December 2024

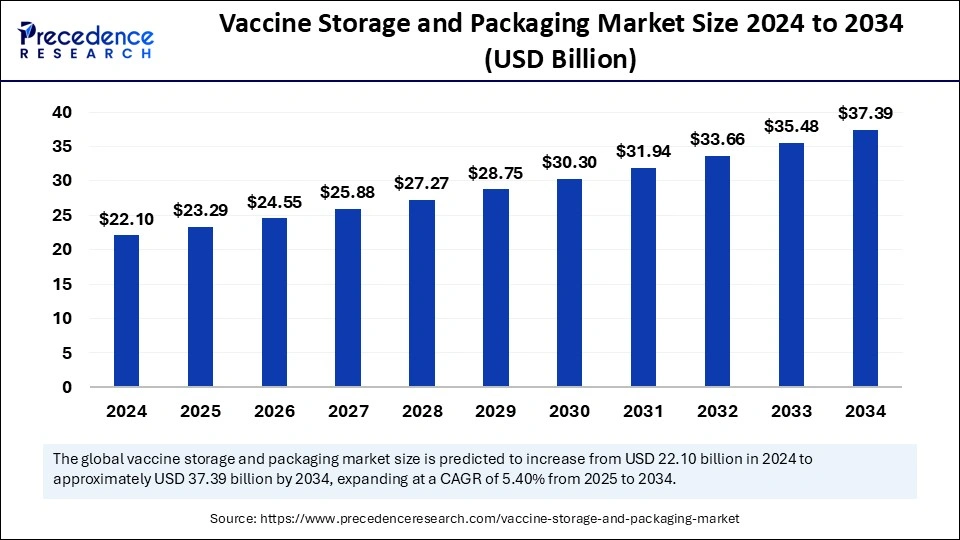

The global vaccine storage and packaging market size is calculated at USD 23.29 billion in 2025 and is forecasted to reach around USD 37.39 billion by 2034, accelerating at a CAGR of 5.40% from 2025 to 2034. The North America market size surpassed USD 8.18 billion in 2024 and is expanding at a CAGR of 5.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vaccine storage and packaging market size accounted for USD 22.10 billion in 2024 and is predicted to increase from USD 23.29 billion in 2025 to approximately USD 37.39 billion by 2034, expanding at a CAGR of 5.40% from 2025 to 2034. The increasing production of vaccines is expected to drive the growth of the market during the forecast period.

The incorporation of artificial intelligence is set to dramatically transform the vaccine storage and packaging market’s landscape, delivering substantial enhancements across several elements of the supply chain. AI algorithms are capable of analyzing vast amounts of data alongside epidemiological trends and various other pertinent factors, allowing for a much more precise prediction of vaccine demand. This predictive analytics facilitates the optimization of production schedules and inventory management, significantly reducing instances of product wastage and stockouts.

Advanced AI systems with monitoring capabilities allow real-time tracking of vaccine stock levels throughout the supply chain. This is particularly vital for vaccines requiring stringent temperature controls and have limited shelf life. By leveraging AI-driven analytics, organizations can manage inventory levels and minimize stockouts, ultimately supporting better supply chain resilience.

AI can refine delivery routes by pinpointing the most efficient paths for transporting vaccines, thereby decreasing transportation times and minimizing fuel consumption. Such optimization is especially crucial for ensuring the timely delivery of vaccines to pharmacies and healthcare facilities in remote or underserved areas. AI-enabled vision systems can also be integrated into the production lines to automate quality checks on vaccine packaging, rigorously adhering to regulatory standards. This approach significantly diminishes the likelihood of human error while simultaneously enhancing the overall quality and safety of vaccine packaging, ensuring that each product meets strict regulations.

AI can analyze real-time data of vaccine storage units to optimize temperature control and adjust settings to maintain ideal conditions. This, in turn, improves the stability of vaccines. Moreover, integrating AI technologies in packaging processes automates several tasks and reduces human errors, thereby enhancing the production output and quality of vaccine packaging.

