 billion in 2025 and is expanding at a CAGR of 7.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global telecom electronic manufacturing services market size reached USD 223.07 billion in 2024 and is projected to hit around USD 455.31 billion by 2034 with a CAGR of 7.40% from 2025 to 2034. The telecom electronic manufacturing services market is driven by technological advancements, the proliferation of 5G networks, and the rising demand for cloud computing and wireless communication.

In the telecom industry, artificial intelligence (AI) plays a crucial role in enhancing network performance. AI analyzes vast amounts of data collected from network sensors and monitoring tools. This capability enables telecom providers to detect and diagnose potential issues before they escalate into significant problems. For example, AI can spot unusual patterns or anomalies in network traffic, which may indicate underlying faults or the potential for outages. By identifying these issues early, telecom companies can take proactive measures, such as re-routing traffic, reallocating resources, or performing maintenance, to mitigate disruptions. This not only helps in ensuring a more reliable service for customers but also reduces operational costs by addressing problems before they become critical. Overall, integrating AI into network management allows telecom providers to operate more efficiently and maintain higher levels of service continuity.

The Asia-Pacific telecom electronic manufacturing services market size reached USD 104.84 billion in 2024 and is projected to hit around USD 216.27 billion by 2034 with a CAGR of 7.51% from 2025 to 2034.

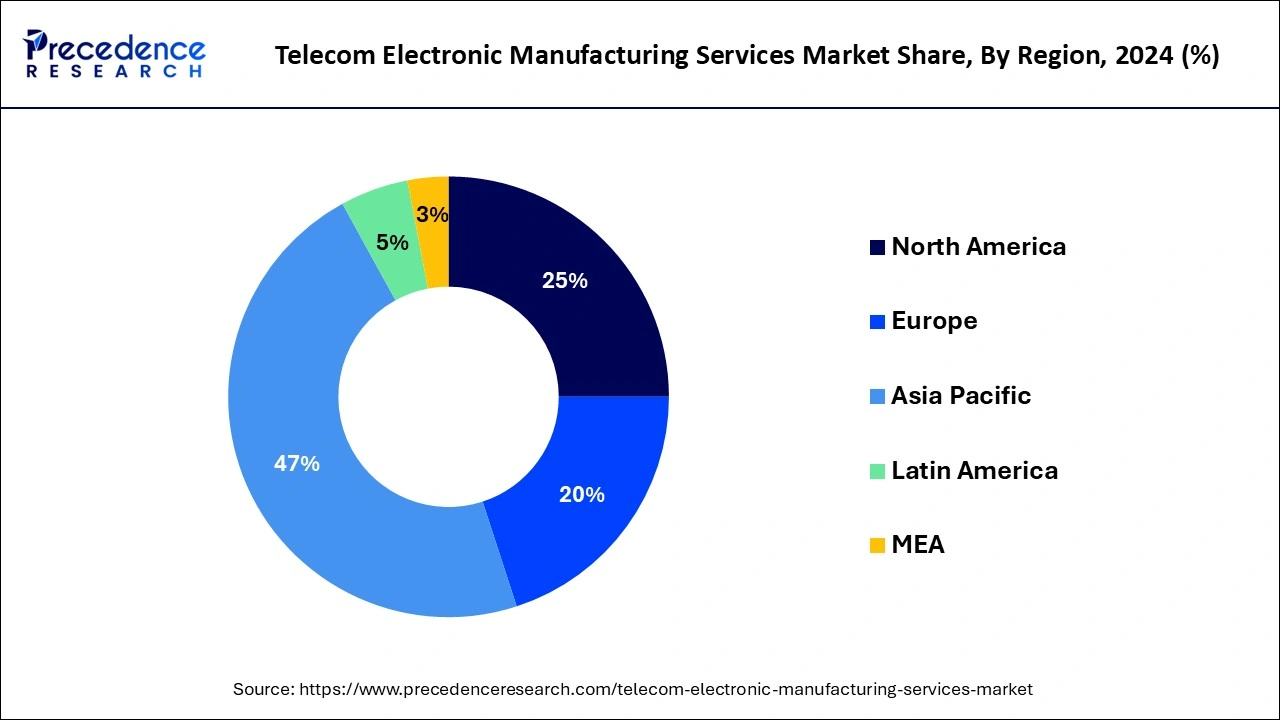

Asia-Pacific held the largest share of 47% in 2024, due to several factors. The region benefits from robust telecommunications infrastructure development, increasing demand for electronic devices, and a thriving manufacturing ecosystem. Countries like China, Japan, and South Korea are key contributors, with well-established electronics industries. Additionally, the availability of skilled labor, technological expertise, and favorable government policies supporting the electronics sector further strengthen Asia-Pacific's dominance in the global Telecom electronic manufacturing services market. The region continues to be a focal point for production, innovation, and market growth.

North America is positioned for rapid growth in the telecom electronic manufacturing services market due to factors like increasing demand for advanced telecom infrastructure, the widespread deployment of 5G technology, and a surge in outsourcing by telecom companies. The region's technological advancements and a robust regulatory framework also contribute. As telecom companies seek specialized manufacturing expertise, North America's EMS providers are well-positioned to meet these needs, fostering the region's substantial growth in the dynamic and evolving telecom electronics manufacturing sector.

