November 2024

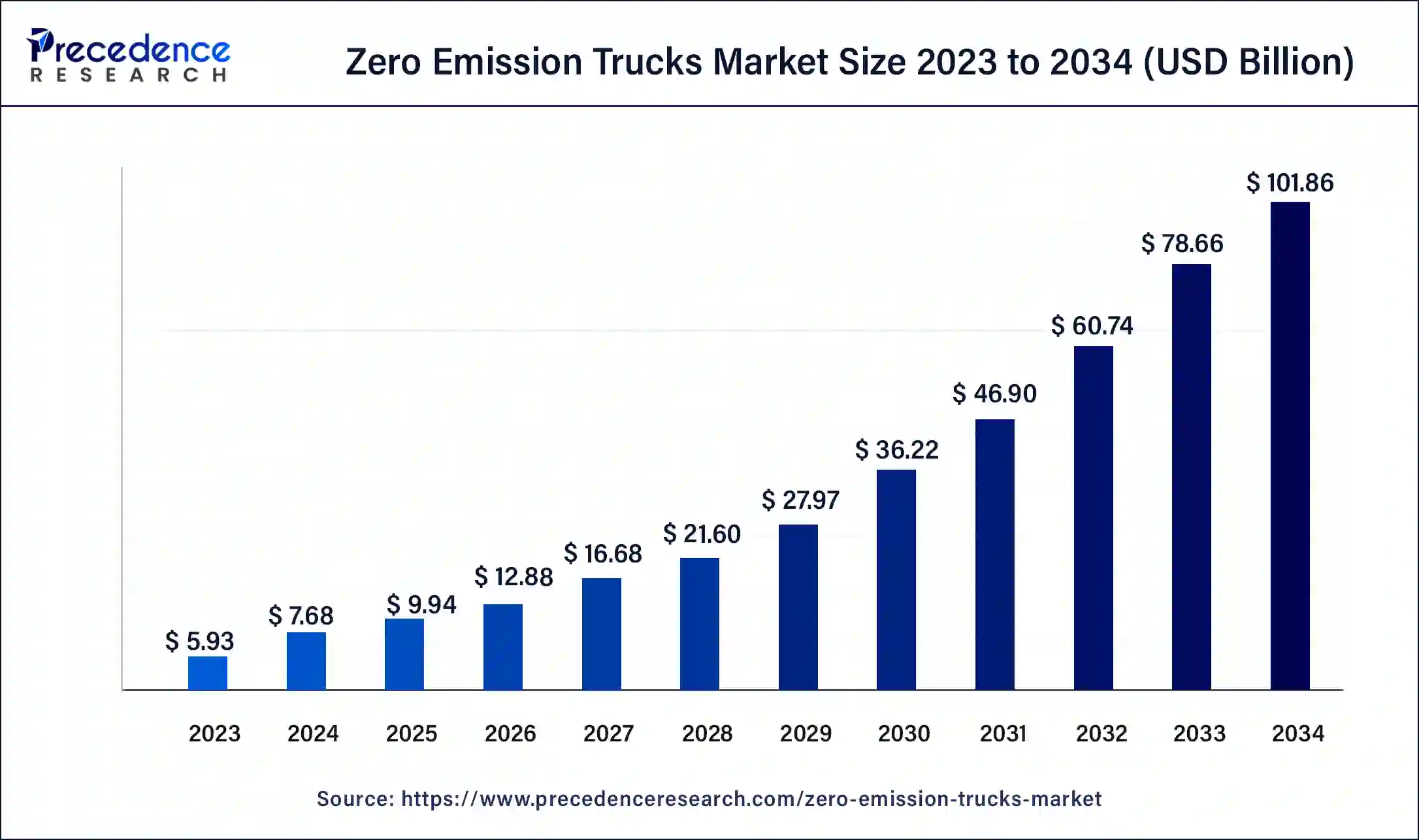

The global zero emission trucks market size was USD 5.93 billion in 2023, calculated at USD 7.68 billion in 2024 and is projected to surpass around USD 101.86 billion by 2034, expanding at a CAGR of 29.5% from 2024 to 2034.

