August 2024

Toluene Market (By Derivative Type: Benzene & Xylene, Toluene Diisocyanatos, Gasoline Additives, Others; By Application: Drugs, Dyes, Blending, Cosmetic Nail Products, Others; By Production Process: Reformate Processes, Pygas Processes, Coke/Coal Processes, Styrene Processes) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

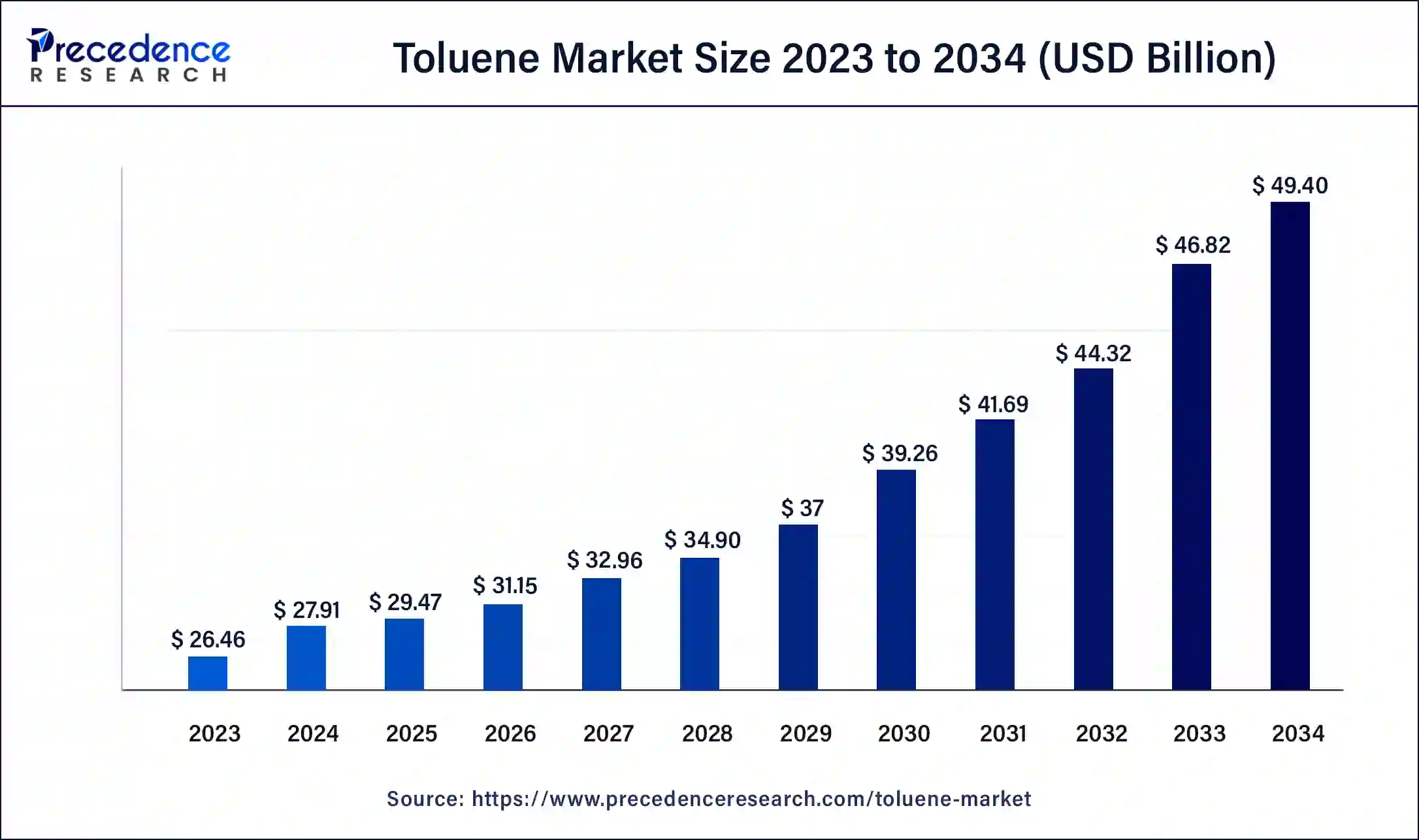

The global toluene market size was USD 26.46 billion in 2023, calculated at USD 27.91 billion in 2024 and is expected to reach around USD 49.40 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034