Meanwhile, Europe is experiencing notable growth in the telecom electronic manufacturing services market due to several factors. The region's strong focus on 5G technology deployment, coupled with the increasing demand for connected devices, drives the need for specialized electronic components. Additionally, supportive government policies and incentives for electronics manufacturing contribute to the expansion of EMS providers. The growing trend of outsourcing by telecom companies in Europe, seeking cost-effective and efficient solutions, further propels the market's growth, positioning the region as a key player in the global telecom EMS industry.

The telecom electronic manufacturing services market involves specialized companies that help design, produce, and manage electronic components for the telecommunications industry. These services include assembling and testing printed circuit board assemblies (PCBAs) used in telecom devices. An avionics company, for instance, might choose to outsource its PCBA production to an EMS partner to expand its product offerings without investing in additional manufacturing facilities. These services providers adhere to industry standards, such as AS9100, and can handle complex requirements like multiple Ball Grid Arrays (BGAs) and intricate PCB designs.

Telecom Electronic Manufacturing Services Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Market Size in 2025 | USD 239.76 Billion |

| Market Size by 2034 | USD 455.31 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand for Telecommunication Services

The growing demand for telecommunication services is a key catalyst for the expansion of the telecom electronic manufacturing services market. As more people worldwide embrace mobile phones and data-driven communication, the need for advanced telecom devices and infrastructure rises. With over 5.2 billion mobile phone users globally in 2021, the surge in connectivity drives telecom companies to seek reliable partners for manufacturing electronic components. This increased demand for telecommunication services not only necessitates the production of more devices but also demands cutting-edge technology and expertise in electronic manufacturing, creating a substantial market for EMS providers.

Telecom EMS companies play a pivotal role in meeting the escalating demand by offering specialized manufacturing services. These services encompass the production of complex components, such as printed circuit board assemblies (PCBAs), supporting the development of advanced telecom devices. As the telecommunications sector continues to grow, EMS providers become essential partners for companies aiming to meet the evolving demands of a connected world efficiently and effectively.

Intensive Capital Requirements

Intensive capital requirements pose a significant restraint on the telecom electronic manufacturing services market The industry demands substantial investments in cutting-edge equipment, technology, and workforce training. For smaller players in particular, these high upfront costs can act as a barrier to entry and growth. Acquiring and maintaining state-of-the-art manufacturing facilities capable of meeting the evolving demands of the telecom sector requires a considerable financial commitment.

Moreover, the need for ongoing capital expenditure to stay technologically competitive puts financial strain on EMS providers. Continuous investment in research and development, upgrading machinery, and training personnel is essential. For some companies, especially those with limited financial resources, navigating these intensive capital requirements becomes challenging, impacting their ability to compete effectively in the market and potentially limiting their capacity to adapt to emerging industry trends.

Digital transformation across industries

The ongoing digital transformation across industries presents lucrative opportunities for telecom electronic manufacturing services (EMS) providers. As various sectors embrace advanced technologies like Internet of Things (IoT), artificial intelligence, and smart automation, the demand for specialized electronic components surges. Telecom EMS companies can capitalize on this trend by diversifying their offerings to cater to industries undergoing digitalization, including healthcare, automotive, and smart cities. By providing tailored electronic manufacturing services to support the evolving needs of these sectors, EMS providers position themselves as key enablers of the broader digital transformation landscape.

Moreover, as industries increasingly rely on interconnected devices and smart technologies, the role of EMS becomes pivotal in ensuring the seamless production of high-quality electronic components. The adaptability of EMS providers to address the unique requirements of different sectors undergoing digital transformation not only drives market growth but also positions them as essential partners in the advancement of modern industries.

The electronic manufacturing segment held the largest market share based on the end-use in 2024. In the telecom electronic manufacturing services market, the electronic manufacturing segment involves the comprehensive production of electronic components, from design to assembly, testing, and packaging. This segment caters to the specific requirements of telecom companies seeking specialized manufacturing expertise. Trends in this segment include a growing focus on end-to-end solutions, agile manufacturing processes, and the integration of emerging technologies like robotics and automation. These trends aim to enhance efficiency, reduce time-to-market, and ensure the delivery of high-quality electronic components for the rapidly evolving telecom industry.

The electronic design & engineering segment is anticipated to witness rapid growth at a significant CAGR of 9.3% during the projected period. In the telecom electronic manufacturing services market, the electronic design & engineering segment involves the creation and optimization of electronic components used in telecommunications. This service encompasses designing circuitry, developing schematics, and ensuring the efficiency of electronic systems. A prominent trend in this segment is the increasing emphasis on miniaturization, energy efficiency, and the integration of advanced technologies to meet the evolving demands of the telecom industry. Providers in this space focus on delivering innovative solutions that enhance the performance and functionality of electronic components in the rapidly advancing field of telecommunications.

By Services

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

October 2024