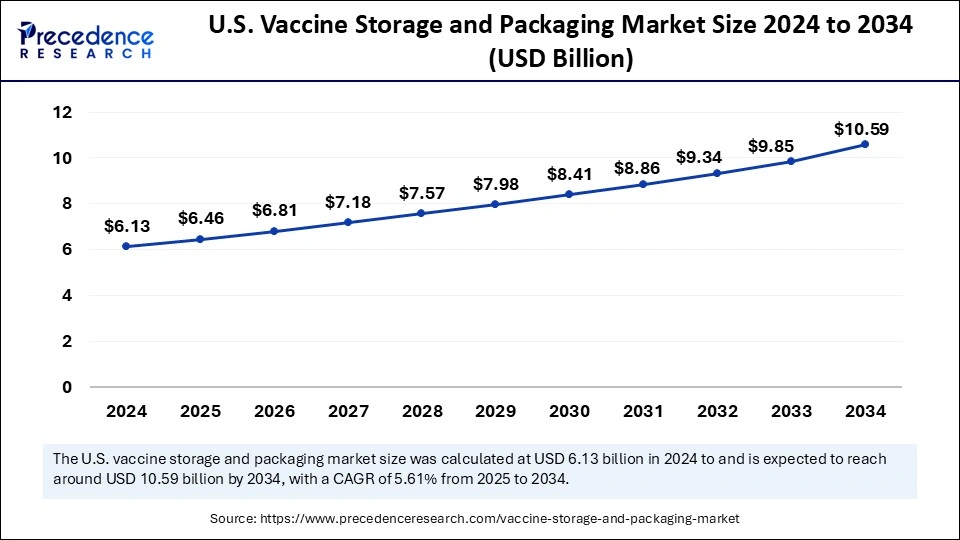

The U.S. vaccine storage and packaging market size was exhibited at USD 6.13 billion in 2024 and is projected to be worth around USD 10.59 billion by 2034, growing at a CAGR of 5.61% from 2025 to 2034.

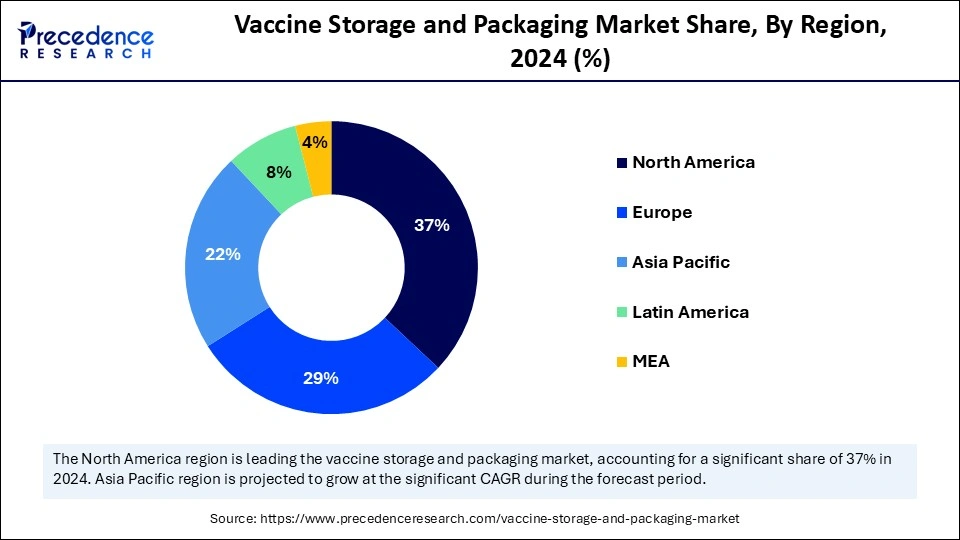

North America dominated the vaccine storage and packaging market by capturing the largest share in 2024. This is mainly due to the region's advanced healthcare systems and unwavering dedication to optimizing public health. Agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada implemented stringent regulations aimed at ensuring the safety and efficacy of vaccines. This boosts the demand for efficient vaccine packaging solutions. These regulations are crucial in ensuring that vaccines are stored and transported under ideal conditions. In Canada, public health agencies are proactive in instituting comprehensive immunization programs and initiatives that significantly bolster the demand for vaccines and associated storage and packaging solutions.

The U.S. is a major contributor to the North American vaccine storage and packaging market. The country boasts well-established pharmaceutical and biotechnology sectors, leading to increased vaccine production. The availability of advanced cold-chain infrastructure ensures the efficient distribution of temperature-sensitive vaccines. Moreover, the country is at the forefront of technological innovations, accelerating the development of advanced vaccine storage solutions.

