April 2025

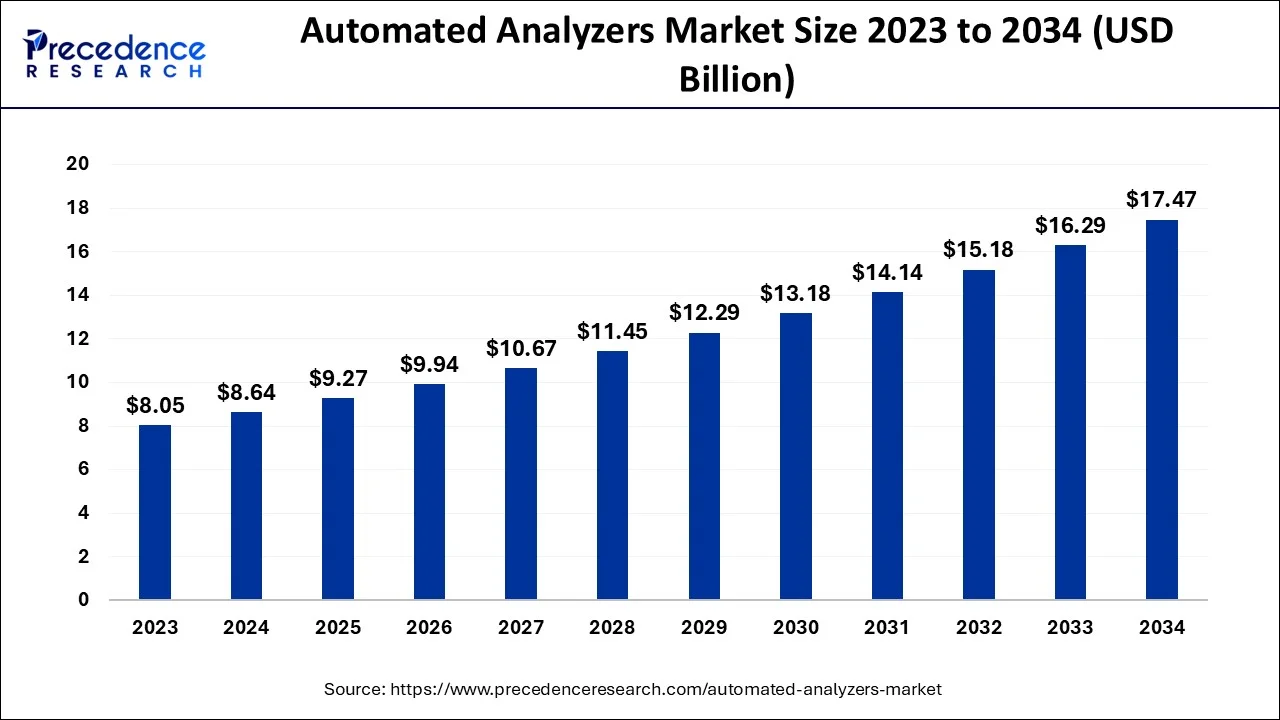

The global automated analyzers market size accounted for USD 8.64 billion in 2024, grew to USD 9.27 billion in 2025 and is projected to surpass around USD 9.27 billion by 2034, representing a healthy CAGR of 7.30% between 2024 and 2034. The North America automated analyzers market size is calculated at USD 3.02 billion in 2024 and is expected to grow at a fastest CAGR of 7.42% during the forecast year.

The global automated analyzers market size is estimated at USD 8.64 billion in 2024 and is anticipated to reach around USD 9.27 billion by 2034, expanding at a CAGR of 7.30% between 2024 and 2034.

