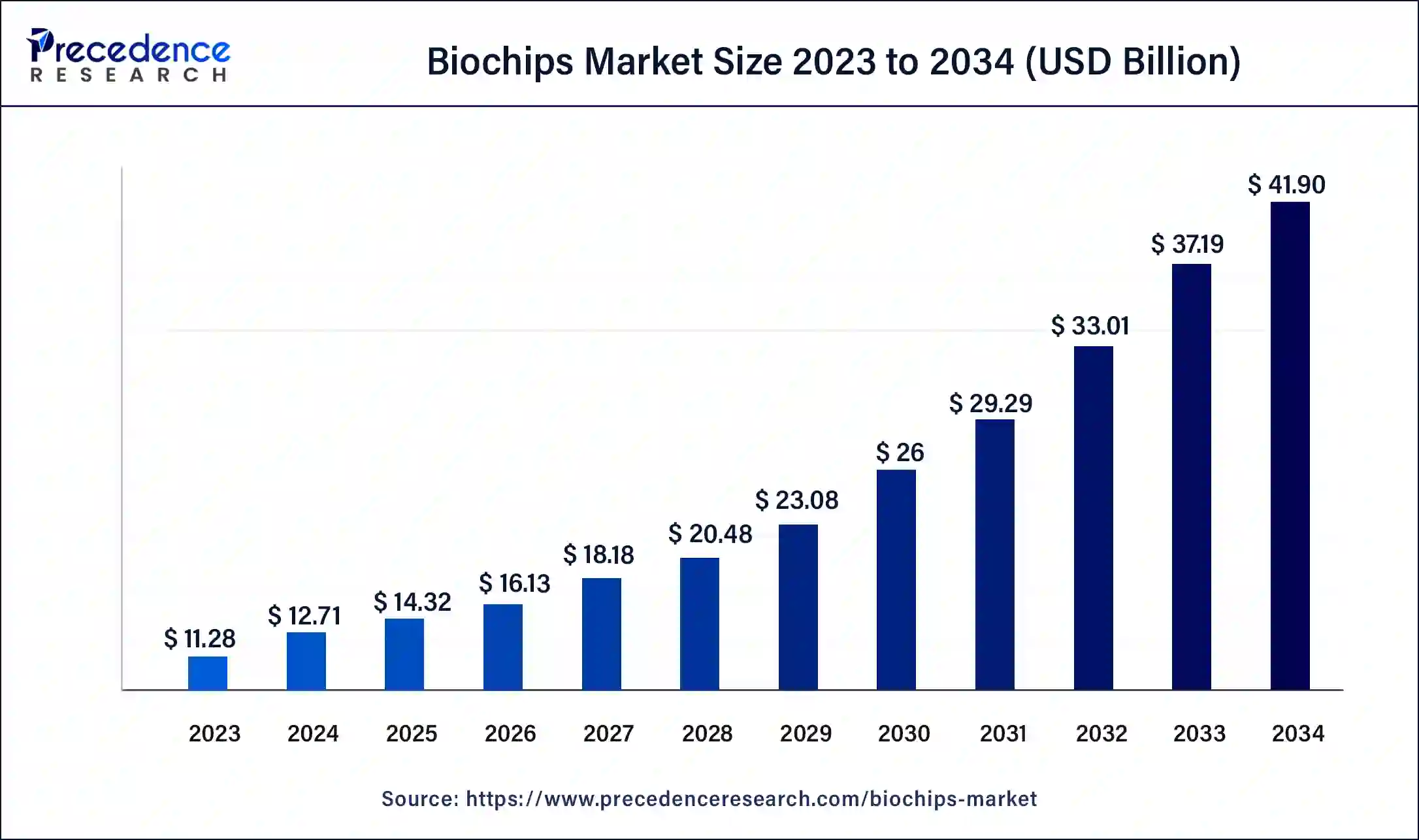

The global biochips market size was USD 11.28 billion in 2023, calculated at USD 12.71 billion in 2024 and is expected to be worth around USD 41.90 billion by 2034. The market is slated to expand at 12.67% CAGR from 2024 to 2034.

