December 2024

The global veterinary pharmacovigilance market size accounted for USD 986.84 million in 2024, grew to USD 1,109.21 million in 2025 and is projected to surpass around USD 3,176.21 million by 2034, representing a healthy CAGR of 12.40% between 2024 and 2034. The North America veterinary pharmacovigilance market size is worth around USD 414.47 million in 2024 and is expected to grow at a fastest CAGR of 12.53% during the forecast period.

The global veterinary pharmacovigilance market size is calculated at USD 986.84 million in 2024 and it is projected to hit around USD 3,176.21 million by 2034, growing at a CAGR of 12.40% from 2024 to 2034.

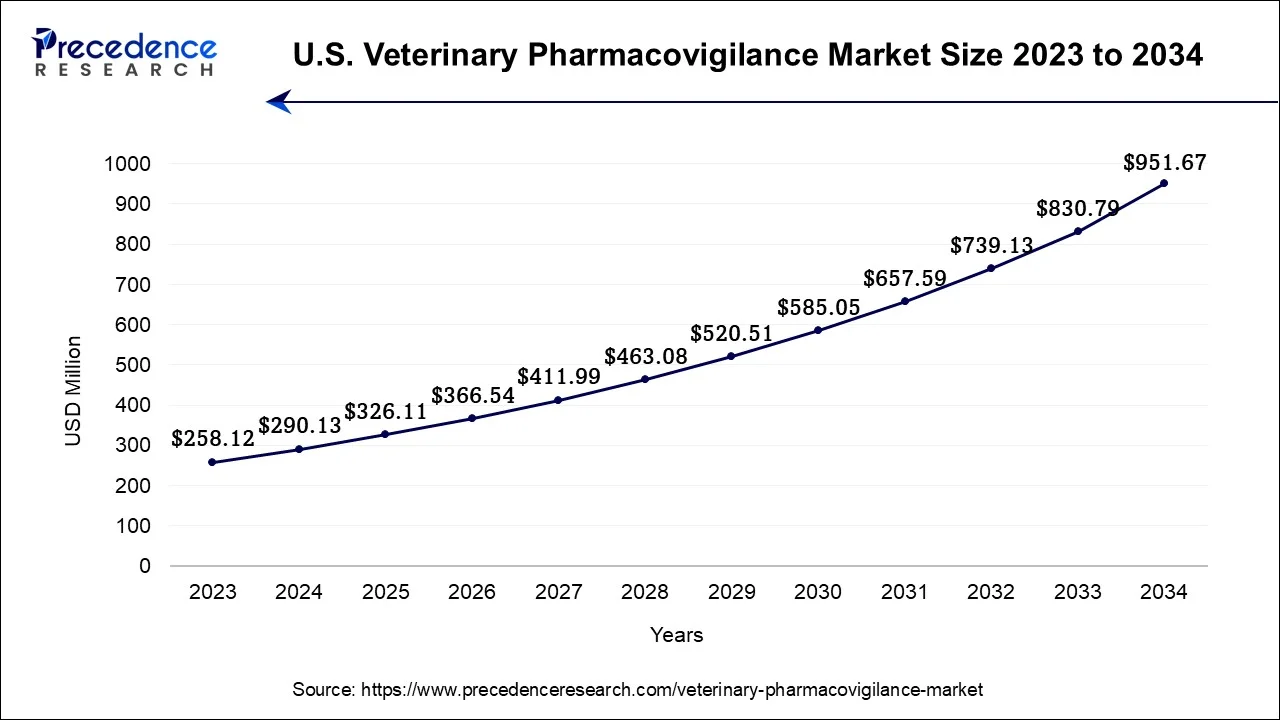

The U.S. veterinary pharmacovigilance market size was exhibited at USD 290.13 million in 2024 and is estimated to reach around USD 951.67 million by 2034, expanding at a CAGR of 12.61% from 2024 to 2034.

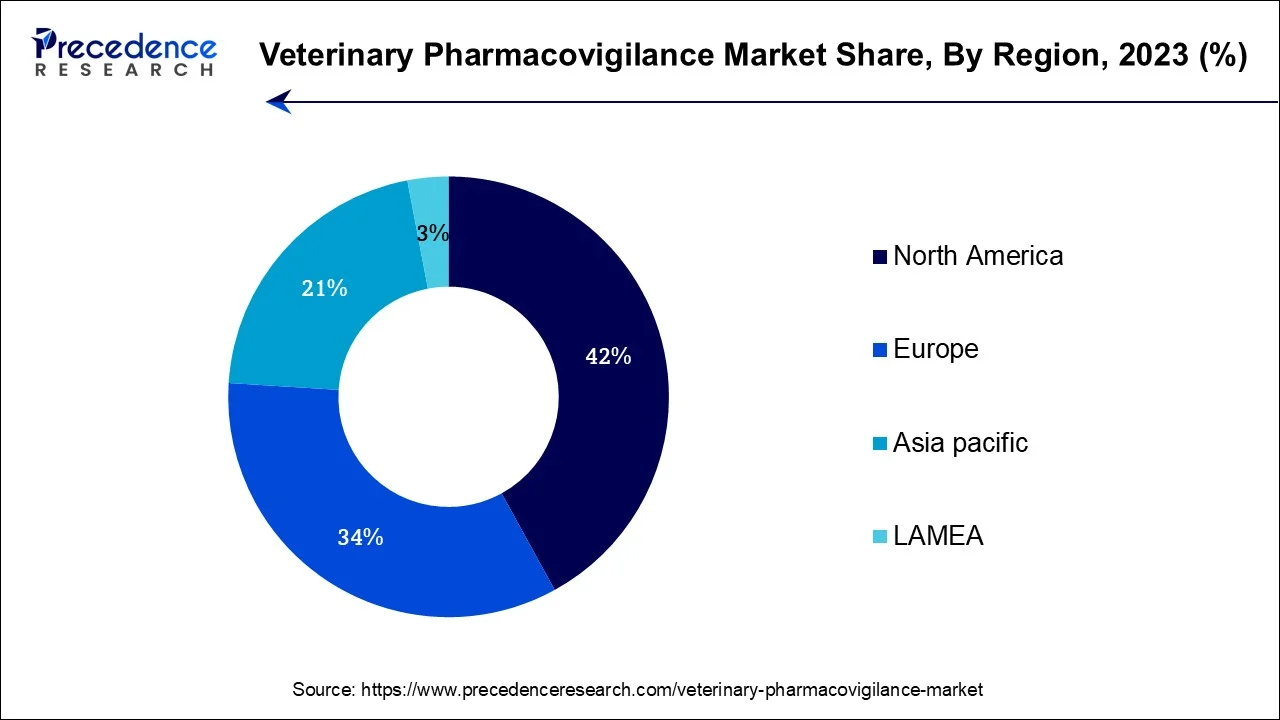

North America has held the largest revenue share 42% in 2023. In North America, the veterinary pharmacovigilance market is witnessing notable trends. Stringent regulatory frameworks imposed by organizations like the FDA in the United States are shaping the industry. There's a growing emphasis on real-time monitoring and data analytics for enhanced drug safety. Additionally, the region is witnessing increased collaboration among key stakeholders, including pharmaceutical companies, regulatory bodies, and veterinary professionals, to ensure compliance and improve pharmacovigilance practices. The expanding adoption of telemedicine and digital health solutions for remote monitoring of animal health is also a significant trend, reflecting the region's technological advancements in the field.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the veterinary pharmacovigilance market is experiencing notable trends. Increased pet ownership and a growing awareness of animal health have fueled the demand for veterinary pharmaceuticals and pharmacovigilance services. Furthermore, the expansion of the livestock industry, especially in emerging economies, has led to stringent regulations, driving the need for safety monitoring. Asia-Pacific is witnessing a shift towards advanced pharmacovigilance technologies and a focus on harmonizing standards. As the region continues to urbanize and modernize its animal healthcare practices, the veterinary pharmacovigilance market in Asia-Pacific is poised for significant growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 3,176.21 Million |

| Market Size in 2024 | USD 986.84 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.40% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution, Product, By Type, Animal Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The upswing in pet ownership notably influences the veterinary pharmacovigilance market demand. With an increasing number of people considering their pets as cherished family members, there is a heightened emphasis on the safety and welfare of these animals. Pet owners are progressively seeking secure and efficient pharmaceutical solutions for their beloved companions. This escalating demand underscores the necessity for rigorous monitoring and evaluation of these medications, making veterinary pharmacovigilance a vital component of ensuring pet health and safety. This elevated awareness of pet health and safety propels the veterinary pharmacovigilance market, ensuring that the drugs administered to pets are rigorously evaluated for adverse effects and efficacy.