The toluene market is a dynamic segment of the global chemical industry primarily driven by its versatile applications. Toluene, an aromatic hydrocarbon, serves as a valuable solvent in various industries, including chemicals, petrochemicals, paints and coatings, and pharmaceuticals. It is also utilized in the synthesis of numerous chemicals and as a blending component in gasoline.

The market's growth is fueled by the expanding automotive and construction sectors, which increase demand for paints and fuels, and the chemical industry's robust growth, which relies on toluene as a feedstock. The market is influenced by environmental regulations due to toluene's potential health and environmental risks, promoting the development of eco-friendly alternatives.

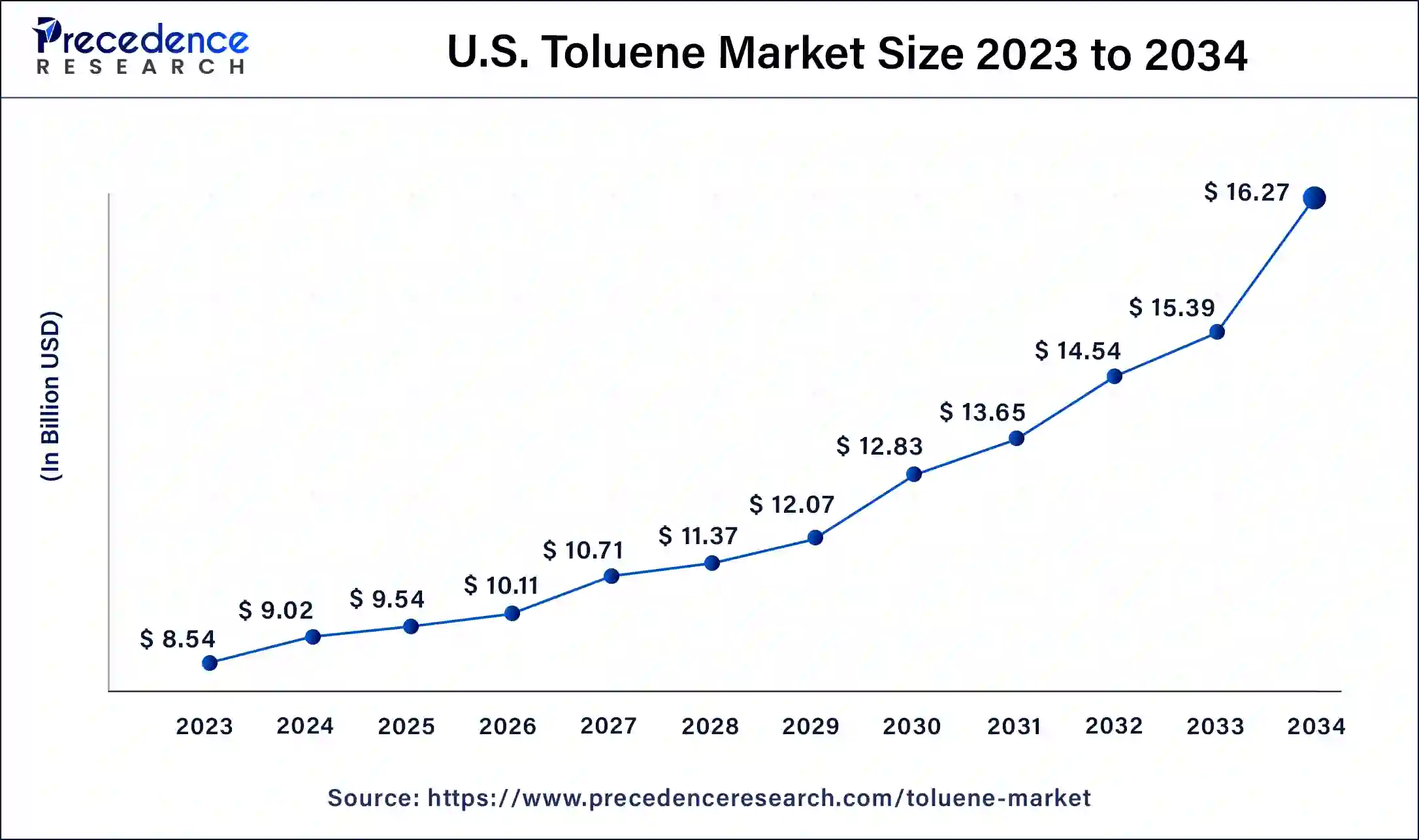

The U.S. toluene market size was valued at USD 8.54 billion in 2023 and is expected to reach USD 16.27 billion by 2034, growing at a CAGR of 6.10% from 2024 to 2034.

