January 2025

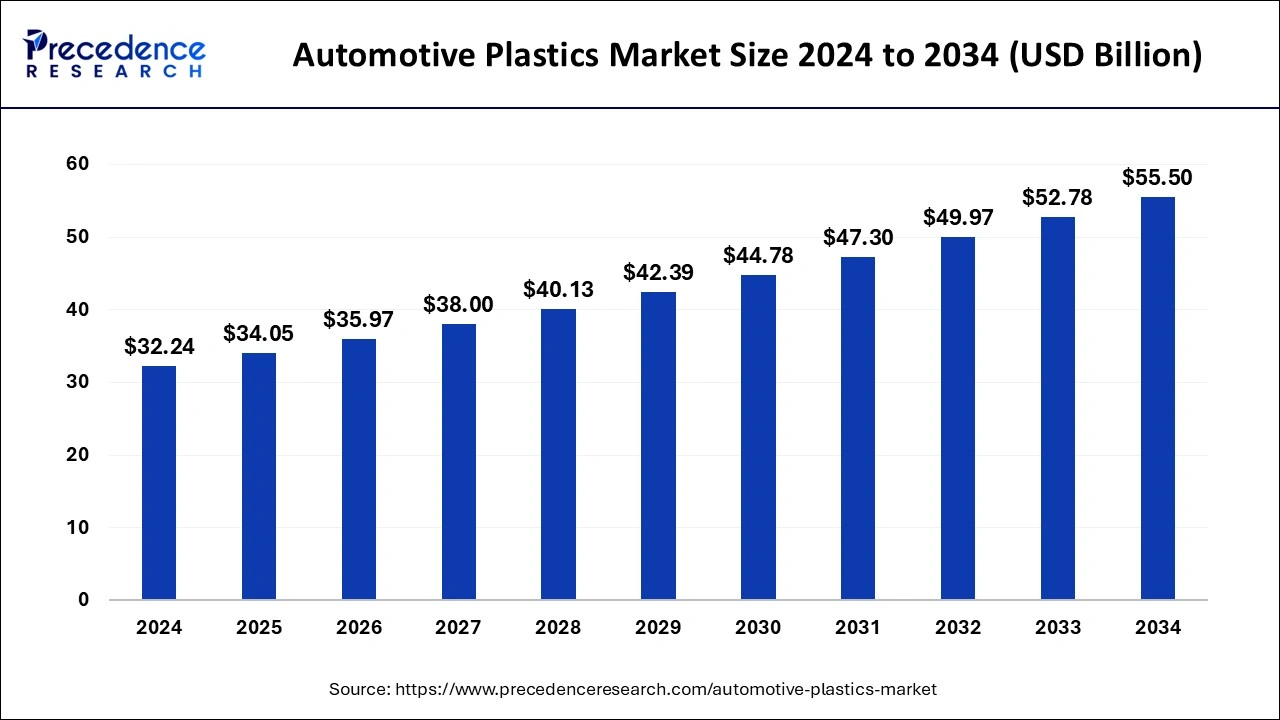

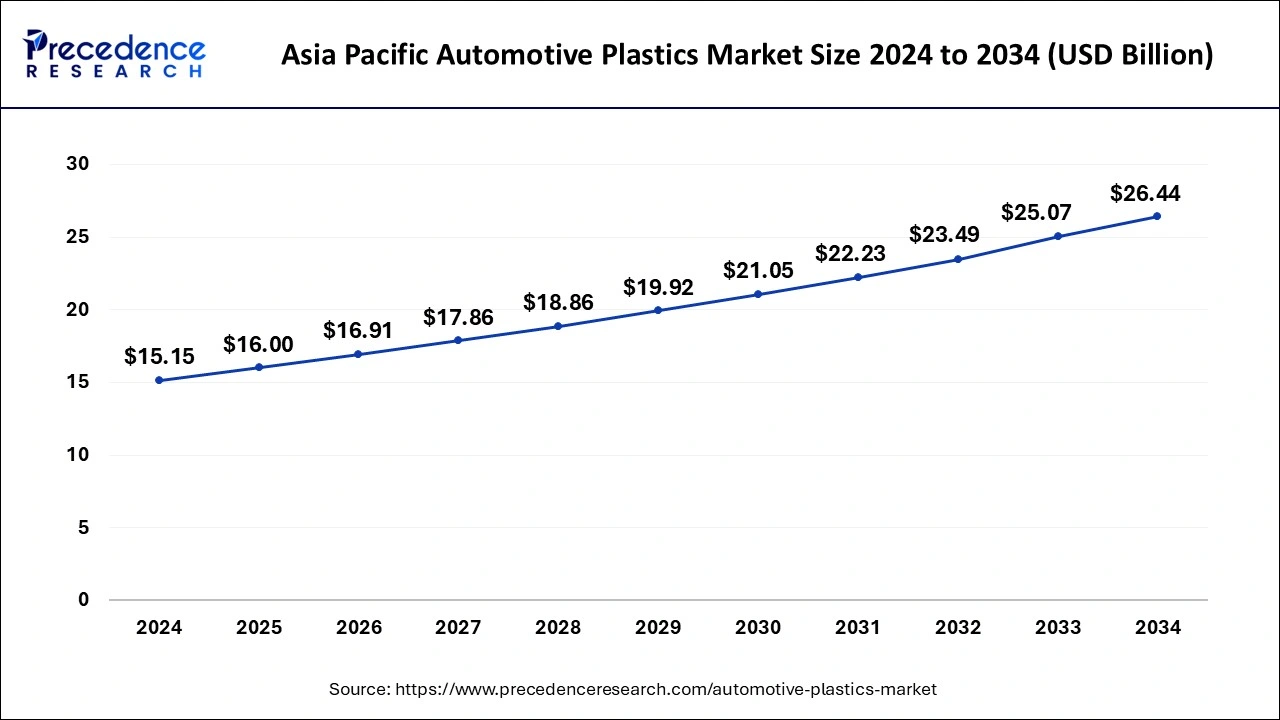

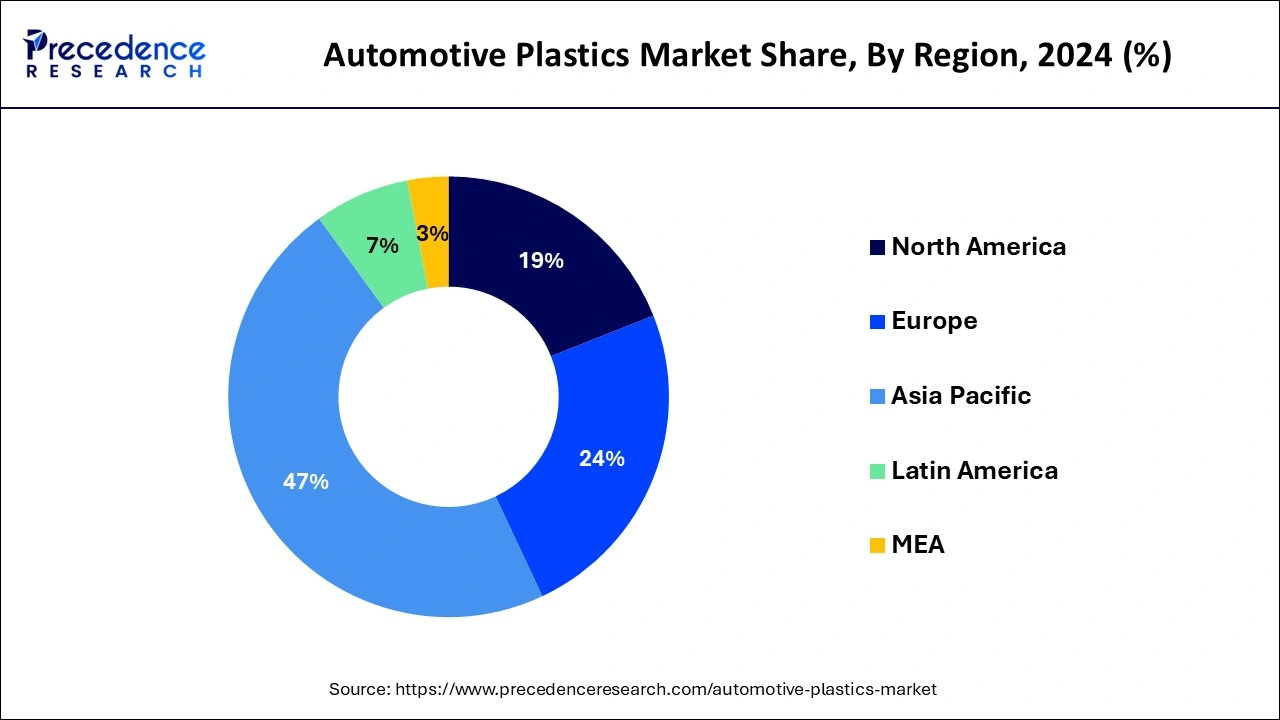

The global automotive plastics market size is calculated at USD 32.24 billion in 2025 and is forecasted to reach around USD 55.50 billion by 2034, accelerating at a CAGR of 5.58% from 2025 to 2034. The Asia Pacific automotive plastics market size surpassed USD 16.00 billion in 2025 and is expanding at a CAGR of 5.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive plastics market size was estimated at USD 32.24 billion in 2024 and is predicted to increase from USD 34.05 billion in 2025 to approximately USD 55.50 billion by 2034, expanding at a CAGR of 5.58% from 2025 to 2034. Automotive plastics can withstand high weather conditions like extreme dry and wet conditions, rapid temperature swings, and intense sunlight and UV rays. They also have excellent chemical and heat resistance and more energy efficiency, which helps the market's growth.

The Asia Pacific automotive plastics market size was valued at USD 15.15 billion in 2024 and is projected to reach around USD 26.44 billion by 2034 with a CAGR of 5.72% from 2025 to 2034.

Asia Pacific dominated the automotive plastics market in 2024. The increased demand for lightweight vehicles helps to the growth of the market in the region. In passenger car applications, automotive plastics are in high demand due to their lightweight properties. In India, China, and Japan, automotive production is high, and the use of automotive plastics is increasing, which leads to the growth of the market in this region. In India, there is a high demand for polypropylene (PP) types of automotive plastics. These factors help to the growth of the market in Asia Pacific.

