Wellness Apps Market Size and Forecast 2025 to 2034

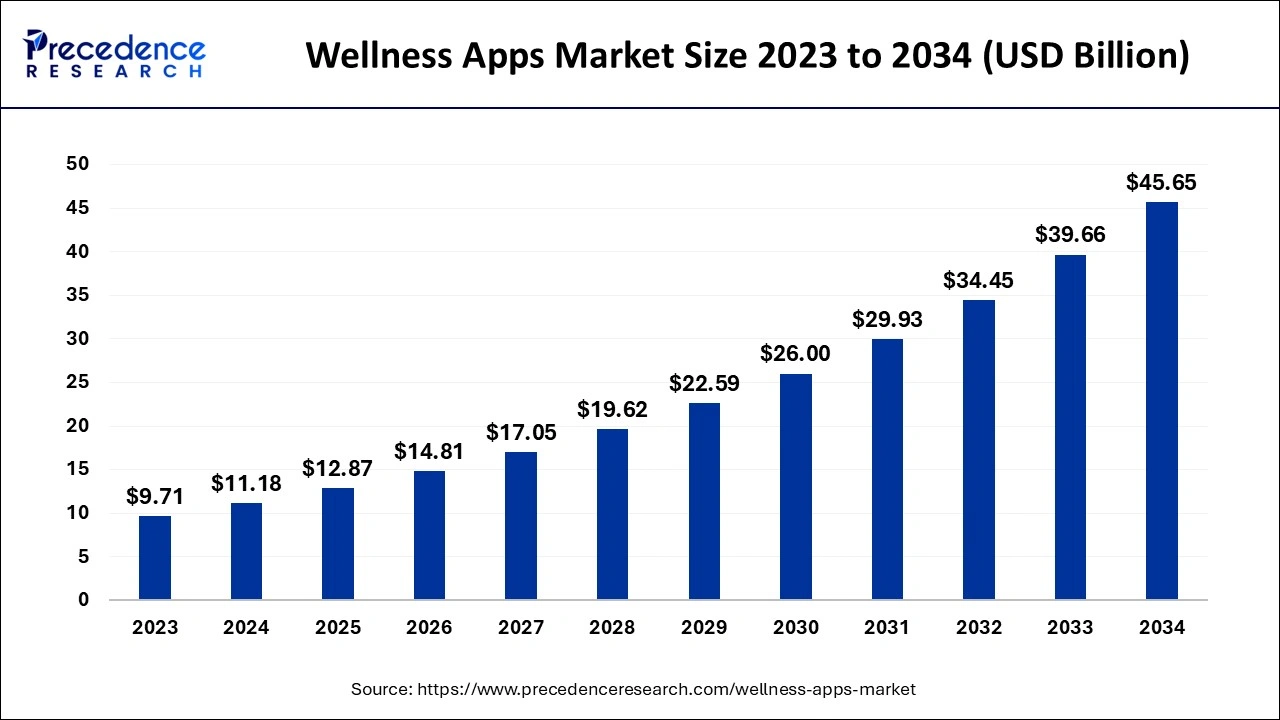

The global wellness apps market size is estimated at USD 11.18 billion in 2024, and is projected to hit around USD 12.87 billion by 2025, and is anticipated to reach around USD 45.65 billion by 2034, expanding at a CAGR of 15.11% between 2025 and 2034. The market growth is attributed to the increasing adoption of digital health solutions and a growing emphasis on wellness among consumers.

Wellness Apps Market Key Takeaways

- In terms of revenue, the wellness apps market is valued at $12.87 billion in 2025.

- It is projected to reach $45.65 billion by 2034.

- The wellness apps market is expected to grow at a CAGR of 15.11% from 2025 to 2034.

