September 2024

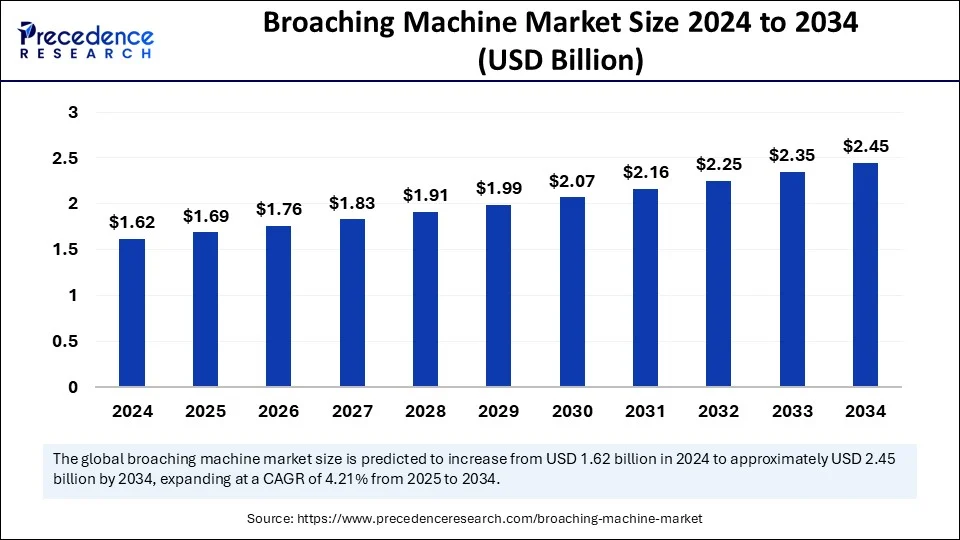

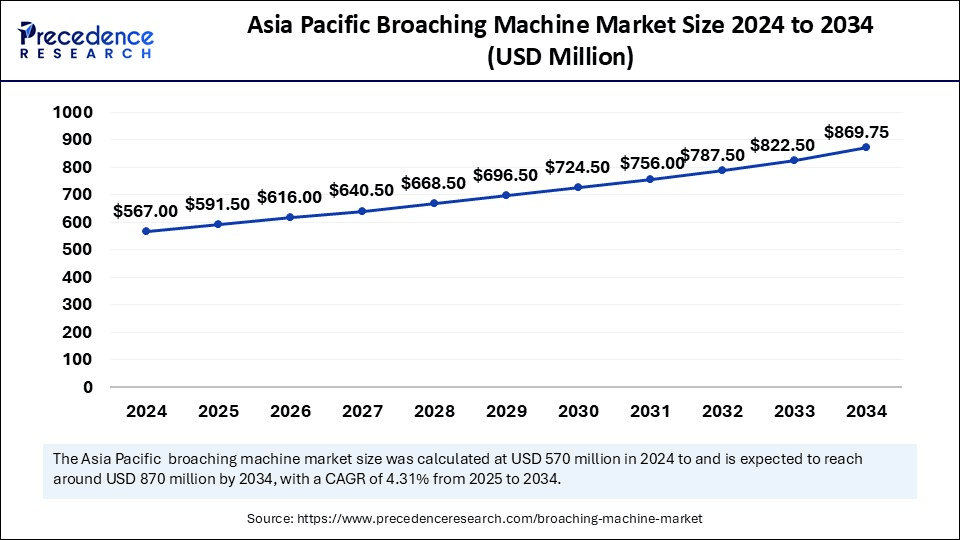

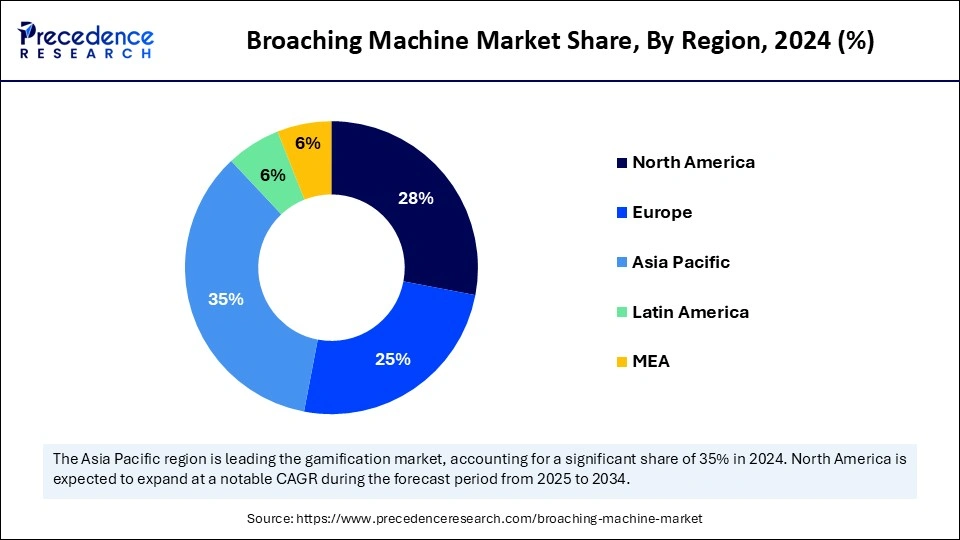

The global broaching machine market size is calculated at USD 1.69 billion in 2025 and is forecasted to reach around USD 2.45 billion by 2034, accelerating at a CAGR of 4.21% from 2025 to 2034. The Asia Pacific market size surpassed USD 567.00 million in 2024 and is expanding at a CAGR of 4.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global broaching machine market size accounted for USD 1.62 billion in 2024 and is predicted to increase from USD 1.69 billion in 2025 to approximately USD 2.45 billion by 2034, expanding at a CAGR of 4.21% from 2025 to 2034. The market is witnessing steady growth due to rising demand for precision machining across industries such as automotive, aerospace, and manufacturing. Broaching machines are widely used for creating complex and accurate shapes in metal components, offering high productivity and efficiency.

Artificial intelligence is significantly reshaping the broaching machine market by enhancing precision, efficiency, and automation in machine operation. AI-powered systems are enabling real-time monitoring and predictive maintenance of broaching machines, reducing downtime and improving productivity. Smart sensors and machine learning algorithms collect and analyze data from the machines, optimizing cutting speeds, tool paths, and material usage for greater accuracy and consistency.

Additionally, AI is streamlining quality control processes by automatically detecting defects and deviations during production, ensuring higher standards in component manufacturing. Recent developments include AI-generated CNC broaching solutions and meeting and industrial sectors for precision and speed.

The Asia Pacific broaching machine market size was exhibited at USD 567.00 million in 2024 and is projected to be worth around USD 869.75 billion by 2034, growing at a CAGR of 4.31% from 2025 to 2034.

Asia Pacific dominated the broaching machine market in 2024. Countries like China, Japan, and India are major contributors. Government initiatives promoting industrial automation and local manufacturing, such as India’s Make in India and China’s Made in China 2025, are driving significant investments in machine tools, including broaching machines.

North America is observed to be the fastest growing region in the broaching machine market during the forecast period. The rapid rate of growth is primarily due to the region's strong presence in the automotive, aerospace, and defense sectors, which rely heavily on precision manufacturing. The U.S. remains the primary contributor, as the U.S. government’s emphasis on revitalizing domestic manufacturing, along with the adoption of advanced CNC and AI-integrated broaching systems, has strengthened the market further.

The European broaching machine market has been observed to be expanding at a considerable rate in recent years, particularly driven by Germany, Italy, and France, where automotive and aerospace manufacturing hubs are integrating Industry 4.0 solutions into broaching machines. The EU Green Deal has also stimulated demand for energy-efficient manufacturing equipment, prompting several companies to upgrade their broaching systems.

