January 2025

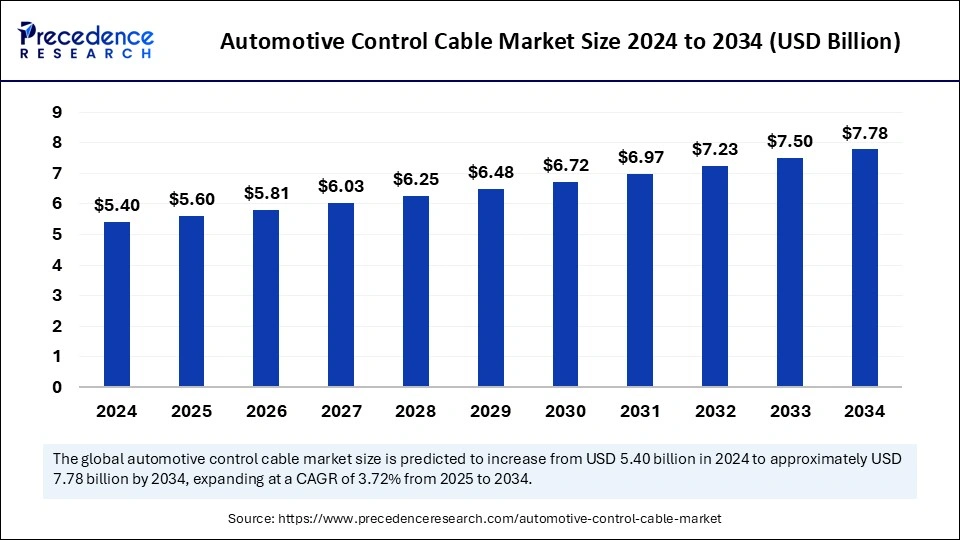

The global automotive control cable market size is calculated at USD 5.60 billion in 2025 and is forecasted to reach around USD 7.78 billion by 2034, accelerating at a CAGR of 3.72% from 2025 to 2034. The Asia Pacific market size surpassed USD 2.27 billion in 2024 and is expanding at a CAGR of 3.84% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive control cable market size was estimated at USD 5.40 billion in 2024 and is predicted to increase from USD 5.60 billion in 2025 to approximately USD 7.78 billion by 2034, expanding at a CAGR of 3.72% from 2025 to 2034. The growth of the automotive control cable market is driven by the rising demand for automotive advancements and safety features. As vehicles become more advanced, the requirement for dependable control systems has escalated, resulting in a notable increase in the production and utilization of cables. Constructed from robust materials, these cables are built to endure demanding conditions, ensuring durability and safety.

In the development of automotive control cables, the use of Artificial Intelligence is considerably improving design optimization, production efficiency, quality assurance, and customization by examining extensive data to detect possible issues, enhance cable routing, identify manufacturing flaws, and tailor cable designs to meet specific vehicle needs, ultimately resulting in greater reliability, cost-effectiveness, and safety of the final product.

AI algorithms can generate a wide range of design options for cable routing and harness layouts while taking into account factors such as spatial constraints, weight restrictions, and signal integrity, enabling engineers to choose the most efficient design. AI can model cable performance under various conditions to detect potential failure areas and refine cable materials and specifications. By examining sensor data from manufacturing equipment, AI can anticipate possible machinery failures, facilitating preventive maintenance and reducing production downtime.

AI-powered machine vision systems can identify defects in cables during their production, including damaged insulation, improper wire termination, or misaligned connectors, allowing for immediate quality control. AI algorithms have the capacity to evaluate historical data to enhance production scheduling, manage inventory effectively, and predict demand for various cable configurations.

