January 2025

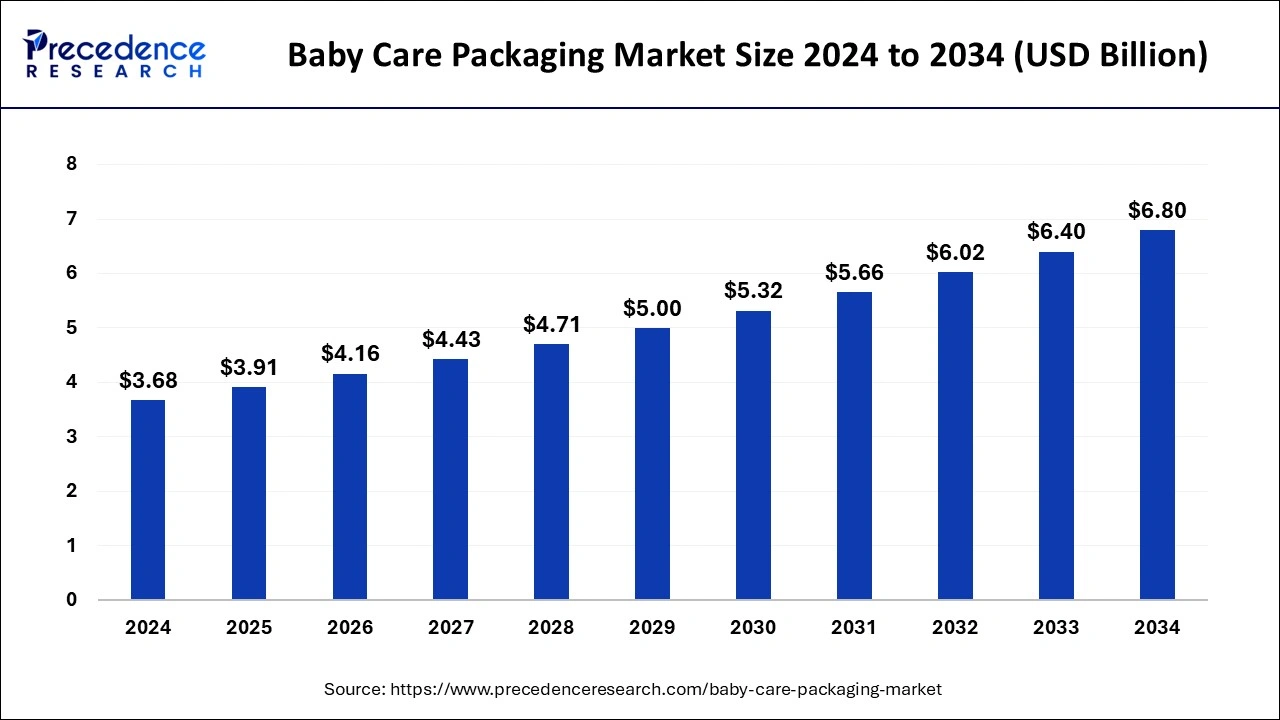

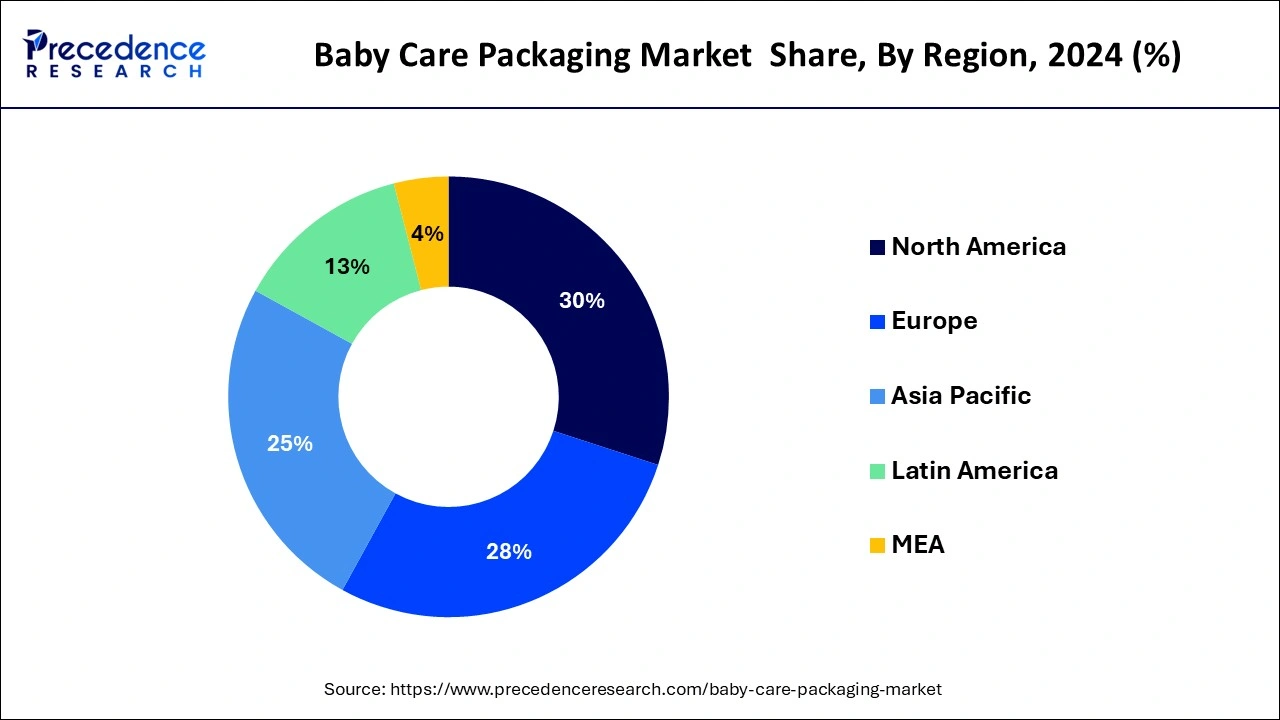

The global baby care packaging market size is calculated at USD 3.91 billion in 2025 and is forecasted to reach around USD 6.80 billion by 2034, accelerating at a CAGR of 6.33% from 2025 to 2034. The North America baby care packaging market size surpassed USD 1.10 billion in 2024 and is expanding at a CAGR of 6.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global baby care packaging market size was estimated at USD 3.68 billion in 2024 and is predicted to increase from USD 3.91 billion in 2025 to approximately USD 6.80 billion by 2034, expanding at a CAGR of 6.33% from 2025 to 2034.

