March 2025

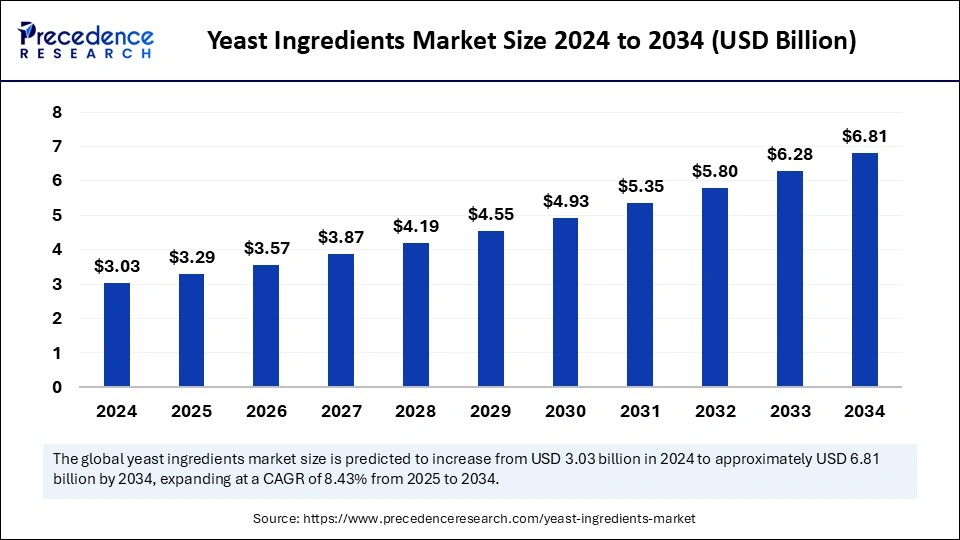

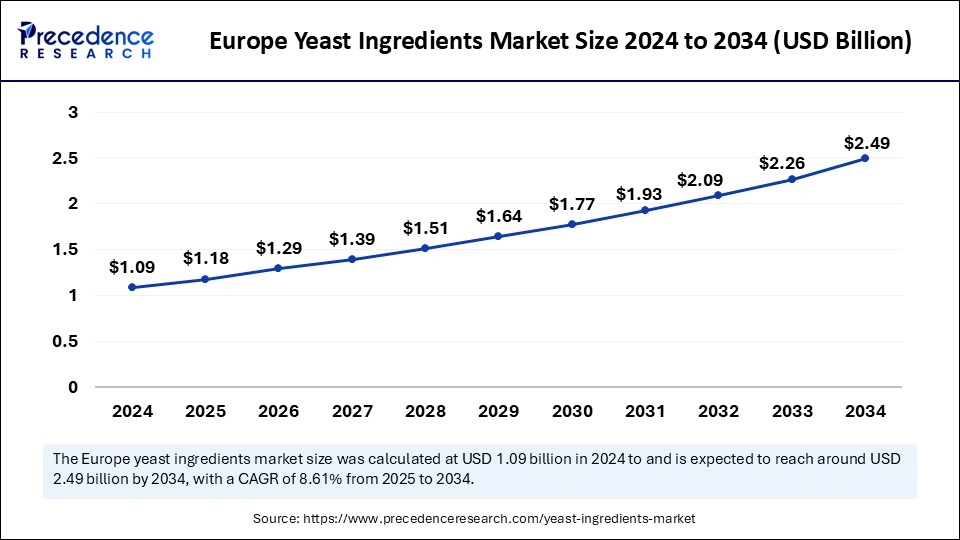

The global yeast ingredients market size is calculated at USD 3.29 billion in 2025 and is forecasted to reach around USD 6.81 billion by 2034, accelerating at a CAGR of 8.43% from 2025 to 2034. The Europe market size surpassed USD 1.09 billion in 2024 and is expanding at a CAGR of 8.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global yeast ingredients market size accounted for USD 3.03 billion in 2024 and is predicted to increase from USD 3.29 billion in 2025 to approximately USD 6.81 billion by 2034, expanding at a CAGR of 8.43% from 2025 to 2034. The rising consumption of processed and fast food across the globe is the key factor driving the yeast ingredients market. Also, increasing awareness regarding calorie reduction coupled with the growing demand for food products with high-grade value can fuel this growth further.

Artificial intelligence systems are helping bakeries to be more accurate in the overall baking processes and automate systems that can precisely measure ingredients, which makes each baked goods batch high-quality and consistent. Furthermore, AI is transforming the way bakeries are interacting with customers. By analyzing the data, AI systems can get an insight into customer preferences, enabling bakeries to provide customized promotions and recommendations.

The Europe yeast ingredients market size was exhibited at USD 1.09 billion in 2024 and is projected to be worth around USD 2.49 billion by 2034, growing at a CAGR of 8.61% from 2025 to 2034.