The global zero emission trucks market size accounted for USD 7.68 billion in 2024 and is expected to be worth around USD 101.86 billion by 2034, at a CAGR of 29.5% from 2024 to 2034. The zero emission trucks market is driven by the emergence of policies aimed at reducing greenhouse gas emissions.

Being one of the most emerging trends in the automotive industry, the zero emission trucks market focuses on the development, manufacturing, and deployment of trucks that produce no tailpipe emissions during operation. Zero-emission trucks are designed to run on alternative fuels or power sources that do not release greenhouse gases or other pollutants into the atmosphere.

The primary goal of zero-emission trucks is to address environmental concerns, particularly related to air quality and climate change. Traditional trucks, especially those powered by internal combustion engines running on fossil fuels, emit pollutants such as carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter. Zero-emission trucks aim to mitigate these environmental impacts by using cleaner and more sustainable energy sources.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 29.5% |

| Market Size in 2023 | USD 5.93 Billion |

| Market Size in 2024 | USD 7.68 Billion |

| Market Size by 2034 | USD 101.86 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Vehicle Type, By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Government initiatives for sustainable mobility

Governments around the world are setting ambitious emission reduction targets to combat climate change. In response to international agreements and commitments, governments are actively promoting the use of zero-emission vehicles, including electric trucks, to achieve these targets. Many governments offer financial incentives, tax credits, grants, and subsidies to promote the purchase and adoption of zero-emission trucks. These incentives help offset the initial higher costs of electric vehicles, making them more attractive to businesses and individuals. Thereby, such initiatives are observed to support the market’s growth by acting as a growth factor for the market.

Lack of charging infrastructure

The limited availability of charging stations creates concerns among potential buyers about the range and reliability of zero-emission trucks. Range anxiety, or the fear of running out of battery power without access to charging, can deter fleet operators and individual consumers from adopting electric trucks. The absence of a robust charging network acts as a barrier to widespread market adoption. Fleet operators and businesses may be hesitant to invest in zero-emission trucks if they perceive challenges in maintaining their vehicles' operational readiness due to insufficient charging options.

Emphasis on reducing logistics cost

Zero-emission trucks, especially electric ones, generally have lower operating costs compared to traditional internal combustion engine vehicles. With fewer moving parts, reduced maintenance requirements, and lower fuel costs, businesses can realize significant operational cost savings over the life cycle of the vehicle.

Many urban areas are implementing stringent emission standards and access restrictions. Zero-emission trucks, meeting these standards, ensure continued access to urban centers, preventing potential fines or delays associated with non-compliance. Adopting zero-emission vehicles is consistent with long-term environmental objectives. Companies that project an image of environmental consciousness could benefit from a competitive advantage as stakeholders and customers value sustainable practices increasingly.

Ashok Leyland:

Renowned for its proficiency in truck manufacture, Ashok Leyland is a major player in the commercial vehicle manufacturing sector. The company achieved greater price realisations and its highest-ever LCV volumes of over 67,000 units in FY23. Leveraging decades of experience in the commercial vehicle industry, Ashok Leyland brings a deep understanding of fleet requirements and logistics to its electric truck offerings.

In June 2023, Ashok Leyland announced that its forthcoming electric compact trucks will be produced at its Hosur production complex's LCV (light commercial vehicle) facility. The Hinduja brand has previously stated that, as part of its larger objectives to increase the LCV volumes through new product rollouts, it will be introducing two new electric small trucks: the electric Dost and the electric Bada Dost.

Nikola Corporation

NIKOLA Corporation is a prominent player in the electric truck manufacturing industry, known for its innovative approach to zero-emission transportation solutions. NIKOLA's product portfolio includes a range of electric trucks, with a notable emphasis on fuel cell-powered vehicles. NIKOLA is investing in the development of a hydrogen fueling network, aiming to overcome infrastructure challenges associated with fuel cell technology.

