September 2024

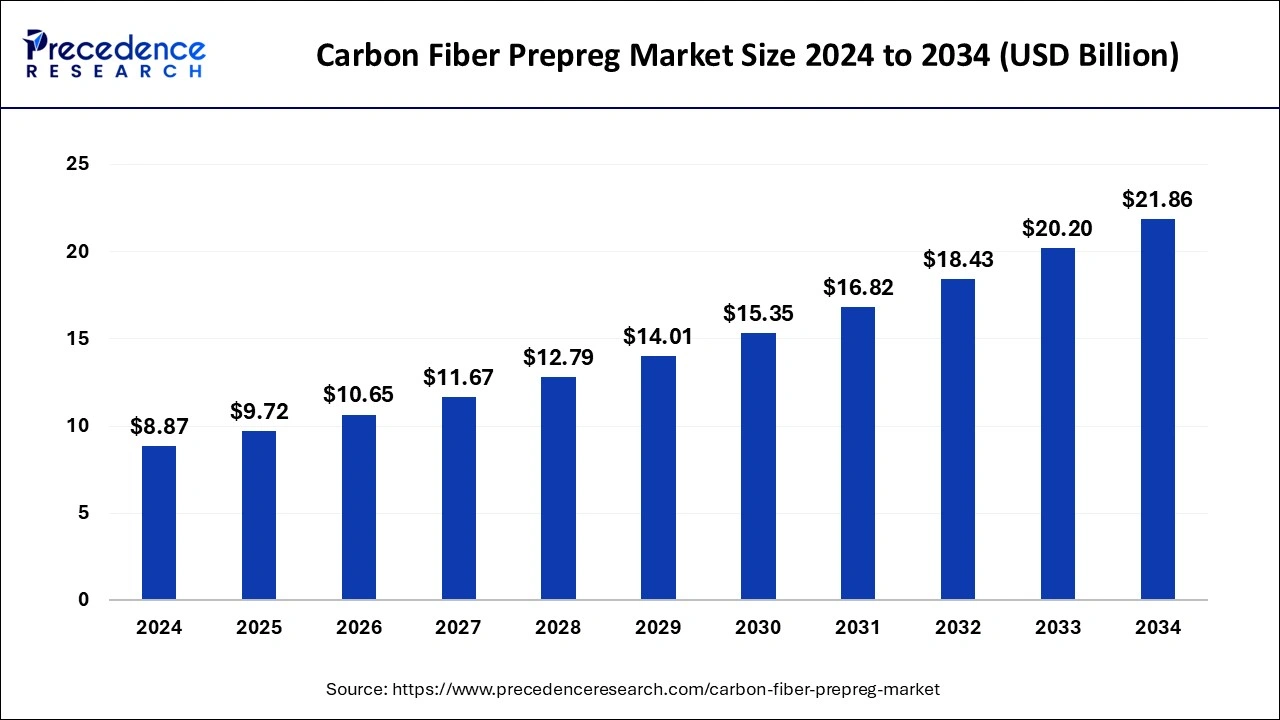

The global carbon fiber prepreg market size is calculated at USD 9.72 billion in 2025 and is forecasted to reach around USD 21.86 billion by 2034, accelerating at a CAGR of 9.44% from 2025 to 2034. The Europe carbon fiber prepreg market size surpassed USD 3.50 billion in 2025 and is expanding at a CAGR of 9.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global carbon fiber prepreg market size was estimated at USD 8.87 billion in 2024 and is predicted to increase from USD 9.72 billion in 2025 to approximately USD 21.86 billion by 2034, expanding at a CAGR of 9.44% from 2025 to 2034. The carbon fiber prepreg market is driven by increasing demand from the wind power sector.

