January 2025

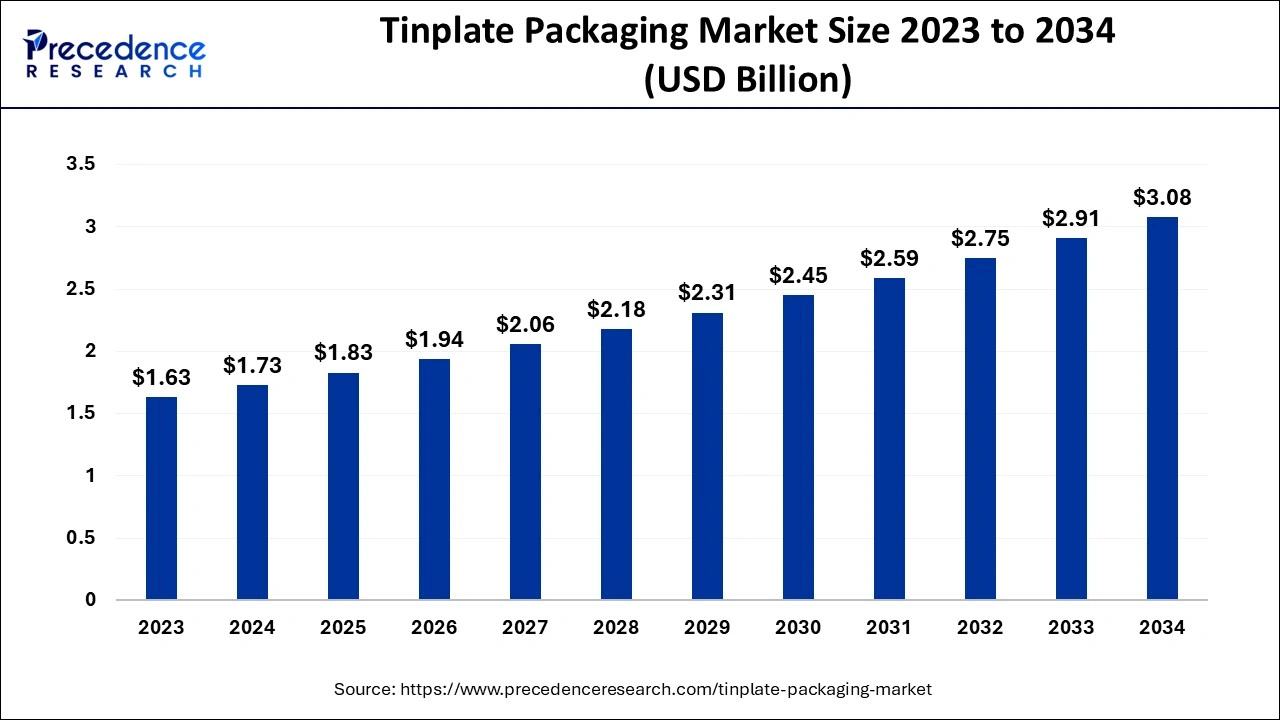

The global tinplate packaging market size accounted for USD 1.73 billion in 2024, grew to USD 1.83 billion in 2025 and is expected to be worth around USD 3.08 billion by 2034, registering a CAGR of 5.97% between 2024 and 2034. The Asia Pacific tinplate packaging market size is calculated at USD 870 million in 2024 and is expected to grow at a CAGR of 6.02% during the forecast year.

The global tinplate packaging market size is worth around USD 1.73 billion in 2024 and is projected to hit around USD 3.08 billion by 2034, growing at a CAGR of 5.97% from 2024 to 2034. The Tinplate Packaging Market is expected growth due to increasing consumer concerns, Environmental sustainability, and recyclability attributes, raising the prominence of food and beverage packaging.