The goal of Nikola's hydrogen fuel network is to increase the output of trucks that emit no emissions. Nikola stated in February 2023 that it was in the process of negotiating an investment deal with Fortescue Future Industries, a branch of Fortescue Metals Group Ltd., an Australian iron ore firm, for the project. The initial volume of hydrogen production is expected to be about 30 metric tonnes per day by the end of 2024.

The electric light-duty vehicles segment held the largest share of the market in 2023. The demand for last-mile delivery services has increased as a result of the growth of e-commerce and rising urbanization. For this, electric light-duty vehicles are a good fit since they are efficient, agile, and have a smaller environmental effect in urban areas.

Electric light-duty trucks are becoming increasingly common in fleets as a result of corporate environmental efforts. Electric light-duty trucks are a desirable option for companies that provide local deliveries and services because of their adaptability, reduced operating costs, and favourable brand image linked with environmentally friendly operations.

The electric medium-duty vehicles segment is observed to expand at the fastest rate during the forecast period. Delivery vans and light trucks are examples of electric medium-duty vehicles that are more widely accessible on the market than some of their heavy-duty equivalents. Due to its availability, companies may quickly and with minimal disturbance add electric medium-duty vehicles to their fleets.

The battery electric trucks segment held the largest share of the zero emission trucks market in 2023. Battery electric technology has matured significantly in recent years, leading to advancements in battery efficiency, energy density, and overall performance. This maturity has positioned battery electric trucks as reliable and viable alternatives to traditional combustion engines.

The hybrid electric trucks segment is observed to witness the fastest rate of growth during the forecast period. Compared to fully electric cars, hybrid electric trucks have a longer range since they integrate conventional internal combustion engines with electric power. Due to its versatility, hybrid electric trucks can be used for a range of tasks, such as long-haul freight, regional transit, and urban delivery. Their versatility renders them appropriate for an extensive array of sectors and applications.

The logistics and transportation segment held the dominating share of the market in 2023. Vehicles used for logistics and transportation, particularly delivery vans and goods trucks, frequently travel great distances and burn a lot of gasoline. Significant reductions in greenhouse gas emissions may result from the segment's adoption of zero-emission cars. Many cities are implementing restrictions on the entry of vehicles with high emissions into urban areas. This encourages logistics and transportation companies to invest in zero-emission vehicles to ensure continued access to these critical locations.

Many logistics and transportation companies have set ambitious sustainability goals and commitments to reduce their carbon footprint. Adopting zero-emission vehicles is a tangible way for these companies to achieve their environmental objectives.

North America is expected to have a significant market share throughout the forecast period. The market for zero-emission trucks is growing as a result of state-level incentives, stricter emission standards, and supportive infrastructure development. Some states in North America, like California, have been especially proactive in implementing policies to reduce greenhouse gas emissions and improve air quality. The adoption of zero-emission trucks is often accelerated by large corporations with extensive logistics and transportation needs.

Many North American companies, especially those with sustainability goals and commitments, have incorporated electric trucks into their fleets. The United States is home to some of the world's largest automotive manufacturers. The involvement of major automakers in producing and promoting electric trucks has significantly influenced the market dynamics. Technological innovation, particularly the development of electric vehicle technologies, has been centred in the United States. New and competitive electric vehicle options have been made possible by the existence of state-of-the-art research and development centers.

North America zero emission trucks market: Government initiatives

Asia Pacific is observed to witness the fastest rate of growth in the zero emission trucks market during the forecast period. High population density and rapid urbanization in many Asia Pacific countries contribute to increased concerns about air quality and pollution. Governments are motivated to address these challenges by promoting environmentally friendly transportation solutions, such as zero-emission vehicles. The region has experienced significant economic growth, leading to an expanding middle class.

This demographic shift has increased the demand for personal vehicles, and there is a growing awareness of the environmental impact of traditional vehicles, driving interest in zero-emission alternatives. Asia Pacific countries, particularly China, have made significant strides in advancing battery technology. The development of high-performance and cost-effective batteries has played a crucial role in making electric trucks more accessible and appealing to consumers.

Asia Pacific zero emission trucks market: Government initiatives

Segments Covered in the Report

By Vehicle Type

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

December 2024

October 2024

January 2025