Europe was the second-largest shareholder in 2024 and is expected to witness the fastest growth in the foreseeable future. This is mainly due to its well-established healthcare and pharmaceutical sectors that facilitate the large-scale production and distribution of vaccines. The European Union (EU) imposed stringent regulations to ensure vaccine safety and efficacy, boosting the demand for high-quality packaging solutions. The European Medicines Agency (EMA) plays an essential role in monitoring and enforcing these standards, ensuring vaccine providers adhere to the highest safety protocols.

Germany emerges as a pivotal player in the European vaccine storage and packaging market. The country has made substantial investments in cold chain logistics and advanced packaging technologies. The country has implemented stringent safety standards regarding pharmaceutical products, supporting market growth.

According to the report published by the WHO in May 2024, Azerbaijan, a country at the boundary of Eastern Europe and West Asia, has recently enhanced its immunization services, supported by the World Health Organization (WHO) and financed by the EU, to strengthen the country’s cold chain system through improved vaccine storage, transportation, handling, and management solutions. This initiative includes the provision of 476 specialized refrigerators and 25 dedicated freezers for vaccines, along with critical spare parts and voltage stabilizers.

Additionally, the initiative entails the distribution of 622 vaccine carriers, 70 insulated cold boxes, and three refrigerated vehicles, each capable of carrying three tonnes, ensuring vaccines are maintained at optimal temperatures during transit to their recipients.

Asia Pacific is considered to be a significantly growing area. The growth of the vaccine storage and packaging market in Asia Pacific is driven by increasing vaccine production. Countries like India and China are emerging as pivotal players in the vaccine manufacturing landscape, largely fueled by proactive government initiatives to enhance public health. Moreover, stringent regulations regarding pharmaceutical safety can influence the market.

Vaccine storage and packaging guarantee the safety and efficient delivery of vaccines from the manufacturing site to the point of administration. This market encompasses products, services, and technologies involved in the safe and efficient storage and handling of vaccines. The rising integration of advanced technologies in vaccine storage units to avert the degradation and potency loss of vaccines due to temperature fluctuations is expected to boost the growth of the market. Effective real-time monitoring of temperatures throughout the storage and transportation cycles is fundamental. There is an increasing use of sensors, data loggers, and sophisticated software to meticulously track temperature deviations, enhancing the safety and efficacy of vaccines.

The rising development of high-quality insulated packaging solutions designed to sustain the required temperature ranges for specific durations, even in challenging environmental conditions, is further supporting market growth. Packaging design must prioritize user-friendliness for both healthcare professionals and logistics personnel, considering factors such as size, weight, and clear labeling. There is also a growing demand for tracking and tracing solutions that not only facilitate the seamless movement of vaccine shipments across the supply chain but also track and monitor vaccine conditions to combat counterfeiting, safeguarding public health.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.39 Billion |

| Market Size in 2025 | USD 23.29 Billion |

| Market Size in 2024 | USD 22.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Packaging Material, End-user and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The persistent threat posed by both endemic and pandemic infectious diseases underscores the urgent need for comprehensive vaccination programs, which drives a heightened demand for efficient storage and packaging solutions. Governments and global health organizations are actively expanding immunization schedules to encompass a broader spectrum of diseases and to ensure that larger populations are reached. This surge in vaccine production mandates the implementation of increasingly sophisticated storage and packaging technologies. The rise of innovative vaccine types, such as mRNA and other biologics sensitive to temperature fluctuations, necessitates establishing advanced cold chain infrastructure to preserve their stability and efficacy throughout the distribution process. Thus, the rising production of vaccines drives the growth of the vaccine storage and packaging market.

Establishing advanced cold chain infrastructure, including temperature-controlled storage facilities, specialized transportation systems, and high-tech packaging technologies, requires substantial initial capital investment. This significant financial barrier can be particularly daunting for smaller companies and those operating in resource-constrained environments. Additionally, maintaining the integrity of the cold chain through multiple stages of transport is complex, restraining the growth of the vaccine storage and packaging market. Delivering vaccines to remote or underserved populations presents significant logistical challenges. This includes navigating diverse terrains, limited transportation options, and inadequate storage facilities at the final distribution points.

The escalating demand for vaccines that necessitate extremely low temperatures presents lucrative opportunities for the innovation of ultra-low temperature (ULT) freezers, specialized transport containers, and sophisticated monitoring systems. Progress in phase change materials (PCMs) for packaging presents the potential for more stable and energy-efficient temperature management during transportation. Moreover, developing packaging solutions equipped with built-in sensors to track temperature and humidity levels can enhance quality control throughout the supply chain. The increasing attention to environmental sustainability is driving demand for eco-friendly packaging alternatives, prompting innovations that minimize material usage and can lead to significant cost savings while reducing environmental footprint.