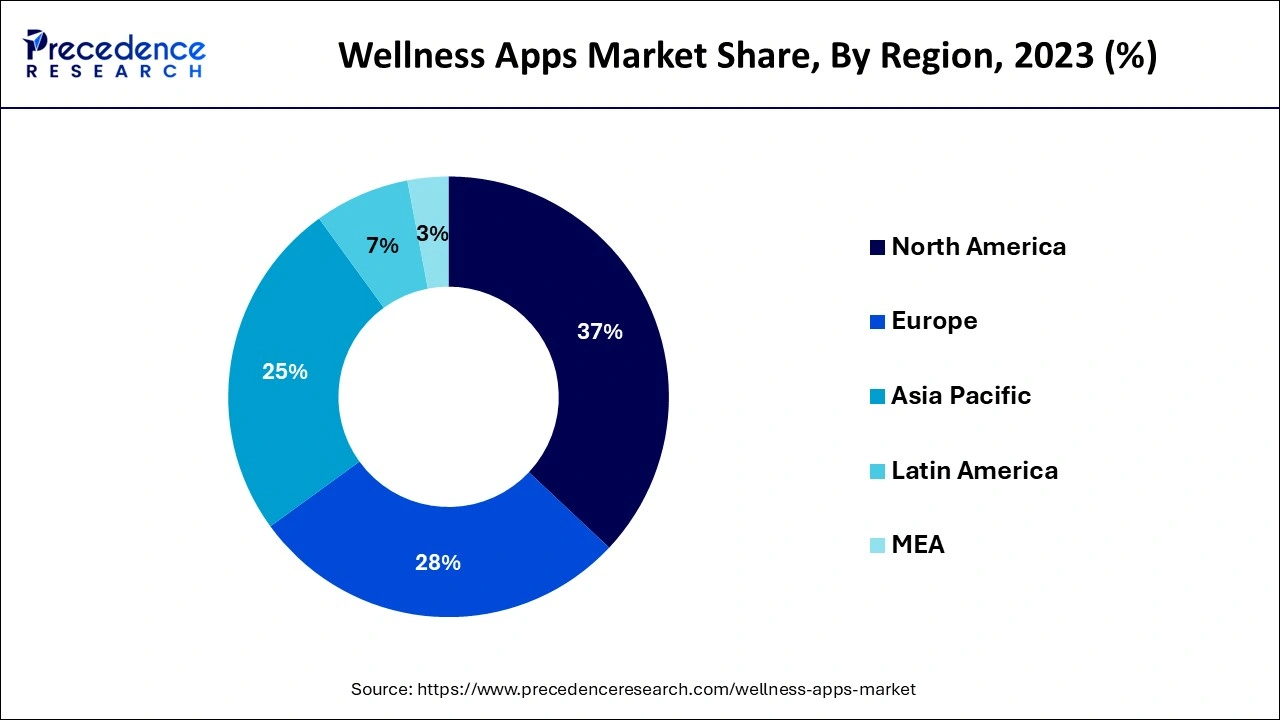

- North America dominated the market with the largest market share of 37% in 2024.

- Asia Pacific is projected to expand at the fastest CAGR in the coming years.

- By type, the exercise and weight loss apps segment contributed the highest market share of 59% in 2024.

- By type, the meditation management segment is expected to grow at the fastest rate during the forecast period.

- By platform, the iOS segment accounted for the largest market share of 53% market in 2024.

- By platform, the android segment is anticipated to grow at a significant CAGR over the studied period.

- By device, the smartphone segment has held the major market share of 67% in 2024.

- By device, the wearable devices segment is expected to expand at a significant growth rate in the coming years.

