March 2025

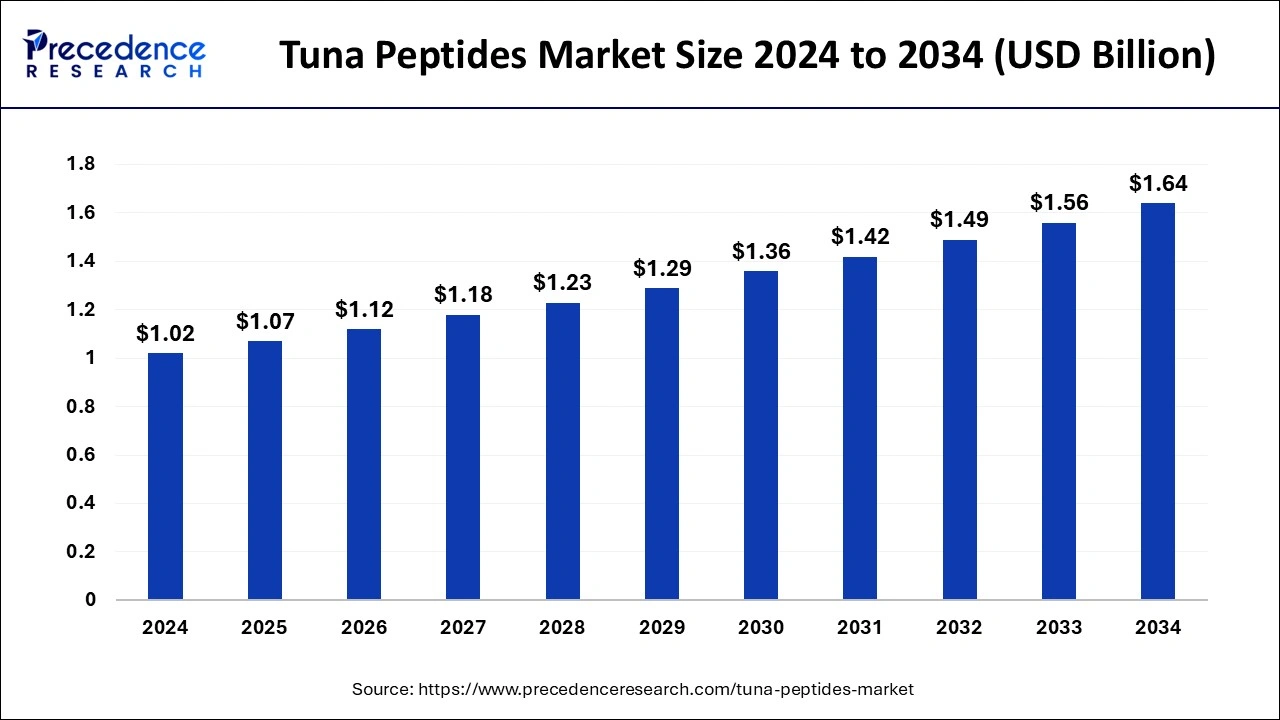

The global tuna peptides market size is calculated at USD 1.07 billion in 2025 and is forecasted to reach around USD 1.64 billion by 2034, accelerating at a CAGR of 4.86% from 2025 to 2034

The global tuna peptides market size was accounted for USD 1.02 billion in 2024 and is expected to exceed around USD 1.64 billion by 2034, growing at a CAGR of 4.86% from 2025 to 2034. The market growth is attributed to increasing consumer demand for health-enhancing products and innovations in peptide extraction technologies.

Artificial intelligence advances the tuna peptides market by bringing system alterations and policy improvements in trade. AI is embedded in organizations to improve product creation, inventory management, and advertising methods. Incorporation of artificial intelligence in data analysis provides a business with the capacity to analyze trends and consumer behavior hence satisfaction and high revenues. AI tools also reduce wastage and help to locate where the best resources are utilized within an organization.