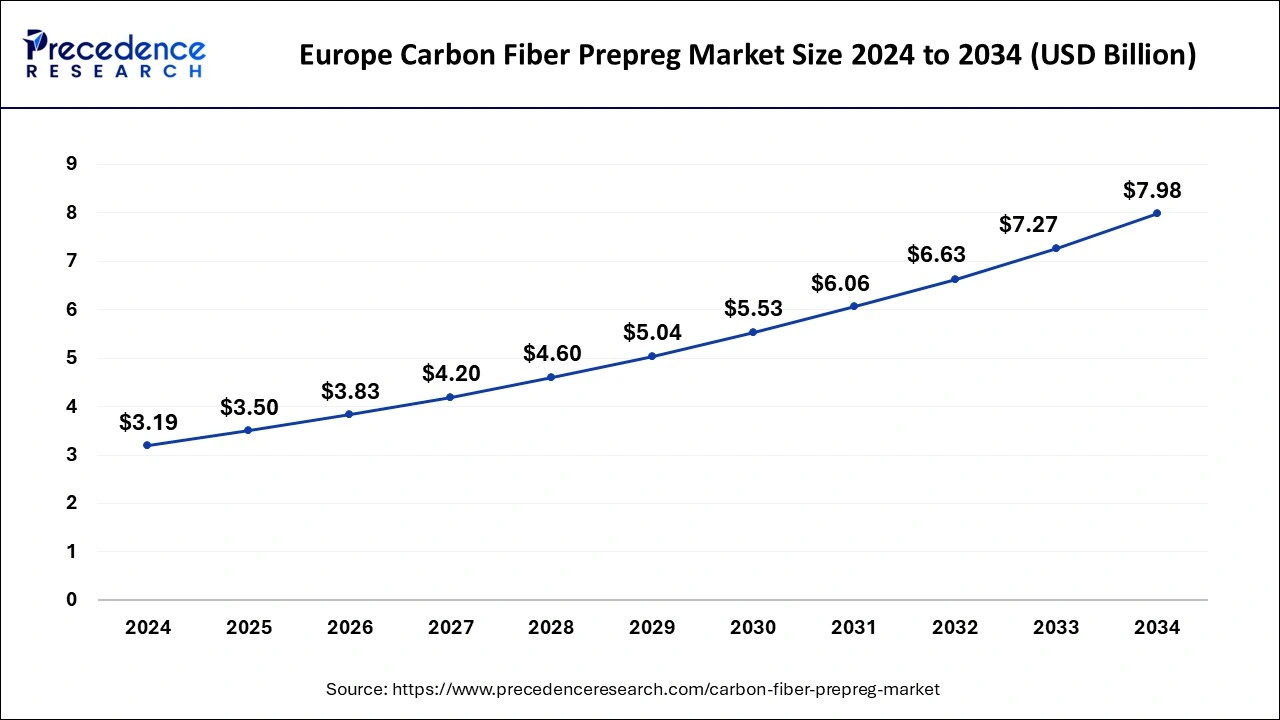

The Europe carbon fiber prepreg market size surpassed USD 3.19 billion in 2024 and is expected to be worth around USD 7.98 billion by 2034 at a CAGR of 9.60% from 2025 to 2034.

