December 2024

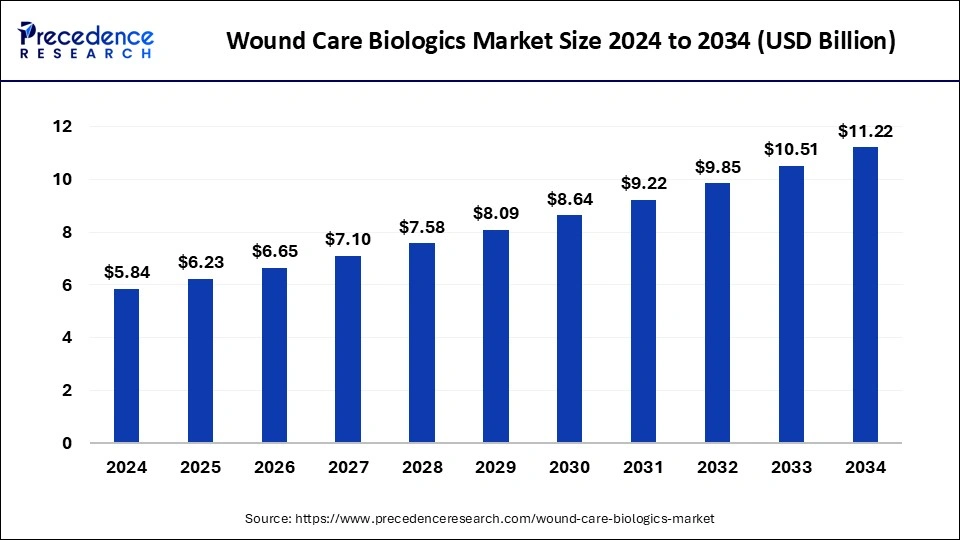

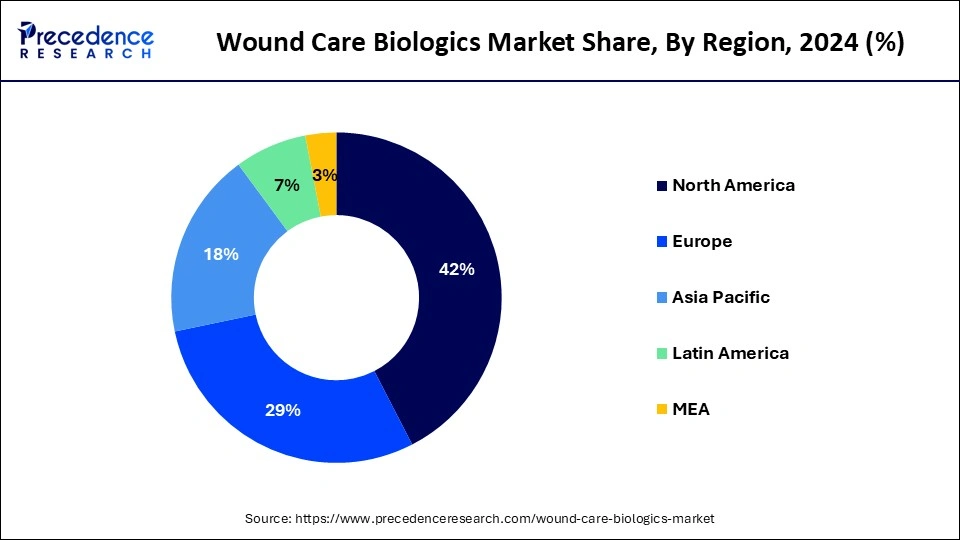

The global wound care biologics market size is calculated at USD 6.23 billion in 2025 and is forecasted to reach around USD 11.22 billion by 2034, accelerating at a CAGR of 6.75% from 2025 to 2034. The North America market size surpassed USD 2.45 billion in 2024 and is expanding at a CAGR of 6.89% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wound care biologics market size accounted for USD 5.84 billion in 2024 and is predicted to increase from USD 6.23 billion in 2025 to approximately USD 11.22 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034.

