March 2024

Telematics Control Unit Market (By Sales Channel: OEM, Aftermarket; By Vehicle Type: SUV, Hatchbacks/Sedan, Light Commercial Vehicle, Heavy Commercial Vehicle; By Application: Information and Navigation, Safety and Security, Fleet/ Asset Management, Insurance Telematics, Infotainment System, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

The global telematics control unit market size was USD 13.39 billion in 2023, calculated at USD 15.04 billion in 2024 and is expected to reach around USD 48.11 billion by 2034, expanding at a CAGR of 12.33% from 2024 to 2034. The telematics control unit market is driven by the growing need for sophisticated ADAS (advanced driving assistance systems).

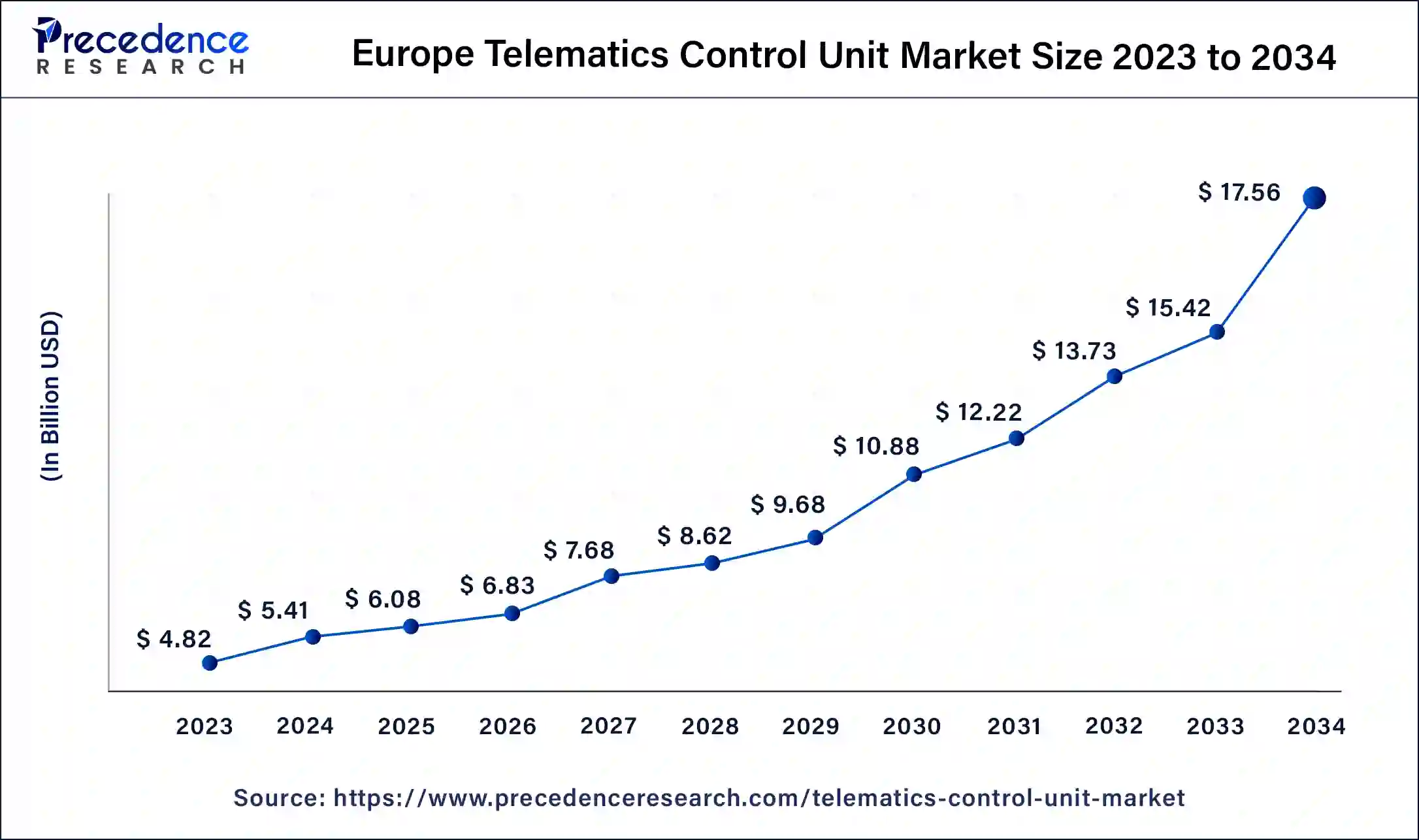

The Europe telematics control unit market size was exhibited at USD 4.82 billion in 2023 and is projected to be worth around USD 17.56 billion by 2034, poised to grow at a CAGR of 12.47% from 2024 to 2034.