The use of artificial intelligence and automation is rapidly revolutionizing the tinplate beverage can packaging business. AI solutions improve production processes by predetermining when different components require repair or replacement, by monitoring the quality of the manufactured products in real-time, and by optimizing the flow of materials. With robotics in production and advanced manufacturing systems, the cost of labor is cut while accuracy in can-making increases. Many of these advancements are aimed at increasing efficiency, decreasing cost, and improving the uniformity of the end product, all of which are key goals of the industry where the consumer base and environmental concerns are ever-shifting.

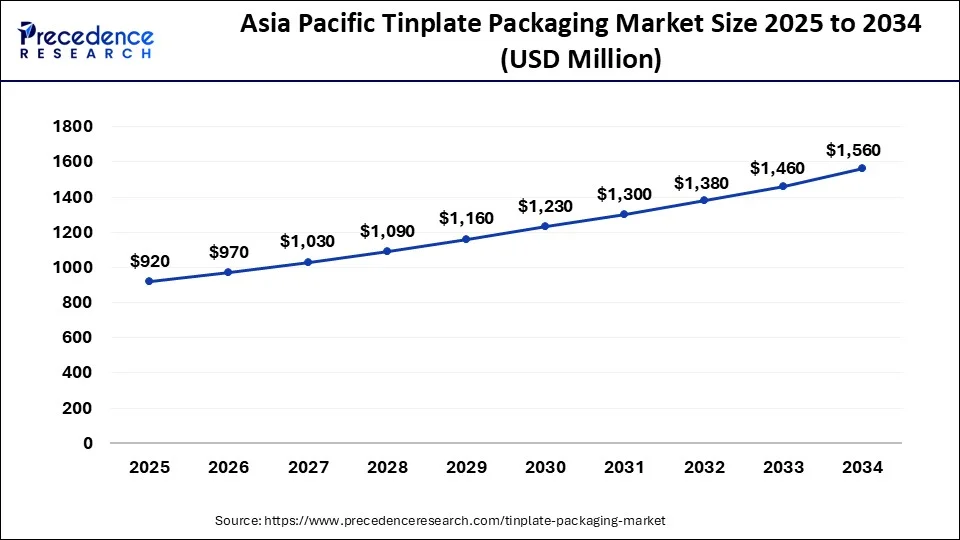

The Asia Pacific tinplate packaging market size is evaluated at USD 870 million in 2024 and is expected to be worth around USD 1,560 million by 2034, growing at a CAGR of 6.02% from 2024 to 2034.