The broaching machine market has experienced consistent growth over recent years, primarily driven by advancements in manufacturing technologies, increasing demand for precision machining, and the rising adoption of automation. Key consumer trends influencing this market include the shift toward automated and CNC-controlled broaching systems, which provide enhanced accuracy, speed, and efficiency. Industries such as automotive, aerospace, and heavy machinery are increasingly demanding broaching machines that offer high precision and lower production times. Moreover, there is a growing inclination toward energy-efficient and AI-integrated broaching solutions, which not only improve productivity but also reduce operational costs.

| Countries | Advancements | Aim/Focus |

| Japan | AI-integrated broaching machines with predictive maintenance systems. | Expand automated broaching solutions globally. |

| United States | CNC broaching systems with adaptive control technology | Improve precision and efficiency for aerospace clients |

| Germany | Hybrid broaching machines focusing on energy efficiency | Enhance presence in the aerospace and defense sectors |

| Denmark | Hydraulic broaching machines with IoT connectivity | Strengths the European market penetration |

| United States | Custom-designed broaching solutions for the automotive and defense sectors | Develop high-speed broaching systems with minimal downtime. |

| Report Coverage | Details |

| Market Size by 2034 | USD 2.45 Billion |

| Market Size in 2025 | USD 1.69 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.21% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material , Type, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for precision machining in the automotive and aerospace sectors

As manufacturers aim for tighter tolerances and enhanced productivity, broaching machines offer highly accurate finishing operations that are essential for producing complex components such as gears, splines, and keyways. Additionally, the shift toward automated manufacturing and Industry 4.0 integration is boosting the adoption of CNC-controlled and hydraulic broaching machines. These advancements ensure higher efficiency, reduced cycle times, and lower human intervention.

High initial investment and maintenance costs

Despite technological advances, the market faces a key restraint in the high initial investment and maintenance costs associated with broaching machines, especially CNC and automated variants. Small and medium-sized enterprises (SMEs) often struggle to justify the capital expenditure required, particularly in developing regions where budget constraints and limited access to advanced technologies are common. Furthermore, the specialized skill set required for machine operation and maintenance poses an additional barrier to widespread adoption.

Lightweight and complex-shaped components in the electric vehicle (EV) sector

The growing demand for lightweight and complex-shaped components in the electric vehicle (EV) sector presents significant opportunities for the broaching machine market. EV components often require high precision and a surface finish, for which broaching machines are well-suited. In addition, the rise of smart manufacturing initiatives is supported by government policies.

The horizontal broaching machines segment held the largest broaching machine market share in 2024, primarily due to their widespread use in automotive and industrial applications. These machines are highly efficient for internal keyways, splines, and surface broaching, making them the preferred choice for mass production. The automotive industry heavily relies on horizontal broaching for engine components, gears, and transmission parts.

On the other hand, the vertical broaching machines segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, especially in the aerospace and defense sectors, where precision and space-saving designs are crucial. These machines are preferred for broaching turbine components, gear teeth, and firearm parts. The integration of CNC automation in vertical broaching has further accelerated its adoption.

The metal segment dominated the broaching machine market, primarily because of the high volume of metal machining applications in the automotive, aerospace, and heavy machinery industries. The broaching process is widely used to create internal keyways, splines, and other features in steel, aluminum, and titanium components, which are standard materials in these sectors.

On the other hand, the composite materials segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to the increased use of lightweight composites in the aerospace and automotive industries, especially for EVs and aircraft. Manufacturers are developing specialized broaching tools and machines capable of handling abrasive composite materials without compromising surface quality or structural integrity.

The automotive segment led the broaching machine market. This dominance is due to the increasing demand for precision-machined components, such as gears, splines, and transmission parts. As the automotive industry moves towards electric vehicles (EVs), there is a growing need for lightweight, complex parts that require precision broaching, boosting the demand for advanced broaching machines in this sector.

However, the aerospace segment is anticipated to grow at a remarkable CAGR between 2025 and 2034. Aerospace components demand extreme precision and high strength, and broaching machines offer an ideal solution for producing turbine discs, fuselage components, and landing gear systems. Additionally, government initiatives supporting aerospace manufacturing in North America and Europe have led to the increased adoption of high-end CNC and hydraulic broaching machines in this sector.

The manufacturing segment held the largest broaching machine market share in 2024. This sector demands high-volume production with consistent precision, making broaching an ideal process for the large-scale manufacturing of automotive, aerospace, and industrial components.

The segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, especially within the aerospace and marine industries, where retrofit parts and maintenance components require precision broaching for longevity and performance.

By Material

By Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

October 2024

December 2024