The vaccine packaging segment dominated the vaccine storage and packaging market with the largest share in 2024. The significance of vaccine packaging is underscored by its critical role in safeguarding the integrity of vaccines. Effective packaging solutions must ensure a sterile environment, uphold required temperature controls, and protect the contents from light and moisture. Innovations such as prefilled syringes and multi-dose vials represent advanced packaging technologies that enhance the delivery of vaccines, ensuring they reach end-users safely and effectively.

The vaccine storage segment is anticipated to grow at a remarkable CAGR during the forecast period. While packaging ensures the vaccines are protected during distribution, efficient storage solutions, including refrigeration and freezing systems, are essential for maintaining the conditions dictated by the packaging. Vaccine storage solutions like refrigeration preserve vaccine quality from the time the vaccine is manufactured until it is administered. These solutions prevent the spoilage of vaccines by keeping them under optimal conditions.

The plastic segment held the largest share of the vaccine storage and packaging market in 2024. One of the primary advantages of plastic is its lightweight nature compared to glass, which facilitates easier and more cost-effective transportation, particularly when handling large quantities of products. Additionally, plastic's inherent durability contributes to its low breakage rates during handling and distribution, thereby minimizing potential risks of contamination and ensuring the successful preservation of vaccines.

On the other hand, the glass segment is projected to witness the fastest growth during the projection period. Glass remains an indispensable material for specific vaccine formulations that require long-term stability or exceptional chemical resistance. Glass is particularly esteemed for its inert and non-reactive characteristics, making it vital for packaging vaccines and other healthcare products that require sterile and optimal packaging conditions.

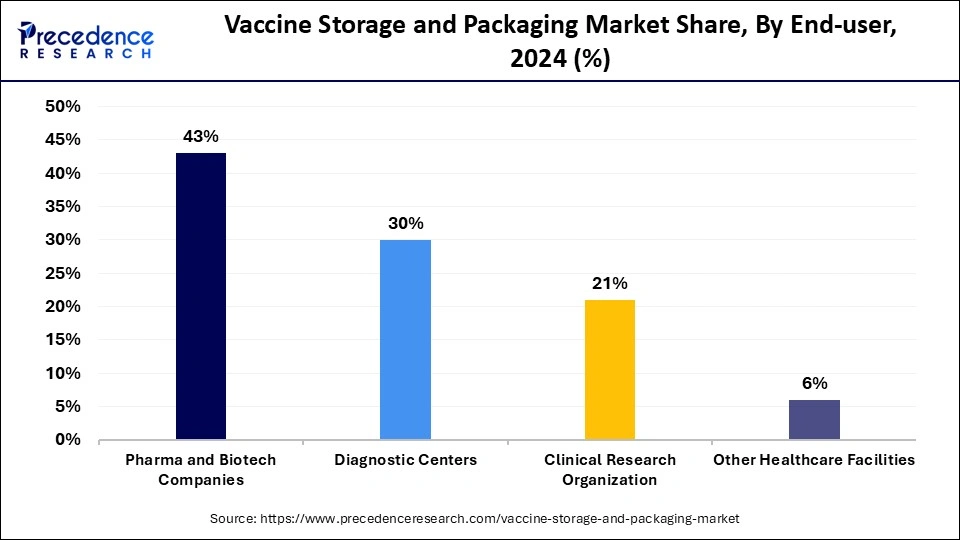

The pharmaceutical and biotech companies held the dominant share of the vaccine storage and packaging market in 2024. These companies are the foremost developers and manufacturers of vaccines. They often engage in research activities to develop and manufacture innovative vaccine formulations. Since these companies have strongly emphasized developing novel vaccines, they often demand innovative vaccine storage and packaging solutions, contributing to segmental growth.

The diagnostic centers segment is expected to grow rapidly in the coming years. While pharmaceutical and biotech companies primarily focus on vaccine production, diagnostic centers are crucial for administering and distributing vaccines. They conduct essential tests and screenings related to diseases preventable by vaccines and often serve as key vaccination sites for the public. Since these centers heavily use vaccines in diagnostic procedures, they require reliable vaccine storage solutions.

By Product Type

By Packaging Material

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

October 2024

September 2023