February 2025

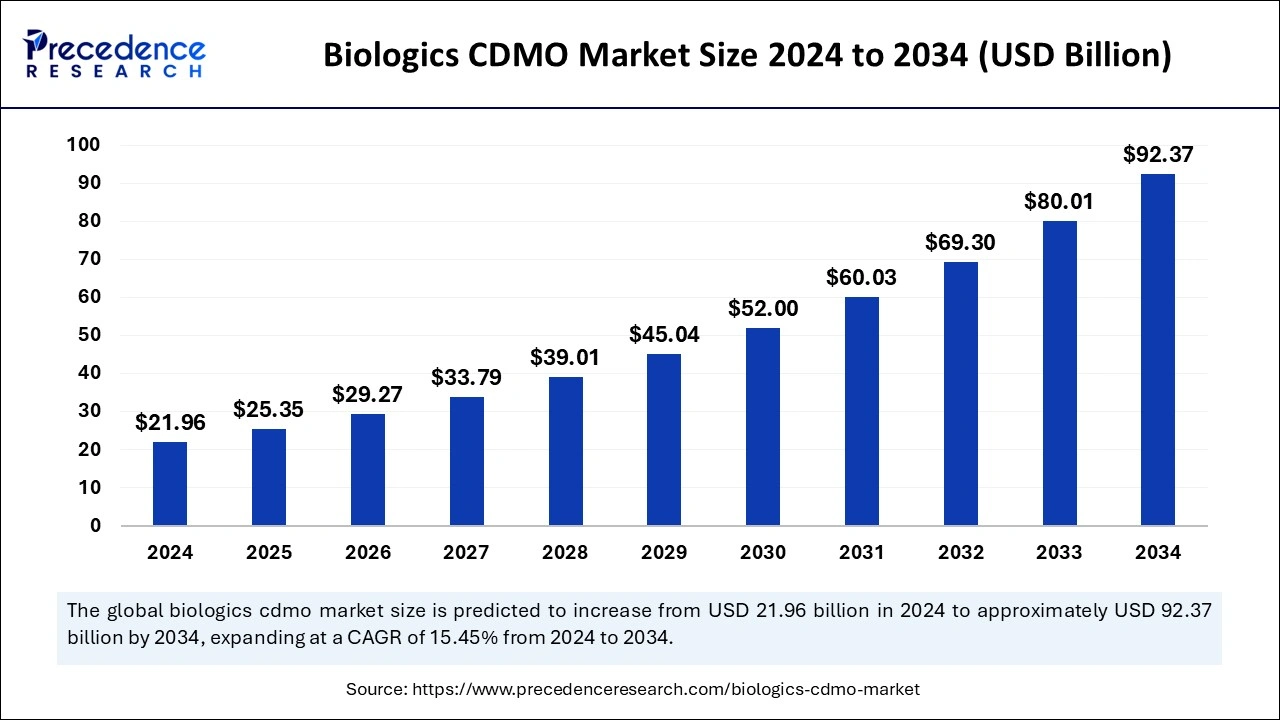

The global biologics CDMO market size is calculated at USD 25.35 billion in 2025 and is forecasted to reach around USD 92.37 billion by 2034, accelerating at a CAGR of 15.45% from 2025 to 2034. The North America biologics CDMO market size surpassed USD 7.91 billion in 2024 and is expanding at a CAGR of 15.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biologics CDMO market size was estimated at USD 21.96 billion in 2024 and is anticipated to reach around USD 92.37 billion by 2034, growing at a solid CAGR of 15.45% from 2025 to 2034.

Artificial intelligence is changing the landscape of drug discovery, quality control efficiency, supply chain management, and optimizing manufacturing performance. Generative AI assists with designing of visual, textual, and molecular content by synthesizing a vast amount of data obtained from the pharmaceutical industries. The integration of AI in biological and chemical processing through autonomous robots eases handling of multiple complex tasks, problem-solving and precise system modelling and control. The incorporation of AI helps in the personalized medicine, tailoring appropriate healthcare solutions and ensuring the safety of patient’s personal health information.

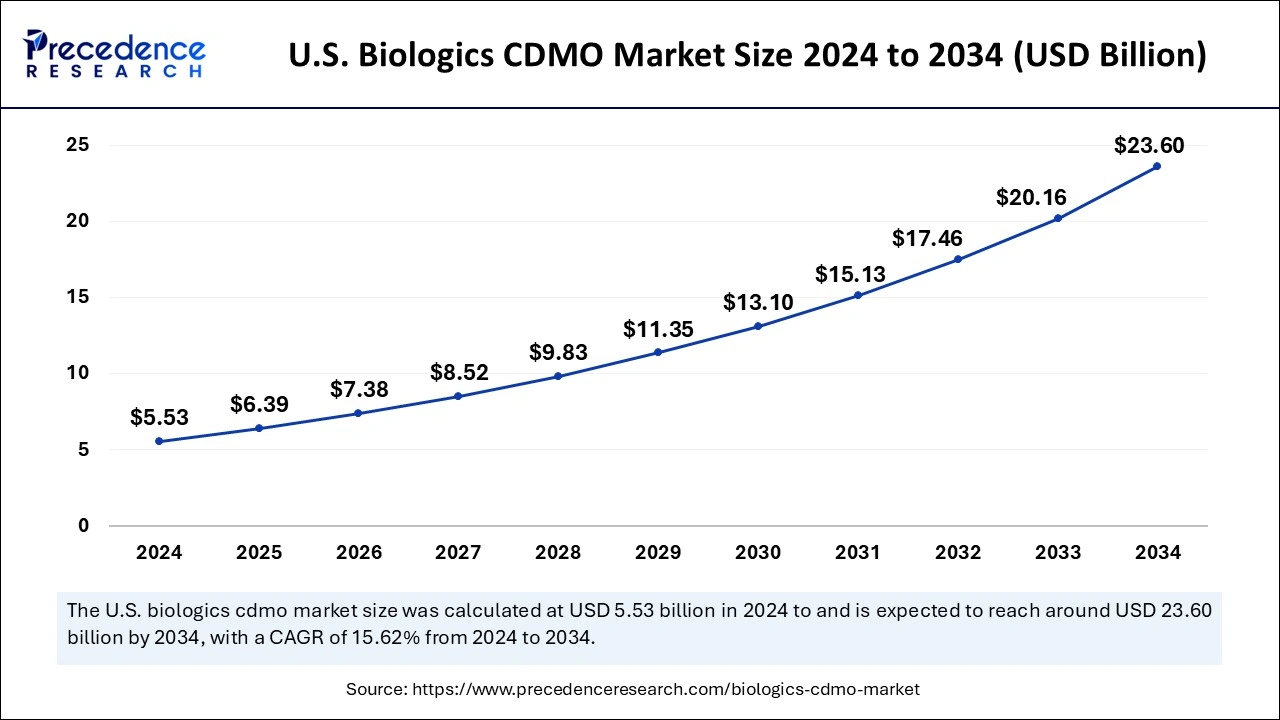

The U.S. biologics CDMO market size was exhibited at USD 5.53 billion in 2024 and is projected to be worth around USD 23.60 billion by 2034, poised to grow at a CAGR of 15.62% from 2025 to 2034.