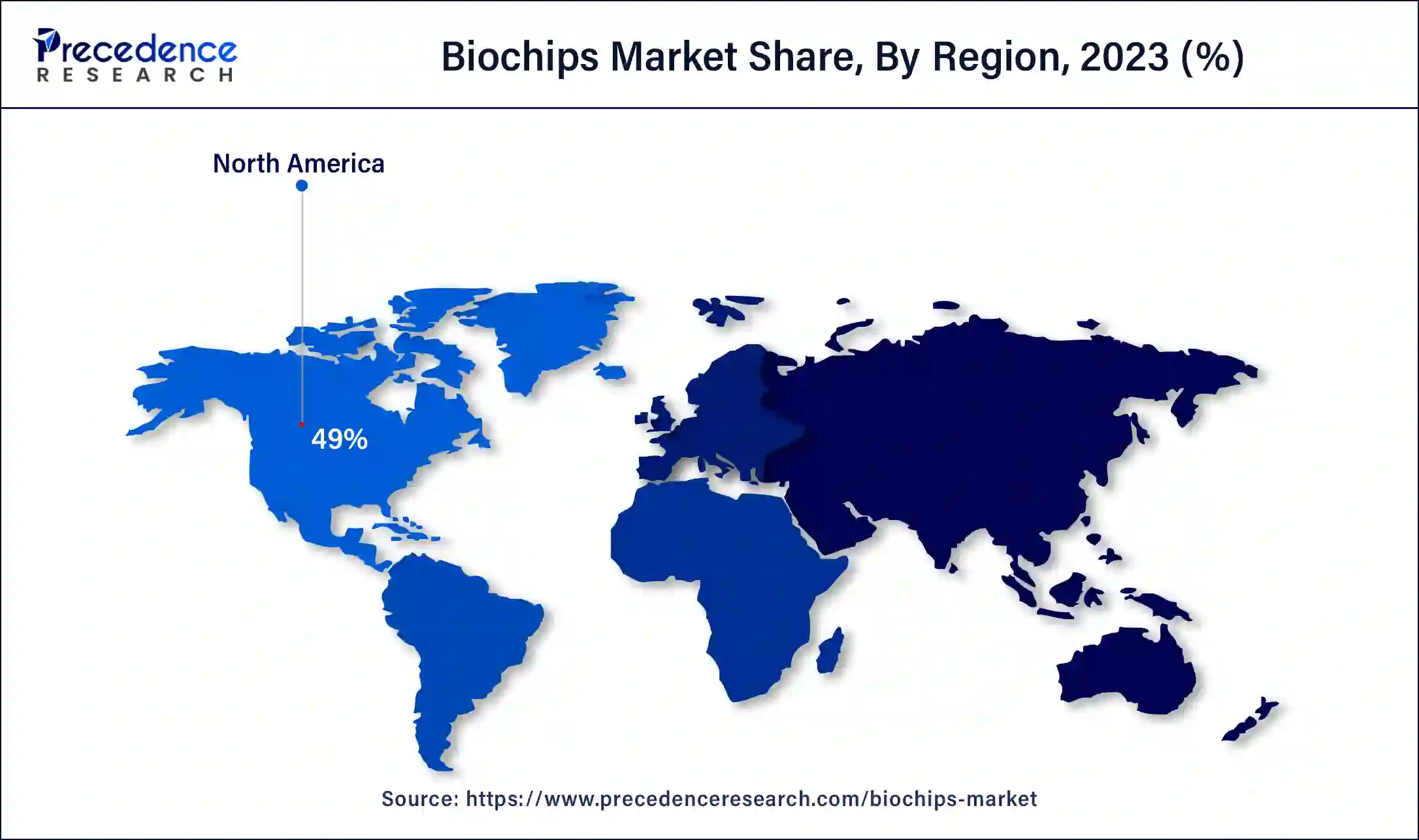

The global biochips market size is projected to be worth around USD 41.90 billion by 2034 from USD 12.71 billion in 2024, at a CAGR of 12.67% from 2024 to 2034. The North America biochips market size reached USD 5.53 billion in 2023. The biochips market growth is attributed to increased application in various healthcare settings.

