January 2025

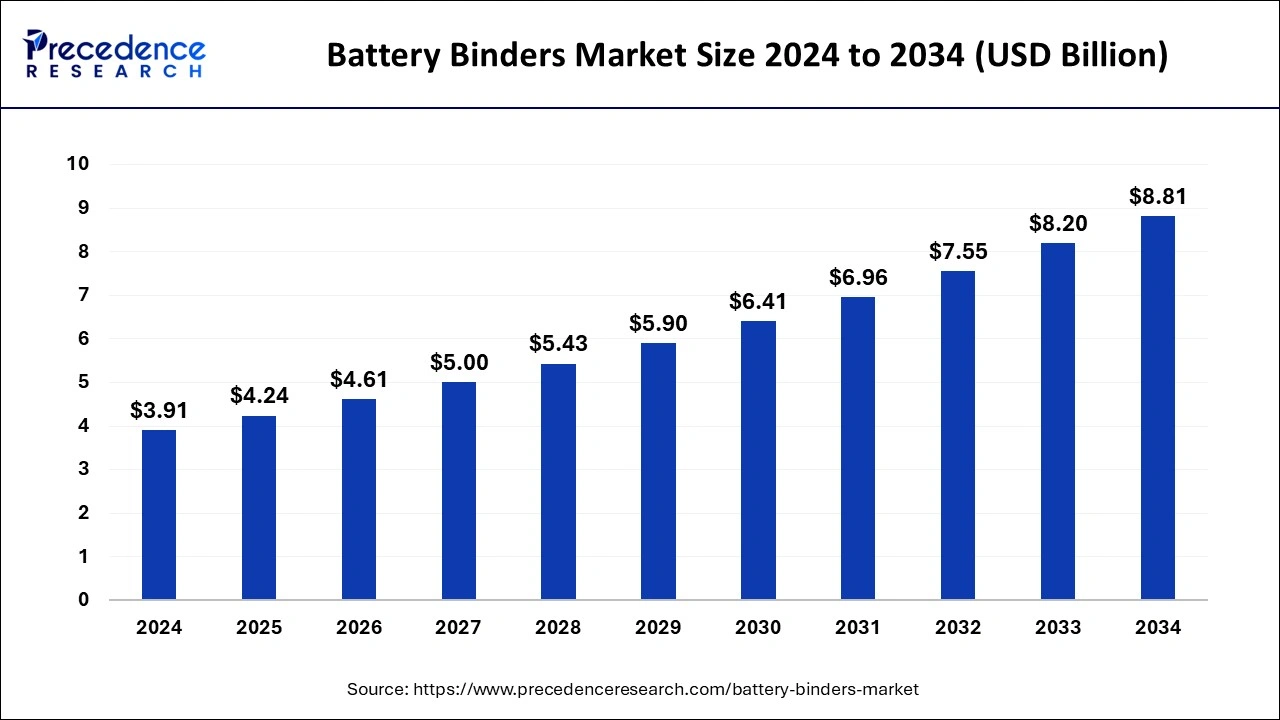

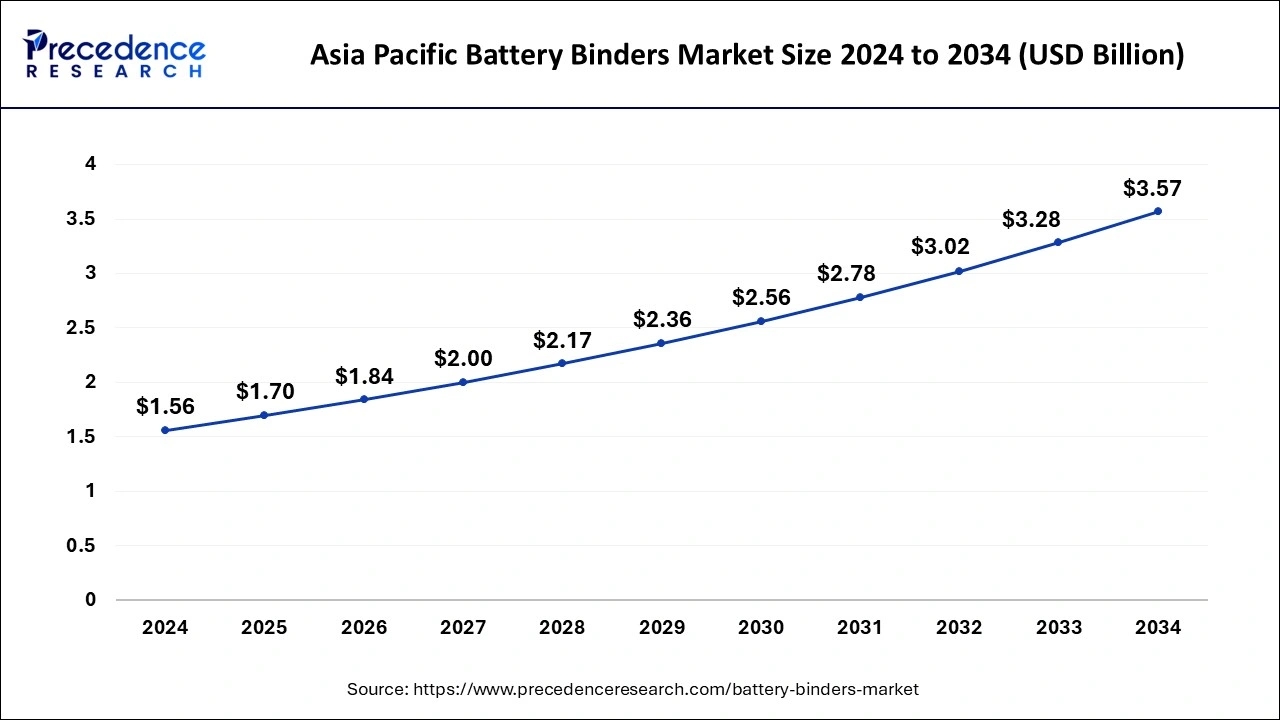

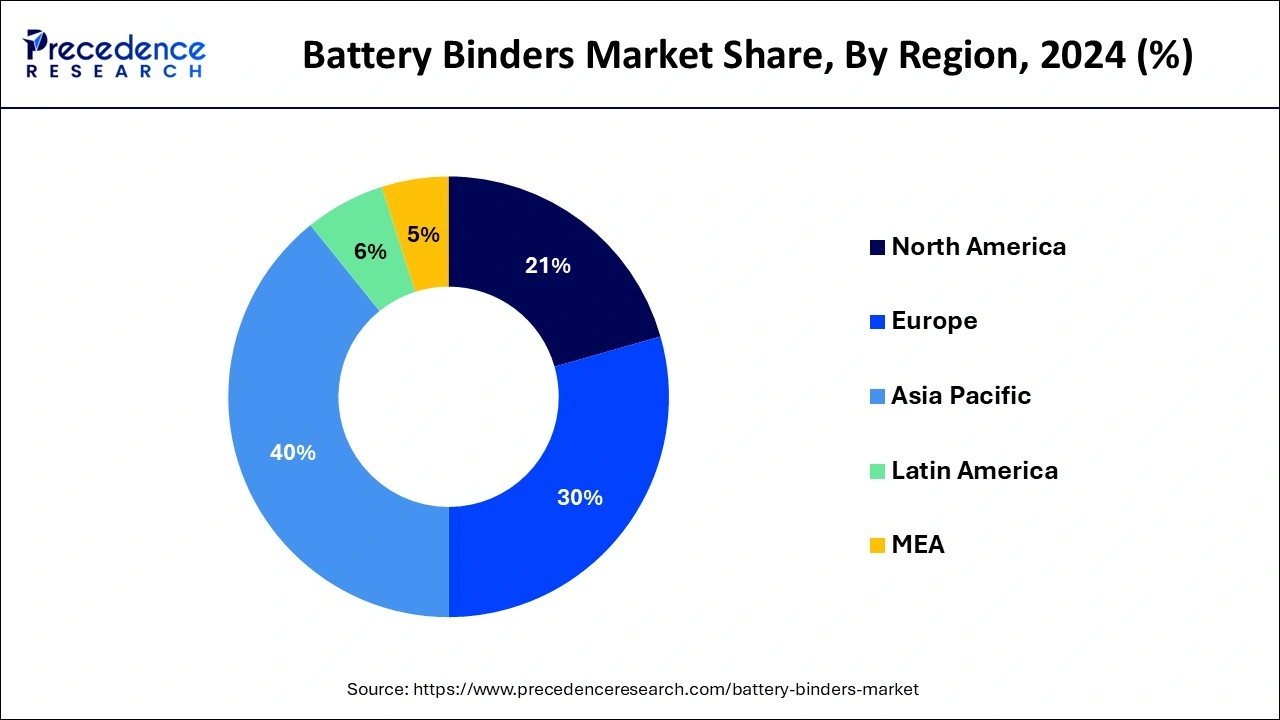

The global battery binders market size is calculated at USD 4.24 billion in 2025 and is forecasted to reach around USD 8.81 billion by 2034, accelerating at a CAGR of 8.46% from 2025 to 2034. The Asia Pacific battery binders market size surpassed USD 1.70 billion in 2025 and is expanding at a CAGR of 8.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global battery binders market size was estimated at USD 3.91 billion in 2024 and is predicted to increase from USD 4.24 billion in 2025 to approximately USD 8.81 billion by 2034, expanding at a CAGR of 8.46% from 2025 to 2034. High-performance batteries are becoming more and more in demand as the automobile industry switches from internal combustion engines to electric propulsion systems, which in turn increases the requirement for high-quality battery binders.

The Asia-Pacific battery binders market size was estimated at USD 1.56 billion in 2024 and is projected to surpass around USD 3.57 billion by 2034 at a CAGR of 8.63% from 2025 to 2034.

Asia Pacific led the battery binders market with the largest share in 2024. Electric vehicle adoption was booming in countries like South Korea, Japan, and China. Due to their aggressive efforts to lower emissions and rely less on fossil fuels, these nations have seen an increase in the need for lithium-ion batteries and battery binders. To satisfy the demands of next-generation batteries, manufacturers were