Europe is projected to host the fastest-growing automotive plastics market during the forecast period of 2025-2034. The European automotive industries are moving towards the use of automotive plastics-based vehicles. In Europe, polypropylene (PP) type of automotive plastics is highly used. These factors help the region's growth.

The automotive plastics market refers to a wide range of polymer materials used in the automotive industry for various vehicle components and parts. These materials offer many advantages over traditional materials like glass and metal, including lighter weight, improved efficiency, improved design flexibility, and corrosion resistance. The benefits of automotive plastics include delivering more design flexibility for circularity and durability, support for reliable and safe vehicle operation, offering greater styling, improving fuel efficiency, meeting performance goals, cost savings, enhancing design freedom, and reducing weight. These benefits help to the growth of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 34.05 Billion |

| Market Size By 2034 | USD 55.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.58% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Process, Application, Vehicle and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising use in the automotive industries

The use of automotive plastics is high in the automotive industry. These are used in the automotive industry because they help to reduce emissions in vehicles, they help to improve fuel efficiency, and have more design flexibility for improving recyclability and durability; automotive plastics are lightweight materials that replace metals and help to reduce vehicle weight. These qualities make automotive plastics ideal for the automotive industry. Expensive metal materials are gradually replaced by automotive plastics in the industry because of their mechanical properties and machinability. These factors help the growth of the automotive plastics market.

Disadvantages of automotive plastics

The disadvantages of automotive plastics include recyclability, waste management, and environmental impact. Automotive plastics and composites are used in the automotive industries in heterogeneous ways, and these are difficult to release for recycling. The disposal, production, and consumption of the components of automotive plastics can affect the economic costs. Automotive plastics may affect the economy and the environment. The regulatory, technical, and economic challenges can hamper the growth of the market. Automotive plastics can lead to environmental and health problems. These disadvantages can restrict the growth of the automotive plastics market.

Research and development

Investment in research and development for the various innovative applications of automotive plastics helps the growth of the market. High demand for lightweight and electric vehicles helps to reduce environmental problems and contributes to the growth of the market. In modern cars, automotive plastics are the main component, and when it comes to the disposal of ELVs (end-of-life vehicles), capturing these automotive plastics for recycling and reuse will be an opportunity for the growth of the market. The government should be involved in government regulations to reduce emissions that help the growth of the automotive plastics market.