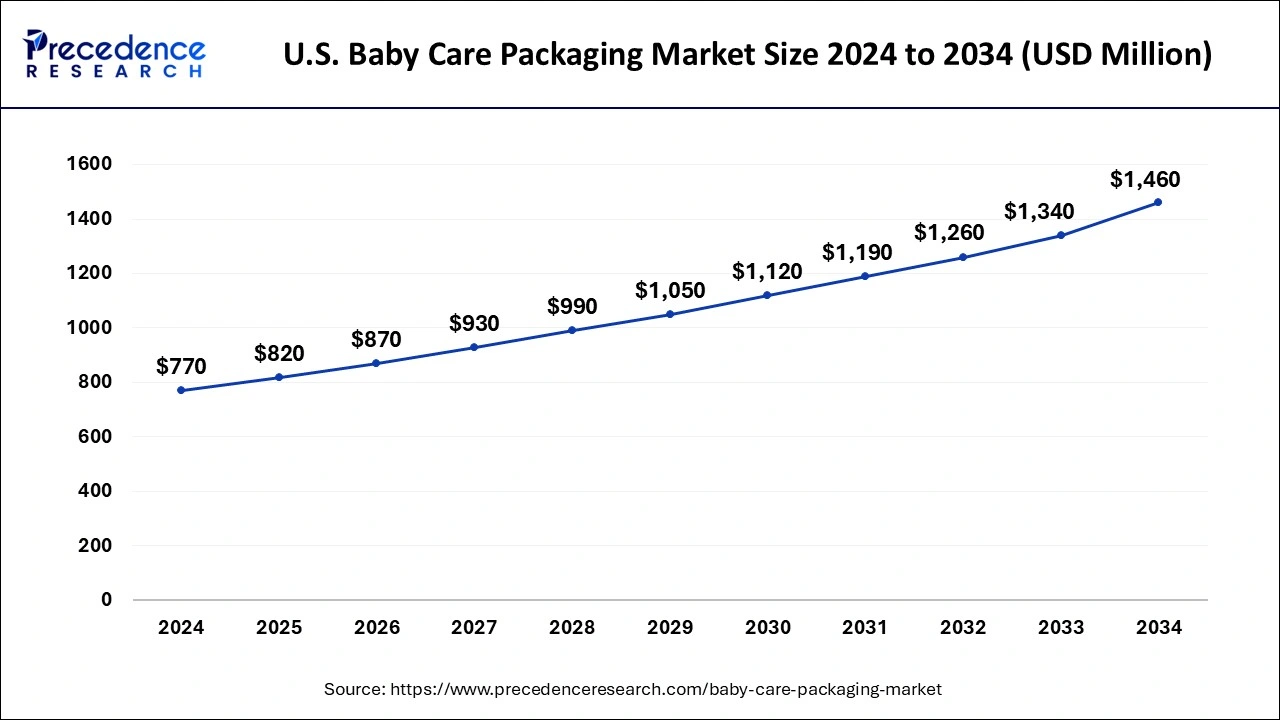

The U.S. baby care packaging market size was valued at USD 770 million in 2024 and is predicted to attain around USD 1460 million by 2034, expanding at a CAGR of 6.61% from 2025 to 2034.

North America dominated the market with largest revenue share of 30% in 2024. North America is a mature baby care packaging market characterized by high levels of product innovation, stringent regulatory standards, and strong consumer demand for premium and sustainable packaging options. The United States and Canada are significant contributors to the North American market, driven by increasing birth rates, rising disposable incomes, and a growing preference for eco-friendly and convenient solutions. Critical trends in the region include adopting sustainable packaging materials, such as biodegradable plastics and recycled content, to meet consumer demands for environmentally friendly products. Additionally, innovations in packaging designs and technologies, such as smart packaging and digital integration, are gaining traction in the North American market.

Asia-Pacific is a rapidly growing baby care packaging market fueled by population growth, urbanization, rising disposable incomes, and changing consumer lifestyles. China, India, Japan, and South Korea are key markets in Asia-Pacific, driven by large populations, increasing birth rates, and a growing middle-class population with higher purchasing power. Demand for baby care packaging formats, such as single-serve portions, resealable pouches, and travel-friendly packaging options. Additionally, there is a growing interest in premium and imported baby care products, driving demand for high-quality and aesthetically pleasing packaging designs.

Europe also contributes to the baby care packaging market characterized by stringent regulatory requirements, sophisticated consumer preferences, and a strong emphasis on sustainability and environmental responsibility. Countries in Western Europe, such as Germany, France, and the United Kingdom, are significant players in the European market, driven by high birth rates, increasing urbanization, and a growing demand for organic and natural baby care products. Sustainable packaging solutions, including bio-based plastics, compostable materials, and recyclable packaging, are increasingly popular in Europe, supported by government initiatives and consumer awareness campaigns promoting sustainable consumption practices.

The baby care packaging market is an essential segment within the broader packaging industry, specifically catering to products designed for infants and young children. The market is significant and continues to grow steadily. The market encompasses various types of packaging solutions, including bottles, containers, pouches, tubs, tubes, and closures, explicitly designed for baby care products such as baby food, baby wipes, diapers, shampoos, lotions, and powders factors such as population growth and increasing. Population growth, increasing disposable incomes, urbanization, and charging lifestyles contribute to developing the market.

The baby care packaging products are distributed through various channels, including supermarkets, hypermarkets, pharmacies, specialty baby stores, and online retailers. Manufacturers often collaborate with retailers to develop customized packaging solutions and ensure the broad availability and accessibility of their products to parents and caregivers.