Consumer awareness of the need to consume foods that help boost their immunity has increasingly become important and is a key growth factor for the tuna peptides market. This growth is attributed to the growing perception of the health qualities that accompany tuna peptides, which include inflammation, oxidative stress reduction, and microbial properties. Innovations in purification methodologies have acted to increase the efficacy and recovery of these bioactive molecules, thus making them easier to incorporate into a range of applications. Furthermore, the increasing number of people focusing on environmentally friendly and renewable seafood products have also increasingly implemented the use of tuna by-products, such as peptides.

| Report Coverage | Details |

| Market Size by 2024 | USD 1.02 Billion |

| Market Size in 2025 | USD 1.07 Billion |

| Market Size in 2034 | USD 1.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.86% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising demand for functional foods, sustainability, and health benefits

Increasing demand for functional foods and nutraceuticals is anticipated to drive the tuna peptides market. Consumers actively seek products with health benefits, particularly those supporting cardiovascular health, weight management, and improved immunity. There is a growing adoption of wellness as a way of life, and many consumers in the United States consider wellness to be a top or important factor in their daily lives. Their association with health benefits such as weight control and immune boosters fits well with the development of obesity and immune-related diseases.

Availability of alternative protein options

Restraining adoption due to competition from alternative protein sources is anticipated to hamper the tuna peptides market in the coming years. It stated that proteins of plant origin and insect proteins bioactive peptides from the marine sources of tuna are the key competitors for tuna peptides in the functional food and nutraceutical industry. Consumers believe that plant-based products usually have a detrimental effect on the environment, and this makes them choose products in this category. This preference only puts pressure on tuna peptide producers to find ways of setting them apart from each other, either through more elaborate formulations or more plausible sustainability stories.

R&D, diversification, and sustainability

High investments in research and development are anticipated to accelerate product diversification, creating significant opportunities for the players competing in the tuna peptides market. Manufacturers are looking for new opportunities to use tuna peptides in spheres, including cosmetics, pharmaceuticals, and functional foods, due to their multifunctional character.

Tuna peptides found have collagen-stimulating and anti-aging properties that are demanded the most in the cosmetics industry in the global anti-aging market, which the National Institute on Aging has predicted to grow with the increase in the aging population. Furthermore, incorporating the tuna peptides as functional food includes the functional food sector, especially in protein-fortified drinks, bars, and capsules.