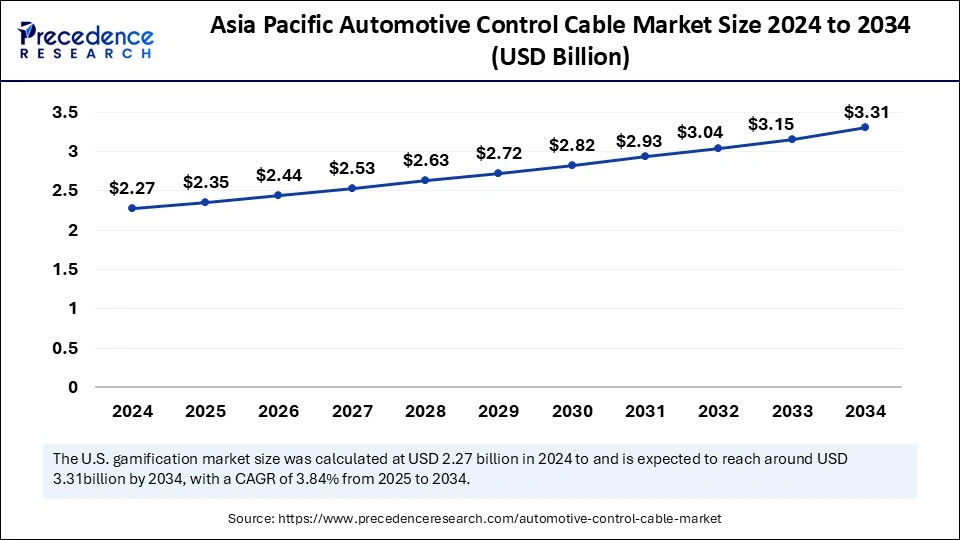

The Asian Pacific automotive control cable market size was exhibited at USD 2.27 billion in 2024 and is projected to be worth around USD 3.31 billion by 2034, growing at a CAGR of 3.84% from 2025 to 2034.

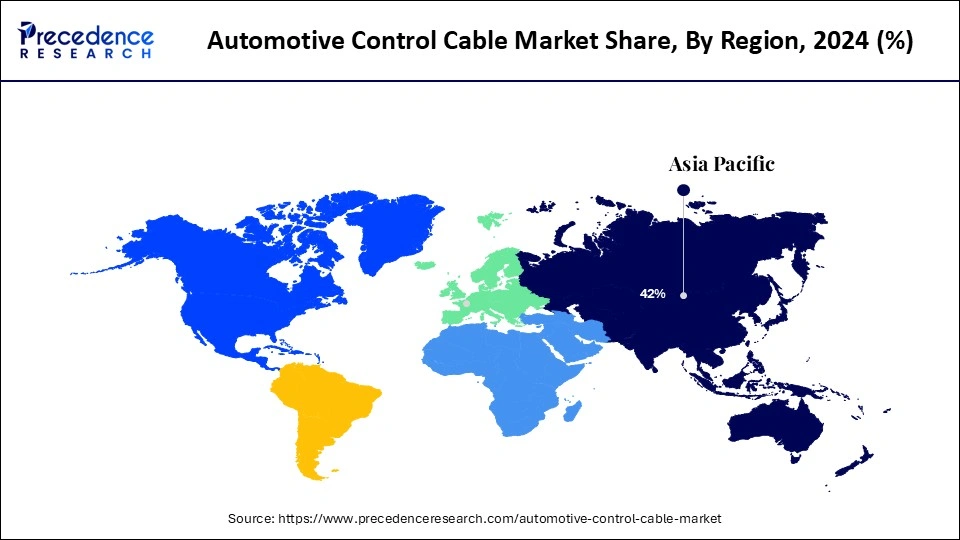

Asia Pacific dominates the automotive control cable market with the largest market share because of its vast population, growing middle class, and rapidly expanding vehicle production. The accelerated urbanization and significant growth of vehicle manufacturing in major markets like China and India are key contributors to the rising demand for automotive control cables in this area. OEMs such as Geely are strategically broadening their product offerings and production capabilities to address this growing market, providing a wide array of control cable solutions tailored to the specific requirements of local consumers. This encompasses the creation of cost-efficient cable options for mass-market vehicles, along with high-performance cables designed for premium and electric vehicles.

The expansion of the aftermarket sector in Asia Pacific is generating more opportunities for control cable suppliers, as there's an increasing need for replacement parts and accessories. The increasing adoption of sophisticated vehicle technologies, such as ADAS and electric powertrains, is also propelling the demand for specialized control cables that meet the rigorous performance and reliability standards of these systems.

North America is the fastest-growing market for automotive control cables, with a notable Compound Annual Growth Rate (CAGR) during the forecast period. The region's growing focus on sustainability and efficiency is driving considerable investments in high-performance control cables that enhance fuel economy and lower emissions. Companies like Ford are proactively integrating advanced cable technologies into their electric vehicle lineups, including high-voltage cables for energy distribution and specialized cables for battery management systems.