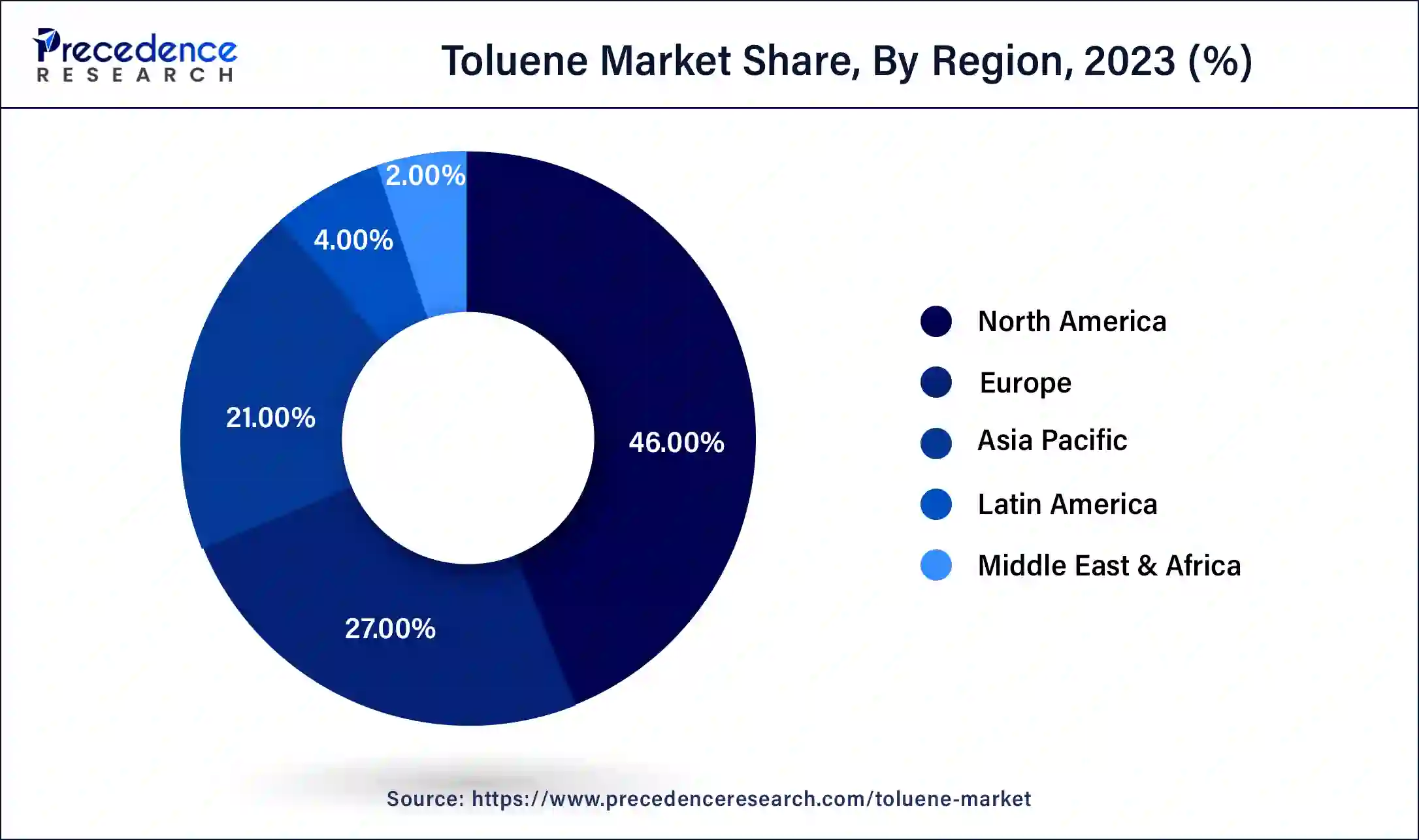

North America has held the largest revenue share 46% in 2023. In North America, the toluene market has experienced fluctuations due to the impact of the COVID-19 pandemic. The initial market slowdown was attributed to reduced industrial activities, particularly in the automotive and construction sectors. However, with the gradual reopening of economies and increased infrastructure projects, the demand for toluene, a vital component in adhesive paints and coatings, is projected to rebound. Furthermore, the growing emphasis on sustainability and environmental regulations is driving research and development efforts towards producing bio-based toluene, aligning with the region's eco-friendly initiatives.

Asia Pacific is estimated to observe the fastest expansion. In Asia Pacific, the toluene market has remained robust. Asia Pacific is a key player in the global chemicals industry, and its surging manufacturing activities, especially in countries like China and India, contribute to consistent demand for toluene. The region's focus on infrastructure development and growth in the automotive sector bolsters the market. Additionally, bio-based toluene production is gaining traction as Asia Pacific champions sustainable practices and seeks alternatives to traditional toluene sources.

In Europe, the toluene market reflects a dynamic landscape, influenced by several key factors. The region's commitment to environmental sustainability and stringent regulations has led to increased efforts to develop and implement bio-based toluene production processes. European manufacturers have been investing in research and development to align with these sustainable goals. Additionally, the region's robust automotive and construction industries contribute to a steady demand for toluene, primarily used in the production of paints, coatings, and adhesives for various applications, from automotive refinishing to architectural projects. These factors together shape a competitive and evolving toluene market in Europe.

| Report Coverage | Details |

| Market Size by 2034 | USD 49.40 Billion |