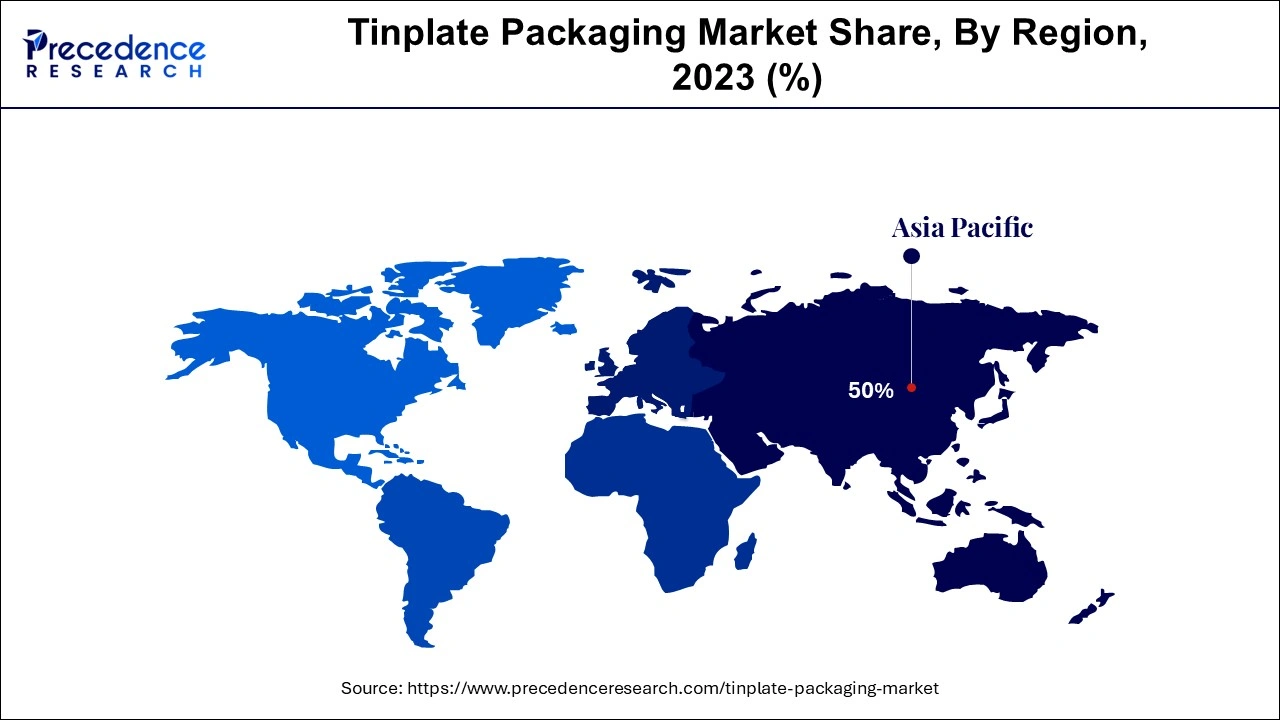

Asia Pacific dominated the tinplate packaging market in 2023 due to the increase in demand for the product across various application segments such as foods and beverages, personal care, and household appliances, among others. The availability of a manufacturing hub in Asia-Pacific nations, including China, Japan, Indonesia, India, and others. The population's concern for packaged food and beverages, especially in urban areas, is one of the main factors pushing the need for proper packaging. Government policies on sustainability and reducing plastic consumption motivate industries to use tin plates that are recognized for their recyclability.

North America is observed to grow at the fastest rate in the tinplate packaging market during the forecast period. Rising demand for preserved food and a high number of industry players in the food & beverage sector in developed nations, such as the United States and Canada. The tinplate industry has many opportunities, as new technologies in tinplate production, such as the invention of new coatings and surface treatments, are expected to improve the efficiency and durability of tinplate. Since sustainability has become a trend, firms have selected tinplate packaging because it has enhanced recyclability and reduced impacts on packaging materials compared to plastics.

A tinplate packaging product fabricated from steel offers a strong and shiny surface to a tinplate-based packaging solution. Tinplate finds applications in the packing of canned foods, beverages, chemicals, paints, and cosmetic products. The potential of this material offers great pressure and temperature resistance, as well as resistance to physical harm throughout the manufacturing phases and during shipment. High recyclability, durability, and easy printability are the features that make customers purchase the product.

The tinplate packaging market is growing as the need for environmentally friendly and sustainable packaging is increasing across the globe. Tinplate is easy to recycle, making it a popular choice for brands concentrated on sustainability. It is also transportable and lighter in structure to help clients cut their transportation costs and energy used in carrying.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.08 Billion |

| Market Size in 2024 | USD 1.73 Billion |

| Market Size in 2025 | USD 1.83 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.97% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Thickness, End-Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase Demand for Packaged Food and Beverages

The major benefit of food storage in tin packaging is that it lasts for a longer period than other packing materials. Due to its enclosed characteristics, tin packaging hinders the effects of light and humidity, hence greatly reducing the rate of deterioration of foodstuffs. Tinplate packaging is ideal for food storage because once sealed, it is virtually airtight to help prevent the degradation of the food stored. Products such as packed food are experiencing a high demand. There is a rising trend in the canned food and beverages industry across developed countries, especially the developing world, which is affecting the tinplate packaging market. An increase in per capita income of the people, changes in lifestyle, and easy availability of packed food and beverages are some of the key factors that are driving the growth and development of tinplate packaging.

