Biologics Contract Development Market Size and Growth 2025 to 2034

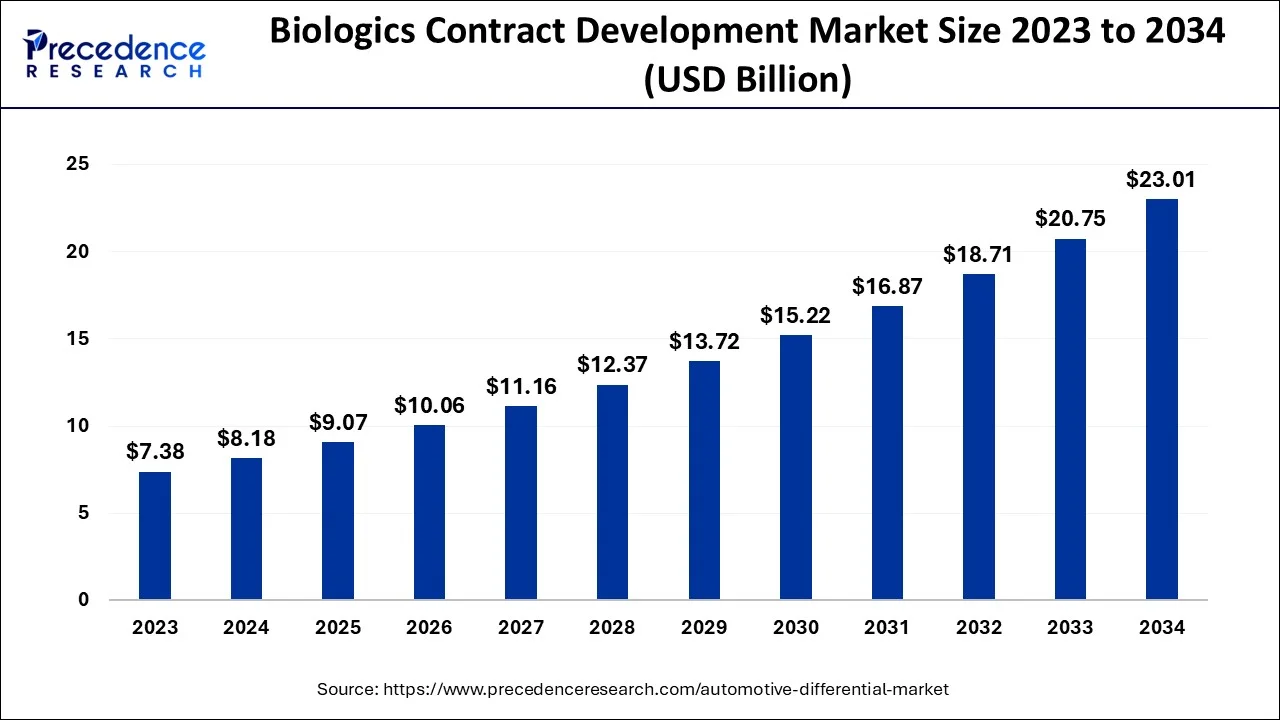

The global biologics contract development market size was estimated at USD 8.18 billion in 2024 and is predicted to increase from USD 9.07 billion in 2025 to approximately USD 23.01 billion by 2034, expanding at a CAGR of 10.90% from 2025 to 2034.

Biologics Contract Development Market Key Takeaways

- In terms of revenue, the global biologics contract development market was valued at USD 8.18 billion in 2024.

- It is projected to reach USD 23.01 billion by 2034.

- The market is expected to grow at a CAGR of 10.90% from 2025 to 2034.

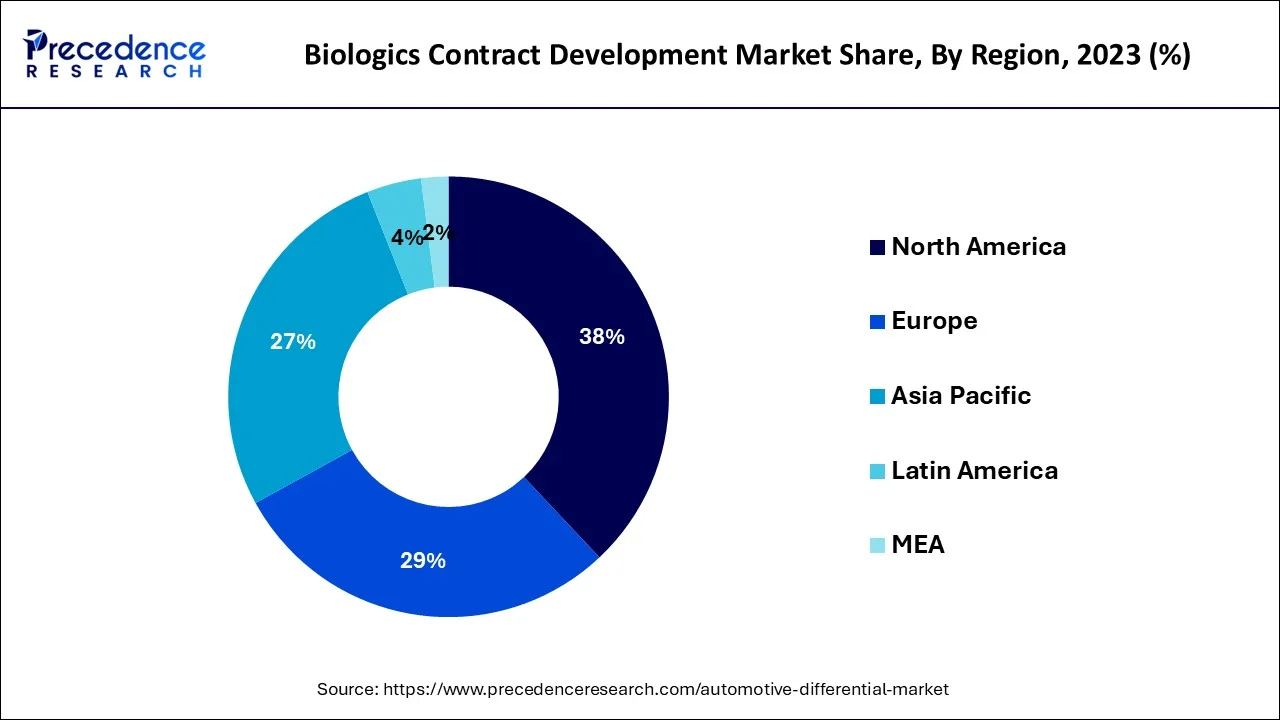

- North America dominated thebiologics contract development market with the largest market share of 38% in 2024.

- Asia Pacific is expected to register to grow at a significant CAGR during the forecast period

- By Indication, the oncology segment captured the biggest market share in 2024.

- By Indication, the immunological disorders segment is expected to expand at the fastest CAGR in the coming years

- By product service, the process development segment contributed the highest market share in 2024.

- By product service, the cell line development segment is expected to expand at a rapid pace in the coming years.

- By source, the mammalian segment generated the major market share in 2024.

Impact of AI on the Biologics Contract Development Market

AI positively impacts the market, revolutionizing every aspect, from drug discovery and quality control to supply chain management.

Drug Discovery: AI helps contract development organizations in drug discovery by identifying potential drug candidates. Ai analyzes genetic and protein data, accelerating the drug discovery process.

Clinical Trials: AI can optimize clinical trials by analyzing patient data and identifying suitable candidates. AI-enabled systems enhance data analysis and detect and optimize quality deviations and non-compliance issues in real time.

Supply Chain Optimization: AI helps CDOs streamline supply chain. Integrating AI technologies in the supply chain helps to reduce lead time and enhance efficiency.

U.S. Biologics Contract Development Market Size and Growth 2024 to 2034

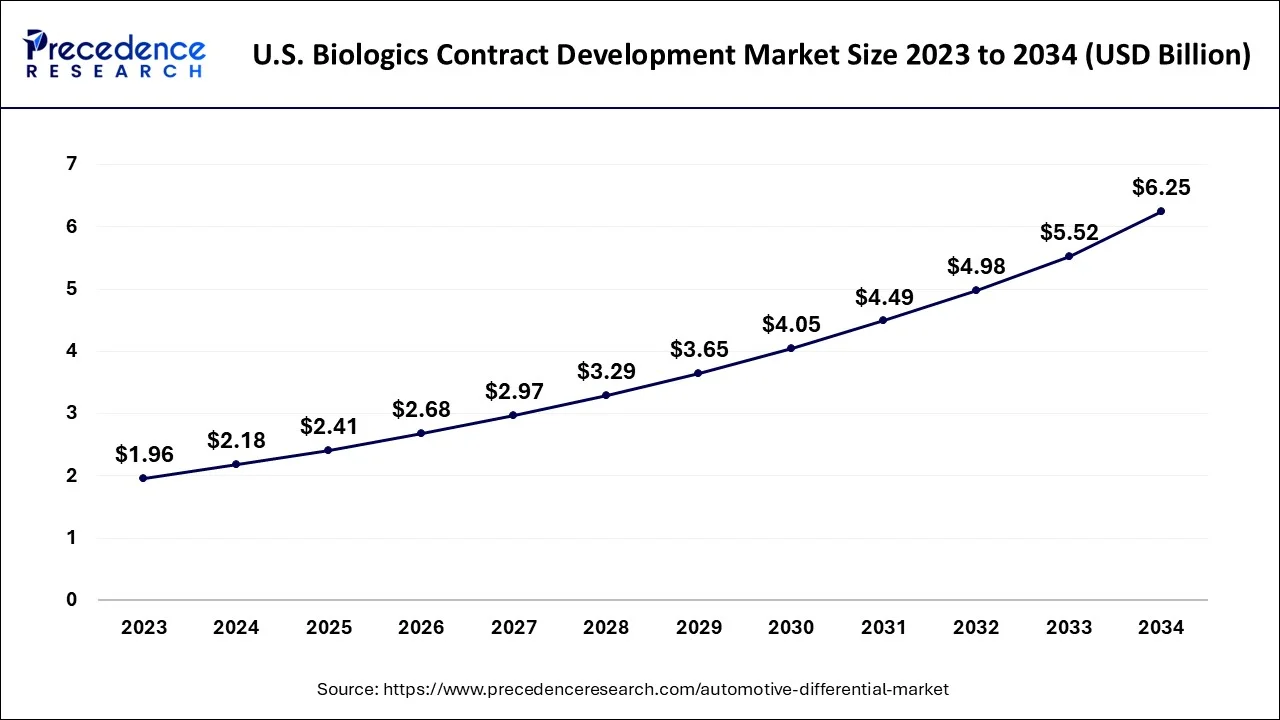

The U.S. biologics contract development market size accounted for USD 2.18 billion in 2024 and is predicted to be worth around USD 6.25 billion by 2034, growing at a CAGR of 11.11% from 2025 to 2034.

North America dominated the market in 2024. This is mainly due to the increasing prevalence of chronic disorders, presence of key market players, growth in the elderly population, rise in the number of clinical trials, strong presence of CROs in the region, rising number of cancer therapies and an increasing number of novel drugs approval. For instance, In 2022, CDER approved 37 new drugs never before approved or marketed in the United States, known as novel drugs. Moreover, the United States is the major market for the biologics CDMO industry.

The rapid expansion of contract development organizations (CDOs) can be a major factor attributed to the region's increasing number of clinical trial activities as well as outsourcing activities. On the other hand, Asia Pacific is expected to register to grow at a significant CAGR during the forecast period owing to the increase in healthcare investment, cost-effective clinical trials, presence of medical expertise at low cost, and an increasing number of pharmaceutical firms to whom big pharmaceutical firms are outsourcing their drug manufacturing. India, China, and Korea are the most popular regions for clinical research among developing countries. The government of these nations promotes and encourage outsourcing as it attracts foreign investment. Moreover, the renowned regulatory bodies in developing nations are aligning their policies with FDA and EMA standards for accelerating the approval process.

Market Overview

Genetically modified proteins called biologics are derived from human genes. Biologic drugs target particular parts of the human immune system. There is an extensive range of biological products such as recombinant gene therapy, blood components, somatic cells, allergenic, vaccines, and others. Biologics are constituted as proteins, nucleic acids, and tissues from living organisms. A pharmaceutical contract development and manufacturing organization (CDMO), is an organization that specializes in providing CDMO services ranging from drug product development & manufacturing to pharmaceutical packaging services including pharmaceutical serialization and aggregation. Incorporating external third-party projects, CDMOs offer crucial services and make their knowledge, development, and manufacturing capabilities available.

The activities of CDMOs are defined as the production of items by a production facility, with the label or brand of another company. Based on their customer designs or their own, formulas, and requirements, Contract manufacturers offer these support services to a number of businesses. They frequently offer a mix of integrated project management and scientific expertise combined with affordable CDMO services, which in turn aids their partner companies in bringing drugs to market more quickly as well as safely.

As drug development is complex, several pharmaceutical companies face obstacles in developing and manufacturing drug substances. With the high costs of tools and the wide range of equipment required for sterile liquid dosage, solid dosage forms, and liquid and semi-solid dosage. Strategic partnerships and collaborations with a CDMO or CMO help pharmaceutical companies to come up with novel and advanced products or formulas for the market without additional infrastructure investment. When pharmaceutical firms find the right CDMO, it helps them to save both time and Small molecules outweigh biologics regarding drug approvals. For instance, In FDA's Center for Drug Evaluation and Research (CDER) approved 37 new drugs in 2022. CDER approved 37 novel drugs, either as NMEs under NDAs or as new therapeutic biological products under Biologics License Applications (BLAs).