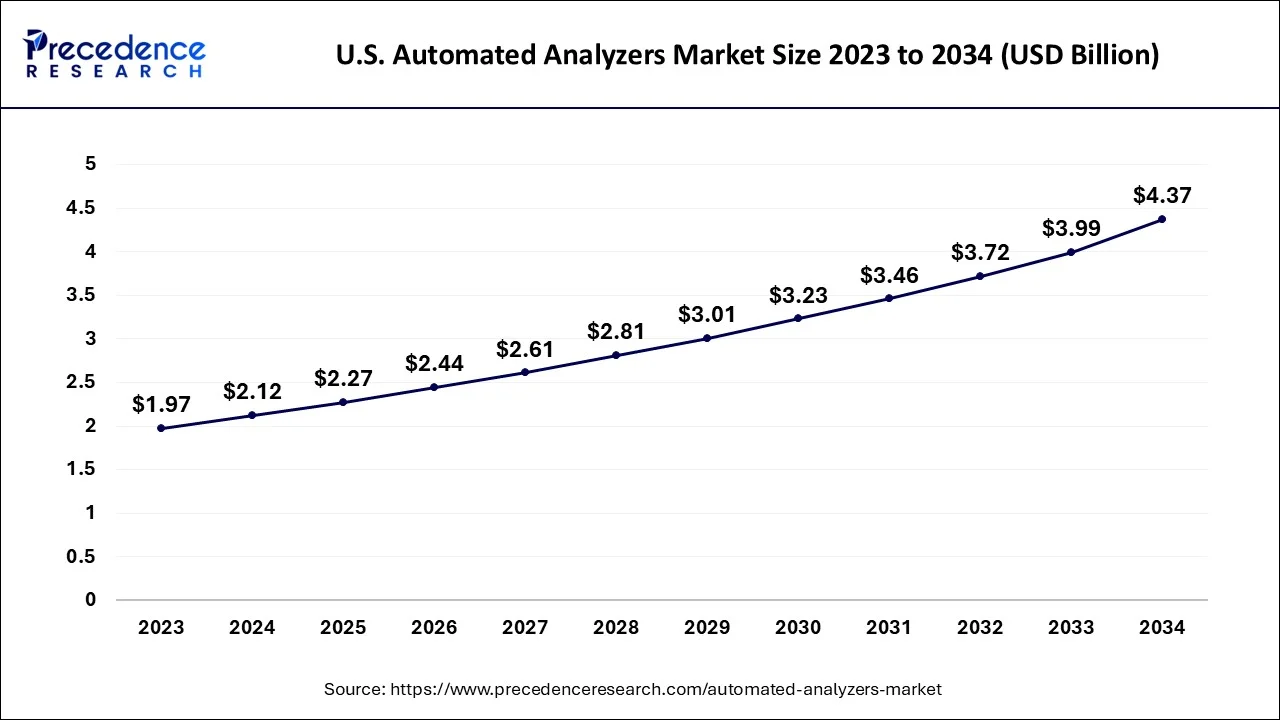

The global automated analyzers market size accounted for USD 2.12 billion in 2024 and is expected to be worth around USD 4.37 billion by 2034, growing at a CAGR of 7.51% between 2024 and 2034.