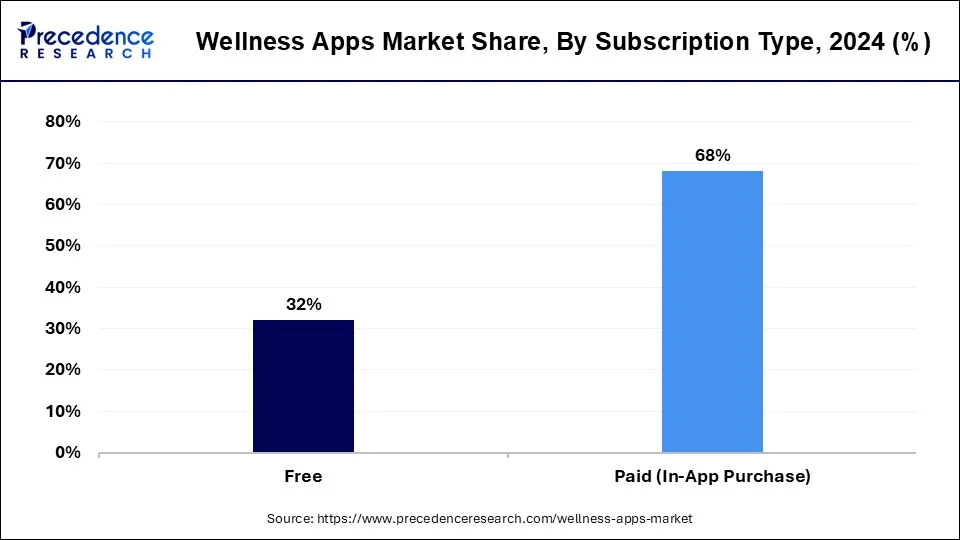

- By subscription, the paid (in-app purchase) segment contributed the highest market share of 68% in 2024.

- By subscription, the free segment is projected to grow at the fastest rate in the near future.

Impact of Artificial Intelligence on the Wellness Apps Market

Developers use Artificial Intelligence (AI) to analyze substantial user data to develop apps that personalize fitness routines, mental health exercises, and nutritional advice based on each individual's needs. AI is an advanced technology that enables wellness apps to track users' behavior effectively, make recommendations with progress, and respond to feedback in real time. Moreover, AI-driven chatbots and virtual assistants interact with users and transact with them round the clock for on-time responses to queries and encouragement to sustain the goal of maintaining wellness.

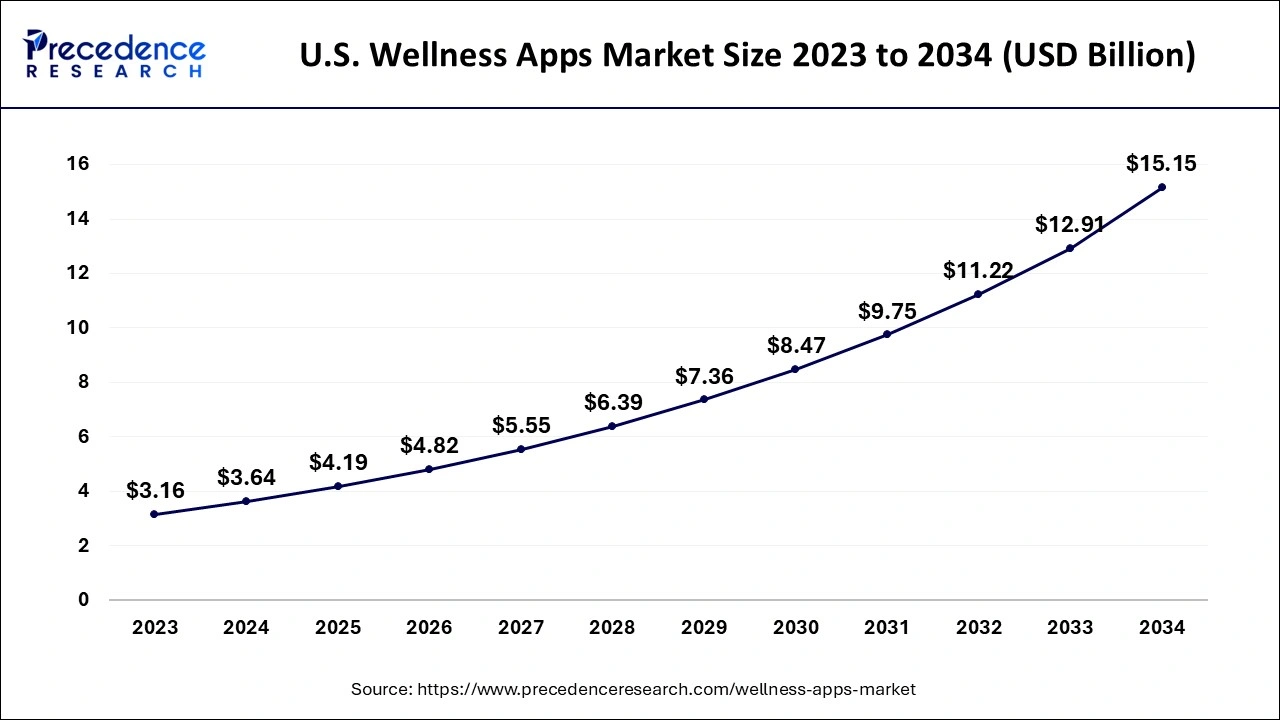

U.S. Wellness Apps Market Size and Growth 2025 to 2034

The U.S. wellness apps market size accounted for USD 11.18 billion in 2024 and is expected to be worth around USD 45.65 billion by 2034, growing at a CAGR of 15.11% from 2025 to 2034.