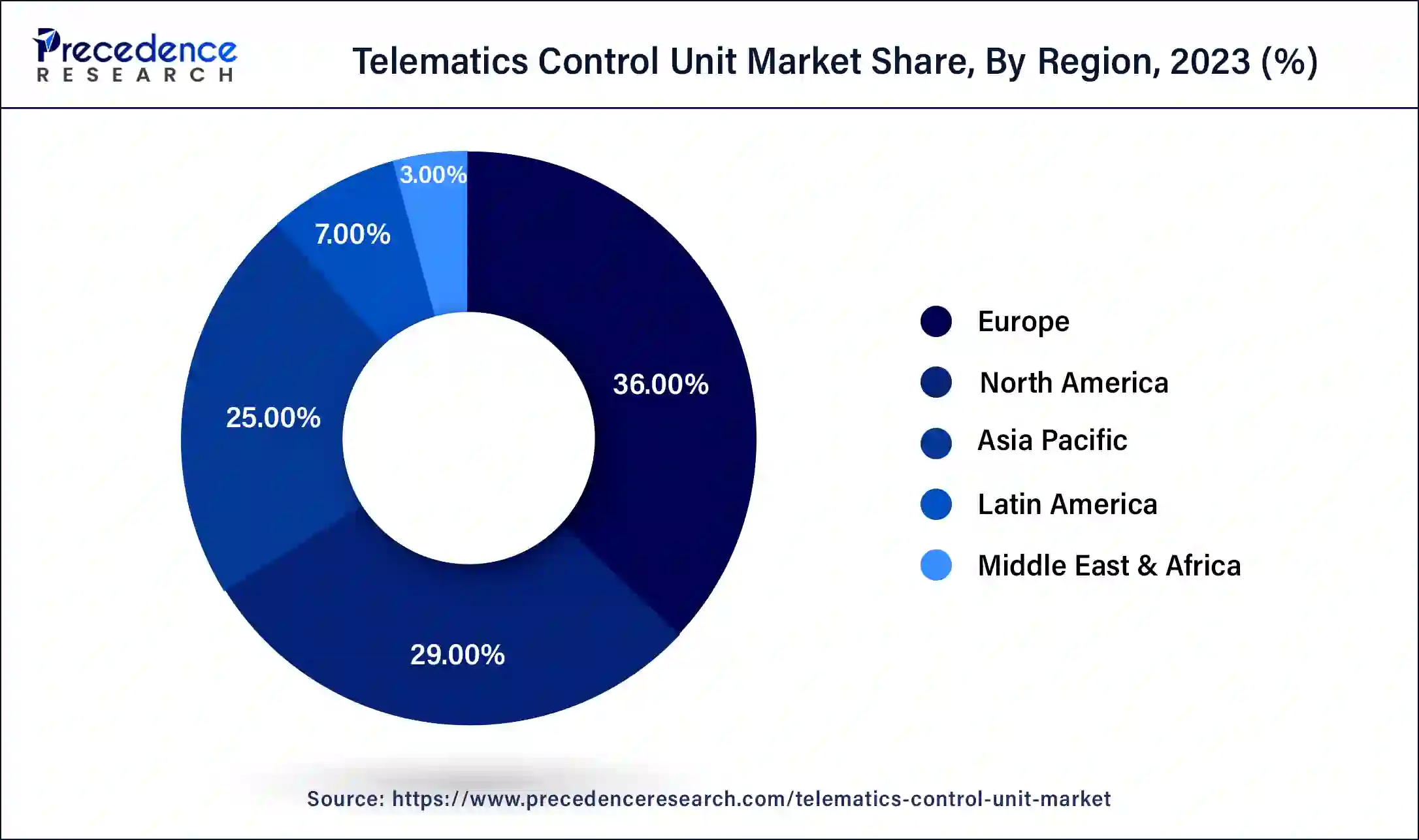

Europe held the dominating share of the telematics control unit market in 2023. Europe is home to some of the world’s leading automotive manufacturers, such as Volkswagen, BMW, and Daimler, who are at the forefront of integrating advanced telematics systems into their vehicles. European governments have implemented stringent regulations and initiatives promoting vehicle safety, emissions reduction, and connectivity. Programs like the European Union's eCall mandate, which requires new cars to have telematics systems that automatically contact emergency services in the event of an accident, have significantly boosted the TCU market.

North America had a notable share in the telematics control unit market in 2023. North American consumers have demonstrated a significant affinity for cars with cutting-edge technology, such as telematics systems. Demand has surged as people become more conscious of the advantages of telematics, which include enhanced convenience, safety, and fuel efficiency. Telematics is becoming essential to modern cars due to the rise of linked cars and the Internet of Things (IoT), which meets consumer expectations for intelligent and connected experiences. North America's leadership in the market has been further reinforced by significant investments in telematics technology and strategic alliances between automakers, IT firms, and suppliers.

These partnerships have resulted in the creation of integrated telematics solutions that provide a wide range of services, including fleet management, car diagnostics, entertainment, and navigation.

Asia-Pacific is observed to be the fastest growing in the telematics control unit market during the forecast period. The deployment of connected and autonomous car technology is accelerating throughout the region. The need for telematics control units is rising as these technologies become increasingly dependent on sophisticated telematics systems to operate. TCUs are necessary for entertainment, vehicle-to-everything (V2X) connectivity, remote diagnostics, and real-time navigation in connected cars. TCUs are becoming increasingly crucial for enabling autonomous features as the car industry progresses toward autonomous driving.

Advanced in-car connectivity capabilities like internet access, streaming services, and real-time navigation are becoming increasingly popular among consumers in the Asia-Pacific area. Due to increasing consumer demand, automakers are encouraged to install TCUs and other cutting-edge telematics systems in their cars. The region's TCU market is expanding mainly due to the trend toward connected lives and the demand for better in-car entertainment.

