January 2025

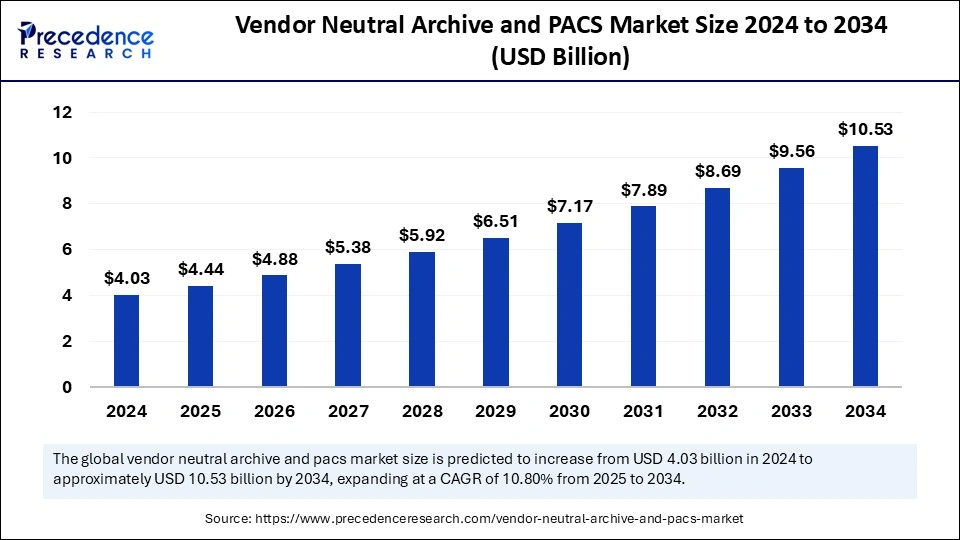

The global vendor neutral archive and pacs market size is calculated at USD 4.44 billion in 2025 and is forecasted to reach around USD 10.53 billion by 2034, accelerating at a CAGR of 10.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vendor neutral archive and pacs market size accounted for USD 4.03 billion in 2024 and is predicted to increase from USD 4.44 billion in 2025 to approximately USD 10.53 billion by 2034, expanding at a CAGR of 10.80% from 2025 to 2034. The growth of the vendor neutral archive and PACS market is driven by the growing amount of medical imaging data and the rapid transition toward digital imaging, generating a need for effective data management solutions. The high adoption of telemedicine and remote diagnostics underscores the necessity for accessible and shareable imaging data, supporting market growth.

Artificial Intelligence can transform the vendor neutral archive and PACS market by improving medical image management, analysis, workflow automation, and diagnostic precision. Integrating AI within VNA and PACS solutions greatly enhances data accessibility, interoperability, and decision-making within the healthcare industry. AI-powered automation assists radiologists and healthcare professionals in streamlining image retrieval, classification, and anomaly detection, which leads to quicker diagnosis, enhanced patient outcomes, and decreased workload for radiologists. Integrating AI in VNA and PACS enhances image recognition and analysis.

Deep learning algorithms can examine extensive datasets of medical images to identify patterns, anomalies, and possible illnesses more rapidly and accurately than traditional techniques. AI-empowered PACS systems support radiologists by highlighting suspicious regions within scans, identifying abnormalities in X-rays, MRIs, and CT scans, and generating automated preliminary reports, which reduces diagnostic mistakes and increases radiology efficiency.

AI is also vital in intelligent workflow automation, improving image indexing, retrieval, and reporting functions within VNA and PACS systems. Automation driven by AI facilitates smart categorization of medical images, ensuring relevant scans are readily searchable and accessible across various hospital departments. This heightened efficiency minimizes redundant imaging, decreases diagnosis delays, and boosts operational efficiency within hospitals.