North America led the wellness apps market, capturing the largest share in 2024. This is mainly due to the growing consumer knowledge about digital health options. Due to the highly tech-savvy population in the U.S. and Canada, the demand for wellness apps that enable personal health management, fitness tracking, and mental well-being is on the rise. Government initiatives favoring preventive healthcare and telemedicine services acted as a stimulus to app adoption. According to the U.S. Department of Health and Human Services, the adoption of telemedicine in the U.S. soared by 154% during the early stages of the pandemic. Furthermore, the region's well-developed technology sector and high penetration of smartphones boosted the market.

North America leads the wellness app market, thanks to its tech-forward population, established digital infrastructure, and increasing investment in preventive healthcare. Key contributing countries include the U.S., driven by high smartphone penetration, consumer wellness spending, and home-grown global app players like Calm, Headspace, and MyFitnessPal, and Canada, Known for its supportive healthcare policies and rising adoption of mental wellness platforms.

Government initiatives like the U.S. Department of Health's “Healthy People 2030” strategy include a digital health component aimed at promoting behavioural wellness using technology. Additionally, several start-up incentives and health-tech incubators are funded by federal and private programmes to encourage innovation in mental health and lifestyle tracking platforms.

The wellness apps market in Asia Pacific is projected to expand at the fastest CAGR in the coming years. Increasing awareness about mental and physical well-being is boosting the demand for health and wellness apps in countries such as China, India, and Japan. With the rising usage of smartphones, the demand for health and wellness apps is rising. Additionally, with the increasing incidence of chronic disease, more and more people are adopting fitness, stress management, and nutrition management apps, further boosting the market in this region.

Asia Pacific is witnessing exponential growth in the wellness app market, driven by a unique blend of ancient health philosophies and modern digital innovation. Countries like India, China, Japan, and South Korea are leading the charge with surging mobile user bases, urban lifestyle stress, and increasing middle-class health consciousness. The region is marked by a rise in homegrown wellness platforms combining local traditions like Ayurveda, traditional chinese medicine (TCM), and yoga with modern UI/UX frameworks. Demand is surging in Tier-2 and Tier-3 cities as affordable smartphones and mobile data reach rural populations.

Market Overview

Rising knowledge of mental and physical health contributes to the significant expansion of the wellness apps market. Nowadays, consumers are looking for products and services that help them get health-related support. Thus, mobile applications are becoming essential tools, which include tracking physical activities and providing mental support. According to the World Health Organization (WHO), about one billion people worldwide suffer from different mental health disorders each year, creating a need for mental wellness solutions. Research from the National Institute of Health states that practical tools in digital health have become essential to health-promoting behavior, with over 60% of adults in the U.S. actively using mobile health apps in 2024. Furthermore, the growing demand for easily accessible and advanced wellness applications for preventive healthcare further fuel the wellness apps market growth in the coming years.

Wellness Apps Market Growth Factors

- The increasing use of wearable technology , which integrates real-time health monitoring with mobile platforms, is expected to drive wellness app usage.

- Rising focus on personalized health solutions is likely to enhance app features like customized fitness plans and mental health tracking.

- Growing demand for mental health support tools due to rising stress and anxiety levels among global populations is anticipated to spur app downloads.

- Advances in AI and machine learning are projected to improve app functionalities, making them more interactive and intuitive for users.

- Increasing partnerships between wellness app developers and healthcare providers are crucial in boosting credibility and integration with mainstream health services.

- The growing interest in gamification within health and wellness apps is anticipated to enhance user engagement by making health management more interactive and fun.