The telematics control unit (TCU) in contemporary cars is crucial for controlling several wireless communication and vehicle tracking functions. It provides connectivity and telematics services by integrating many technologies, such as GPS, telecoms (GSM, 4G, 5G), and occasionally Wi-Fi. These services can include entertainment systems, remote vehicle monitoring, car diagnostics, emergency call systems (eCall), navigation, and over-the-air software updates. Advanced driving assistance systems (ADAS) and connected car features rely heavily on TCUs. They make it possible for automobiles, infrastructure, and other linked equipment to communicate in real time to improve traffic management and road safety. TCUs gather data about vehicle usage, driving habits, and maintenance requirements. Vehicle manufacturers, fleet managers, and insurance providers can all benefit from this data.

| Report Coverage | Details |

| Market Size by 2034 | USD 48.11 Billion |

| Market Size in 2023 | USD 13.39 Billion |

| Market Size in 2024 | USD 15.04 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.33% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Sales Channel, Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for connected cars

Consumers today demand the same ease and connectivity from their cars as their smartphones and other personal electronics. Real-time navigation, streaming services, internet surfing, and social media access are just a few of the capabilities that connected cars offer. TCUs enable a strong telematics infrastructure, which is necessary for these services. The market for telematics control units and the requirements for these functionalities are expanding. Telematics system use is accelerating due to government restrictions to reduce emissions, increase vehicle efficiency, and improve road safety. For example, regulations about pollution control and fleet monitoring frequently mandate that cars have TCUs installed. This drives the growth of the telematics control unit market.

Increasing awareness of vehicle safety and security

Modern buyers are prepared to spend more on cars with the newest safety innovations since they are becoming more conscious of the safety features of vehicles. Features like automated emergency braking, lane deviation alerts, and collision avoidance systems are becoming increasingly popular. TCUs are critical in making these features possible and boosting their market uptake.