concentrating on creating binders with improved qualities like higher thermal stability, better adhesion, and increased mechanical strength. Solar and wind power facilities, among other renewable energy installations, were expanding quickly throughout the Asia Pacific region. Energy storage systems were being used to store extra renewable energy for later use. These systems mostly rely on lithium-ion batteries.

During the forecast period, North America is observed to grow at a significant rate in the battery binders market. Lithium-ion battery demand is rising in North America due to the growing popularity of electric vehicles, and this in turn is driving up the need for battery binders. Battery binders are in high demand as a result of the widespread use of smartphones, tablets, laptops, and other consumer electronics gadgets that require batteries. The demand for binders rises as a result of the deployment of energy storage systems for backup power, integration of renewable energy sources, and grid stabilization. The expansion of production capacity by major players in the region and the formation of strategic alliances between suppliers of binder and battery manufacturers are factors driving the growth of the market.

One of the main factors propelling the market for battery binders has been the global movement towards electrification of automobiles. The demand for lithium-ion batteries and battery binders has increased as a result of governments enforcing strict emission regulations and providing incentives for the adoption of electric vehicles. The need for energy storage systems has increased due to the growing emphasis on renewable energy sources like solar and wind. Electricity produced from renewable sources may be efficiently stored in lithium-ion batteries when paired with efficient binders. In order to increase lithium-ion battery performance, energy density, and lifespan, research and development activities are ongoing. This includes developments in binder compositions to improve battery electrode stability and mechanical strength.

The battery binders market is anticipated to increase steadily over the next several years, driven by the EV market's ongoing expansion, advances in battery technology, and rising investments in renewable energy projects. The performance and economic viability of lithium-ion batteries will be improved by innovations in binder materials and production techniques, which will further propel market expansion.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.46% |

| Market Size in 2025 | USD 4.24 Billion |

| Market Size by 2034 | USD 8.81 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, By Battery Type, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding electronics industry

Lightweight, high-performance batteries are becoming more and more necessary as smartphones, tablets, wearables, and other portable electronic devices become more common. The need for advanced battery technologies is being driven by the shift to electric vehicles and the deployment of energy storage systems for the integration of renewable energy.