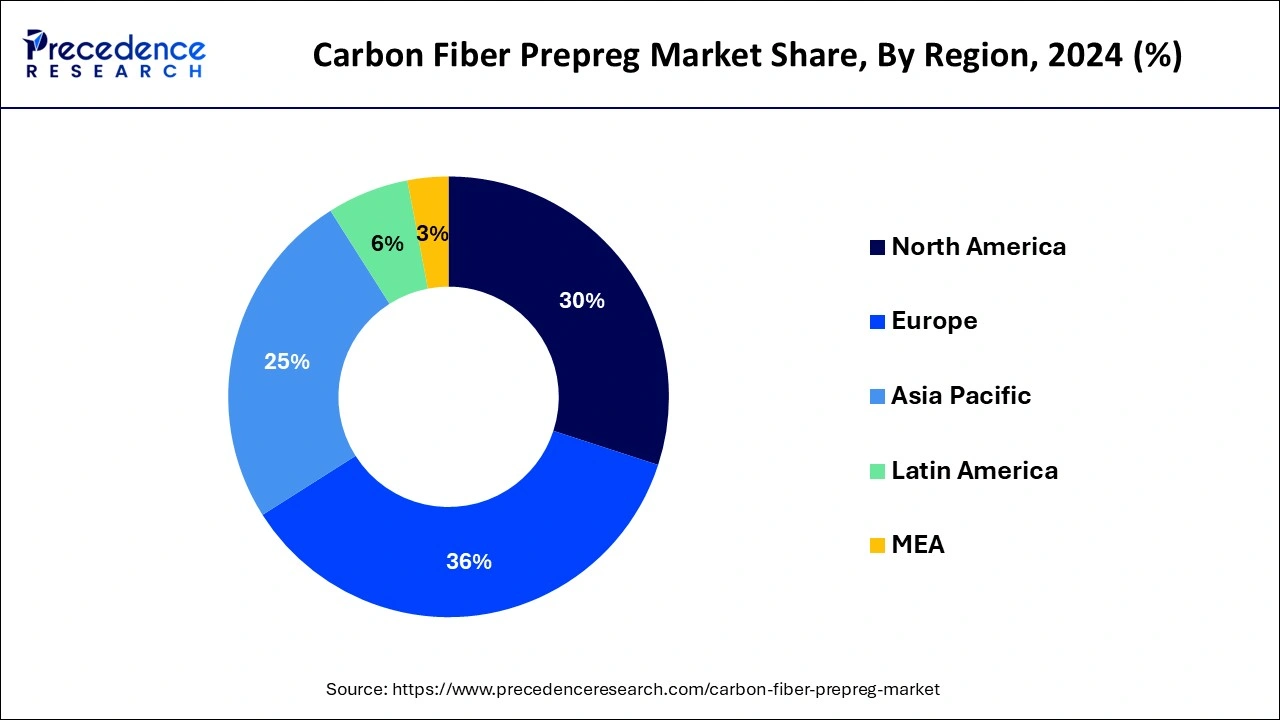

Europe held the largest share of 36% in 2024 in the carbon fiber prepreg market. The rising number of construction activities in the region creates a sum of potential in the area for the market to expand. Because of its resistance to corrosion, exceptional strength, and longevity, carbon fiber prepreg is used in infrastructure projects and provides benefits, including longer lifespans and lower maintenance costs. The demand for carbon fiber prepreg as a building material is expected to increase if public and private entities spend on updating and upgrading infrastructure, propelling revenue growth in the area.

Europe is home to a thriving aerospace and defense sector, which represents a significant market for carbon fiber prepreg materials. Carbon fiber composites offer exceptional strength-to-weight ratio, durability, and corrosion resistance, making them ideal for aircraft components, missile structures, and defense applications. The region's continued investment in aerospace innovation and defense modernization drives the demand for high-performance carbon fiber prepreg materials.

Asia-Pacific is observed to be the fastest-growing carbon fiber prepreg market during the forecast period. Carbon fiber prepreg is becoming increasingly popular among a variety of end-use sectors because of its excellent mechanical qualities, low weight, and high strength-to-weight ratio. Lightweight materials are in high demand in the aircraft sector to improve fuel efficiency and lower pollution. They are also broadly used in the automobile industry to meet weight reduction goals and enhance vehicle efficiency.

An intermediary material known as carbon fiber prepreg is a sheet of carbon fiber soaked with matrix resin. Prepreg comes in various forms, including cloth prepreg, which is made of carbon fibers woven into a fabric and impregnated with matrix resin, and UD prepreg (unidirectional prepreg), which aligns carbon fibers in a single direction. The strength, rigidity, and resistance to chemicals and high temperatures of carbon fiber prepregs are well-known. These characteristics and the fact that carbon fiber is incredibly light make it advantageous for use in both military and commercial applications, such as aerospace components and aircraft interiors.