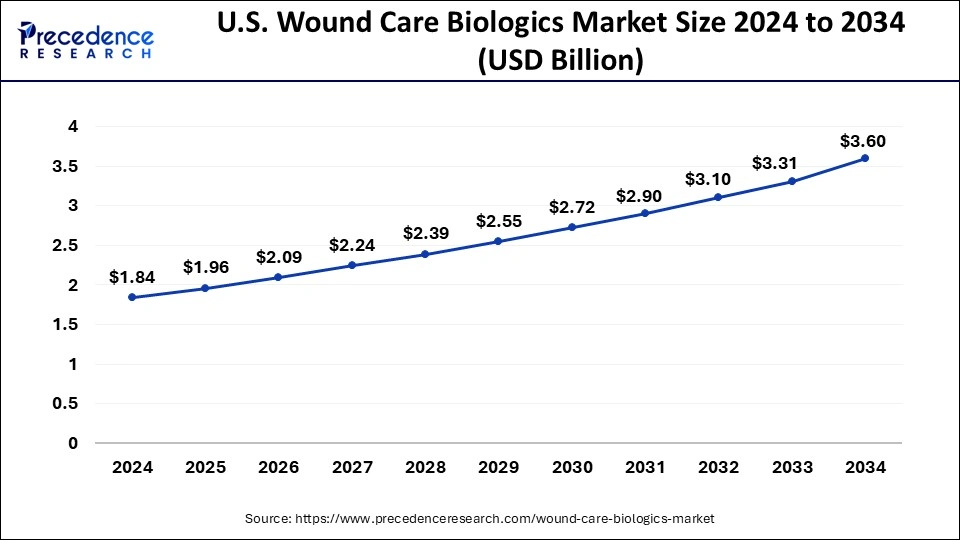

The U.S. wound care biologics market size was exhibited at USD 1.84 billion in 2024 and is projected to be worth around USD 3.60 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034.

Moreover, 37.3 million Americans, or 1 in 10 of the population, have diabetes, according to Centers for Disease Control and Prevention Updates from January 2022. 96 million adult Americans, or more than one in three, have prediabetes. Therefore, it is expected that the growing prevalence of diabetes foot in the United States and the rising incidence of diabetes, which is a key risk factor for the formation of foot ulcers, would drive demand for wound care biologics and accelerate market expansion throughout the projection period.

Asia Pacific is expected to witness the fastest growth rate in the wound care biologics market during the forecast period. Rapid economic growth and rising disposable incomes in countries such as China, India, and Southeast Asian nations are leading to increased healthcare spending. As a result, patients are more willing and able to invest in advanced wound care treatments, driving market growth. There is an increasing awareness among healthcare professionals and patients about the importance of advanced wound care products, including biologics, in promoting wound healing and preventing complications. This heightened awareness is driving the adoption of wound care biologics in the region.

The wound care biologics market revolves around the offering of a class of advanced therapeutic products used in the treatment of wounds and tissue injuries. These biologics are derived from living organisms or their products and are designed to enhance the natural healing processes of the body. They differ from traditional wound care products by leveraging biological components to promote tissue regeneration, reduce inflammation, and accelerate the overall healing response.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.75% |

| Market Size in 2025 | USD 6.23 Billion |

| Market Size by 2034 | USD 11.22 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Wound Type, Product, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of ulcers and chronic wounds

One of the main drivers of the wound care biologics market is the rising incidence of chronic wounds and ulcers, which is being driven by vascular disorders, diabetes, and ageing populations. There is an increasing need for enhanced treatment options as the cost of treating chronic wounds in healthcare throughout the world grows.

Growth factors, extracellular matrices, and stem cell-based therapies are examples of wound care biologics that provide potential new ways to treat complicated chronic wounds that frequently do not respond to standard medical therapy. They can also hasten the healing process. These cutting-edge biologics are vital to the therapy of chronic wounds because they stimulate tissue regeneration and lower inflammation.

Extracellular matrices improve wound closure by acting as a scaffold for tissue regeneration and cell migration. The promotion of tissue regeneration and immune response modulation are two ways that stem cell treatments contribute. Because these biologics are individualized, individuals with varying wound characteristics can get customized therapies that maximize their results. Further advancements in wound care biologics research and development might lead to revolutionary changes in the field of healthcare, particularly in the area of chronic wound treatment.

High cost and regulatory challenge

Wound care biologics can be expensive compared to traditional wound care products. The high cost of production, research, and development, as well as the complexity of biological manufacturing processes, contribute to elevated pricing. This cost may limit access for certain patient populations and healthcare systems.