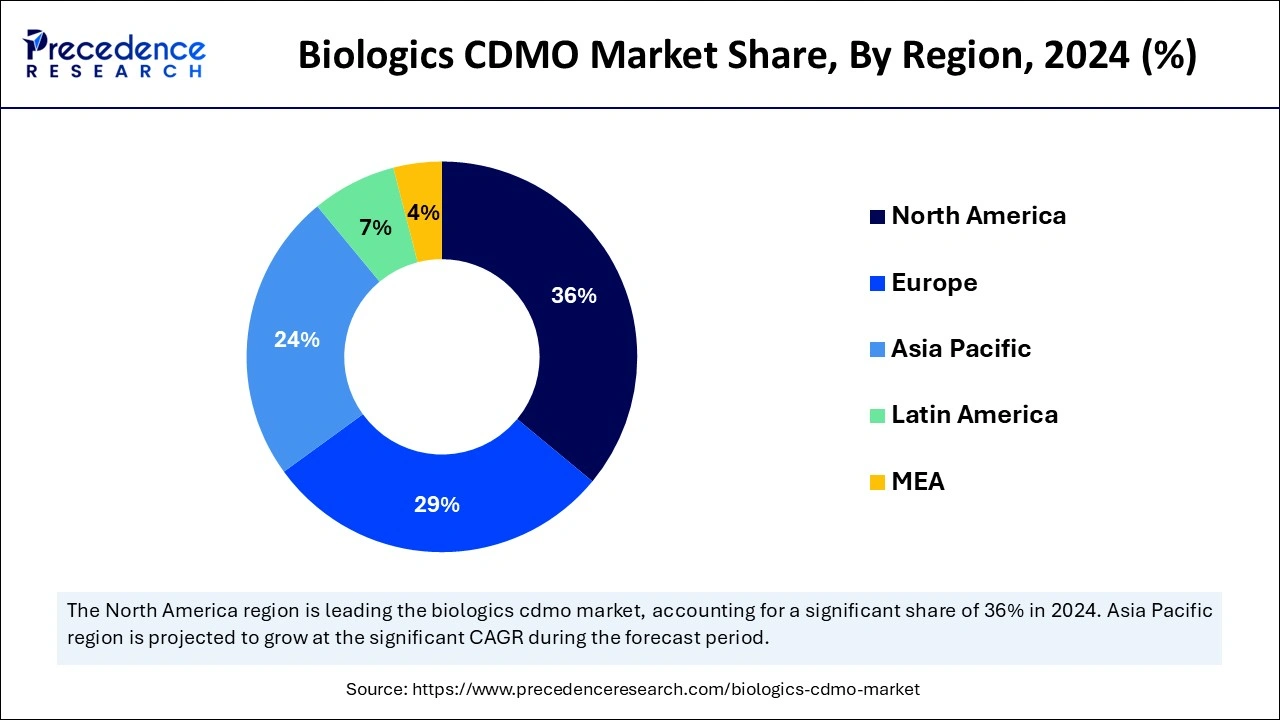

North America had dominated in the biologics CDMO market in 2024. Many of the world's top pharmaceutical and biotechnology companies are based in North America, especially in the United States. Pfizer, Amgen, and Johnson & Johnson headquarters are located nearby, offering a solid foundation for biologics CDMO operations. The Food and Drug Administration (FDA) of the United States has established clear rules for authorizing and regulating biologics. This regulatory clarity stimulates investment in biologics and innovation.

Asia-Pacific is observed to be the fastest growing in the biologics CDMO market during the forecast period. The region is seeing an increase in foreign direct investment, especially in the biopharmaceutical industry. Global corporations are establishing manufacturing and research and development (R&D) centers to take advantage of the lower costs and access to trained personnel in the area. The region's biologics manufacturing costs are generally less than those of North America and Europe. Due to its reduced labor, raw materials, and overall operating costs, it is a desirable location for CDMO services.

Pharmaceutical businesses can obtain services for developing and producing biological medicinal products from a biologics contract development and manufacturing organization (CDMO). This kind of CDMO may provide the same services for small molecule medications in addition to biologics, or they may focus exclusively on developing and producing biologics.

Pharmaceutical businesses can benefit greatly from the experience that biologics CDMOs have in handling pre-formulation, clinical trials, and commercial production. Biologics CDMO businesses offer the knowledge and expertise to be first to market when it matters. With their cutting-edge treatments for a variety of illnesses, such as cancer, autoimmune and other genetic disorders, and infectious diseases, biologics have entirely changed the way drugs are delivered.

| Report Coverage | Details |

| Market Size by 2034 | USD 92.37 Billion |

| Market Size in 2024 | USD 21.96 Billion |

| Market Size in 2025 | USD 25.35 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 15.45% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Molecule Type, Product Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for biological medicinal products and small-molecule drugs

Even with the rise of biologicals, small-molecule medications are still crucial for treating a wide range of illnesses. CDMOs are essential for maximizing and scaling up the manufacture of these medications. Their proficiency in process optimization, synthetic chemistry, and regulatory compliance aids pharmaceutical companies in effectively introducing these medications to the market.