The baby care packaging market is highly competitive, with several multinational and regional players operating. Some leading companies in the market include Procter & Gamble, Kimberly-Clark Corporation, Johnson & Johnson, Nestle, Unilever, and Henkel. These companies invest heavily in research and development, product innovation, and marketing to maintain their competitive edge in the market. The market is dynamic and evolving, driven by safety, sustainability, innovation, and changing consumer preferences. As parents increasingly prioritize baby care products' safety, convenience, and environmental impact, the demand for high-quality, sustainable packaging solutions will continue growing globally.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.33% |

| Market Size in 2025 | USD 3.91 Billion |

| Market Size by 2034 | USD 6.80 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material and By Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product differentiation and branding

Packaging is vital for product differentiation and branding in the competitive baby care packaging market. Eye-catching designs, vibrant colors, and attractive graphics help brands stand out on store shelves and capture consumers’ attention. Customized packaging options, such as personalized labels or unique shapes, allow brands to create a distinct identity and build brand loyalty among consumers.

Innovation in packaging materials and designs

Ongoing innovation in packaging materials and designs drives market growth by offering improved functionality, sustainability, and aesthetics. Manufacturers are developing packaging solutions made from lightweight, durable, and eco-friendly materials that meet consumer preferences for sustainability and environmental responsibility. Advanced packaging designs, such as easy-open tabs, ergonomic shapes, and stackable containers, enhance user experience and convenience.

E-commerce growth

The growth of e-commerce channels has expanded access to baby care products, driving demand for packaging solutions optimized for online retail. E-commerce-friendly packaging features such as secure seals, protective packaging materials, and compact designs ensure product safety and compliance with health standards. Packaging manufacturers must adhere to regulatory requirements related to materials, labeling, and safety warnings. Compliance with these regulations instills consumer confidence and trust in baby care products, driving market demand.

Cost constraints and sustainability challenges

Cost consideration is a significant restraint in the baby care packaging market. Manufacturers must balance the need for high-quality, functional packaging with cost-effectiveness to remain competitive. However, investments in innovative materials, designs, and features that enhance product safety, convenience, and attractiveness may result in higher production costs, limiting profit margins. While there is growing demand for sustainable and eco-friendly packaging solutions in the baby care market, transitioning to sustainable materials and practices presents challenges.

Sustainable packaging options such as biodegradable plastics, compostable materials, and recycled content may have limited availability, higher costs, or inferior performance compared to traditional packaging materials. Balancing sustainability goals with product safety, functionality, and cost-effectiveness remains challenging for manufacturers.

Customization and personalization

Offering customized and personalized packaging options allows manufacturers to cater to individual preferences and create unique brand experiences. Customized packaging solutions, such as personalized labels, graphics, or packaging sizes, enable brands to connect with consumers personally and build brand loyalty. Personalization also allows manufacturers to address niche markets and target specific consumer segments with tailored packaging offerings. Manufacturers can capitalize on this opportunity by developing added convenience packaging solutions, such as single-serve portions, resealable closures, and travel-friendly formats. Packaging innovations that simplify product usage, storage, and transportation meet the needs of busy parents and caregivers, enhancing product appeal and usability.

Health and safety features

As consumers prioritize safety and hygiene in baby care packaging market products, packaging manufacturers can leverage this opportunity by developing packaging solutions with enhanced safety features. Packaging materials and designs that prevent contamination, tampering, and spoilage ensure product integrity and consumer trust. Incorporating antimicrobial coatings, tamper-evident seals, and child-resistant closures enhances product safety and addresses consumer concerns.

Digital integration and smart packaging

Integrating digital technologies and smart features into packaging creates enhanced functionality and connectivity opportunities. Smart packaging solutions, such as QR codes, NFC tags, or RFID sensors, enable interactive experiences, product authentication, and real-time information access for consumers. Digital integration also facilitates supply chain visibility, inventory management, and marketing analytics for manufacturers.