The shift towards electric vehicles and the evolution of ADAS are fueling a demand surge for innovative and dependable cable solutions. Moreover, the stringent regulatory requirements in North America, especially concerning safety and emissions, are prompting the use of high-quality control cables that fulfill these standards. The rising focus on vehicle connectivity and automation is also influencing the demand for advanced cable technologies that can support these capabilities. The North American automotive control cable market is set for significant growth in the years ahead, driven by a combination of factors, including the increased adoption of electric vehicles, the growing focus on sustainable practices, and the ongoing advancement of automotive technology.

Automotive control cables are vital elements in vehicles that convey mechanical force from the driver-operated controls to the associated systems in the automobile, such as the throttle, clutch, and brakes. They are critical in managing numerous functions of a vehicle. These cables link various vehicle parts, including the throttle, brakes, and gear shift, facilitating smooth operation and improved performance. Constructed from robust materials, these cables are built to endure demanding conditions, ensuring durability and longevity. Their precise engineering allows for accurate control, enhancing the overall safety and functionality of the vehicle.

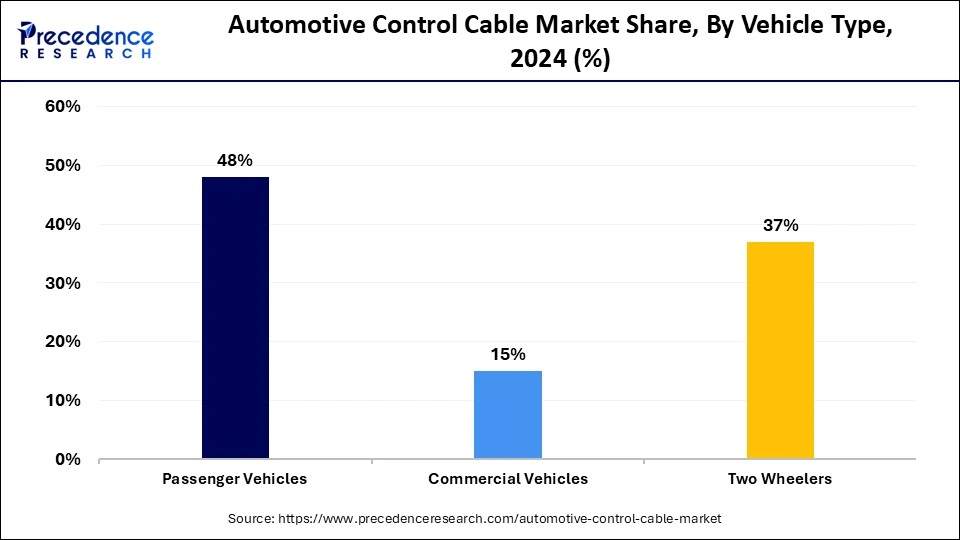

The market for automotive control cables is currently experiencing significant expansion, driven by the increasing demand for automotive innovations and safety features. As vehicles become more advanced, the requirement for dependable control systems has escalated, resulting in a notable increase in the production and utilization of cables. Major market segments encompass applications ranging across passenger vehicles, commercial vehicles, and motorcycles. North America, Europe, and Asia Pacific are observing strong market activities due to an increase in automotive production and a transition towards electric vehicles. The market landscape is defined by technological progress and a commitment to improving vehicle performance and safety.

Technological advancement: As the automotive sector advances with more sophisticated electronic systems, the need for dependable and high-performance control cables has risen significantly. Features of advanced driver assistance systems (ADAS), such as adaptive cruise control, lane departure warnings, and automatic emergency braking, depend on a network of sensors, cameras, and electronic control units (ECUs) to improve vehicle safety and enhance the driving experience. These systems demand precise and responsive control cables to command and transmit signals accurately.

Development of autonomous vehicles: The push towards autonomous driving capabilities has further highlighted the critical need for reliable control cables. Self-driving vehicles require a strong and redundant system of control cables to ensure that essential functions like steering, braking, and throttle control continue to operate even if a single point of failure occurs.

Investments in research and development: The Government and the company's growing investments in R&D are driving innovations and developments of cutting-edge technologies, including automotive control cable.

Advancement in materials and manufacturing process: Advancements in materials and production methods have also supported the growth of the automotive control cable market. Companies are investigating lightweight and corrosion-resistant materials, such as stainless steel and high-performance polymers, to enhance the functionality and durability of control cables.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.78 Billion |

| Market Size in 2025 | USD 5.60 Billion |

| Market Size in 2024 | USD 5.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.72% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Cable Type, Material Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing focus on vehicle safety standards

The increased focus on strict vehicle safety standards and regulations is considerably impacting the Global Automotive Control Cable Market. Safety remains a key priority for both automotive manufacturers and consumers, leading to a concerted effort to improve vehicle safety features. Regulatory authorities are enacting more comprehensive safety policies that mandate the incorporation of dependable and strong control systems within vehicles.