Alternative Packaging Materials

Alternative packaging materials like aluminum, plastic, paper, and others used in the manufacturing of different forms of packaging material are far different from sheet metal in all respects or properties. Plastic material is favored for its lightweight and flexibility in packaging, and aluminum is favored due to its protective and recyclable abilities. While tinplate packaging possesses certain inconveniences in achieving the optimal performance and characteristics of the packaging needed by industries, it is a hindrance and likely not very suited for use.

Sustainable Packaging Products

Tinplate packaging is a packaging material made from recycled steel. Recycling is important as it ensures the minimization of natural resources, conservation of energy, and general reduction of impacts of packaging waste on the environment. This factor makes people look for environmentally friendly and greener packaging. This attribute makes it a perfect food packing material because it will be perfect for protecting food products and ensuring the products are in good shape. Tinplate packaging is also light and sturdy. Due to resource optimization, reusability, durability, shock-resistant characteristics, energy-saving, minimum carbon emission, and desirable disposal options, tinplate packing can satisfy the needs of customers, manufacturers, and those who prefer green products.

The cans segment contributed the largest growth in the tinplate packaging market in 2023. Population growth, changes in the population’s lifestyle, and a shift towards the consumption of products like canned foods and beverages have also enhanced the demand. Some of the factors include storage & protection capacity of the cans, variety & size & shape availability. The can is relatively reasonably recyclable, and the availability is easily accessible. The expanding usage of cans across the food and beverage industry is the main driver of the segment. Cans are eco-friendly, portable, and convenient for handling food items and various beverages to carry, use, and transport. The demand for the cans is also expected to rise because the products are convenient to use, easy to transport and store, and have a longer shelf life.

The containers segment is expected to witness significant growth in the tinplate packaging market during the forecast period. Tinplate is a material used for manufacturing and fabricating cans and containers to preserve and convey products. Tinplate containers are used to pack many kinds of production articles, food articles, tobacco articles, paints, varnishes, medical articles, and cosmetics. Tinplate containers are employed to carry foods, beverages, and other items because they make the products durable and shield the contents. Tinplate containers are a worthy choice for food and non-food items because the tinplate coating shields the contents from impurities.

The 0.15 to 0.30 mm segment had the highest shares in the tinplate packaging market in 2023. A tinplate of 0.15 to 0.30 mm thick is used for canning beverages and food products along with other uses. These sheets have relatively low weight compared to the thickness, and this makes it possible to use them in the formation of lighter packs. Laminated films with thinner sheets mean less material is consumed, and packages have a lower overall weight, resulting in cost savings in transportation, storage, and logistics. Snack food cans use tinplate with a thickness of 0.15 – 0.20mm, as they represent light-weighting.

The below 0.15mm segment is projected to witness significant growth in the tinplate packaging market during the forecast period. Due to the increase in the use of lighter, durable, and cheap sheets in the food, beverage, and consumer industries, particularly in the packaging of personal care products as well as confectionery, these sheets have several uses in several other industries.

The food & beverage segment held the largest share of the tinplate packaging market in 2023. The food & beverage industry is shifting towards sustainable packaging varieties, and friendly tinplate expands this shift, leading to the segments’ growth. Tin plate, which is thin steel coated with tin, is used in many markets because it is hard-wearing, cheap, and effective at uses such as in the manufacture of cans, boxes, drums, and containers. Tinplates are suitable for food and beverage products because of their non-reactive nature with food products. The tinplate is lightweight as well as low cost to make hence making it suitable for industries that seek reliable yet cheap packaging solutions.

The paints & coatings segment is estimated to witness significant growth in the tinplate packaging market during the forecast period. The development of infrastructure through increasing urbanization and industrialization has led to the growth of the need for the paint industry. The corrosion characteristic of tinplate pails will lead to demand for this segment. The tinplating process includes applying a thin layer of tin to a steel base and then coating it with a lacquer. Tinplate is used for general cans for paints, aerosols, and other products. Organosols and acrylics are mostly used as the lacquer layer and for decoration on tin plates.

By Product Type

By Thickness

By End-Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025