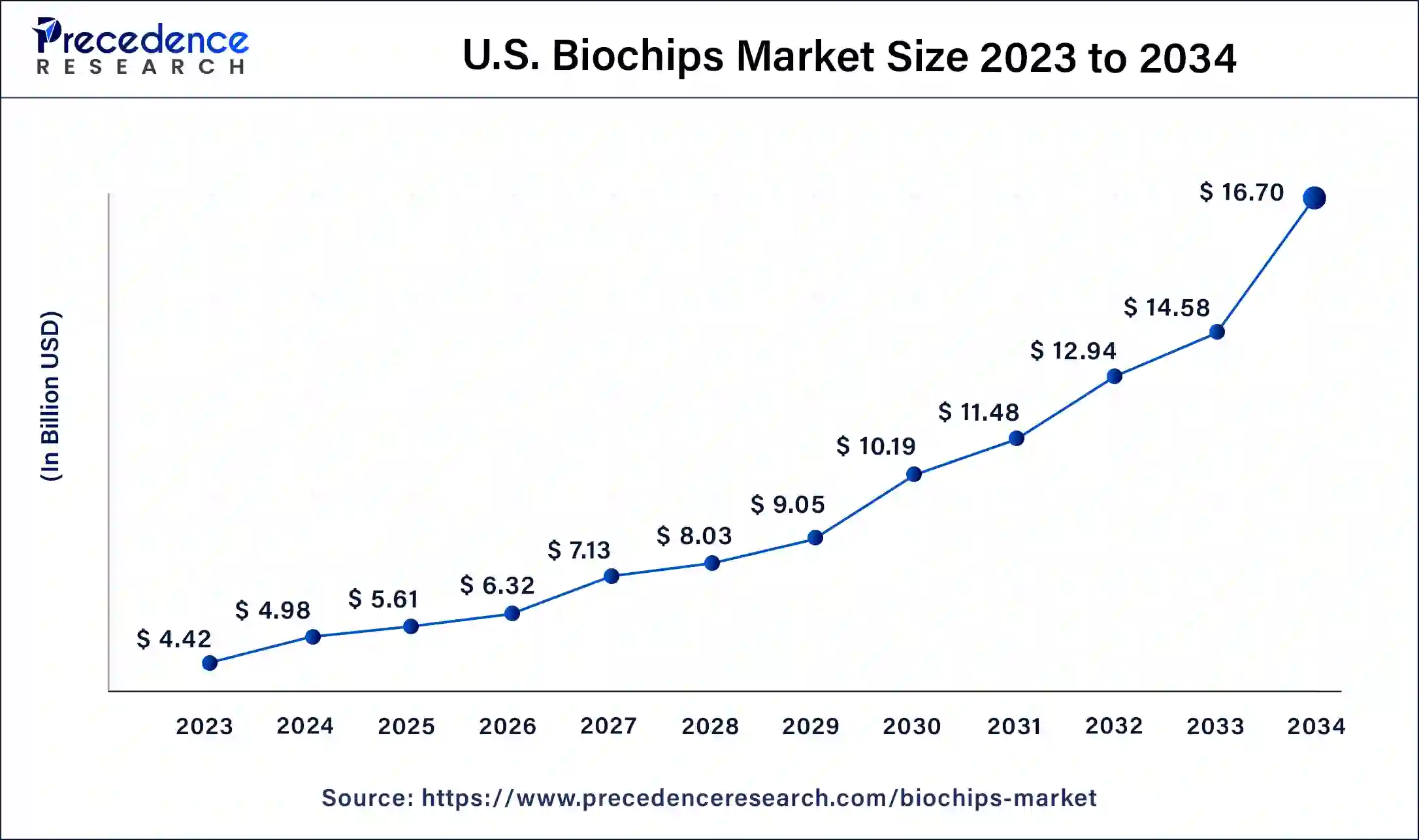

The U.S. biochips market size was exhibited at USD 4.42 billion in 2023 and is projected to be worth around USD 16.70 billion by 2034, poised to grow at a CAGR of 12.84% from 2024 to 2034.