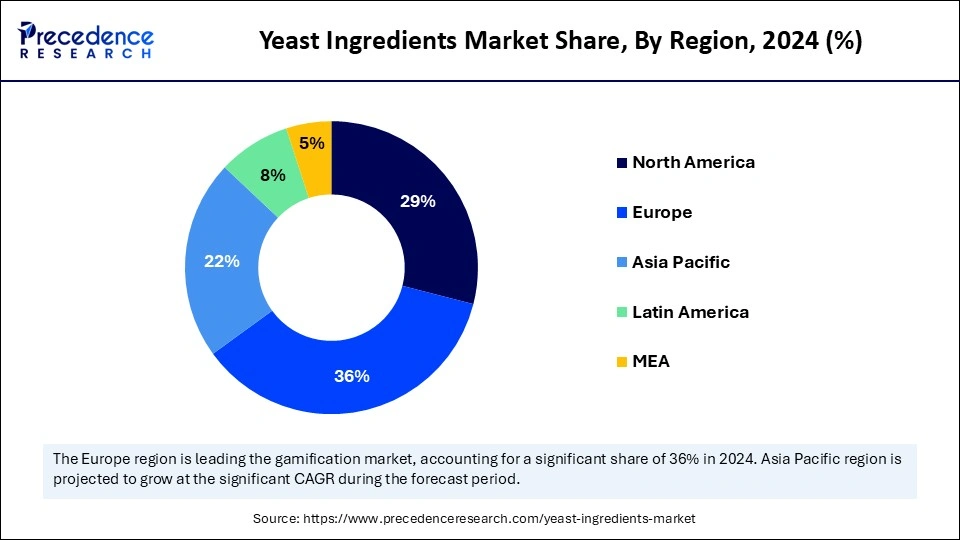

Europe dominated the global yeast ingredients market in 2024. The dominance of the region can be attributed to the ongoing advancements in the bakery industry coupled with the growth of business in emerging markets such as the U.K., Italy, Germany, and France. Furthermore, the increasing demand for bakery products in other European countries will likely contribute to market expansion soon. Enhancements in yeast manufacturing technology and techniques to keep high-quality standards and innovations are further propelling regional market growth.

Asia Pacific is expected to grow at the fastest rate in the yeast ingredients market over the studied period. The growth of the region can be credited to the rising awareness about the consumption of nutritional products and high animal feed production in the region. In Asia Pacific, emerging countries like. China, India, and Japan are major contributors to the market growth. China held the largest market share in Asia Pacific, owing to the highest growth in yeast production and consumption.

Yeast is a type of fungus used mainly in brewing and baking because of its capability to ferment sugars, creating alcohol and carbon dioxide gas. The important component in this product is Saccharomyces cerevisiae. Other ingredients are flour, water, sugar, and salt. Yeast necessitates a moist, warm environment to grow and undergo fermentation. Also, its part in the baking process is important as it boosts the leavening process, which results in the distinguished flavor and texture of cakes, bread, and other baked items.

| Country | Imports |

| United States | USD 352.4 million |

| France | USD 74.8 million |

| Brazil | USD 60.4 million |

| United Kingdom | USD 59.2 million |

| Algeria | USD 47.3 million |

| Report Coverage | Details |

| Market Size by 2034 | USD 6.81 Billion |

| Market Size in 2025 | USD 3.29 Billion |

| Market Size in 2024 | USD 3.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.43% |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for ready-to-eat food products

Increasing preference for ethnic food such as Mexican and Thai food in restaurants has strengthened the demand for the yeast ingredients market. Constantly changing food consumption patterns and people's habits impact market growth positively. In addition, the increased need for convenience in food products facilitated the demand for ready-to-eat food like ready-to-consume noodles and soups, which possess high amounts of yeast.

Strict food safety regulations

Strict regulatory laws implemented by governments and regulatory bodies in many countries are major factors hampering the yeast ingredients market. The unavailability of raw materials necessary in the manufacturing of a diverse range of yeast types can impact market growth negatively. Moreover, the lack of raw materials potentially will create demand-supply imbalances, and the increasing global focus on decreasing dependence on fossil fuels will hinder market growth further.

Increasing demand for organic yeast offering

The growing demand for organic yeast is the latest trend in the yeast ingredients market. Organic yeast is gaining traction due to customers' preferences for sustainable and healthier options. In the baking market, organic yeast is utilized in many baked items like cookies, crackers, cakes, biscuits, and buns. Furthermore, the production of this yeast requires milk, organic sugar, and flour as raw materials, sticking to stringent organic standards. However, producing organic yeast can sometimes pose some technical challenges.

The yeast extracts segment dominated the yeast ingredients market in 2024. The dominance of the segment can be attributed to the benefits offered by yeast extracts in food items. Yeast extracts contain vitamins, minerals, amino acids, nucleotides, and others. It is also an important component in the food & beverage industry. The crucial properties of extracts include sodium content reaction, high nutritional value, and flavor and taste enhancers. Additionally, it is extensively used in savory mixes, dairy products, soups, and processed foods.

The yeast autolysates segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing use of yeast autolysis in pork and poultry applications. These products are rich in proteins, vitamins, fiber, and micronutrients and hence incorporated into food products. However, they are widely utilized as a nutrient for microorganisms and a pet food ingredient in fermentation processes.

In 2024, the food segment led the yeast ingredients market by holding the largest share. The dominance of the segment can be linked to the increasing awareness among key players about calorie deduction, including China, the U.S., and Italy. Consumers are rapidly inclining towards balanced diets, which will drive the demand for food applications in the segment. Furthermore, the surging importance of plenty of protein intake in developing economies such as China and India can propel segment growth further.

The feed segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment can be driven by the increasing use of yeas feed as an animal feed for its nutritional value. The feed yeast used in animal meals enhances digestion and boosts the growth of animals. In addition, the dry yeast, after fermentation, generates products like nitrogen, oxygen, and CO2, which are then used to produce animal feed.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

December 2024

October 2024

January 2025