The rigid plastics segment dominated the market in 2024. Rigid plastics, such as polyethylene, polypropylene, and polyethylene terephthalate, are widely used in the baby care packaging market due to their durability, lightweight, and versatility. Plastic bottles, containers, and jars are commonly used for baby food packaging, beverages, lotions, and shampoos. Advantages of rigid plastic packaging include resistance to breakage, ease of handling, and compatibility with various manufacturing processes, such as injection molding and blow molding. Rigid metal packaging, primarily aluminum and steel, is used in baby care products such as baby food, formula, and snacks. Metal packaging is recyclable and has a high recycling rate, contributing to sustainability efforts in the baby care industry.

The paper and board packaging segment is expected to grow fastest during the forecast period. Paper and board are commonly used for baby care products such as diapers, wipes, and boxes. Paper-based packaging materials, including cardboard, paperboard, and corrugated board, offer strength, flexibility, and printability, making them suitable for branding and marketing. Paper and board packaging is lightweight, cost-effective, and recyclable, aligning with sustainability goals and consumer preferences for eco-friendly packaging options in the baby care packaging market.

Flexible packaging, including films, pouches, and bags, is widely used in baby care products such as baby food, snacks, and wipes. Flexible packaging offers lightweight, space-saving, and convenience advantages, making it ideal for on-the-go use and travel. It also provides excellent barrier properties, protecting products from moisture, oxygen, and contaminants.

Glass packaging, primarily used for baby food jars and bottles, offers several advantages, such as transparency, chemical inertness, and recyclability. Glass containers are non-toxic, odorless, and impermeable, preserving the freshness, flavor, and nutritional value of baby food products. They also provide an elegant and premium look, enhancing product appeal on store shelves. Glass packaging is 100% recyclable and can be recycled indefinitely without losing quality, making it a sustainable choice for environmentally conscious consumers.

The baby wet meals segment dominated the market in 2024. Baby wet meals, including purees, mashed vegetables, and fruit blends, are typically packaged in convenient and portable containers such as jars, pouches, or tubs. Packaging for baby wet meals emphasizes safety, freshness, and convenience, with features such as tamper-evident seals, resealable closures, and portion-sized servings. Transparent packaging materials, such as clear plastic or glass jars, allow parents to see the contents and check for freshness before purchase. Innovations in baby wet meal packaging include single-serve pouches with spouts for easy feeding on the go and microwaveable containers for quick and convenient heating.

Besides, the baby milk products segment is expected to grow at the fastest rate in the baby care packaging market. Baby milk products, including infant formula and follow-on formula, are growing at the fastest rate and are typically packaged in cans, bottles, or cartons with secure closures and tamper-resistant seals. The baby care packaging market for baby milk focuses on preserving product freshness, preventing contamination, and ensuring accurate portioning and measurement. Manufacturers may use specialized packaging materials, such as aluminum cans or multi-layered cartons, to protect the nutritional integrity of the milk and extend its shelf life.

Convenience features such as scoop holders, measuring scoops, and easy-grip handles enhance usability and user experience for parents. Baby cereals and dry meals, including rice cereal, oatmeal, and multi-grain blends, are typically packaged in resealable bags, boxes, or canisters to maintain freshness and prevent moisture absorption. Packaging for baby cereals and dry meals may feature clear windows or transparent panels to allow consumers to see the product inside and check for quality.

Baby finger snacks, including teething biscuits, puffs, and fruit snacks, are typically packaged in small, portable containers such as easy-open lids, tear-off strips, and single-serve portions. Snack packaging may feature colorful and playful designs to appeal to children and encourage interaction during feeding. Baby drinks, including fruit juices, water, and milk-based beverages, are typically packaged in bottles, cartons, or pouches with child-resistant closures and spill-proof caps.

Packaging for baby drinks prioritizes safety, hygiene, and product integrity, with features such as tamper-evident seals, anti-choking caps, and straw attachments. Transparent packaging materials, such as clear plastic or glass bottles, allow consumers to see the contents and verify freshness before consumption. Portable and lightweight packaging options, such as single-serve bottles or juice boxes, offer convenience and ease of use for parents on the go.

By Material

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2023

June 2023

April 2025