Additionally, regulatory approval for biologics can be a lengthy and complex process. Stringent regulatory requirements, especially for novel biologic products, can slow down market entry and increase development costs. Obtaining approval from regulatory authorities such as the FDA (U.S. Food and Drug Administration) or the EMA (European Medicines Agency) is crucial but can be a challenging and time-consuming process. Thus, this is expected to hamper the wound care biologics market over the forecast period.

Biotechnology and regenerative medicine

Considerable advancements in regenerative medicine and biotechnology are observed to offer lucrative opportunities for the wound care biologics market. Advances in tissue engineering, biomaterials, and cellular processes have resulted in the creation of biological medicines that possess improved healing properties. The industry's dedication to offering more efficient and individualized treatment choices for complicated wounds is demonstrated by the incorporation of cutting-edge technology, such as gene therapy and tissue regeneration, into wound care biologics.

Furthermore, the combination of biotechnology and artificial intelligence has made it easier to identify new therapeutic targets, which in turn has made it possible to create biologics that are customized to the unique profiles of individual patients. The potential of gene therapy to alter cellular processes genetically suggests that it may be useful in treating the underlying causes of chronic wounds. Precise treatments are made possible by tissue regeneration procedures that are guided by sophisticated imaging and diagnostic instruments.

The fields of wound care are changing as a result of the convergence of biologics and technology. In addition to enhancing the effectiveness of already available therapies, this combination creates opportunities for novel approaches that might completely alter the landscape of wound care in the future.

The chronic wound segment held the dominating share of the wound care biologics market in 2024. The increasing prevalence of chronic wounds, particularly associated with ageing populations and the rise in conditions like diabetes, contributes to the demand for effective wound care solutions. Wound care biologics offer advanced treatment options for non-healing or slow-healing chronic wounds. For instance, according to the data by Mission Regional Medical Center, 6.7 million individuals are estimated to be living with chronic wounds at the moment, and over the next ten years, that figure is predicted to increase at a rate of more than two percent.

An ageing population, increased rates of illnesses and ailments including diabetes, obesity, and the aftereffects of radiation therapy are the main causes of the rising occurrence. Chronic wounds left untreated can result in a reduced quality of life and even limb amputation. Over $50 billion is spent on chronic wounds by the healthcare system. In the United States (US), about two million individuals with diabetes (about 29 million people, or 9.5% of the population) get a diabetic foot ulcer or other non-healing sore each year.

The acute wound segment is expected to grow at a moderate rate in the wound care biologics market over the projected period. Wound care biologics are designed to promote and accelerate the natural healing process of the body. In the case of acute wounds, such as surgical incisions, traumatic injuries, or burns, biologics can be applied to enhance tissue repair and reduce the overall healing time.

The biological skin substitutes segment, in 2024, held the largest share of the wound care biologics market. Biological skin substitutes provide a three-dimensional scaffold that mimics the extracellular matrix of natural skin. This scaffold offers structural support to the wound site, facilitating cell migration, proliferation, and tissue regeneration. Moreover, biological skin substitutes are widely used in the treatment of burns and chronic wounds, providing an effective alternative to traditional wound care methods. Their ability to address complex wounds makes them valuable in challenging clinical scenarios.

The topical agents segment is expected to grow significantly in the wound care biologics market during the forecast period. Topical agents in the wound care biologics market refer to therapeutic substances applied directly to the surface of wounds to facilitate healing and manage various aspects of the wound healing process. These agents can include a range of biologically derived substances designed to address specific aspects of wound care. The development and use of topical agents in wound care biologics continue to evolve, driven by advancements in biotechnology and regenerative medicine. These agents aim to provide targeted and effective solutions for promoting optimal wound healing outcomes.

The hospitals and clinics segment held the dominating share of the wound care biologics market. The segment is also observed to sustain dominance throughout the forecast period. Hospitals and clinics are primary settings for the assessment and diagnosis of wounds. Healthcare professionals in these settings evaluate the type and severity of wounds, determining the appropriate course of treatment, which may include the use of wound care biologics. In addition, healthcare providers in hospitals and clinics prescribe wound care biologics based on the patient's condition and the nature of the wound. They oversee the administration of these biologics, ensuring proper dosage and application. Thereby, driving the segment expansion.

By Wound Type

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

July 2024

January 2025