The pharmaceutical industry's shift towards personalized treatment and targeted therapy further fueled the need for specialized biologics and small-molecule medications. CDMOs with strong manufacturing skills and the ability to quickly adjust to changing market conditions are well-positioned for expansion. This drives the growth of the biologics CDMO market.

Increasing adoption of automation and Internet of Things (IoT) technologies

In biologics production, automation enables streamlined procedures that lower human error and unpredictability. Through real-time parameter monitoring, IoT-enabled equipment can guarantee constant quality and regulatory compliance throughout the production process. IoT sensors gather large volumes of data while production is taking place. Analyzing this data can increase overall operating efficiency through process optimization, predictive maintenance, and continuous improvement.

Shortage of skilled professionals in bioprocessing and biomanufacturing

A thorough understanding of bioprocess engineering, cell culture techniques, purification processes, and regulatory compliance is required by the biologics CDMO industry. Not only do proficient experts need to carry out these procedures, but they must also be continuously innovated and optimized. Lack of such knowledge may make it more difficult for CDMOs to remain competitive in a market that is expanding quickly and to satisfy the changing needs of their biopharmaceutical clients. This limits the growth of the biologics CDMO market.

Advantages of investments in contract manufacturing facilities

Manufacturing biologics calls for specific resources and knowledge. Pharmaceutical businesses can avoid the high initial capital expenditures of establishing and maintaining these facilities by investing in contract manufacturing facilities. Alternatively, by using CDMOs' already-existing infrastructure and obtaining economies of scale, companies can outsource production to them. This opens an opportunity for the growth of the biologics CDMO market.

Potential for additional CDMOs and big pharma alliances

CDMOs possess deep technical expertise in cell culture, fermentation, purification, and analytical testing. They invest in state-of-the-art infrastructure and technology to fulfill the unique requirements of biologic production. CDMOs are skilled at negotiating intricate regulatory procedures, guaranteeing that goods meet international standards. These procedures require specific equipment and knowledge because they involve living cells. Strict regulatory requirements are in place for biologics to ensure their efficacy and safety.

The mammalian segment dominated the biologics CDMO market in 2024. Mammalian cell-based biologics are frequently more sophisticated than those created with other systems, such as yeast or bacterial cells. Because of their complexity, therapeutic proteins may be produced structurally and functionally in ways that are very similar to human proteins. This makes them excellent treatments for various illnesses like cancer, autoimmune diseases, and chronic illnesses. Due to their improved efficacy, the increased demand for these biologics has also increased the demand for CDMO services based on mammalian cell culture.

The microbial segment is observed to be the fastest growing in the biologics CDMO market during the forecast period. The market for biosimilars has expanded due to the expiring patents for some popular biologics. Because microbial systems are efficient and affordable, many biosimilars are made there. A growing pipeline of new biologics is being generated using microbial systems, including novel therapeutic proteins and peptides.

The monoclonal antibodies segment dominated the biologics CDMO market in 2024. The industry has grown due to large investments made by venture capital firms into biotech businesses, creating mAbs. Government subsidies and funding for monoclonal antibody research, particularly during pandemics, have supported the market. Advancements in upstream and downstream bioprocessing have increased the efficiency and yield of mAb synthesis. The usage of single-use systems has improved manufacturing flexibility and decreased the possibility of cross-contamination. The characterization of mAbs has been enhanced by sophisticated analytical techniques, guaranteeing increased quality and consistency in production.

The recombinant proteins segment is observed to be the fastest growing in the biologics CDMO market during the forecast period. Improvements in expression methods, including insect, bacterial, yeast, and mammalian cell lines, have significantly increased the yield and productivity of recombinant protein synthesis. Advances in cell-free protein synthesis, continuous manufacturing, and single-use bioreactors have simplified production procedures, cutting expenses and time.

