January 2025

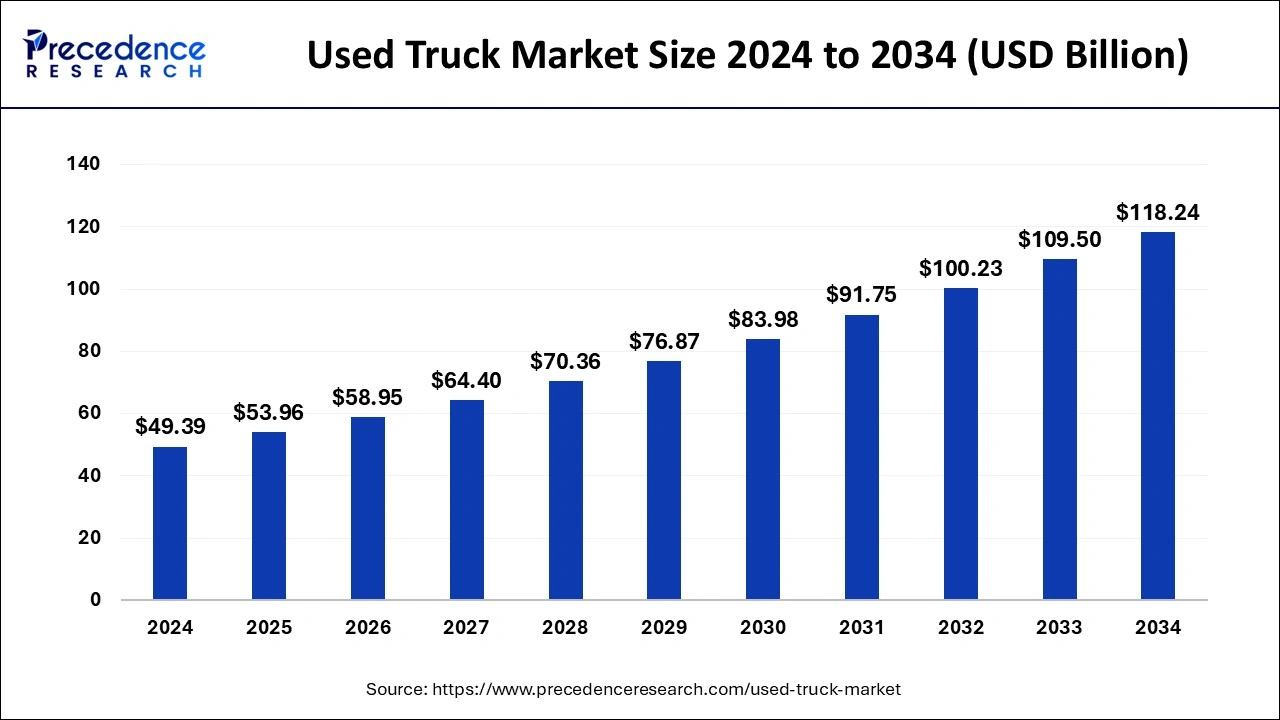

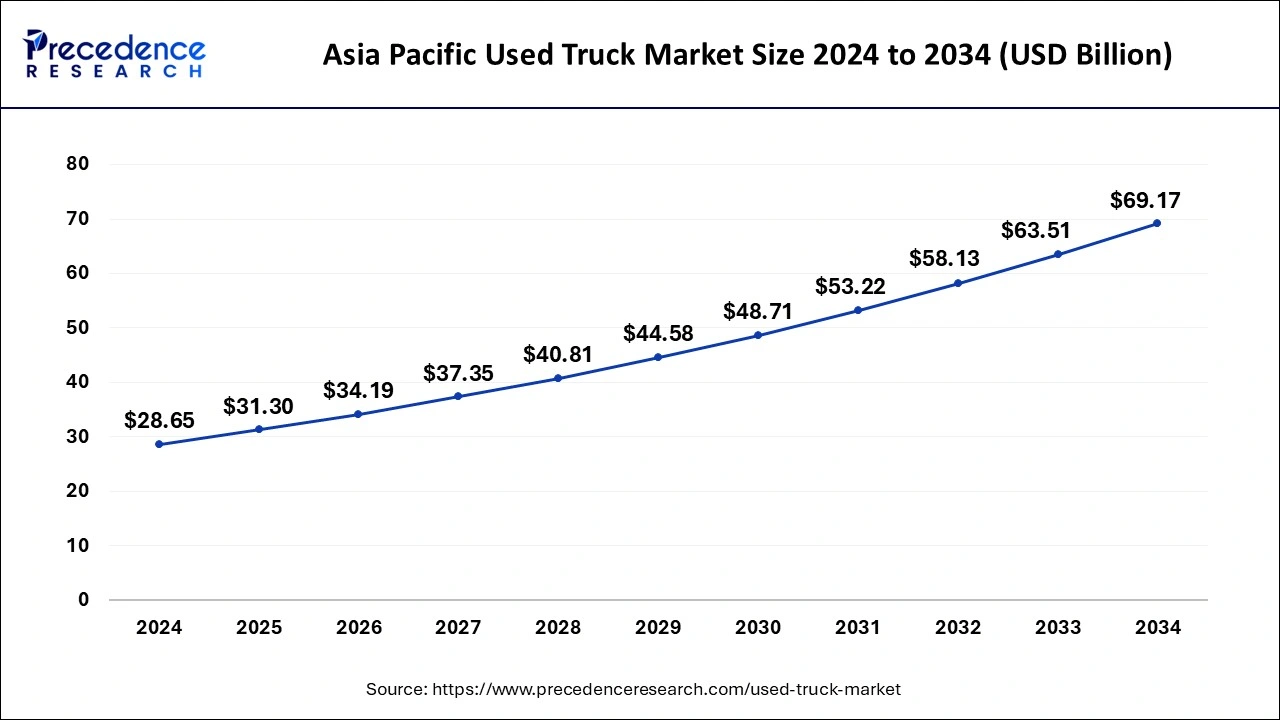

The global used truck market size is calculated at USD 53.96 billion in 2025 and is forecasted to reach around USD 118.24 billion by 2034, accelerating at a CAGR of 9.12% from 2025 to 2034. The Asia Pacific used truck market size surpassed USD 31.30 billion in 2025 and is expanding at a CAGR of 9.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global used truck market size was estimated at USD 49.39 billion in 2024 and is predicted to increase from USD 53.96 billion in 2025 to approximately USD 118.24 billion by 2034, expanding at a CAGR of 9.12% from 2025 to 2034. The rising construction activities and the affordability of used trucks in industrial operations drive the growth of the used truck market.

The Asia Pacific used truck market size was valued at USD 28.65 billion in 2024 and is anticipated to reach around USD 69.17 billion by 2034, poised to grow at a CAGR of 9.21% from 2025 to 2034.