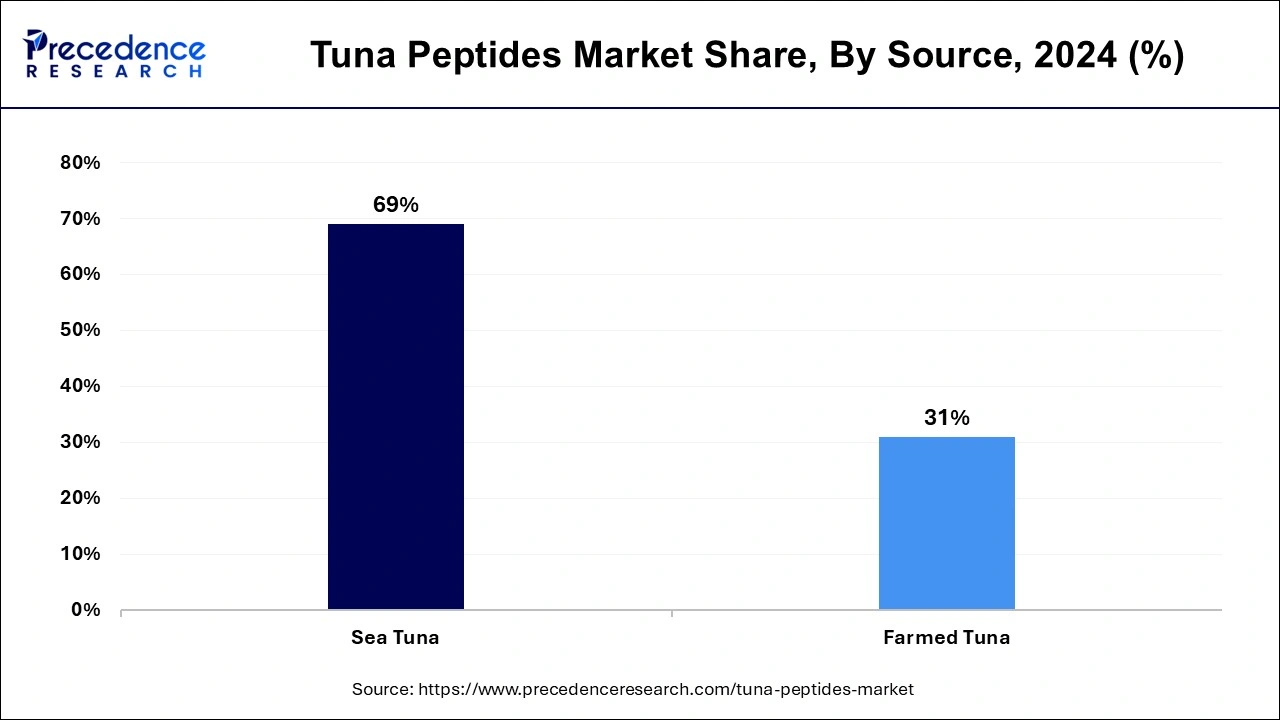

The sea tuna segment held a dominant presence in the tuna peptides market in 2024, due to the higher concentration of bioactive compounds in wild-caught tuna fish. The open-sourced wild tuna contains peptides with higher antioxidant activity and antihypertensive compared to fish from the farmed fish. The feeding habits within seawater and healthier growth conditions result in better yields of potent peptide extraction for tuna. Furthermore, the rising demand for wild-caught fish is due to the popularity of the sustainable market segments and natural sources of seawater tuna.

The farmed tuna segment is expected to grow at the fastest rate in the tuna peptides market during the forecast period of 2025 to 2034, owing to the growing demand for ecological and stabilization of production. With increasing cases of overfishing and depletion of sources of wild fish, farmed tuna is, therefore, a more sustainable source and scalable to seawater tuna. Efficiency of feed formulation in aquaculture, new genetic strains, feeding techniques, and breeding technology for aquaculture lead to lower costs and better quality of farmed tuna peptides. The farmed tuna segment is expected to increase over time since there is a growing concern about the environmental sustainability of food, and farmed tuna is viewed as more environmentally friendly than wild capture tuna. Consumer knowledge of MSC and ASC certifications promoting sustainable aquaculture is driving the increase needed for farmed tuna.

The dietary supplement segment accounted for a considerable share of the tuna peptides market in 2024 due to the increasing consumers’ awareness of products with healthy attributes, especially those nutrients that build and sustain the heart, immune, and metabolic systems. Tuna peptides containing collagen that work as a bioactive compound have shown positive effects in these health gains. Furthermore, such a trend demonstrates the shift in using tuna peptide-based supplements and further fuels the market.

The functional foods and beverages segment is anticipated to grow with the highest CAGR in the tuna peptides market during the studied years, owing to the growing willingness of consumers for products that would help enhance their health. The U.S. Food and Drug Administration or FDA has acknowledged that globally there is increased consumers’ awareness of functional foods, and it showed that currently. Additionally, developments in the food processing industry enhance the efficiency of including such bioactive compounds as tuna peptides.

North America held the dominating share of the tuna peptides market in 2024 due to growing demands for functional food products such as dietary supplements and functional foods. The region’s focus on bioactive ingredients, such as tuna peptides, is greatly associated with growth in health consciousness and the strong pull towards natural products. Moreover, the easy availability of new products and increasing focus on health and wellbeing further propels the region.

Asia Pacific is projected to host the fastest-growing tuna peptides market in the coming years, owing to the growing health concern and emphasis on functional foods and beverages. The region is a portend for more demand for marine-based proteins and peptides, particularly in nutraceuticals and functional foods. The continual development of innovative food processing technology in the region and enhancements in the SW supply chain is helping to raise the availability of bioactive components such as tuna peptides in FK&B items.

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

May 2024

August 2024