North America dominated the biochips market in 2023 due to its well-developed healthcare structure, high research and development investment, and highly developed key players. America and Canada both have a strong presence in the biotechnology and pharmaceutical industries, which creates a high demand for biochips used in drug development, detection, and treatment associated with personalized medicine.

Large and healthy expenditure on healthcare, along with a stringent regulatory environment, contributes to the increased use of exploitative biochip technologies. Additionally, collaboration between research institutions and universities that work closely with industry players in the development of biochip uses further boosts the market in this region.

Asia Pacific is expected to grow at the fastest CAGR in the biochips market during the forecast period owing to the growing healthcare industry, emerging investments in biotechnology solutions, and trends such as personalized medicine. China, India, and Japan are utilizing biochip technology to cater to large populations and the growing cases of chronic diseases. Additionally, an increase in the middle-class population and better availability of healthcare in the Asia Pacific further fuels the need for high-level diagnostics and biochips.

Biochips are microsystems that perform thousands of biochemical operations at the same time and are, therefore, considered indispensable in molecular biology. These devices are widely used in a number of different fields, such as genomics and proteomics, as tools for high throughput screening and analysis. The biochips market products and solutions are widely employed in molecular diagnostics for biomarkers and genetic profile identification, drug discovery, and testing for the efficacy of therapeutic candidates.

Computerized medicine, the demand for individualized medicine enhancement in genomics technology, and the growing rate of long-term ailments are also credited to the growth of the biochips market. The incorporation of biochips with upcoming technologies, such as artificial intelligence and machine learning, will improve their analysis abilities and increase their portfolio demand, which will further boost the market. Moreover, the innovation and advancement in these fields of specialization, such as biotechnology and pharmaceuticals, further fuel the biochip application across the various sectors.

Impact of AI on the Biochip Market

The combination of biochips with AI/machine learning helps to increase the reliability of data analysis and, therefore, a more accurate prognosis of treatment outcomes and disease progression. In the pharmaceutical industry, biochips are used to help the rapid development of drugs and get new therapies to the biochips market.

| Report Coverage | Details |

| Market Size by 2034 | USD 41.90 Billion |

| Market Size in 2023 | USD 11.28 Billion |

| Market Size in 2024 | USD 12.71 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.67% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Fabrication Technology, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Impact of chronic disease prevalence on biochip adoption

The growing prevalence of chronic diseases is likely to boost the adoption of biochips in the healthcare sector. Congenital and lifestyle diseases, including cardiovascular diseases and cancer, create the need for early and accurate diagnosis, which is where biochips are utilized. They help to monitor chronic diseases with less invasiveness and frequency. Biochips offer healthcare practitioners constant information on the state of health of the patient, which is very useful with chronic diseases. The integration of biochips in wearable gadgets and home monitoring systems also increases the level of compliance and participation of the patient in managing their illness. Additionally, the reduction of healthcare costs by avoiding the worsening of diseases and hospital admissions increases the adoption of biochips, which further propels the market.

Increasing demand for personalized medicine

Increasing demand for personalized medicine is anticipated to drive the market in the coming years. The trend of the individualized approach to molecular diagnostic tools helps doctors assess their genetic profile as accurately as possible. Through the use of biochips, genetic mutations and biomarkers are vital in the determination of the appropriate treatment; hence, targeted therapy that is widely used in precision medicine is detected. Further, the possibility of producing biochips for individual use means that they will always fit into the latest developments in personalized medicine. Given the dynamics of the increase in the use of individual treatment plans based on genetic profiles, biochips will be even more important within clinical medicine in the future.