The polypropylene (PP) segment dominated the automotive plastics market in 2024. Polypropylene (PP) is used as automotive plastics in various industries, such as the automotive industry for many components and parts. These include tires, suspension insulators, soundproof and air filtering systems, headrests, seats, engine covers, battery cases, dashboard components, door panels, interior trims, and bumpers. Automotive plastics like polypropylene (PP) are widely used for cars or other vehicles because of their ability to adopt several plastic fabrication methods and their heat and chemical resistance. Polypropylene (PP) has crystal clearer transparency than polyethylene. It has outstanding mechanical properties and high resistance to freezing, heat, impact, and fatigue. Polypropylene (PP) is hard and may be used for structural and mechanical applications that help the growth of the segment. These factors help the growth of the polypropylene (PP) product type segment and contribute to the growth of the market.

The polyvinyl chloride (PVC) segment is projected to grow at the fastest rate in the automotive plastics market during the forecast period. Polyvinyl chloride (PVC) is also called vinyl, and it is a versatile and economical thermoplastic polymer that is highly used in the construction and building industry. Polyvinyl chloride (PVC) is used in the automobile industry and plays the main role in helping to make modern automobiles of high quality, safe, and cost-effective. It helps to reduce their effect on the environment. Polyvinyl chlorides (PVC) are also used for a high range of auto parts, including blow molding, compression molding, injection molding, and extrusion processes that help the growth of the polyvinyl chloride (PVC) product type segment and contribute to the growth of the automotive plastics market.

The injection molding segment dominated the automotive plastics automotive plastics market in 2024. Automotive plastics are commonly used in injection molding. In the automotive industry, the most common type of injection molding is thermoplastic injection molding, which makes use of materials like ABS (acrylonitrile butadiene styrene), nylon, and polypropylene for the manufacturing of automobile parts. Other injection molding materials are used in automotive parts, including polyurethane (PE), polymethyl methacrylate (PMMA), polyamide (PA), etc. The injection molding process is beneficial for automotive plastic parts production because of their repeatability, material availability, high surface finish quality, color options, fast prototype with rapid tooling, etc., properties. These factors help to the growth of the injection molding process type segment and contribute to the growth of the market.

The interior furnishing segment dominated the automotive plastics market in 2024. Automotive plastics are used for interior furnishing. In the car interiors, different types of plastics are used, including polyurethane (PU), polycarbonate (PC), polyethylene (PE), polystyrene (PS), acrylonitrile butadiene styrene (ABS), and polyvinyl chloride (PVC). These automotive plastics are used in car interior furnishings like instrumental panels, trims, and bumpers. Automotive plastics are commonly used for steering wheels, armrests, headrests, and car seats because of their cost-effectiveness, lightweight, and durability properties. These factors help the growth of the interior furnishing application type segment and contribute to the growth of the market.

The electrical components segment will grow at the fastest rate in the automotive plastics market during the forecast period. Automotive plastics may be insulators or electric conductors. It plays a unique role as an alternative to driving trains and batteries. Increasing demand for reduction in greenhouse gas (GHG) emissions. These automotive plastics may reduce weight and help electric vehicles to deliver with greater driving ranges. Electric vehicles emit less heat than internal combustion engine cars. Due to the lighter weight of the components, automotive plastics are used in electrical component applications. These factors help the growth of the electrical components application type segment and contribute to the growth of the automotive plastics market.

The exterior furnishing segment will grow significantly during the forecast period. For exterior furnishing applications, automotive plastics are helpful due to their longevity and durability properties. These automotive plastics have design flexibility, greater styling, and lighter properties. As compared to traditional automotive materials like glass and metals, automotive plastics offer major advantages. For the vehicle exteriors like trims, liftgates, hoods, bumpers, and lights, there are automotive plastics used. These types of automotive plastics are used for the automotive body parts of vehicles. These automotive plastics help to improve safety and to reduce emissions. These benefits help the growth of the exterior furnishing application type segment and contribute to the growth of the growth of the automotive plastics market.

The passenger cars segment dominated the automotive plastics market in 2024. In the passenger cars vehicle type automotive plastics are used. The passenger cars' vehicles include internal combustion engine (ICE) vehicles and electric vehicles. Electric vehicles include battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), and fuel cell electric vehicles (FCEV). Automotive plastics are used in vehicles because of their performance, fuel efficiency, increased safety, low cost, high chemical resistance, and lightweight properties. These automotive plastics help to replace metals and provide more design flexibility to improve recyclability and durability. These factors help to the growth of the passenger cars vehicle type segment and contribute to the growth of the market.

By Product

By Process

By Application

By Vehicle

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

July 2024

December 2024