Predictive analytics and clinical decision support are other significant aspects of AI integration in the VNA and PACS. AI-driven PACS can evaluate past imaging data, patient records, and diagnostic reports to forecast disease progression and recommend personalized treatment strategies. This functionality is especially beneficial in fields like oncology, cardiology, and neurology, where early detection and prompt intervention are crucial.

Additionally, AI is advancing interoperability and data standardization in VNA systems by enabling automated metadata tagging, real-time image synchronization, and smooth integration with electronic health records. By employing machine learning algorithms, VNA platforms can standardize DICOM (Digital Imaging and Communications in Medicine) and non-DICOM data, ensuring universal accessibility across healthcare networks and imaging devices.

The vendor neutral archive (VNA) and picture archiving and communication system (PACS) are essential elements in the healthcare industry, facilitating the storage, retrieval, and management of medical images and related data. PACS is a centralized hub for storing and accessing imaging data from various modalities, including X-rays, MRIs, and CT scans, promoting efficient workflows and enhancing patient care. In contrast, VNA represents a more sophisticated solution that provides a vendor-neutral repository for medical images, enabling healthcare providers to integrate and manage imaging data from multiple PACS systems and additional sources. This interoperability guarantees seamless access to patient information across various departments and healthcare facilities, bolstering clinical decision-making and operational efficiency.

The vendor neutral archive and PACS market is witnessing rapid growth due to the growing volume of medical imaging data and the requirement for effective data management solutions. The shift from analog to digital imaging has notably enhanced diagnostic capabilities, yet it has also introduced data storage, retrieval, and interoperability challenges. VNA confronts these challenges by offering a unified platform that integrates various imaging systems and ensures long-term data accessibility. Furthermore, the increase in telemedicine and remote diagnostics has highlighted the necessity for imaging data that is both accessible and shareable. Cloud computing and cybersecurity innovations are further improving the functionality and security of VNA and PACS solutions, rendering them more scalable and resilient.

The transition to digital imaging is boosting the need for effective data management solutions, making VNA and PACS crucial. The need for interoperability and seamless data integration across different healthcare systems and facilities is propelling the usage of VNA. Moreover, advancements in cloud computing and cybersecurity are increasing the scalability, accessibility, and security of VNA and PACS solutions. The growth of telemedicine and remote diagnostics emphasizes the significance of accessing and sharing imaging data, further promoting the market for these technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.53 Billion |

| Market Size in 2025 | USD 4.44 Billion |

| Market Size in 2024 | USD 4.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Imaging Modality, End-user, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Use of Digital Imaging and Electronic Health Records

A significant factor driving the growth of the vendor neutral archive and PACS market is the swift adoption of digital imaging technologies and the incorporation of electronic health records in healthcare settings. As hospitals, diagnostic centers, and clinics transition to paperless operation, the demand for efficient, scalable, and centralized image storage solutions considerably rises. Previously, medical imaging data was stored in isolated, vendor-specific PACS systems, resulting in data silos and inefficiencies in coordinating patient care. With the increasing shift toward seamless data sharing, healthcare organizations are embracing VNA solutions that facilitate cross-platform compatibility, centralized storage, and real-time access to imaging data.

The enforcement of EHR mandates by governments and regulatory bodies, such as the Health Information Technology for Economic and Clinical Health Act in the U.S., further accelerates the adoption of PACS and VNA solutions in medical facilities. Additionally, the increasing volume of medical imaging procedures due to the rise in chronic diseases, aging populations, and advancements in imaging technologies lead to a surge in the need for effective image management solutions. Medical professionals, including radiologists, oncologists, and cardiologists, require prompt access to high-quality images for accurate diagnosis and treatment planning. VNA and PACS solutions are vital elements of contemporary healthcare workflows.