Moreover, Livestock Health Concerns significantly boost demand for the veterinary pharmacovigilance market. Given the pivotal role of the livestock industry in global food production, prioritizing the welfare of these animals is of utmost importance. Pharmacovigilance is indispensable in overseeing and ensuring the safety and efficacy of medications employed in agriculture. Rising concerns about disease outbreaks, antibiotic resistance, and food safety underscore the necessity for rigorous oversight. This heightened focus on livestock health drives the need for comprehensive pharmacovigilance services, making it a critical component of animal agriculture and a key market driver.

The complex Regulatory Landscape poses a significant restraint on the demand for the veterinary pharmacovigilance market. Navigating intricate and varied veterinary drug regulations across different regions demands substantial resources and expertise. Compliance challenges, coupled with the need for tailored reporting processes, can lead to increased operational costs and complexity for businesses. This regulatory maze may deter market entry for some, limiting market growth and creating barriers to the effective monitoring and assessment of veterinary pharmaceuticals across global markets.

Moreover, the scarcity of skilled professionals poses a significant constraint on the veterinary pharmacovigilance market. With a limited pool of experts proficient in monitoring and assessing adverse drug reactions in animals, the industry faces challenges in ensuring comprehensive pharmacovigilance services. This shortage can lead to delays in reporting and addressing safety concerns, potentially compromising animal health and public safety. To meet the increasing demand for these services and maintain the market's growth trajectory, addressing the skills gap through education and training initiatives is imperative.

Technological advancements are catalyzing demand for the veterinary pharmacovigilance market by enhancing efficiency and accuracy. Integration of AI, machine learning, and data analytics streamlines adverse event monitoring, enabling quicker identification of drug-related issues. Automation and real-time data analysis facilitate rapid responses to safety concerns, bolstering consumer and regulatory confidence. These innovations not only improve animal health but also reduce operational costs for pharmaceutical companies. Consequently, the veterinary pharmacovigilance market experiences heightened demand as technology-driven solutions proves essential for ensuring drug safety in the evolving veterinary pharmaceutical landscape.

Moreover, Public awareness regarding the safety of veterinary pharmaceuticals has surged, driving increased demand for the Veterinary Pharmacovigilance Market. As pet owners and consumers become more informed about the potential risks associated with animal medications, they seek reassurance through vigilant monitoring and evaluation. This heightened awareness prompts regulatory bodies and industry players to prioritize drug safety, resulting in a growing market for pharmacovigilance services. The desire to safeguard animal health and protect public trust in veterinary pharmaceuticals amplifies the importance of comprehensive pharmacovigilance, thereby fueling market demand.

The Anti-infectives segment has held 47.2% revenue share in 2023. Anti-infectives in the veterinary pharmacovigilance market refer to pharmaceutical products designed to combat and prevent infectious diseases in animals. These drugs include antibiotics, antivirals, and antifungals, among others. A significant trend in this sector involves heightened scrutiny of antibiotic usage, driven by growing concerns surrounding antimicrobial resistance. Regulatory bodies are imposing stricter controls on antibiotic prescriptions in animal health, necessitating more robust pharmacovigilance to monitor their responsible use. Additionally, the development of novel anti-infectives and vaccines for emerging animal diseases reflects the evolving landscape of veterinary pharmacovigilance in addressing infectious threats.

The Biologics segment is anticipated to expand at a significantly CAGR of 15.8% during the projected period. Anti These products derived from living organisms or their components, such as vaccines, monoclonal antibodies, and cell-based therapies. Recent trends in the market indicate a growing interest in biology for animal health. This includes the development and usage of innovative biologic products to address various diseases in pets and livestock. With increasing regulatory scrutiny, pharmacovigilance for biologics is becoming more crucial, necessitating rigorous monitoring and assessment to ensure their safety and efficacy in veterinary medicine. The market is witnessing a shift towards advanced pharmacovigilance strategies to address the unique challenges posed by biologics, promising a vibrant future for this sector.