Control cables, essential to the operation of various safety systems like airbags and antilock braking systems, have become more crucial than ever. This ongoing dedication to enhancing vehicle safety generates a higher demand for quality automotive control cables, thus creating market opportunities for manufacturers aiming to meet these requirements.

The rapid growth of urban areas and infrastructures has resulted in the establishment of more roads and routes for traffic movement. People are traveling more frequently than in the past. Various governing organizations are initiating programs to encourage the use of public transport. This increase in the movement enabled by automobiles leads to a reduction in the lifespan of vehicles and their components. Consequently, numerous spare parts, including automotive control cables, require replacement. Thus, urban growth is anticipated to drive the automotive control cable market forward during the forecast period.

The rising use of drive-by-wire technology

Drive-by-wire, also referred to as x-by-wire, involves replacing mechanical linkages in vehicle control systems with electronic or electromechanical systems. This technology removes the necessity for physical cables, substituting them with electronic signals conveyed through wires. The adoption of drive-by-wire technology is influenced by several factors, such as enhanced efficiency, weight reduction, and improved functionality. The growing emphasis on vehicle electrification is driving the uptake of drive-by-wire technology.

Electric vehicles demand sophisticated control systems to manage the intricate interactions among the battery, motor, and charging systems. As drive-by-wire technology progresses and matures, it presents a considerable challenge to the traditional cable market. The removal of physical cables diminishes the demand for control cables, as they are no longer necessary for transmitting mechanical motion. This transition to electronic control systems is likely to significantly affect the market, compelling manufacturers to adjust their product lines and seek new opportunities within the drive-by-wire framework.

BMW's latest vehicle models are equipped with a sophisticated drive-by-wire steering system that employs electronic signals for steering control, removing the necessity for a conventional steering column and cables. This innovation reduces weight and facilitates more precise control and integration with additional vehicle systems, including lane-keeping assistance and features for autonomous parking.

Increasing manufacturing of vehicles

The growth in global vehicle manufacturing is a key factor driving the expansion of the global automotive control cable market. As nations progress and disposable incomes increase, a larger number of consumers are acquiring vehicles, resulting in rising production levels. This increase in automobile demand is directly linked to the necessity for critical components, such as control cables. With a rising trend towards personalized mobility, the automotive industry is frequently creating a range of vehicles designed to satisfy various consumer preferences. As a result, this development boosts the quantity of automotive control cables needed across different vehicle categories, significantly contributing to market expansion.

The passenger car segment dominates the market with the largest market share, fueled by a broad consumer base and a continuous craving for state-of-the-art features. This segment is at the leading edge of technology adoption, with key manufacturers such as Toyota and Volkswagen making significant investments in advanced cable technologies aimed at enhancing vehicle performance and safety. This encompasses the use of high-precision cables for advanced driver-assistance systems, including lane departure warning and adaptive cruise control, as well as the development of lightweight, resilient cables to enhance fuel efficiency and lower emissions. Additionally, the growing trend toward the electrification of passenger vehicles is accelerating the creation of specialized cable solutions for battery management systems and electric motor control, resulting in a spike in demand for innovative and dependable cable technologies.

The commercial vehicle segment is witnessing the fastest growth, showing a remarkable CAGR throughout the forecast period. This increase is primarily due to the rising implementation of electric and autonomous technologies in heavy-duty vehicles. The flourishing e-commerce and logistics industries are driving a significant rise in the demand for reliable control cables in trucks and buses. Companies like Daimler are designing robust control cable systems to satisfy the stringent demands of heavy-duty applications. This includes the creation of cables that can endure extreme temperatures, vibrations, and mechanical stress, ensuring optimal functionality and safety in challenging operating conditions. Furthermore, the incorporation of telematics and fleet management systems is boosting the need for smart cable solutions capable of providing real-time insights into cable performance and wear, facilitating proactive maintenance, and reducing downtime. The transition towards electric commercial vehicles is also prompting the development of high-voltage cables for power distribution and motor control.