The use of electric vehicles and renewable energy storage technologies is accelerating due to growing regulatory pressure to cut greenhouse gas emissions and switch to cleaner energy sources. Large sums of money are being allocated by governments and private investors to the construction of infrastructure, including battery production facilities, to support the ecosystem of electric vehicles. In the upcoming years, it is anticipated that this investment would increase demand for battery binders. Thereby, the expansion of the electronics industry is observed to act as a driver for the battery binders market.

Lack of recycling infrastructure

Batteries binders frequently contain components that, if not recycled or disposed of appropriately, could be hazardous to the environment. Thereby the factor acts as major restraint for the battery binders market. When batteries approach the end of their life cycle, these valuable materials are lost without efficient recycling procedures in place, which contributes to resource depletion and the need for more environmentally harmful mining operations to meet demand. Due to their complicated composition and potential for environmental damage, batteries including those incorporating binders present considerable hurdles when it comes to disposal. A growing number of industries, including automotive and electronics, that depend on battery technology are under pressure to handle the end-of-life management of their products, including battery binders, as environmental awareness increases and governments impose stronger regulations on waste management and recycling.

Expansion of renewable energy storage

When demand is higher or renewable energy sources aren't actively producing electricity, battery storage offers a dependable way to store extra energy produced during peak production periods for later use. Whereas the rising demand for renewable energy storage platforms creates a significant opportunity for the battery binders market. The viability of batteries for large-scale energy storage applications has increased due to advancements in battery technology, including enhancements in energy density, cycle life, and safety. By integrating renewable energy sources into current networks, battery storage helps to decrease dependency on fossil fuels and greenhouse gas emissions. Because of growing market competition, economies of scale, and technological breakthroughs, the cost of battery storage systems has been declining steadily. Energy storage options are becoming more appealing and financially feasible for utilities, companies, and homeowners due to their lower costs.

The Polyvinylidene Fluoride segment held the largest share in battery binders market. It is true that polyvinylidene fluoride, or PVDF, has found use in a number of industries, including the battery sector. PVDF is frequently utilized as a binder material in lithium-ion batteries (LIBs) in the battery industry. Because of its chemical stability, PVDF is beneficial in the severe conditions seen in batteries. Because of its strong thermal stability, PVDF can withstand high temperatures without losing its characteristics, which is important in battery applications where temperatures might rise during charging and discharging. PVDF gives the electrodes mechanical strength, which aids in preserving their structural integrity throughout the battery's frequent cycles of charge and discharge.

PVDF ensures strong contact and effective electron transport within the battery by exhibiting good adhesion to both the electrode materials and the current collectors. Due to PVDF's electrochemical inertness, which prevents it from taking part in internal electrochemical reactions, the battery's performance is guaranteed to remain stable over time. In the battery industry, elements including the rising demand for lithium-ion batteries in a range of applications like consumer electronics, grid storage systems, and electric cars affect the need for PVDF as a binder material. The need for high-performance binder materials like PVDF is anticipated to increase as these applications grow.