Impact of high costs

High costs of biochip technology are likely to hamper the market growth. These costs reduce the affordability of biochips and restrict the reach of small health facilities. High costs are also inevitable when carrying out biochip-based diagnostics. This necessarily inflates the cost of the diagnostic tests, thus making it a preserve of the financially capable. Moreover, the growing shift of potential parties towards affordable healthcare technology further hinders the biochips market in the coming years.

Advancements in nanotechnology enhancing biochip development

Surging advancements in nanotechnology enhancing the development and functionality of biochips are projected to create immense opportunities for the players competing in the market. The application of nanotechnology in the development of biochips results in the development of smaller, better-performing, and high-sensitivity devices. These nanotech-revamped biochips are capable of detecting very low concentrations of biological species, and on this front, they are quite useful in early disease diagnosis and screening. Developers are combining nanotechnology with the development of precise and trustworthy next-generation biochip diagnostic devices. Additionally, the use of nanomaterials enhances biochip stability and minimizes background noise, hence enhancing the precision and reliability of the results. All these factors will further boost the biochips market in the coming years.

The DNA chips segment dominated the market with the largest market share of 36% in 2023 due to their application to genomics and tailored medicine. Microarrays or DNA Chips enable a number of thousands of genes to be analyzed at the same time and are widely used in gene expression profiling, genetic variation, and disease studies. The current and rising focus on personalized medicine necessitates the use of DNA chips as they provide the necessary broad genetic data on individual patients. Furthermore, the development of DNA chips, including an increase in their sensitivity and resolution, offering improved data to researchers and clinicians, further boosts their demand.

The lab-on-chip segment is projected to grow rapidly in the biochips market in the future years owing to its high utilization in diagnostics and medical testing. LOC devices combine several laboratory applications into one chip while being cheap and portable. They found that the rising trend in point-of-care diagnostics and decentralized health systems is facilitating LOC technology. The evolution in microfluidics and material science adds to the performance and versatility of the LOC devices that open up their application in the diagnosis of infectious diseases and chronic diseases. Furthermore, telemedicine and other remote healthcare solutions are also creating demand for LOC technology, as these devices can easily be incorporated into home-based and mobile testing applications.

The microarrays segment held the largest share of the biochips market in 2023 due to their versatility use in genomic and proteomic studies. Microarrays are rapid and analyze thousands of genes or proteins at the same time, thus making them useful in large-scale studies or biomarker identification. The feature that renders them most valuable is the ability to give high sensitivity and the capacity to pick out two or more targets within one assay. Furthermore, microarray technology has experienced improvements in the cost of the technology and the development of better data analysis tools, which will further propel the segment in the coming years.

The microfluidics segment is projected to grow rapidly in the biochips market in the future years owing to its efficient way of dealing with small volumes of fluids. Microfluidic devices provide fast and precise measurements, which is useful for point-of-care diagnosis and molecular targeting. Their portability and high-throughput capabilities make them usable in various processes. Furthermore, there are continued technological innovations in lab-on-a-chip systems, better fabrication approaches, and improvements in microfluidic engineering. All these factors further boost their demand.