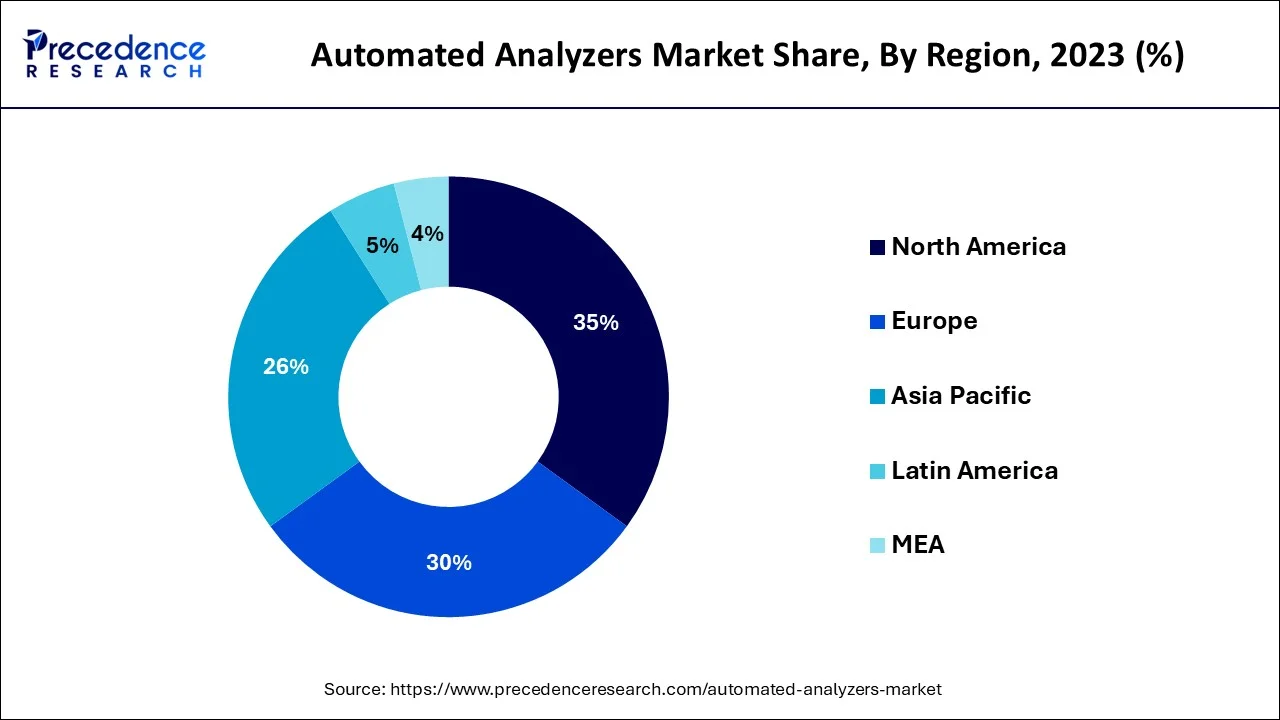

On the basis of geography, North America dominates the market owing to the well-established healthcare infrastructure in the region and is home to several leading players in the market, driving innovation and technological advancements. The growing prevalence of chronic diseases, growing demand for point-of-care testing, and rising investments in healthcare research and development are among the key factors driving the growth of the automated analyzers market in North America. Additionally, the region has a high adoption rate of advanced technologies, fueling the demand for automated analyzers in clinical diagnostics and research applications.

The region in Asia-Pacific is anticipated to have the greatest CAGR because the factors such as increasing healthcare expenditure, rising demand for point-of-care testing, and growing investments in healthcare infrastructure and research and development are driving the market growth in this region. Additionally, the region has a large population base and a high occurrence of chronic diseases, further boosting the demand for advanced diagnostic technologies such as automated analyzers. With increasing government initiatives and expanding the healthcare industry in countries like India, China, and Japan, the Asia-Pacific automated analyzers market is expected to experience significant growth in the coming years.

China is a rapidly growing market for automated analyzers. The country has a large population base and a high prevalence of chronic diseases, which has led to rising demand for advanced diagnostic technologies such as automated analyzers. Additionally, the Chinese government has been investing heavily in the healthcare industry, which has helped drive the market's growth. For instance, in August 2021, the Japanese medical device company Sysmex Corporation launched a new automated analyzer called the HISCL-800, which uses chemiluminescence immunoassay technology to measure a wide range of biomarkers in clinical samples.

These above factors are expected to fuel the demand for the automated analyzers market in the region over the forecast period.

Automated analyzers are medical devices designed to automate laboratory processes, such as testing and analysis, to improve laboratory efficiency and accuracy. Automated analyzers can perform diagnostic tests quickly and accurately, including blood, urine, and genetic tests. The global automated analyzers market is growing rapidly, driven by several factors. These include the increasing demand for advanced diagnostic tools, new laboratory automation technologies, the growing demand for point-of-care testing, the increasing investments in healthcare infrastructure, and the rising demand for personalized medicine.

Furthermore, increasing demand for advanced diagnostic tools for the occurrence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is rising, and there is a growing need for early disease detection and personalized medicine. Automated analyzers are important tools for developing personalized medicine, as they can perform complex genetic tests quickly and accurately.

Investments in healthcare infrastructure are expected to propel the market. Furthermore, developing new laboratory automation technologies and point-of-care testing will drive market expansion. New laboratory automation technologies, such as robotics and artificial intelligence. These technologies improve laboratory efficiency, reduce errors, and increase throughput. For instance, automated analyzers can perform repetitive tasks such as pipetting, which can be time-consuming and error-prone when done manually has fueled the global automated analyzers market growth over the last few decades.

However, High costs related to automated analyzer products are anticipated to impede market growth over the forecast period. Some automated analyzers are complex to operate and require specialized training. This can limit their adoption in settings where personnel may not have the required expertise, which limits their acceptance to some extent.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have increased demand for automated analyzers, particularly for diagnostic testing of COVID-19. Automated analyzers can perform various diagnostic tests quickly and accurately, including nucleic acid amplification tests (NAATs) for detecting SARS-CoV-2, the virus that causes COVID-19. The demand for NAATs has surged during the pandemic, and automated analyzers have played a crucial role in increasing testing capacity and improving turnaround times.