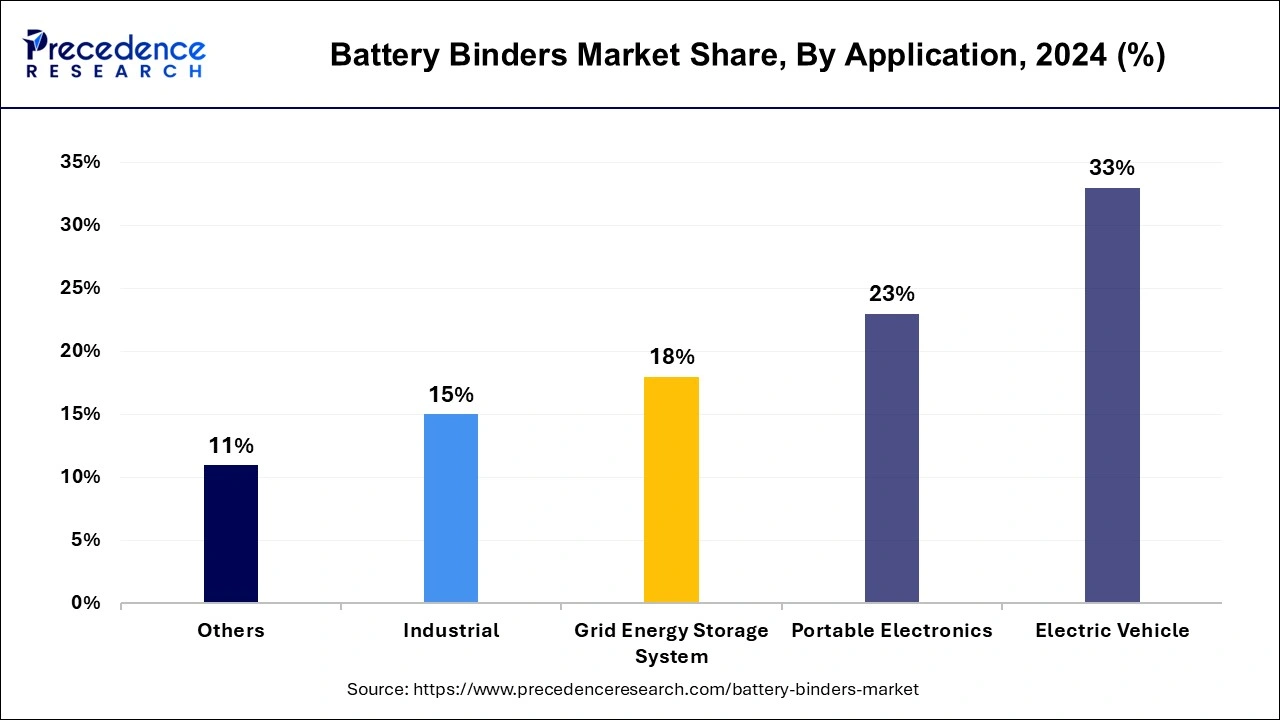

The electric vehicle segment held the largest share of 33% in 2024. Indeed, the market for battery binders has been stimulated by the advent of electric vehicles (EVs) in a number of related areas. Lithium-ion batteries, the most popular kind of batteries used in electric cars, depend heavily on battery binders.

These binders contribute to the structural integrity and effective operation of the battery by holding the electrodes and other parts together. The need for lithium-ion batteries and battery binders is rising as more consumers and governments place a higher priority on EV adoption in an effort to cut down on carbon emissions and rely less on fossil fuels. Battery binder technologies are advancing as a result of ongoing research and development activities targeted at enhancing battery performance, durability, and energy density.

Governments from all around the world are encouraging the use of electric vehicles by providing a range of incentives and subsidies. The demand for batteries and battery components like binders is fueled by these rules, which incentivize automakers to build more EVs. Consumers and businesses are moving toward electric vehicles as a result of growing awareness of climate change and the negative environmental effects of traditional combustion engine automobiles.

Enhancements in the supply chain, such as where battery binders' raw materials are sourced, are contributing to cost savings and increased availability, which is further propelling market expansion. Companies in the battery binders market are investing more in R&D, which is resulting in breakthroughs in manufacturing techniques and materials that improve the functionality and effectiveness of battery binders.

The automotive segment held a significant share of the battery binders market in 2024. The segment is observed to continue the growth during the forecast period. The automotive industry is one of the largest and most lucrative markets for battery binders due to the high volume of batteries used in electric and hybrid vehicles. As such, the automotive segment represents a significant source of revenue for binder manufacturers. The large-scale production of automotive batteries also provides economies of scale, allowing manufacturers to achieve cost efficiencies and competitive pricing for their binder products.

Automotive manufacturers and battery suppliers are continuously investing in research and development to enhance the performance and cost-effectiveness of electric vehicle batteries. This includes developing advanced materials and technologies for battery components such as binders. By investing in innovative binder materials and manufacturing processes, companies aim to improve battery performance, reduce production costs, and gain a competitive edge in the automotive market.

By Type

By Application

By Battery Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025