Significant Initial Investment and Complicated Implementation Process

Despite the advantages of VNA and PACS solutions, a primary constraint hindering the growth of the vendor neutral archive and PACS market is the substantial initial investment and complexity involved in their implementation. The deployment of enterprise-wide VNA systems necessitates substantial capital outlay for software, hardware, cloud storage, cybersecurity, and IT infrastructure. Moreover, integrating VNA with current hospital systems, EHRs, and legacy PACS solutions can be technically demanding and protracted. Healthcare facilities, particularly smaller and mid-sized hospitals or diagnostic centers, frequently encounter budget limitations that restrict their capacity to invest in premium VNA and PACS solutions. The requirement for IT expertise, data migration services, and adherence to stringent regulatory standards further complicates and increases the cost of implementation.

Another hindrance is the concerns about data security and privacy associated with cloud-based PACS and VNA systems. Medical imaging data is highly confidential, and healthcare organizations must ensure compliance with the Health Insurance Portability and Accountability Act, General Data Protection Regulation, and other regulatory mandates when adopting cloud-based storage solutions. These concerns impede cloud adoption, prompting some institutions to continue using on-premises PACS, thereby constraining market growth.

AI-Enabled Image Analysis and Cloud-Based PACS & VNA Solutions

A significant opportunity for the growth of the vendor neutral archive and PACS market resides in the incorporation of AI and cloud-based imaging solutions. AI-driven image recognition, anomaly detection, and predictive analytics revolutionize how radiologists and healthcare professionals analyze medical images. AI algorithms built into PACS platforms can autonomously identify tumors, fractures, or other irregularities in CT scans, MRIs, and X-rays, aiding radiologists in achieving quicker and more precise diagnoses. In addition, AI-driven automation in image indexing, retrieval, and classification improves workflow efficiency, lightening the burdens on healthcare professionals and reducing human errors in interpreting imaging results.

Cloud-based VNA and PACS solutions are becoming increasingly popular due to their scalability, remote access, and cost benefits. Cloud-based platforms allow healthcare providers to store, access, and share medical images effortlessly across various locations, making them perfect for telemedicine, teleradiology, and multi-site hospital networks.

The transition toward cloud-based VNA solutions also bolsters disaster recovery, business continuity, and AI-enabled analytics, facilitating real-time decision-making and enhancing patient care. As healthcare organizations continue to emphasize digital transformation, AI-integrated and cloud-based PACS & VNA solutions are projected to offer substantial growth opportunities in the upcoming years.

The computed tomography segment dominated the vendor neutral archive and PACS market with the largest share in 2024. This is mainly due to the rise in the usage of computed tomography (CT) scans in diagnosing diseases, assessing trauma, and planning treatment. CT imaging is an essential resource in radiology, as it delivers detailed cross-sectional images of internal organs, bones, and tissues, allowing for the early identification of medical conditions such as cancer, cardiovascular diseases, neurological issues, and musculoskeletal injuries.

The global surge in the prevalence of chronic illnesses has resulted in a higher demand for CT imaging, which has driven the necessity for efficient management of the increasing volume of medical images via robust PACS and VNA solutions. Progressions in high-resolution, multi-slice CT scanners have also broadened the application of CT imaging in cardiology, oncology, and emergency medicine. With AI-enhanced image quality and automated reporting systems, healthcare providers can now process, analyze, and store CT images more rapidly and accurately, decreasing diagnostic errors and improving workflow efficiency. As hospitals and imaging centers modernize their radiology infrastructure, the demand for advanced PACS and VNA solutions catering to CT imaging is anticipated to remain high.

The magnetic resonance imaging segment is expected to grow at the fastest rate during the forecast period. The growth is attributed to the increasing use of magnetic resonance imaging (MRI) in neurology, orthopedics, and oncology. MRI provides superior contrast for soft tissues compared to CT and X-rays, making it the preferred choice for analyzing the brain and spinal cord, assessing joints, and detecting tumors. The rising incidence of neurological disorders, musculoskeletal injuries, and cancer has spurred the need for MRI diagnostics, leading to a greater uptake of PACS and VNA systems specifically designed for managing MRI data. Moreover, innovations in 3T and 7T MRI technology, functional MRI (fMRI), and AI-enhanced imaging interpretation have significantly improved diagnostic accuracy and efficiency, further propelling the segment growth.

