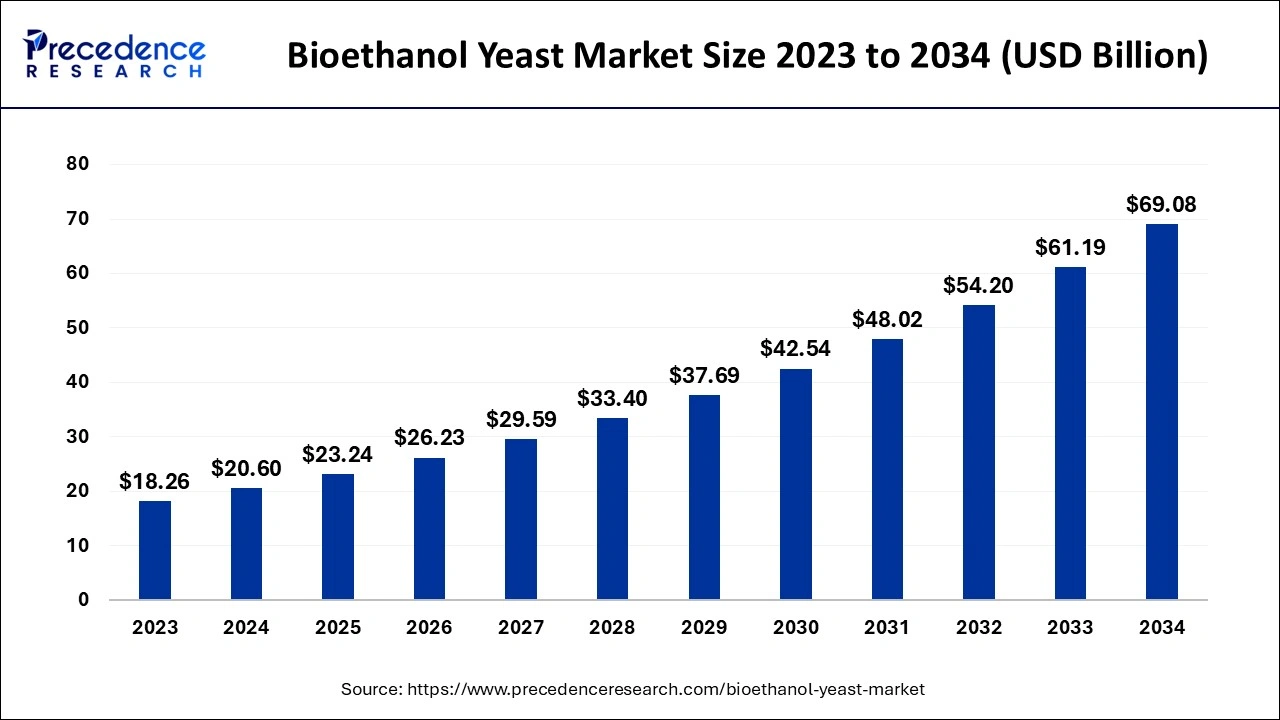

The global bioethanol yeast market size accounted for USD 20.60 billion in 2024, grew to USD 23.24 billion in 2025 and anticipated to reach around USD 69.08 billion by 2034, registering a healthy CAGR of 12.86% between 2024 and 2034. The North America bioethanol yeast market size is evaluated at USD 8.65 billion in 2024 and is expected to grow at a CAGR of 12.98% during the forecast year.

The global bioethanol yeast market size is calculated at USD 20.60 billion in 2024 and is predicted to reach around USD 69.08 billion by 2034, expanding at a CAGR of 12.86% from 2024 to 2034. The bioethanol yeast market growth is attributed to increasing demand for renewable energy sources and government incentives promoting biofuels.

Artificial Intelligence (AI) improves different production processes and advances the bioethanol yeast market. Advanced mathematics and complex programming process big amounts of data and produce conclusions that are risky. This allows manufacturers to optimize the fermentation procedures and achieve increased yield results. Constant vitality is preserved, and the AI’s capability for quality control and waste minimization contributes to greater ecological efficiency. Furthermore, such technological enhancement as AI allows the creation of new yeast strains and genetic research & modeling due to the increased demand for renewable energy sources.