High initial costs

Research and development expenditures are high when creating a telematics control unit. Businesses need to invest in software development, hardware design, and ensuring the device complies with strict vehicle regulations. The high initial expenses of this procedure are attributed to the need for specialized tools, experienced engineers, and a substantial amount of time. TCUs handle sensitive data regularly; therefore, adhering to data protection laws is essential. Development costs may increase if strong security measures are implemented, and compliance is guaranteed. The world of technology is changing quickly, particularly in electronics and telecommunications. To be competitive, businesses must upgrade their TCUs often, which drives up R&D expenses. Furthermore, OEMs and customers may be reluctant to spend money on pricey, high-tech systems that might soon become antiquated due to fears of obsolescence. This limits the growth of the telematics control unit market.

Growth in electric vehicles

EVs demand careful route planning, particularly regarding the locations of charging stations. TCUs improve the driving experience by offering real-time traffic updates and navigation. They provide crucial security features like geofencing, anti-theft systems, and vehicle tracking in shared mobility circumstances. EVs don't emit any pollutants from their tailpipes, but TCUs assist in reporting and monitoring energy efficiency and consumption, which helps ensure that environmental rules are followed.

TCUs supply the information needed for usage-based insurance (UBI) models, which enable insurers to give specialized coverage depending on driving patterns and vehicle use. This opens an opportunity for the growth of the telematics control unit market.

The OEM segment dominated the telematics control unit market in 2023. Safety standards and regulations are essential to the automotive business, and OEMs adhere to them diligently. OEMs may guarantee compliance of their telematics systems with all applicable requirements, including cybersecurity and data privacy standards, by directly integrating TCUs into the vehicle. Given that telematics systems gather and transfer sensitive data, compliance is crucial. Manufacturers can customize their telematics systems to a great extent, meeting the unique requirements of various vehicle types and consumer categories. Their versatility enables them to serve a broad spectrum of customers, ranging from high-end cars with cutting-edge entertainment systems to business cars emphasizing fleet management and logistics.

The aftermarket segment is observed to be the fastest growing in the telematics control unit market during the forecast period. Modern telematics systems, now standard in new cars, are absent from many older cars. Demand for aftermarket TCUs is rising as owners and fleet managers look to enhance their vehicles with cutting-edge capabilities. Older models lack capabilities like remote diagnostics, GPS navigation, vehicle tracking, and real-time data analytics. These devices make these features possible. The aftermarket industry is expanding due to the growing appeal of old automobiles. The necessity of equipping secondhand cars with contemporary telematics systems is growing along with the demand for them. Adding cutting-edge amenities to used cars through aftermarket TCUs increases their marketability and appeal to consumers.