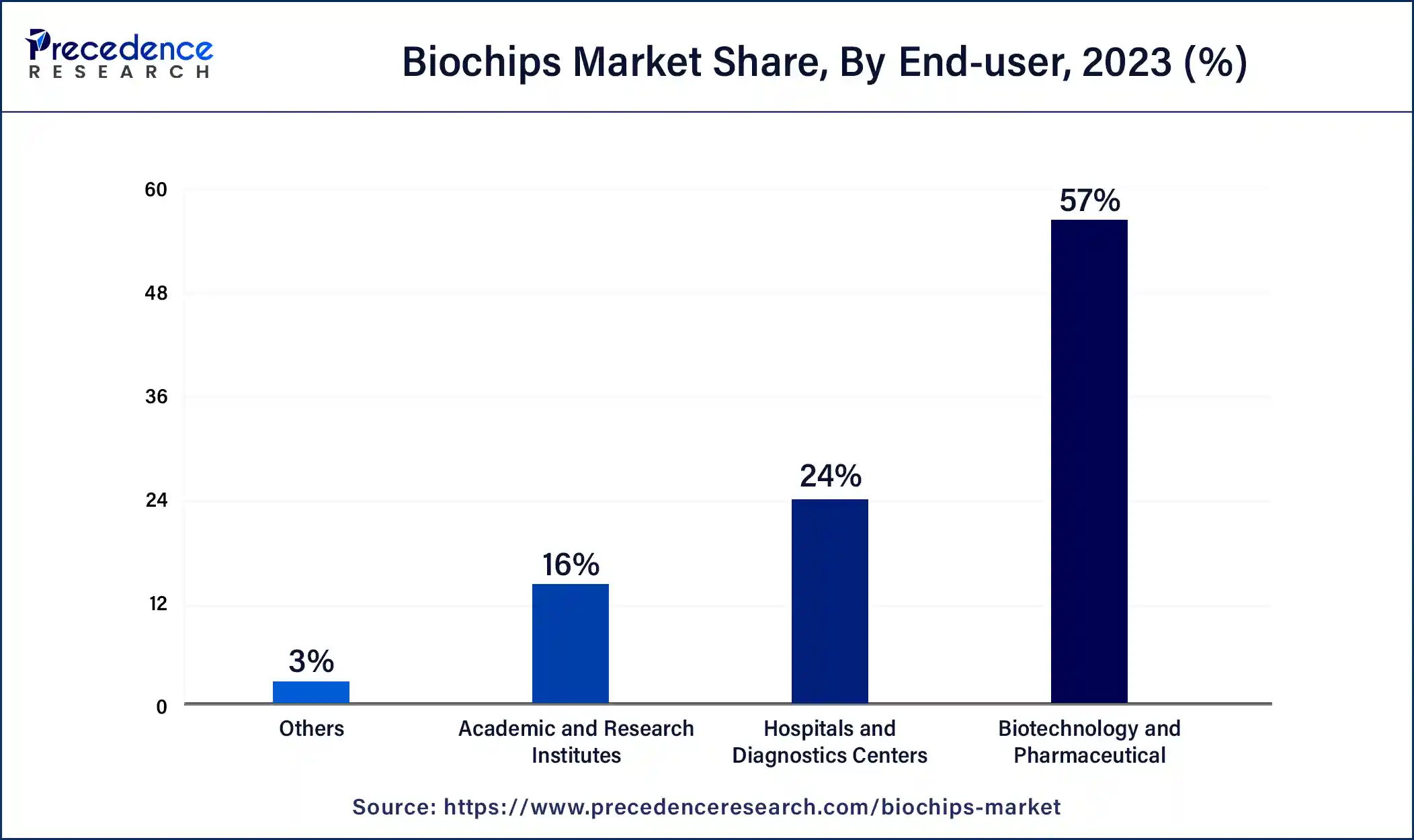

The biotechnology & pharmaceutical companies segment dominated the biochips market in 2023. Biochips are used by biotechnology and pharmaceutical companies in the development of new drugs and high-throughput screening of compounds and biological markers. The thesis of the use of biochips in genomic and proteomic biomarker discovery is driven by the fact that it expedites the identification of drug targets and the development of personalized drugs. They also use biochips to perform clinical trials, and they use the chips to monitor the responses of patients to the new treatments. Additionally, the increased adoption of biochips in personalized medical care will further fuel the biochips market in the coming years.

The academic & research institutes segment is projected to grow rapidly in the biochips market in the future years owing to the increasing emphasis on science and advanced studies in the field of biotechnology. These institutions are heavily dependent on biochips as these chips are used in scanning genomics, proteomics, molecular biology, and a lot more. Biochips equip researchers with the opportunities to execute highly sensitive, multiple analyses simultaneously, which is essential in the progress of sciences and the formation of technologies. The rise in the availability of research funds for projects and grants focused on diseases’ pathways and new therapeutics, in particular, requires the use of biochip technologies. Furthermore, the partnerships between academic and industrial entities are expected to increase the usage of biochips in research facilities and expand its possibilities.

Segments Covered in the Reports

By Type

By Fabrication Technology

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client