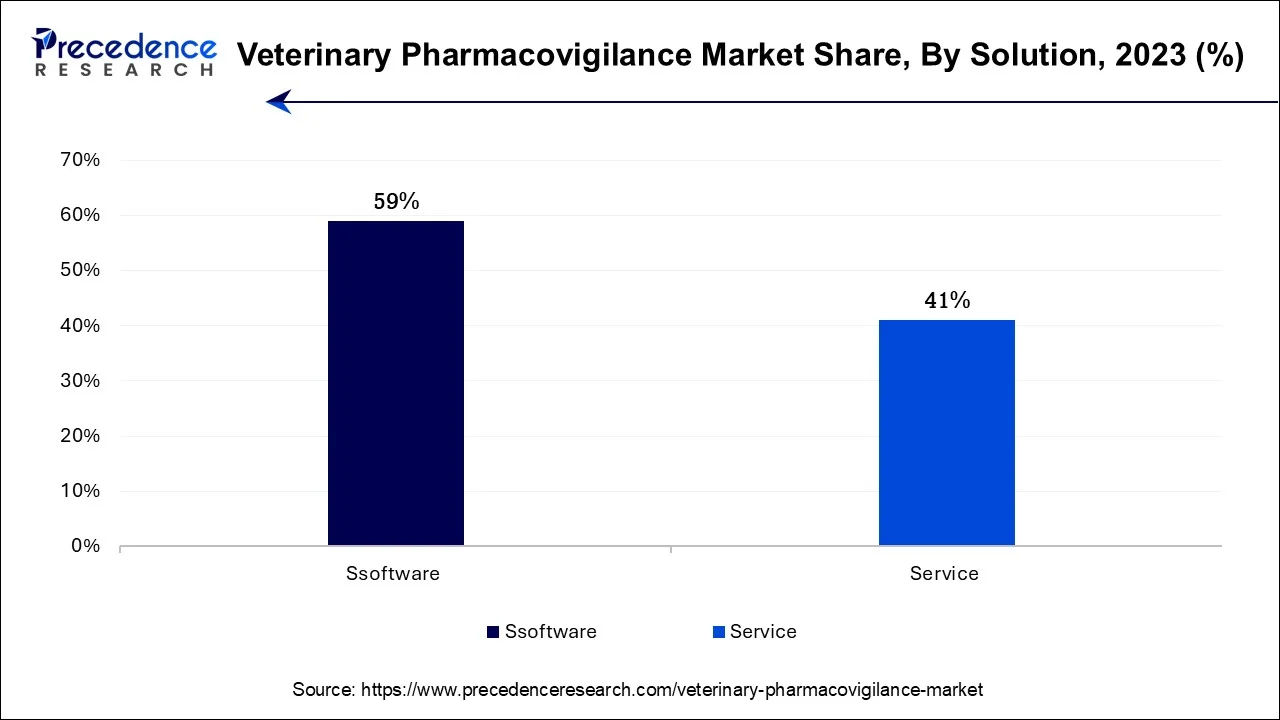

The software segment is anticipated to hold the largest market share of 59% in 2023. In the veterinary pharmacovigilance market, software solutions are dedicated applications created to enhance the monitoring and handling of adverse drug reactions and safety information linked to veterinary pharmaceuticals. These software applications simplify the processes of data collection, analysis, and reporting, ultimately boosting the efficiency and precision of pharmacovigilance operations. Recent trends in this market include the integration of artificial intelligence and machine learning, enabling predictive analytics for the early identification of safety concerns. Additionally, cloud-based solutions are gaining prominence, allowing real-time data access and collaboration among stakeholders, enhancing the overall effectiveness of veterinary pharmacovigilance efforts.

The service segment is projected to grow at the fastest rate over the projected period. In the veterinary pharmacovigilance market, "services" refer to the comprehensive offerings provided for the surveillance and monitoring of veterinary pharmaceuticals. Veterinary pharmacovigilance services encompass the collection, assessment, and management of data pertaining to adverse drug reactions in animals.

Recent trends in these services involve the incorporation of cutting-edge technologies like artificial intelligence and data analytics to enhance monitoring efficiency and accuracy. Furthermore, there is an increasing focus on aligning international standards and regulations within this sector. The rising demand for real-time monitoring and the broadening of service portfolios to encompass a wider variety of animal species are also prominent trends, mirroring the evolving landscape of animal healthcare and pharmaceutical safety.