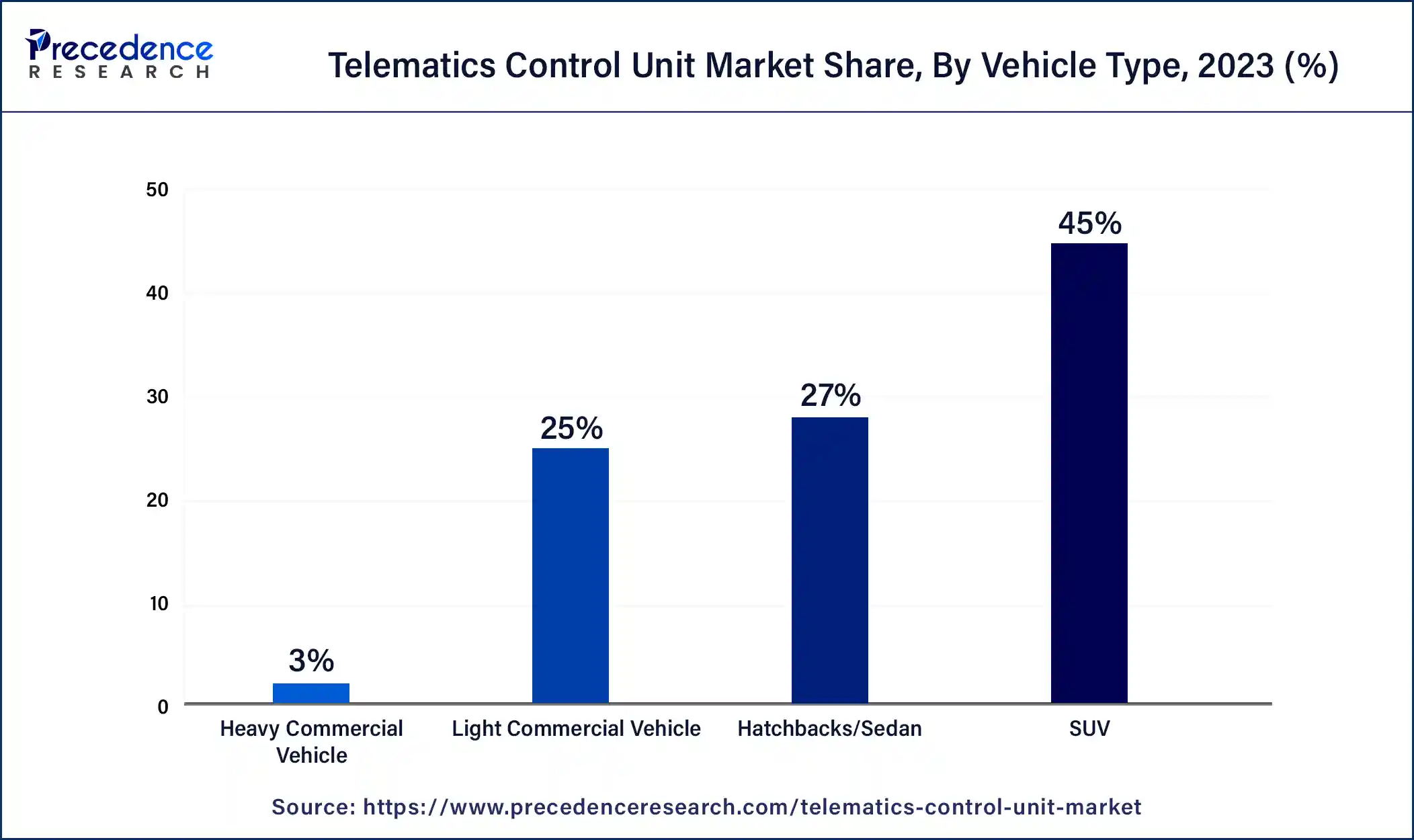

The SUV segment dominated the telematics control unit market in 2023. Globally, SUVs are becoming more and more popular among consumers. Many drivers, especially city dwellers, families, and adventure seekers, find a higher driving posture, comfort, and space appealing. Due to their popularity, SUV sales have increased dramatically, increasing demand for telematics control units because these cars frequently have cutting-edge networking features.

The hatchbacks segment is observed to be the fastest growing in the telematics control unit market during the forecast period.

Hatchbacks are well-liked in cities with limited parking and space due to their small size and fuel efficiency. The demand for hatchbacks has increased as more buyers value affordable and ecologically friendly automobiles. To improve the aesthetics and usability of these cars, the telematics control unit, which makes it possible for functions like communication, navigation, and vehicle diagnostics, is being progressively incorporated into them.

The insurance segment dominated the telematics control unit market in 2023. The insurance segment's supremacy in the TCU market has mainly been attributed to the advancement of telematics technology. With the use of sophisticated sensors, GPS, and communication systems, modern TCUs can offer real-time information on vehicles' location, state, and behavior. Due to the increased accuracy and dependability of these systems, insurers can now provide more complex and competitive insurance packages. The value proposition of telematics-enabled insurance is further enhanced by the integration of services like crash detection and emergency assistance.

The safety and security segment shows a significant growth in the telematics control unit market during the forecast period. Consumers are becoming increasingly concerned about safety When selecting a vehicle. Because of this, there is a greater need for cutting-edge safety features, including automatic accident notification (ACN), emergency call systems (eCall), and tracking of stolen vehicles. TCUs are essential components of these systems because they allow for real-time communication between the car and emergency personnel, which speeds up reaction times and may even save lives in the event of a collision. The emphasis on vehicle security has increased due to increased car thefts and cybersecurity risks. TCUs offer remote vehicle shutdown, geofencing, and stolen vehicle recovery services.

Segments covered in the report

By Sales Channel

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

January 2025

January 2025

October 2024