Improving patient outcomes and reducing healthcare costs is the factor that propelled the market demand. The various factors are helping to drive the market are:

| Report Coverage | Details |

| Market Size in 2024 | USD 8.64 Billion |

| Market Size by 2034 | USD 17.47 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.3% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Analyzer and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing need for point-of-care testing to brighten the market prospect

The need for point-of-care testing (POCT) is increasing rapidly in the automated analyzers market, enabling faster diagnosis and treatment of diseases. Point-of-care testing involves performing diagnostic tests at or near the site of patient care, with results available in minutes. POCT is particularly useful in emergencies, where rapid diagnosis is critical, and in remote or resource-limited settings, where access to laboratory testing may be limited. Automated analyzers are increasingly used in point-of-care testing, as they offer rapid results with high accuracy.

These analyzers use advanced technologies, such as microfluidics, biosensors, and lab-on-a-chip devices, to perform multiple tests simultaneously in a compact and portable format. Automated analyzers used in POCT include blood glucose meters, cardiac markers, hematology analyzers, and infectious disease tests, among others.

Point-of-care testing can help reduce healthcare costs by reducing the need for expensive laboratory testing, hospital admissions, and unnecessary treatments. Patients value convenience and fast results, and point-of-care testing offer both. POCT can reduce wait times and enable patients to receive treatment quickly, increasing patient satisfaction.

The growing adoption of point-of-care testing in emerging markets, where access to laboratory testing may be limited, and the increasing focus on personalized medicine requires rapid and accurate diagnostic testing. Overall, the growing need for point-of-care testing is expected to continue to drive the growth of the automated analyzers market during the forecast period.

Increasing adoption of laboratory automation: The adoption of laboratory automation is increasing rapidly in the automated analyzers market, as it offers several benefits, such as increased efficiency, accuracy, and reproducibility, as well as reduced labor costs and turnaround time. Laboratory automation involves using advanced technologies, such as machine learning, robotics, and artificial intelligence, to automate laboratory workflows, including sample preparation, analysis, and data management.

Also, automated analyzers are a critical component of laboratory automation, as they enable high-throughput analysis of large samples with high accuracy and reproducibility. Automated analyzers can perform various tests, including clinical chemistry, immunoassays, hematology, microbiology, and molecular diagnostics. These analyzers can also be integrated into laboratory automation systems, allowing for seamless sample processing and data management. These developments will further drive demand for the automated analyzers market.

Technical issues related to automated analyzers is causing hindrance to the market

Automated analyzers are often complex systems that require specialized expertise to operate and maintain. This can create challenges for smaller or less technologically advanced healthcare providers that may lack the necessary resources or personnel to use these systems effectively. Integrating automated analyzers with existing laboratory information management systems (LIMS) and electronic health record (EHR) systems can be a significant technical challenge.

This can create interoperability issues, leading to delays or errors in test results. It requires rigorous quality control procedures to ensure accurate and reliable results. Failure to properly calibrate and maintain these systems can lead to errors in test results, potentially leading to misdiagnosis or inappropriate treatment. Thus, this factor may impede demand for the automated analyzer market.

Immuno-based analyzers are expected to grow exponentially over the forecast period due to Immuno-based analyzers utilize techniques such as ELISA, radioimmunoassay, and chemiluminescence immunoassay to measure the concentration of antigens or antibodies in a given sample. These techniques are commonly used in clinical diagnostics to detect and detect x a wide range of diseases and conditions, including infectious diseases, autoimmune disorders, and cancer.

Immuno-based analyzers are highly specific and sensitive, which allows for the accurate and reliable detection of low-level analytes in complex biological samples. Additionally, these analyzers are often highly automated, allowing for a high throughput of samples and reducing the risk of human error.

On the basis of application, the automated analyzers market is divided into drug discovery, genomics, proteomics, bioanalysis, analytical chemistry, and clinical diagnostics, with drug discovery accounting for most of the market because It involves using automated analyzers to screen compounds for potential therapeutic effects.

Furthermore, automated analyzers are critical in drug discovery as they enable the rapid screening of large libraries of compounds for potential therapeutic effects. High-throughput screening (HTS) is a key to drug discovery, and automated analyzers are used to rapidly test thousands of compounds against specific targets cost-effectively and efficiently. This helps to accelerate the drug discovery process and increase the chances of identifying promising drug candidates.

Additionally, automated analyzers are used in lead optimization and ADME/Tox studies to refine drug candidates further and ensure their safety and efficacy. Overall, automated analyzers play a critical role in drug discovery and are essential for advancing the development of new treatments and therapies and further help create demand for drug discovery in the automated analyzers market.

Segments Covered in the Report:

By Analyzer

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

December 2024

November 2024

November 2024