- The surging awareness of holistic wellness is projected to boost the use of apps for mental, physical, and emotional well-being across various demographics.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 45.65 Billion |

| Market Size in 2025 | USD 12.87 Billion |

| Market Size in 2024 | USD 11.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.11% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, Device, Subscription, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Drivers

Growing Awareness of Mental and Physical Well-being

Growing awareness of mental and physical well-being is expected to drive demand for wellness apps in the coming years. The adoption of wellness apps is increasing among the younger generations, who want easily available solutions to control stress and have a balanced lifestyle. According to research by the American Psychological Association, about 70% of adults say mental health resources in their lives have been becoming increasingly necessary, and a large number of people have started using digital wellness solutions. Additionally, 83% of users acknowledge that realistic health plans and interventions are what wellness apps have empowered them to attain better overall well-being. Apps that provide services such as mindfulness exercises, meditation guides, and sleep markers are in high demand among health-conscious individuals. Additionally, companies have started offering corporate wellness programs, with 64% of employers investing in digital health initiatives yearly, reflecting soaring mental health awareness among businesses for employees' well-being. Furthermore, the growing demand for such applications for preventive measures further boosts the market in the coming years.

| Year | Percentage of Adults Using Wellness Apps | Percentage of Users Reporting Improved Well-being | Percentage of Employers Investing in Digital Health Initiatives |

| 2023 | 40% | 83% | 64% |

| 2024 | 52% (Projected) | 90% (Projected) | 70% (Projected) |

Restraint

Limited Access in Low-income Regions

Limited access to advanced smartphones and reliable internet services in low-income regions is projected to hinder the market. Many wellness apps require users to have an Android or iPhone and a good internet connection to maximize the app's features. In developing countries where technologies are not so prevalent, the use of wellness apps is still low. Some of these solutions are rooted in the digital divide. Those who lack the means to access these solutions are often rural users.

Opportunity

High Adoption of Telemedicine and Digital Health Platforms

The high adoption rate of telemedicine and digital health platforms is expected to create immense opportunities for key players competing in the wellness apps market. Wellness apps are gradually embedded into telemedicine systems. This allows individuals to receive advice and get health services and consultations through mobile devices. According to the World Health Organization, the adoption of telemedicine services increased worldwide by 50% in 2024 and is expected to rise further in 2024. These changes present new prospects for wellness app developers, who evaluate the possibility of functioning with healthcare organizations to synchronize physical and mental well-being tracking products and services. Moreover, the growing number of individuals seeking technologies that effectively manage chronic diseases, mental health, and other lifestyle-related illnesses is expected to boost the market growth in the coming years.

Wellness Goes Digital: Where Mindfulness Meets Innovation

The wellness app market is experiencing a robust evolution driven by increasing mental health awareness, lifestyle-related diseases, and the growing preference for holistic well-being. A significant trend is the rise of AI-driven personalisation, where users receive custom fitness, sleep, and mindfulness routines based on real-time behavioural data. Additionally, integration with wearables like smartwatches and fitness bands has enabled seamless health tracking, making wellness a daily, data-backed pursuit.

Gamification of wellness is also on the rise, turning workouts, meditation, and healthy habits into engaging challenges. Corporate wellness programmes are increasingly being digitised as businesses focus on employee well-being. Furthermore, multi-functional apps that combine nutrition, mental wellness, fitness, and habit tracking into one interface are becoming the new standard, replacing single-purpose tools.

Type Insights

The exercise and weight loss apps segment led the market with the largest share in 2024, owing to the increasing cases of obesity. Busy lifestyles encouraged people to engage in physical activities like exercise and Yoga, leading to increased demand for exercise and weight loss apps. Moreover, with the rising obesity rates, there is a high demand for weight loss apps among health-conscious individuals, contributing to segmental growth.

The meditation management segment is expected to grow at the fastest rate during the forecast period, owing to the increasing focus on mental well-being. According to a report published by WHO in 2024, about 1 in 8 individuals worldwide are living with mental health issues, prompting the demand for meditation apps. Guided meditation and relaxation techniques are used on these apps to manage stress, anxiety, and sleep problems. The adoption of meditation management apps is rising due to the increasing awareness about mental health, further fueling the segmental growth. According to the Global Wellness Institute (GWI), meditation apps downloaded 45% more in 2024 after the COVID-19 Pandemic.