| Market Size in 2023 | USD 26.46 Billion |

| Market Size in 2024 | USD 27.91 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Derivative Type, Application, Production Process, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Evolving chemical industry and rising electronics manufacturing

The toluene market experiences significant growth driven by an evolving chemical industry. Toluene serves as a vital raw material in the production of benzene and xylene, both essential components for a wide range of chemical processes. With the chemical sector continually evolving and expanding its applications in various industries, the demand for toluene remains robust. This growth is further propelled by the increasing need for toluene in the manufacturing of specialty chemicals, adhesives and sealants.

Additionally, the surge in electronics manufacturing has a substantial impact on the Toluene market. High-purity toluene is indispensable in the semiconductor industry, where it is used for its exceptional solvency properties. With the ever-growing electronics sector, characterized by rapid technological advancements and increased demand for electronic devices, the need for high-purity toluene continues to rise. As electronic components become more intricate and specialized, the Toluene market is poised to benefit from the expansion of the electronics manufacturing industry.

Fluctuating crude oil prices and substitute products

Fluctuating crude oil prices can create uncertainties in the toluene market, causing manufacturers to grapple with unpredictable cost variations. The reliance on petroleum refining as a primary source of toluene production further intensifies this challenge. In times of rising crude oil costs, the production of toluene becomes more expensive, translating to higher prices for end-users. This price volatility adds complexity to budgeting and planning for both manufacturers and consumers, potentially impacting their decisions in the market. As a result, managing these cost fluctuations and ensuring supply stability becomes a crucial task for industry players.

Bio-based toluene production and increased use in the energy sector

The toluene market experiences a surge in demand due to two significant factors: the emergence of bio-based toluene production and its increased use in the energy sector. Bio-based toluene, derived from renewable feedstock, aligns with the global shift toward sustainable and environmentally friendly practices. As environmental concerns grow, industries are increasingly turning to bio-based toluene as a greener alternative to the conventional petroleum-based version.

The growing adoption of toluene in the energy sector is notably driven by its integral role in advanced energy technologies. Particularly, toluene plays a crucial part in the production of solar cells. As the field of solar energy continues to expand and gain recognition as a clean and renewable energy source, the demand for toluene in photovoltaic applications surges. Its utilization in solar cells enhances their efficiency and performance, underscoring toluene's importance in the pursuit of sustainable energy solutions. This increased use of toluene in the energy sector reflects the industry's commitment to innovation and environmental consciousness, further propelling the toluene market's growth.

Impact of COVID-19

According to the derivative type, the disposables segment has held 59% revenue share in 2023. In the toluene market, benzene and xylene stand out as essential derivative types. Benzene, a crucial chemical compound derived from toluene, finds extensive use in the production of various plastics, synthetic fibers, and rubber materials, contributing significantly to these industries. On the other hand, xylene, another noteworthy derivative, serves as a key component in the manufacturing of plastics, polyester fibers, and various solvents, further underlining its importance in the chemical and industrial sectors. These derivative types represent vital facets of the toluene market, shaping its trajectory and driving its applications across multiple industries.

The gasoline additives segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. Gasoline additives are key components in the toluene market, where toluene is used as an octane booster for gasoline. This application is experiencing growth as fuel efficiency and emissions regulations become more stringent, driving the need for additives that enhance engine performance while maintaining compliance with environmental standards. These trends underscore the enduring relevance and versatility of toluene derivatives in the evolving chemical and automotive industries.

Based on the application, drugs segment is anticipated to hold the largest market share of 43% in 2023. In the toluene market, the application of toluene in drugs remains essential, particularly in the pharmaceutical industry. Toluene is a key component in the synthesis of various drug compounds, offering solvency and stability in drug formulations. As the pharmaceutical sector continues to advance and innovate, the demand for toluene remains steady. The development of new drugs, particularly in areas like oncology and neurology, fuels the market.

On the other hand, the cosmetic nail products segment is projected to grow at the fastest rate over the projected period. Toluene's presence in nail polishes provides durability, shine, and a smooth finish. The nail industry has been trending toward safer, toluene-free formulations due to increasing consumer awareness of the health hazards associated with toluene exposure. As a result, the market is witnessing a shift toward toluene-free and eco-friendly nail products.

The reformate processes segment had the highest market share of 39% in 2023 based on the production process. Reformate processes involve the production of toluene as a byproduct of catalytic reforming in petroleum refineries. This process has gained attention due to the increasing demand for high-octane gasoline, as toluene is a valuable component in blending gasoline. A trend in the reformate process segment is the emphasis on refining techniques to enhance the toluene yield and purity while adhering to stringent environmental regulations. These processes continue to play a crucial role in toluene production, aligning with the growing need for cleaner fuel alternatives.

The styrene processes segment is anticipated to expand at the fastest rate over the projected period. Styrene processes focus on the use of toluene as a feedstock for the production of styrene monomer. Styrene is a key raw material in the manufacturing of various plastics and synthetic rubber. A trend in the styrene process segment is the innovation in catalytic systems to improve styrene yield and optimize energy consumption. Given the expanding applications of styrene-based products, these processes are poised for sustained growth, further propelling the toluene market.

By Derivative Type

By Application

By Production Process

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024