The hospitals segment held the largest share of the vendor neutral archive and PACS market in 2024 due to the high frequency of imaging procedures conducted in hospital environments. Hospitals demand effective systems for image storage, retrieval, and sharing to enhance radiology workflows, better coordinate patient care, and meet regulatory standards. With the integration of PACS and VNA solutions, hospitals can eliminate data silos, promote interoperability among departments, and provide physicians with immediate access to imaging information. The growing utilization of AI-assisted diagnostics, digital pathology, and enterprise imaging solutions has further boosted the demand for scalable, cloud-based VNA platforms that facilitate seamless data exchange across various healthcare IT systems, including electronic health records.

The diagnostic imaging centers segment is anticipated to witness the fastest growth over the projection period as independent imaging centers, outpatient diagnostic facilities, and specialty radiology clinics increasingly implement cloud-based PACS and VNA solutions. The rise in outpatient healthcare services and telemedicine has driven the demand for diagnostic imaging centers to provide remote access to medical images. Cloud-based PACS and VNA solutions empower radiologists and referring physicians to securely access, evaluate, and share imaging data from any location, thereby enhancing patient outcomes and shortening wait times for diagnostic results. Furthermore, AI-powered imaging solutions within diagnostic centers are revolutionizing radiology workflows by automating image analysis, identifying anomalies in scans, and creating real-time diagnostic reports. This innovation not only boosts radiologist productivity but also enhances diagnostic precision and reduces operating expenses.

North American Vendor neutral archive and PACS market Trends

North America dominated the market with the largest share in 2024. This is mainly due to the high embrace of digital healthcare infrastructure, robust regulatory requirements, and increasing investment in AI-driven imaging technologies. The region also boasts a well-established healthcare system. The increased volume of medical imaging procedures resulted in a heightened demand for sophisticated image storage, management, and interoperability solutions.

The significant presence of leading healthcare IT firms such as GE Healthcare, IBM Watson Health, and Change Healthcare has further solidified the region’s dominance in the vendor neutral archive & PACS market. Government regulations, including HIPAA (Health Insurance Portability and Accountability Act) and the HITECH Act (Health Information Technology for Economic and Clinical Health), have prompted hospitals and imaging centers to adopt PACS and VNA systems that comply with data security and interoperability standards. Additionally, the increased prevalence of chronic diseases, an aging population, and the proliferation of AI-powered diagnostic tools have further bolstered regional market growth.

United States

The U.S. holds the largest portion of the North American vendor neutral archive & PACS market. The widespread implementation of cutting-edge medical imaging technologies and governmental initiatives aimed at modernizing healthcare infrastructure support market growth in the U.S. The nation is experiencing a significant rise in the adoption of PACS solutions, facilitating automated image analysis, early disease identification, and streamlined radiology workflows. The swift growth of cloud-based healthcare solutions has further increased the need for scalable VNA platforms, enabling healthcare providers to access and manage medical images remotely. Prominent healthcare institutions such as the Mayo Clinic, Cleveland Clinic, and Johns Hopkins Hospital have adopted AI-driven PACS systems to enhance diagnostic efficiency and shorten imaging turnaround times.

Canada

Canada plays a crucial role in the vendor neutral archive & PACS market, driven by the expansion of telehealth services, governmental investments in digital healthcare transformation, and a rising acceptance of cloud-based imaging solutions. The Canadian healthcare system is rapidly incorporating interoperable VNA platforms, allowing for seamless image-sharing among hospitals and diagnostic facilities. Initiatives like Canada Health Infoway, which focus on enhancing healthcare interoperability and data standardization, have spurred the demand for innovative PACS and VNA solutions.