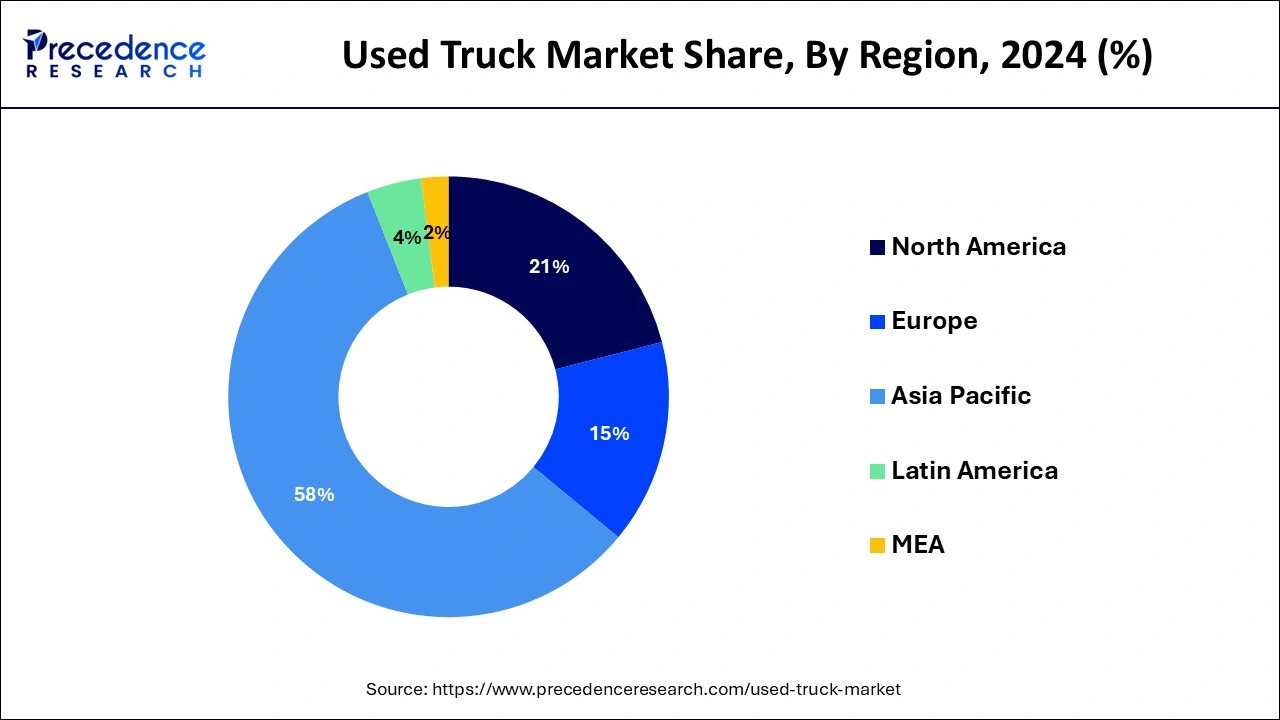

Asia Pacific dominated the used truck market with the largest market share of 58% in 2024. The growth of the market in the region is attributed to the rising industrialization and population, and the developing economies in the region are driving the demand for the used trucks in the region. The expansion of real estate and agriculture infrastructure in countries like India and China is expected to boost the growth of the market during the forecast period. The rising presence of the major market players and the regularity of support are further contributing to the growth of the used truck market across the region.

North America is expected to witness significant growth in the used truck market during the forecast period. North America, particularly the United States, has a large and dynamic economy with significant demand for transportation services. The trucking industry plays a crucial role in the country's economy, transporting goods across vast distances to support various sectors, including manufacturing, retail, agriculture, and construction. As a result, there is a constant need for reliable and cost-effective used trucks to meet the diverse transportation needs of businesses.

North America boasts a well-developed network of highways, roads, and transportation infrastructure, facilitating the movement of goods and people across the continent. The extensive road network and accessibility of trucking routes make trucks a preferred mode of freight transport for many businesses, further driving demand for used trucks.

The used truck market refers to the buying and selling of pre-owned or second-hand trucks. These trucks have been previously owned and operated by individuals, businesses, or organizations before being sold in the secondary market. Trucks enable faster delivery of goods and can carry multiple loads at a time. Trucks are allowed to deliver more load or logistics compared to ships, trains, and aircraft.

Trucks are responsible for the safe and secure delivery of logistics, commodities only can be transported from ships, trains, and aircraft to the ports, yards, and airports respectively, trucks further deliver three commodities to their ultimate destination. Rising supply chain, logistics, and construction activities are propelling the demand for the used trucks market. The value proposition of the used trucks is the most important factor in the growth of the used trucks market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.12% |

| Market Size in 2025 | USD 53.96 Billion |

| Market Size by 2034 | USD 118.24 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle, By Sales Channel, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of construction sector

The increasing construction activities in developing and urban areas are fueling the demand for used trucks while promoting the growth of the used truck market. The rising global population that drives the need for residential and commercial buildings is boosting the demand for equipment and devices used in the construction sector at a rapid pace. Additionally, the rising demand for used commercial trucks for agricultural operations and the delivery of e-commerce logistics are boosting the growth of the market. Lowered prices of used trucks enhance the quality of the operation and save additional operation costs which also contributes to the market’s expansion.

Concerns regarding regular maintenance

Potential buyers of used trucks may be hesitant due to concerns about the maintenance costs associated with older vehicles. As trucks age, they typically require more frequent repairs and replacements of components such as tires, brakes, suspension systems, and engines. The uncertainty surrounding future maintenance expenses can deter buyers from investing in used trucks, especially if they are operating on tight budgets or looking to minimize ongoing operating costs.

Another concern for buyers of used trucks is the availability of replacement parts and qualified service technicians. Older truck models may have discontinued parts or components that are difficult to source, leading to longer lead times for repairs and higher costs for aftermarket parts. Additionally, finding skilled technicians with experience working on older truck models may be challenging, further complicating maintenance and repair efforts.

Rising focus on sustainable transportation

As governments and organizations worldwide prioritize sustainability goals, there's an increasing demand for fuel-efficient vehicles in the transportation sector. Used trucks that offer better fuel efficiency, such as those with newer engine technologies or alternative fuel options like compressed natural gas (CNG) or electric powertrains, become more attractive to buyers seeking to reduce their carbon footprint and operating costs.

Governments and regulatory agencies are implementing policies and incentives to encourage the adoption of sustainable transportation practices. These may include tax incentives, grants, subsidies, or regulatory exemptions for vehicles that meet certain environmental standards. Used trucks that comply with emission regulations or qualify for eco-friendly incentives may command higher resale values and attract more buyers in the used truck market.

The medium-duty truck segment dominated the used truck market with the largest share in 2024. The dominance of the segment is attributed to the rising demand for medium-duty trucks in small and medium-scale businesses for loading and offloading logistics and materials, this factor promotes the segment’s growth. Medium duty trucks are gross weighted between 14000 to 26000 lbs. and come under the classification of 4 to 6 vehicles.

The medium-duty trucks are made for lightweight operations and enable various operations in logistics. The maximum capacity of the medium-duty truck is about 5 to 7 tons. These types of trucks are considered the most cost-efficient trucks and are easy to drive around the urban areas for the delivery of medium logistics. Medium-duty trucks are fuel-efficient trucks and widely used in the retail sector for shipping purposes. All these factors promote the segment’s expansion in the market.

The heavy-duty trucks segment is observed to expand at a significant rate during the forecast period of 2025-2034. Heavy-duty trucks are typically designed and built to withstand rigorous use and operate over longer distances and timeframes compared to light-duty trucks or passenger vehicles. As a result, heavy-duty trucks tend to have longer lifespans and higher durability, making them attractive options for buyers in the used truck market who seek vehicles with proven reliability and longevity.

Heavy-duty trucks are versatile vehicles that can be used for various applications, including long-haul transportation, construction, agriculture, and specialized industries such as oil and gas. Their ability to perform a wide range of tasks makes them valuable assets for businesses and individuals, leading to sustained demand in the used truck market.

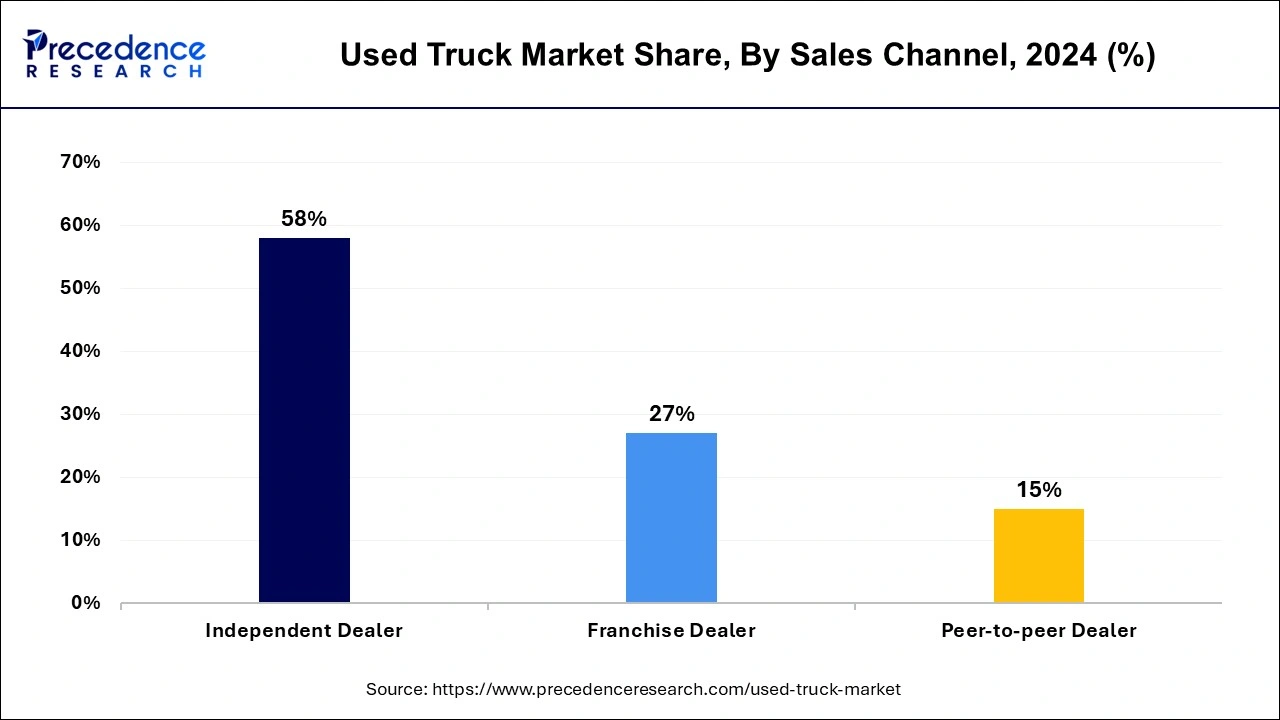

The independent dealer segment dominated the used truck market with the largest share of 58% in 2024. The growth of the segment is increasing due to the rising preference for buying trucks from independent sellers due to the wider variety and offers given by the sellers which is attracting a larger consumer base and driving the growth of the segment in the market.

Independent seller offers a wider range of inventory, convenience, market access, quality assurance and satisfaction, vehicle inspection before buying, financing options, guidance and expertise, and support after sales. Additionally, the wider presence of the multiple independent dealers is also contributing to the growth of the segment in the market.

The construction segment dominated the used truck market with the largest market share in 2024. The growth of construction activities globally due to the rising population is driving the growth of the market in the construction industry. The rising infrastructural activities and the residential and commercial building spaces, furthermore the increasing urbanization and shifting population towards the urban areas for the better lifestyle and incomes resulted in the rise in infrastructure in the urban areas. Used trucks are cost-efficient and perform construction tasks like loading and offloading construction equipment and materials are boosting the demand for the used trucks in the construction industry.

The logistics and transportation segment is observed to grow at the fastest rate during the forecast period. The logistics and transportation industry relies heavily on commercial vehicles, including trucks, for the movement of goods and materials. As such, this sector represents a significant portion of the overall demand for trucks, both new and used. Companies in logistics and transportation frequently update and expand their fleets to meet growing demand, leading to a constant turnover of used trucks in the market.

Commercial fleets operated by logistics and transportation companies typically adhere to specific replacement cycles for their vehicles. After a certain period of use or mileage, trucks are replaced with newer models to maintain efficiency, reliability, and compliance with regulatory standards. As a result, a steady supply of used trucks enters the market from fleet turnover, creating opportunities for buyers in the logistics and transportation sector to acquire quality pre-owned vehicles.

By Vehicle

By Sales Channel

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

August 2024