The French company Toray Carbon Fibers Europe S.A., a subsidiary of Toray Industries Inc., declared that its production facilities in Lacq and Abidos, in Southwest France, have received ISCC Plus certification. With this certification, Toray Carbon Fibers Europe can provide and manufacture carbon fiber by utilizing the mass balancing approach to allocate and use biomass or recycled materials.

Carbon Fiber Prepreg Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.44% |

| Market Size in 2025 | USD 9.72 Billion |

| Market Size by 2034 | USD 21.86 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Resin Type, By Process, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand in aerospace and defense

Carbon fiber prepregs provide high customizability and design freedom, enabling engineers to modify material properties to application needs. Because different components in aerospace and military have substantially varying performance requirements, adaptability is very beneficial in these fields. To fulfill the exacting performance requirements of aerospace and defense applications, engineers can modify parameters like fiber orientation, resin formulation, and curing methods to produce the best strength, stiffness, and other mechanical features.

Limited production capacity

Manufacturers with limited production capacity may have to pay more for prepreg materials. A lack of supply may result in higher prices and production costs for businesses that use prepreg in their manufacturing processes. Ultimately, consumers might pay more for these increased expenses, reducing the appeal of carbon fiber items. Thereby, limited production capacity acts as a major restraint for the carbon fiber prepreg market.

Reinforcement of concrete structures

Carbon fiber prepregs have less environmental impact than typical construction materials, so they can reinforce concrete while adhering to sustainability guidelines. When compared to the production of steel, CFRP composites are made with less energy and emissions due to sophisticated manufacturing techniques. Furthermore, the extended service life of CFRP-reinforced structures minimizes the carbon footprint of infrastructure projects by reducing the need for periodic repair and replacement.

The epoxy resin prepregs segment dominated the carbon fiber prepreg market in 2024. Prepregs based on epoxy resins provide excellent mechanical qualities, such as stiffness, fatigue resistance, and a high strength-to-weight ratio. These characteristics make them perfect for structural integrity and longevity applications, like wind turbine blades, automobile parts, sporting goods, and aerospace components. Compared to other resin types, many epoxy resin systems cure at comparatively low temperatures, which is beneficial for maintaining the integrity of the carbon fibers during manufacture. Epoxy resin prepregs are more economical for large-scale manufacturing when curing temperatures are lowered since they require less energy and money for processing.

The phenolic resin prepregs segment is anticipated to grow in the carbon fiber prepreg market during the forecast period. Superior mechanical qualities, such as a high strength-to-weight ratio, stiffness, and dimensional stability, are displayed by phenolic resin prepregs. These characteristics make them appropriate for high-pressure applications where structural integrity and performance are critical, like body panels for automobiles and aircraft and athletic goods like golf clubs and tennis rackets. Phenolic resin prepregs have certain environmental advantages as sustainability becomes more important when choosing materials. Recycled or bio-based resources can be used to create phenolic resins, which lessens the final product's carbon impact and need on fossil fuels.