Asia Pacific Vendor neutral archive and PACS market Trends

Asia Pacific is the fastest-growing region in the market, driven by the swift digital transformation in healthcare, increased volumes of medical imaging, and rising governmental investments in healthcare IT infrastructure. The escalating use of AI-driven imaging analytics, cloud-based PACS systems, and smart hospital projects has intensified the need for vendor-neutral imaging storage systems throughout the region. The increasing prevalence of chronic diseases, a growing aging population, and the demand for earlier disease detection further expedite the adoption of advanced medical imaging technologies. Governments in nations such as China, Japan, and India are substantially investing in modernizing healthcare facilities by integrating VNA and PACS solutions to ensure seamless access to imaging data across various healthcare institutions.

China

China is expected to lead the Asia Pacific vendor neutral archive & PACS market. This is mainly due to government efforts to digitize healthcare, heightened AI utilization in medical imaging, and the expansion of hospital networks. The Healthy China 2030 initiative launched by the Chinese government has accelerated funding for digital healthcare transformation, resulting in the widespread deployment of AI-driven PACS and cloud-based VNA systems. Furthermore, China's growing inclination toward telemedicine and AI-enhanced diagnostics is compelling healthcare providers to implement remote-access imaging solutions, allowing radiologists to analyze and interpret scans from any location.

Japan

Japan is witnessing a rapid adoption of VNA and PACS solutions, spurred by its sophisticated healthcare system, high volumes of imaging procedures, and substantial government backing for AI-driven medical imaging. The aging demographic in Japan has led to a heightened demand for effective imaging storage and management systems, especially in oncology, neurology, and cardiology.

The Ministry of Health, Labour and Welfare in Japan has been advocating for the adoption of AI and cloud-based PACS solutions to enhance radiology workflows, mitigate diagnostic errors, and improve patient care efficiency. Additionally, Japan's leadership in robotic surgery and AI-assisted diagnostics results in an increased demand for AI-driven imaging platforms, further promoting market growth.

European Vendor neutral archive and PACS market Trends

Europe is considered to be a significantly growing area. Stringent data protection laws, a rise in the adoption of cloud-based imaging technologies, and a growing demand for AI-enhanced radiology processes are likely to support the European market. The increasing frequency of imaging procedures and government initiatives for healthcare digitization are spurring the deployment of sophisticated PACS and VNA systems in hospitals and diagnostic facilities throughout the region.

Regulatory frameworks such as the General Data Protection Regulation and the EU Medical Device Regulation mandate that healthcare organizations maintain secure and interoperable storage for medical data, fostering the uptake of VNA solutions. Additionally, the heightened emphasis on cross-border healthcare data exchange and the rise in telemedicine have intensified the demand for cloud-based PACS and AI-supported diagnostic imaging systems.

Germany

Germany stands out as one of the foremost markets for VNA & PACS in Europe due to its advanced healthcare infrastructure, growing integration of AI in radiology, and a strong commitment to patient data protection. Hospitals and imaging facilities in Germany are channeling investments into AI-enhanced PACS solutions to improve diagnostic accuracy, optimize workflows, and decrease imaging processing times. The nation's dedication to telehealth and inter-hospital imaging data sharing has increased the need for cloud-based VNA solutions, which provide secure and scalable medical image storage.

United Kingdom

The UK is swiftly embracing VNA and PACS technologies, propelled by the national health service’s initiative for digital modernization, a rise in the volume of imaging procedures, and advancements in AI-powered radiology. The NHS has actively encouraged the adoption of cloud-based VNA solutions to enable image sharing among healthcare providers, which minimizes duplicate scans and enhances the efficiency of patient care. The integration of AI within PACS systems has gained traction in the UK, as radiologists utilize machine learning techniques to identify diseases in medical images with greater precision. Furthermore, the UK's robust telemedicine framework and focus on early disease detection stimulate the adoption of AI-enhanced diagnostic imaging technologies.

By Imaging Modality

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025