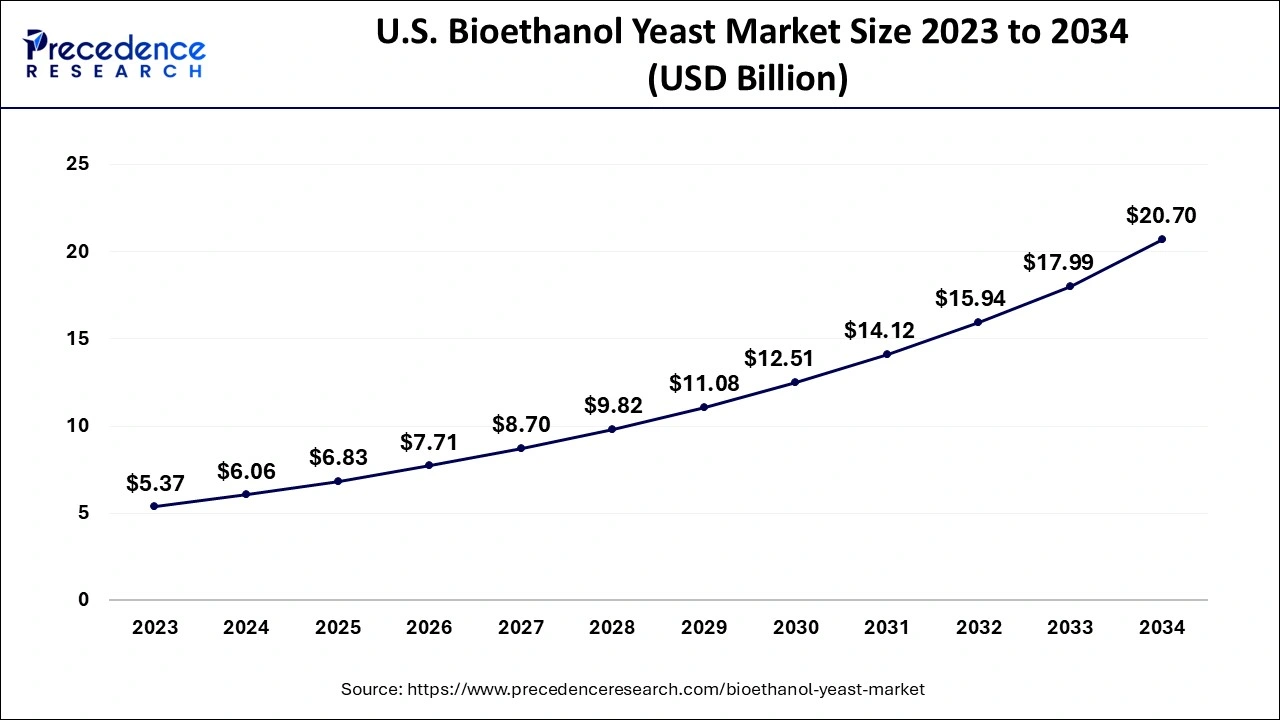

The U.S. bioethanol yeast market size is exhibited at USD 6.06 billion in 2024 and is expected to be worth around USD 20.70 billion by 2034, growing at a CAGR of 13.05% from 2024 to 2034.