The FDA's Center for Drug Evaluation and Research (CDER) gave its approval to 37 new molecular entities in 2022. In comparison, there were 50 new approvals in 2021, 53 in 2020, 48 in 2019, and 59 in 2018. 17 of 2022's new drugs were small molecules, accounting for 46%. Large molecules, such as biosimilars, biologics, and cell and gene therapies, are also projected to witness the fastest growth during the forecast period. The growth of the market is driven by factors such as rapid growth in outsourcing services, increasing need to reduce costs, development of cell lines, and increasing approval in biologics products.

The strong presence of pharmaceutical companies around the world represents as the primary factor strengthening the market growth. The growth of the biologics contract development market is driven by the increasing aging population, new product launches, wide adoption of advanced technology for biological production, and increasing prevalence of chronic disorders such as gynecological disorders, neurological disorders, ophthalmic disorders, cancer, cardiovascular disorders, and others, rising demand for novel and innovative therapies, and biotech and pharma firms requiring huge capital investments for innovative technologies are forming collaborations or partnerships with CDMOs.

Biologics Contract Development Market Growth Factors

- Rising demand for outsourcing services, the need to reduce costs, the development of cell lines, and the increasing approval of biologics products drive the market.

- The strong presence of pharmaceutical companies worldwide represents the primary factor in strengthening market growth.

- The growth of the biologics contract development market is driven by the increasing aging population, growing prevalence of age-related diseases, and demand for personalized medicines.

- The rising adoption of advanced technologies to accelerate biologics production fuels the market's growth.

- The increasing prevalence of chronic disorders, such as neurological disorders, ophthalmic disorders, cancer, and cardiovascular diseases, contributes to market expansion.

- Rising demand for novel therapies and the increasing collaborations or partnerships between pharmaceutical companies and CDMOs to develop biologics drive the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23.01 Billion |

| Market Size in 2025 | USD 9.07 Billion |

| Market Size in 2024 | USD 8.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Product Service, Indication, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Several pharma and biopharma firms are increasingly looking to outsource their required activities

Several pharma and biopharma firms are increasingly looking to outsource their required activities as it aids to speed up the workflow of the company, reduces drug manufacturing costs, and provides medical expertise. These factors are projected to drive the biologics contract development organization market growth during the forecast period. Biologics CDMO companies can handle any and all steps of drug development and manufacturing. Biologics CDMOs offer various services related to dosage, formulation, research and development, stability, and manufacturing. Biologics Contract development and manufacturing organizations (CDMOs) are crucial resources for pharmaceutical firms. They have valuable experience in everything from pre-formulation to clinical trials and commercial production.

Restraints

Less control over production than an in-house production facility

In-house productions facility offers the company direct control over the quantity and quality of the products. It offers the flexibility to the companies to easily change the scope, modify timelines and reduce or increase the volume based on the given demand. The outsourcing production of items hands this power over to the Contract development and manufacturing organization (CDMO) quality assurance facilities.

Opportunities

Increasing M&A and collaboration activities

The increasing M&A and collaboration activities between biopharma or pharma companies and CDMOs are expected to accelerate market growth. For instance, In September 2020, AGC Biologics, a leading Biopharmaceutical Contract Development and Manufacturing Organization (CDMO), acquired MolMed. MolMed is a biotechnology company focused on the research, development, production, and clinical validation of cell and gene therapies for the treatment of rare diseases and cancer. Cell and gene therapy is an innovative growing therapeutic field that aims to treat disorders that do not have proper treatments. After this acquisition, AGC Biologics is pleased to offer end-to-end cell and gene therapy CDMO services to their current and future customers. This acquisition would help the company strengthen its market position in cell and gene therapy.

Indication Insights

The oncology segment held the largest market share in 2024. This is mainly due to the increasing demand for cancer therapies. Several pharmaceutical companies are investing in R&D and outsourcing drug manufacturing services to accelerate drug discovery and development. Biologics therapy aids in repairing, activating, and improving the immune system as cancers are formed due to the dysfunction of the immune system. Biopharmaceutical and pharmaceutical companies increasingly invest in novel cancer-related treatments, contributing to segmental growth.

The immunological disorders segment is expected to expand at the fastest CAGR in the coming years. The increasing prevalence of autoimmune diseases like rheumatologic diseases, arthritis, and lupus drives the growth of the segment. People are becoming aware of autoimmune diseases, thus increasing the demand for early detection and prevention. Ongoing advancements in diagnostic technologies like enzyme-linked immunosorbent assays and immunofluorescence assays contribute to segmental growth.