The inner core segment dominates the market with the largest market share. Inner cores act as the primary pathways for transmitting signals and control actions, which is crucial for the accurate functioning of modern vehicles. These cores are designed to offer reliable performance across various conditions, often made from high-tensile strength materials and equipped with low-friction coatings to ensure smooth and dependable signal transmission. Breakthroughs in material science have enabled the creation of inner cores with improved flexibility and durability, facilitating more intricate cable routing and better wear resistance. Additionally, the increasing incorporation of electronic systems in vehicles has heightened the demand for inner cores that can manage high-frequency signals and reduce signal loss, guaranteeing the precision and reliability of electronic control systems.

The protective covers segment is expected to be the fastest-growing market, with a significant rate during the forecast period. Protective covers are essential for shielding inner cores from environmental threats, such as moisture, chemicals, abrasion, and extreme temperatures, thus ensuring lasting reliability and performance. The rising focus on vehicle durability and safety has driven a strong demand for high-quality protective covers. Advances in this area include the innovation of advanced polymer coatings and shielding materials that offer exceptional resistance to environmental deterioration. Moreover, the growing complexity of vehicle wiring systems and the need for improved electromagnetic compatibility (EMC) have increased the demand for specialized protective covers that come with integrated shielding and insulation capabilities. The upsurge of electric vehicles, which feature high-voltage systems and challenging operating conditions, has further heightened the demand for sturdy protective covers that can ensure the secure and reliable functioning of crucial cable systems.

The steel segment holds a dominant position in the market, securing the largest portion due to its intrinsic strength and durability qualities considered vital across various vehicle applications. The resilient characteristics of steel enable it to endure significant tensile forces and severe environmental conditions, making it a dependable option for essential control cable functions. As global vehicle production continues to rise, the need for control cables, and thus for steel-based solutions, increases correspondingly, presenting significant opportunities for this sector. This encompasses the use of high-strength steel alloys in brake cables, clutch cables, and throttle cables, where dependability and longevity are critical. Additionally, progress in steel processing and coating technologies has resulted in enhanced corrosion resistance and improved fatigue life, boosting the overall performance and longevity of steel-based control cables.

The aluminum segment is experiencing the fastest growth, with a significant CAGR throughout the forecast period. Aluminum provides an attractive, lightweight substitute for steel, which greatly enhances fuel efficiency in contemporary automotive designs. The push for lighter vehicles, motivated by strict emissions standards and consumer preferences for fuel-efficient automobiles, is accelerating the use of aluminum control cables. Furthermore, innovations in aluminum alloy development and manufacturing processes have improved its strength-to-weight ratio and resistance to corrosion, making it a suitable option for a wider array of applications. This includes the incorporation of aluminum in control cables for electric vehicles, where minimizing weight is essential for optimizing range and performance. Additionally, the increasing emphasis on design innovation and manufacturing efficiency in the automotive field is boosting the use of aluminum control cables, as they provide enhanced design flexibility and easier installation compared to traditional steel cables. The recyclability of aluminum also corresponds with the rising focus on sustainability within the automotive industry, further propelling its market expansion.

The throttle control cable segment dominates the automotive control cable market, holding the largest share due to its essential role in managing engine functions. These cables serve as a critical connection for accurate acceleration control, which is becoming more sought-after in contemporary vehicles. Original equipment manufacturers (OEMs) like Ford incorporate advanced throttle control cable systems in their newest models, which emphasize improved responsiveness and overall performance. This includes the use of innovative materials and designs that reduce friction and enhance feedback, resulting in a more polished driving experience. Additionally, the emergence of electronic throttle control (ETC) systems has driven advancements in hybrid cable-electronic solutions, where cables act as a reliable mechanical backup to ensure operation in crucial scenarios.

The brake control cable segment is expected to experience the fastest growth, with a notable CAGR in the forecast period. This increase is linked to the essential safety role of brake control cables, which enable effective communication between the brake pedal and the braking system. Firms such as Bosch are leading this innovation, creating cables that boost braking performance and safety features. Innovations include the adoption of high-strength materials, corrosion-resistant coatings, and designs that reduce cable stretch and enhance responsiveness. Furthermore, the incorporation of sensor technology in brake cable systems allows for real-time monitoring of cable tension and wear, aiding in predictive maintenance and enhanced overall vehicle safety. The growing implementation of ADAS and autonomous driving technologies is also fueling the demand for dependable and accurate brake control systems, driving the expansion of this segment.

By Vehicle Type

By Cable Type

By Material Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025