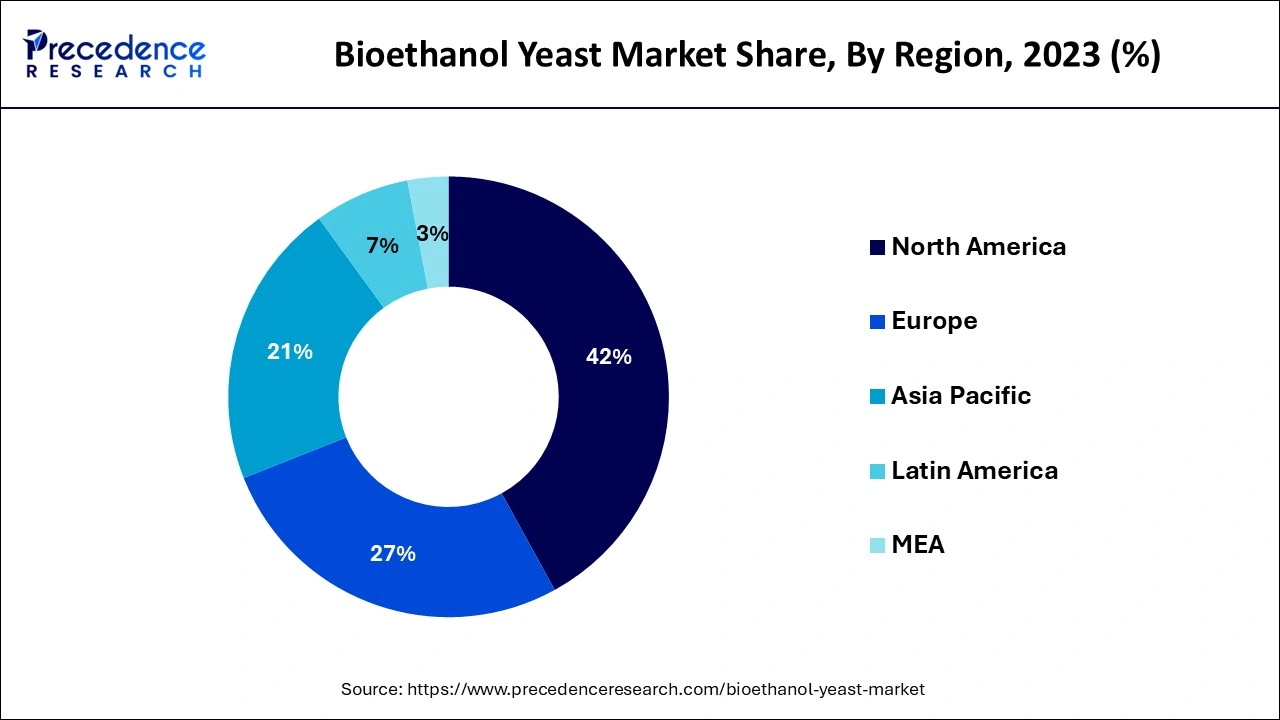

North America held the largest share of the bioethanol yeast market in 2023 due to the high government support in terms of policies and regulations towards bioethanol. The principal supporter of the bioethanol industry in America has been the U.S. EPA through policies such as the Renewable Fuel Standard RFS, which provides blending requirements for renewable fuels, including ethanol. U.S. bioethanol production in 2023 was 16.5 billion gallons for about 10% of the domestic consumption of gasoline, as EIA data shows. Furthermore, the increasing pressure towards finding environmentally friendly fuel sources and the steady improvements in yeast production have increased the demand for bioethanol yeast.

Asia Pacific is projected to host the fastest-growing bioethanol yeast market in the coming years, owing to the rapid industrialization, population growth, and consequently rising demands for energy. China and India are among the countries that are focusing on spearheading the enhancement of bioethanol production as countries work towards reducing their dependence on fossil fuels. India is also expected to scale up its bioethanol generation under the National Biofuels Policy, which promotes biofuels in the transportation industry.

Rising concern for renewable energy commodities and a global effort towards emission reduction is facilitating the bioethanol yeast market. Transportation fuel, derived predominantly from agricultural commodities, such as sugarcane, corn, and wheat, is bioethanol, a clean-burning fuel that competes directly with fossil fuels. This process is being driven by energy security issues, which will be discussed in the later sections for countries, including India, Brazil, and Indonesia, where domestic bioethanol helps cut down the import dependency on oil.