Product Service Insights

The process development segment led the market in 2024. Biologics process development includes two techniques major downstream process development and upstream process development. Upstream process development is defined as choosing the right bioreactor systems, cell lines, and operating parameters. In order to fulfill the client's business needs, Upstream process development services are offered by biologics manufacturing organizations. The prominent companies which offer upstream process development are Bionova Scientific, AGC Biologics, and others. Downstream and Upstream processing are unit operations needed in the production of biologics, using host cell proteins.

The two process steps differ from each other. Upstream mainly deals with inoculum development whereas downstream bioprocessing deals with harvested, purified, and clarified items and can also include final product development. Downstream processing involves the production of a purified final product including hormones enzymes, and antibiotics that are usually procured on large scales.

The cell line development segment is expected to expand at a rapid pace in the coming years. The growth of the segment is attributed to the rising demand for recombinant proteins, monoclonal antibodies, increasing rates of oncology, rising autoimmune disorders, increasing prevalence of chronic disorders, genetic disorders, and others. Recombinant cell lines are highly used to produce recombinant biopharmaceutical proteins. Researchers focus on developing several protein-based therapies that accelerate the development of high-expression cell lines. Moreover, the growing prevalence of various chronic diseases is driving demand for cell line development services. The rising production of vaccines further boosts the demand for cell line development services.

Source Insights

The mammalian segment held the largest share of the market in 2024 owing to the increasing use of mammalian cells for protein expression. Mammalian cell culture is used for manufacturing several biological products including, synthetic hormones, antibodies, and enzymes. Mammalian cell culture is used for viral vaccine production to provide protection to people from infectious disorders. Mammalian cell culture is also used for basic research in cell biology, physiology, and medicine to examine as how cells work and disease causation. The most commonly used mammalian cell cultures are Murine myeloma cells, baby hamster kidney (BHK21) cells, and Chinese hamster ovary (CHO) cells to produce biopharmaceuticals. On the other hand, the microbial source segment is projected to grow at a significant rate during the forecast period. Recombinant proteins such as insulin or antibody fragments are manufactured using microbial systems. They are highly demanded due to their high productivity and low cost.

The microbial segment is the second-largest segment in 2024 and is projected to grow steadily in the coming years. The growth of the segment is driven by the increasing manufacturing of microbial-based biologics like vaccines, enzymes, and antibiotics. The increasing adoption of biologics significantly boosts the demand for microbial-based contract development services. The high productivity and cost-effectiveness of microbial-based biologics are anticipated to boost segmental growth. Moreover, the rising demand for recombinant protein therapeutics contributes to segmental growth.

Biologics Contract Development MarketCompanies

- Abzena Ltd

- AGC Biologics

- Bionova Scientific, Inc.

- BioXcellence

- Curia Global, Inc.

- Fujifilm Diosynth Biotechnologies

- Genscript

- KBI Biopharma

- STC Biologics

- Thermo Fisher Scientific Inc.

- WuXi Biologics

- Boehringer Ingelheim Group

- Samsung Biologics

- Lonza Group

Recent Developments

- In October 2024, Samsung Biologics, a global contract development and manufacturing organization (CDMO), launched S-HiCon, a new high-concentration formulation platform. S-HiCon helps in the development and manufacturing of high-dose biopharmaceuticals.

- In May 2024, AGC Biologics and BioConnection, a contract manufacturing organization specializing in aseptic filling of vials and syringes for clinical and commercial production, collaborated to offer end-to-end biopharmaceutical development and manufacturing capabilities for drug substance and drug product.

- In June 2024, Abzena, the leading end-to-end integrated contract and development manufacturing organization (CDMO) for complex biologics and bioconjugates, partnered with Argonaut Manufacturing Services, Inc. The aim of the partnership was to provide a fully integrated drug substance and drug product manufacturing solution for biopharmaceutical organizations.

Segments Covered in the Report

By Source

- Microbial

- Mammalian

- Others

By Product Service

- Cell Line Development

- Microbial

- Mammalian

- Others

- Process Development

- Upstream

- Microbial

- Mammalian

- Others

- Downstream

- Impurity, isolation, & identification

- Physicochemical characterization

- Pharmaceutical analysis

- Others

- By Product

- MABs

- Recombinant proteins

- Others

- Upstream

- Others

By Indication

- Oncology

- Immunological disorders

- Cardiovascular disorders

- Hematological disorders

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content