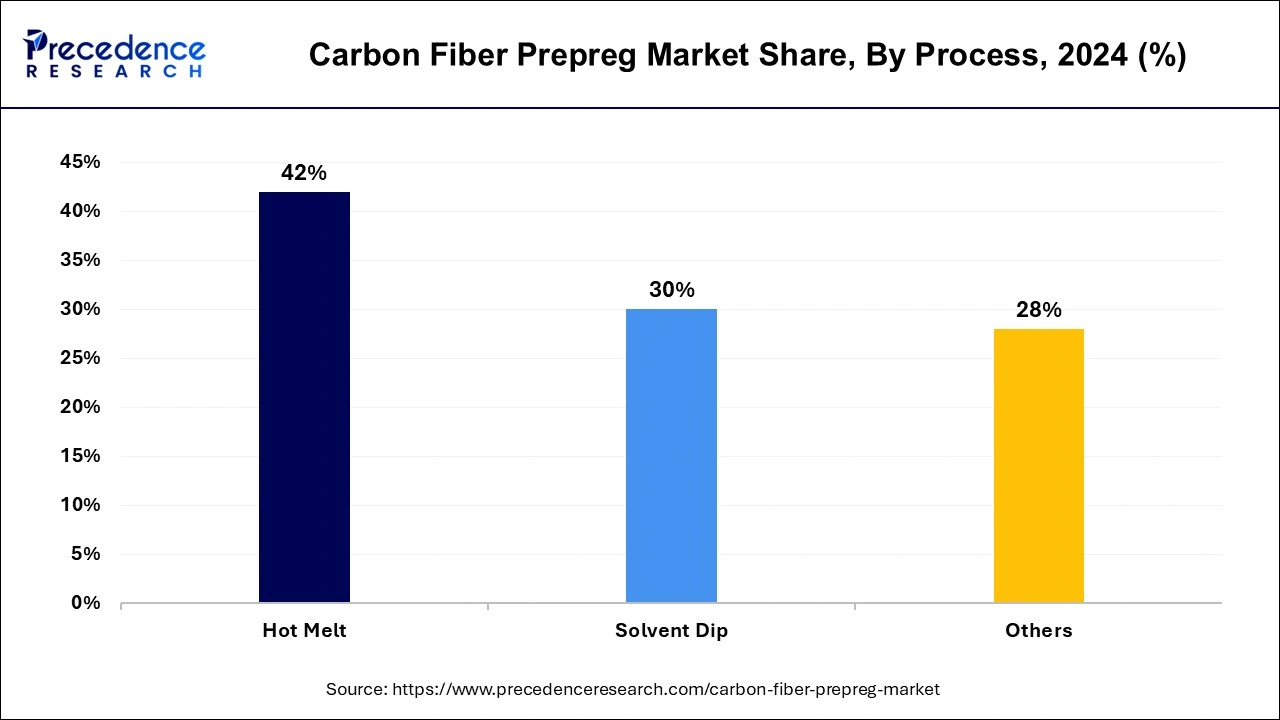

The hot melt segment dominated the carbon fiber prepreg market with revenue share of 42% in 2024. Unidirectional prepregs and fabric can both be produced using the hot melt technique. This technique consists of two steps. The hot resin is first applied in a thin layer to a paper substrate. The prepreg machine allows for the interaction of the resin and reinforcing material. The resin is injected into the fiber upon applying pressure and heat, producing the final prepreg that is twisted around a core.

The solvent dip segment is the fastest growing in the carbon fiber prepreg market during the forecast period. The solvent dip method, which entails dissolving the resin in a solvent bath and then immersing the reinforcing fabric in the resin solution, can only create fabric prepregs. Subsequently, the solvent is removed from the prepreg using a drying oven.

The aerospace and defense segment dominated the carbon fiber prepreg market in 2024. Materials with outstanding strength-to-weight ratios, high stiffness, and resistance to corrosion and fatigue are needed for aerospace and defense applications. Carbon fiber prepreg satisfies these criteria to an extraordinarily high degree. Due to its exceptional mechanical qualities, it is perfect for structural elements in missiles, defense systems, spacecraft, and airplanes. Customized solutions are frequently needed for aerospace and defense applications to satisfy certain design specifications and performance goals.

Carbon fiber prepreg is highly versatile concerning resin compositions, fiber orientations, and curing procedures, enabling producers to customize materials to match the requirements of individual applications precisely.

The automotive segment is the fastest growing in the carbon fiber prepreg market during the forecast period. When compared to conventional materials like steel or aluminum, carbon fiber prepreg materials have better mechanical qualities. High-performance automobile parts can be designed and produced because of their improved stiffness, strength, and fatigue resistance. These characteristics help enhance the car's handling, dynamics, and general performance.

The wind energy segment shows a significant growth in the carbon fiber prepreg market during the forecast period. Renewable energy sources are growing more and more significant on a global scale, with wind power emerging as a significant contender. Governments and organizations worldwide make substantial investments in wind energy projects to cut carbon emissions and achieve sustainability goals. The demand for materials that can survive the rigors of wind turbine construction and operation is growing due to the spike in wind turbine installations.

By Resin Type

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

December 2024