Yeast-based fermentation processes are essential in the improvement of the yield of the bioethanol. These innovations increase the conversion rate of biomass to ethanol and reduce energy utilization by the bioethanol production process, thus making bioethanol a more economically feasible and sustainable fuel.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.08 Billion |

| Market Size in 2024 | USD 20.60 Billion |

| Market Size in 2025 | USD 23.24 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.86% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing adoption of bioethanol as a sustainable fuel source

The growing adoption of bioethanol as a sustainable fuel source is anticipated to drive demand for efficient production in the bioethanol yeast market. An increasing interest in the use of blends as fuel is thus promoting further research on qualities of yeast that are most suitable for bioethanol production. Biofuels are being pushed by governments globally to reduce possible emissions and reliance on fossil fuels.

Global Biofuel Demand, 2020-2023

| Year | Demand (in Billion Liters) |

| 2020 | 150.3 |

| 2021 | 158.2 |

| 2022 | 164.4 |

| 2023 | 175.6 |

Availability of diverse feedstocks

The limited availability of diverse and sustainable feedstocks is anticipated to restrain the growth of the bioethanol yeast market. Particularly in those areas that have specialized crops, such as sugarcane or corn, most of them experience fluctuations since they are seasonal crops that affect the supply chains. Bioethanol production is limited by this constraint since large-scale production requires considerable investments in agricultural sectors that may not be well developed in some regions. Additionally, a conflict of interest has been observed between the food and fuel industries as they struggle to access the same food crops.

High investments in research and development activities

High investments in research and development activities are likely to advance the capabilities of yeast strains tailored for the bioethanol yeast market. New innovative technologies, including gene editing tools CRISPR-Cas9, are being considered to develop better and stronger yeast with difficulties associated with yeast slower fermentation and contamination.

The U.S. Department of Energy has invested a lot of funds towards the BETO Bioenergy Technologies Office. Such measures have ensured that bioethanol production costs have been cut by up to 40% over the last decade, pulling the industry forward. Furthermore, international multilateral agreements between the governments and the private sector, along with universities and research institutions, stress realizing the gap between experimental and industrial-scale production of bioethanol.

The baker’s segment held a dominant presence in the bioethanol yeast market in 2023 due to its applicability to large-scale bioethanol production and lower costs. The segment proved to be competitive, and it effectively catalyzed first-generation bioethanol feedstock, such as corn and sugarcane. USDOE, in its annual report to Congress in 2023, described the importance of baker’s yeast in the attainment of bioethanol production, especially under the Renewable Fuel Standard regulation of blending biofuels into transportation fuel. Additionally, the research projects funded by the European Commission in 2023 were aimed at improving baker’s yeast.

The brewer’s segment is expected to grow at the fastest rate in the bioethanol yeast market during the forecast period of 2024 to 2034, owing to its upgraded ability to transform second-generation bioethanol feedstocks, such as the lignocellulosic biomass. Renewable energy report of 2024 by IRENA states that investments in second-generation bioethanol plants are on the rise in regions such as Europe and Asia-Pacific. In this, brewer’s yeast is instrumental in harnessing agricultural residues for bioenergy production. The USDA 2024 has also identified brewer’s yeast as critical in decreasing the usage of fossil fuels through the effective conversion of non-food biomass.

The biofuel segment accounted for a considerable share of the bioethanol yeast market in 2023 due to the increasing trend among countries regarding the use of renewable energy to curb greenhouse gas emissions. Bioethanol is one of the most popular bio-products mixed with transportation fuel, which is produced from various developed yeast strains, with profound bioethanol manufacturers including America, Brazil, and China. Additionally, the growing need for the use of biofuels as a way of eliminating greenhouse gas emissions and the provision of renewable energy further fuel the segment.

The animal feed segment is anticipated to grow with the highest CAGR in the bioethanol yeast market during the studied years, owing to the need to meet the ever-increasing demand for quality, healthy feeding to livestock and poultry. Bioethanol yeast has then been adopted as a protein source in animal feed, as it is a more sustainable means of protein production than soybean meal production. Furthermore, yeast helps enhance digestion and the immune system of animals taking feed, and this has promoted the uptake of yeast in animal feeds.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client