Platform Insights

The iOS segment accounted for the largest share of the wellness apps market in 2024. This is mainly due to the increase in usage of iOS devices among the population, especially youngsters. Advanced technologies in these devices and the rising number of iPhone users worldwide contributed to segmental dominance. Furthermore, superior iOS app user experience further bolstered the segment.

The Android segment is anticipated to grow at a significant CAGR over the studied period. This is due to its large user base and affordability. With the increasing usage of smartphones, the usage of wellness apps is rising. The open-source nature of Android creates an environment for a varied set of wellness apps to be created, raising the accessibility of these apps. Furthermore, the proliferation of low-cost smartphones contributes to segmental expansion.

Device Insights

The smartphone segment led the global market with the largest share in 2024, as mobile phones are the most preponderant platform for health and wellness apps. According to a Pew Research Center report, 90% of US adults owned smartphones in 2024. Smartphones' portability and continuous connectivity allow people to choose from various fitness tracking, meditation, and nutrition management apps. Furthermore, the growing number of smartphone applications being developed will further fuel the segment.

The wearable devices segment is expected to expand at a significant growth rate in the coming years, owing to the increasing adoption of smartwatches and fitness trackers. These devices allow users to monitor their physical activity, sleep patterns, and heart rate in real time, enhancing the health-tracking experience. The inclusion of a wearable that connects to a wellness app enhances user engagement with the app through its ability to give valuable insights into the users' health through the wearable. International Data Corporation (IDC) stated that the shipment of wearable devices worldwide, including fitness bands and smartwatches, reached 533.6 million in 2024. Moreover, the growing demand for personalized health-tracking solutions is expected to propel the demand for wearable devices.

Subscriptions Insights

The paid (in-app purchase) segment dominated the global wellness apps market in 2024 as users become more willing to pay for premium features, such as personalized fitness plans and advanced meditation solutions. Paid apps offer virtual consultations with health professionals, enhancing user experience. Paid wellness apps typically provide a non-ad space, detailed analytics, and personalized recommendations. Moreover, the increasing demand for premium wellness services augmented the segment.

The free segment is projected to grow at the fastest rate in the near future., owing to the high number of free app users. Free apps provide invaluable wellness services, including simple fitness tracking, basic meditation guides, and basic nutrition tips, making them available to the masses. These free apps offer basic features, attracting a wider user base. With the rising adoption of smartphones, the demand for free wellness apps is increasing, contributing to segmental growth.

Wellness Apps Market Companies

- Mindscape

- Calm

- Headspace Inc.

- Appster

- Under Armour, Inc.

- Kayla Itsines

- Apple Inc.

- Sleepace

- Withings

Recent Developments

- In October 2024, Deepinder Goyal, co-founder and CEO of Zomato, launched a new wellness startup called Continue. The company aims to focus on health tracking and mental wellness. Initially incorporated under Upslope Advisors, Continue represents Goyal's venture into health and wellness, having invested ?50 lakh of his own funds into the project. Goyal describes Continue as a platform that will serve as his personal health and wellness team, dedicated to researching and tracking methods to optimize performance and maintain peak health. Although details on the offerings are still scarce, Goyal expressed enthusiasm about developing innovative solutions that he hopes to share with the world in the future

- In June 2024, Equanima announced the upcoming release of its innovative wellness app and games to enhance emotional intelligence and mental health. The app, which incorporates AI for personalized mood monitoring and e-learning modules, will launch by the end of Q3 2024 and target Millennials and Gen Z who face mental health challenges.

- In January 2024, FOXO Technologies formalized a partnership with KR8.ai to launch the VITHAR AI Health Coach, a subscription-based wellness app. This application combines epigenetic biomarker analysis with machine learning to provide personalized health recommendations based on users' genetic insights and health statistics.

Segments Covered in The Report

By Type

- Meditation Management

- Exercise and Weight Loss Apps

- Stress Management

- Diet & Nutrition Apps

By Platform

- Android

- iOS

- Web-Based

By Device

- Tablets

- Smartphones

- Wearable Devices

By Subscription

- Free

- Paid (In-App Purchase)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting