April 2025

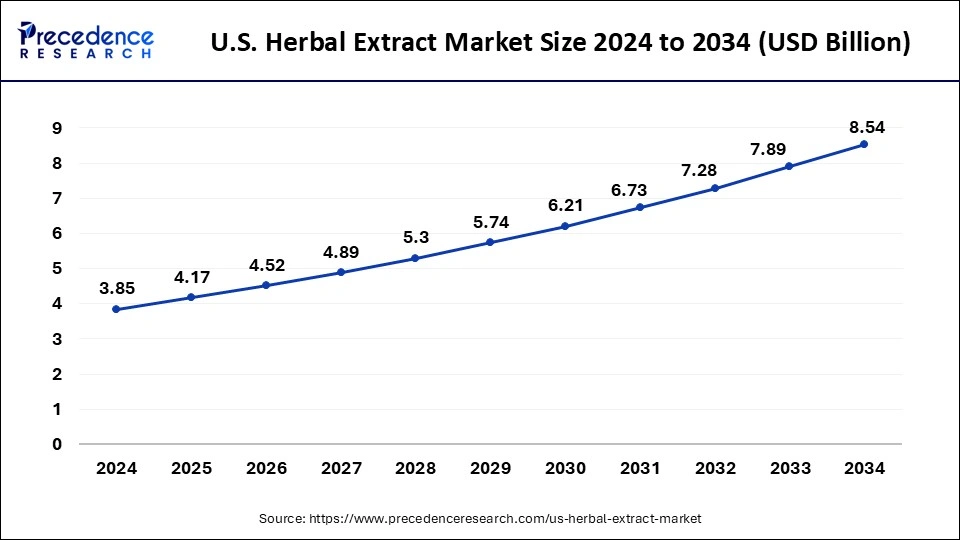

The U.S. herbal extract market size is calculated at USD 4.17 billion in 2025 and is forecasted to reach around USD 8.54 billion by 2034, accelerating at a CAGR of 8.28% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. herbal extract market size accounted for USD 3.85 billion in 2024 and is predicted to increase from USD 4.17 billion in 2025 to approximately USD 8.54 billion by 2034, expanding at a CAGR of 8.28% from 2025 to 2034.

The U.S. herbal extract market offers herbal extract that is a concentrated substance derived from plant material, such as leaves, flowers, stems, roots, or seeds, using a solvent or extraction method. The purpose of herbal extraction is to isolate and preserve the active compounds or constituents of the plant that are believed to have medicinal, therapeutic, or flavoring properties. Herbal extracts can be used in various forms, including liquid tinctures, capsules, powders, or incorporated into creams and lotions. They are popular in traditional and alternative medicine practices worldwide and are believed to offer natural therapeutic benefits.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.28% |

| Market Size in 2024 | USD 3.85 Billion |

| Market Size by 2034 | USD 8.54 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

Growing customer preference for natural ingredients and clean labels

The U.S. herbal extract market is expected to grow as consumers' preferences for natural ingredients and clear labeling grow. Today's consumers want clean labels and are more aware of the components utilized in every product they purchase. Consumers are turning more and more toward goods with identifiable, natural constituents rather than synthetic chemicals or artificial additions. This customer's desire for natural ingredients and simple labeling is exactly what basil extract offers. It is made from the leaves of the basil plant, a well-known herb with a lengthy culinary and medical history. It provides a natural way to improve the taste, scent, and possible health advantages of different items.

Manufacturers may meet customer requests for products devoid of artificial flavors, colors, and preservatives by using the extract. It offers a natural substitute for artificial additives, enabling businesses to develop clean-label products that appeal to customers who are concerned about their health.

The trend toward natural ingredients and clean labeling is not limited to the food business; it also permeates other consumer items including home care and personal care products. These industries can also benefit from the extract's natural scent, antibacterial qualities, and possible skincare advantages. Its use in household and personal care products satisfies customer needs for natural, safe, and environmentally responsible substitutes.

High production cost

The main issue with herbal extracts is getting and processing the botanical constituents, which may take a lot of time and resources and raise manufacturing prices. For instance, the methods used for extracting and purifying rare or speciality herbs are the primary cause of the rising cost of production. In addition, additional manufacturing-related considerations including labor, energy, and equipment all drive up production costs. Furthermore, several businesses must follow stringent legal requirements like Good Manufacturing Practices (GMP), which can increase expenses even further. Thus, these elements may have an adverse impact on the U.S. herbal extract market, which would impede its expansion.

Rising consumer awareness

The developing food and beverage industry in the United States, which has been driven by rising food consumption and population growth, is what is propelling the worldwide herbal extract market's expansion. A hectic lifestyle, excessive labor, growing living standards, and climate change are all making Americans more health-conscious. Customers may now choose natural and organic food items to maintain their health and fitness, which raises the need for herbal extracts and their constituents. The increase in consumer spending power on natural, organic, and health-conscious food and beverage products accompanied by growing disposable incomes had a significant role in the expansion of the U.S. herbal extract market.

The dried crops segment held the largest share of the U.S. herbal extract market in 2024, the segment is observed to witness a significant growth rate throughout the forecast period. The segment growth is attributed to the growing demand from various industries such as cosmetics, pharmaceuticals, and others. The dried turmeric whole sub-segment is expected to capture a significant market share during the forecast period.

The primary bioactive compound in turmeric is curcumin, known for its antioxidant and anti-inflammatory properties. Dried turmeric serves as a key source for curcumin extraction in the herbal extract market. Dried turmeric extracts are commonly used in the production of dietary supplements.

Capsules, tablets, or liquid supplements containing turmeric extracts are popular in the health and wellness industry. Moreover, growing consumer awareness of the potential health benefits of curcumin has led to increased demand for products containing dried turmeric extracts. Anti-inflammatory and wellness trends have further fueled this demand.

The essential oil segment is expected to grow at a fastest rate during the forecast period. Essential oils are highly concentrated extracts obtained from aromatic plants, ensuring potency and effectiveness in therapeutic applications. Consumers perceive essential oils as pure, natural, and potent alternatives to synthetic drugs or chemical-based products.

The food & beverage segment held the dominating share of the U.S. herbal extract market in 2024, the segment is observed to sustain the position throughout the forecast period. Herbal extracts, derived from various plants, contribute natural flavors to food and beverages. They are often used as alternatives to artificial flavors and additives, aligning with the growing consumer preference for clean labels and natural ingredients.

Additionally, herbal extracts' antibacterial qualities aid in the long-term preservation of food items and drinks. This is anticipated to lead to a rise in the use of herbal extracts in food items and drinks to prolong their shelf life without sacrificing quality.

The personal care & cosmetics segment is expected to grow significantly over the forecast period because herbal extracts have anti-inflammatory, antibacterial, and other qualities. These qualities have increased consumer demand for herbal extracts used in cosmetics and personal care products. The U.S. herbal extract market for natural herbal extracts used in cosmetics and personal care products is predicted to grow as a result of continued product development and the rising use of organic ingredients like essential oils. Teeth cleansing is another application for these chemicals.

Shampoos, soaps, and baby items all contain them as well. One of the main uses of essential oils in the personal care and cosmetics business is in general hygiene. Furthermore, a lot of perfumes, body sprays, and air fresheners include essential oils. Thereby, driving the segment expansion.

By Product

By Application

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

March 2025