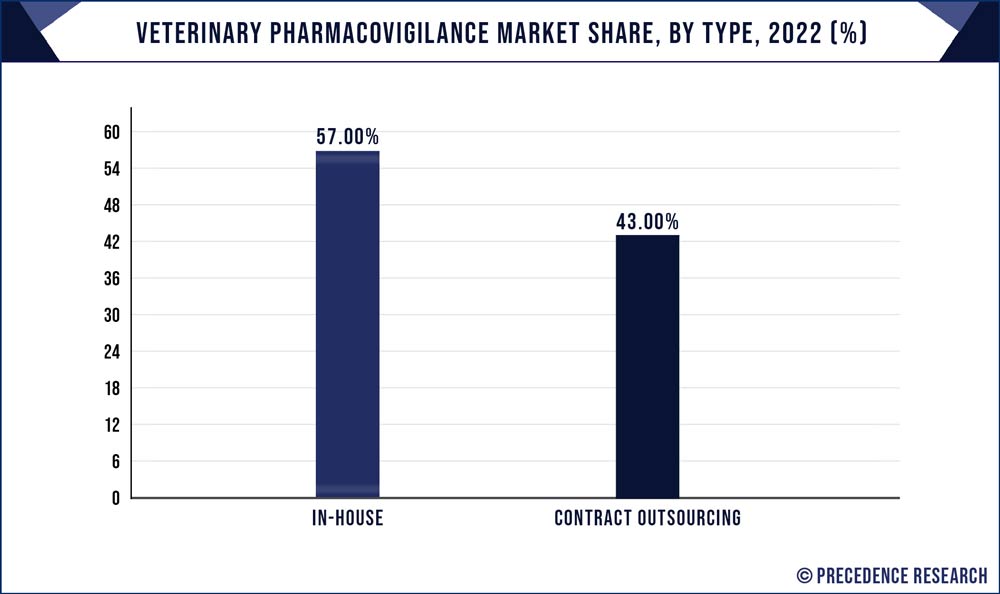

The in-house segment had the highest market share of 57% in 2023. In the veterinary pharmacovigilance market, "In-house" refers to pharmacovigilance activities that are conducted internally by pharmaceutical companies or animal health organizations. These entities handle the entire pharmacovigilance process, from data collection to adverse event reporting and regulatory compliance.

Recent trends in in-house veterinary pharmacovigilance include increased investment in digitalization and data management systems to streamline operations. Companies are also prioritizing training and development of in-house pharmacovigilance teams to enhance expertise. The growing complexity of veterinary pharmaceuticals is driving the need for specialized in-house teams to ensure the safety of their products and maintain compliance with evolving regulations.

Contract outsourcing is anticipated to expand at the fastest rate over the projected period. Contract outsourcing in the veterinary pharmacovigilance market refers to the practice of delegating pharmacovigilance responsibilities to third-party service providers. These outsourcing firms handle data collection, analysis, and regulatory compliance on behalf of pharmaceutical companies and veterinarians. Recent trends indicate a growing reliance on contract outsourcing as it offers cost-effective solutions and access to specialized expertise. Veterinary pharmacovigilance outsourcing providers are increasingly adopting digital tools and data-driven strategies to streamline processes. This trend aligns with the broader industry shift towards data-centric approaches and demonstrates the market's responsiveness to evolving needs and challenges in drug safety monitoring.

The Dog segment held the largest revenue share of 54.5% in 2023. In the veterinary pharmacovigilance market, the category of "dog" specifically pertains to pharmacovigilance services focused on canines. Recent trends in this segment involve heightened awareness and concern among dog owners regarding the safety of pharmaceuticals. This has resulted in increased demand for monitoring services tailored to canine health. Moreover, the development of specialized medications for dogs has expanded the need for vigilant surveillance. As a result, the veterinary pharmacovigilance market is witnessing a growing emphasis on canine-specific drug safety assessment and reporting, addressing the unique requirements of dog healthcare.

The cat segment is anticipated to grow at a significantly faster rate, registering a CAGR of 14.6% over the predicted period. In the veterinary pharmacovigilance market, "cat" specifically pertains to the monitoring and safety assessment of pharmaceuticals administered to feline companions. Recent trends in this niche include a heightened emphasis on cat-specific drug safety data, reflecting the growing population of pet cats. The development of specialized medications and vaccines for cats has also increased, necessitating vigilant pharmacovigilance. Additionally, there's a trend towards personalized medicine for cats, aligning with the broader movement in veterinary medicine, where precise monitoring and safety measures are tailored to individual animal needs, contributing to the evolving landscape of feline healthcare and pharmaceutical safety.

Segments Covered in the Report

By Solution

By Product

By Type

By Animal Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

August 2024

November 2024