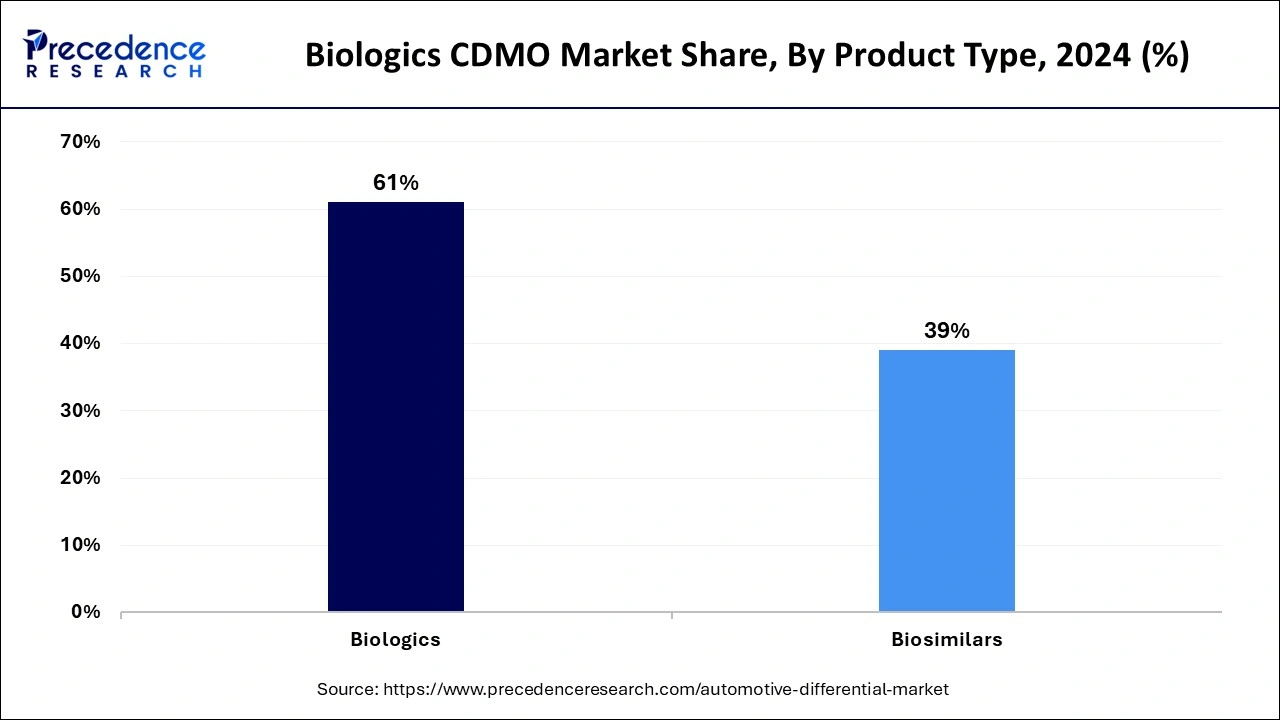

The biologics segment has a significant share in the biologics CDMO market in 2024. Treatments for complicated diseases like cancer, autoimmune disorders, and hereditary problems have shown greater efficacy and specificity when using biologics, which include vaccines, recombinant proteins, cell and gene treatments, and monoclonal antibodies. Biologics, frequently customized to unique patient profiles, are in more demand due to the trend toward personalized therapy.

The oncology segment dominated the biologics CDMO market in 2024. Millions of new cases of cancer are identified annually, indicating a rising global prevalence of the disease. This has led to a significant need for novel and efficient biologic medicines. The need for cutting-edge oncology therapies is further fueled by the fact that an aging global population is more vulnerable to cancer.

Biologic medications that target different types of cancer are rapidly emerging from the pipeline because of significant investments made by pharmaceutical and biotech businesses in oncology research and development. Research into cancer, clinical trials, and the creation of biologic treatments are all greatly aided by substantial funding from public agencies, nonprofit groups, and private investors.

The auto-immune diseases segment grows at a notable rate in the biologics CDMO market during the forecast period. The frequency and prevalence of autoimmune illnesses, including lupus, rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease, have increased significantly. This increase is driving the need for efficient biologic medicines. The need for biologic therapy has been fueled partly by increased awareness of autoimmune disorders and their earlier and more accurate detection due to developments in diagnostic procedures.

The trend toward personalized medicine and precision therapeutics is driving the need for biologics that cater to each patient's specific requirements. Biologics are ideally adapted to fulfill the individualized therapeutic needs associated with autoimmune disorders.

By Type

By Molecule Type

By Product Type

By Indication

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

March 2025

July 2024