November 2024

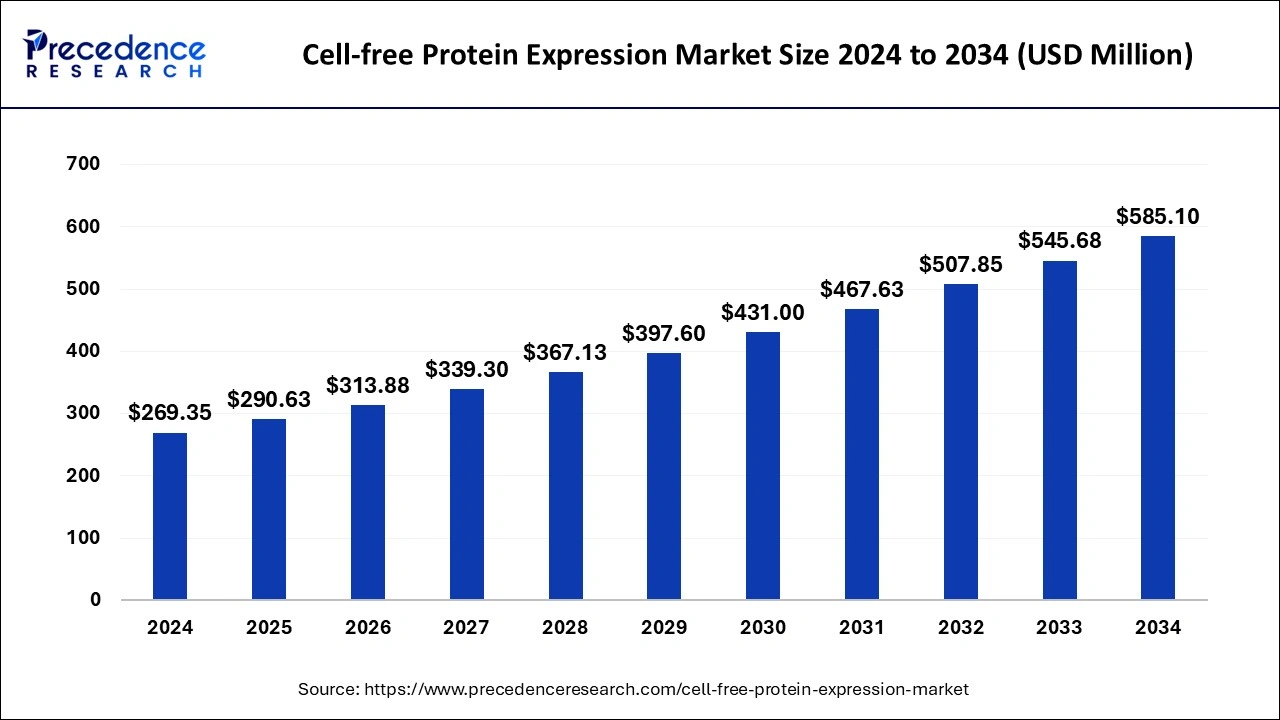

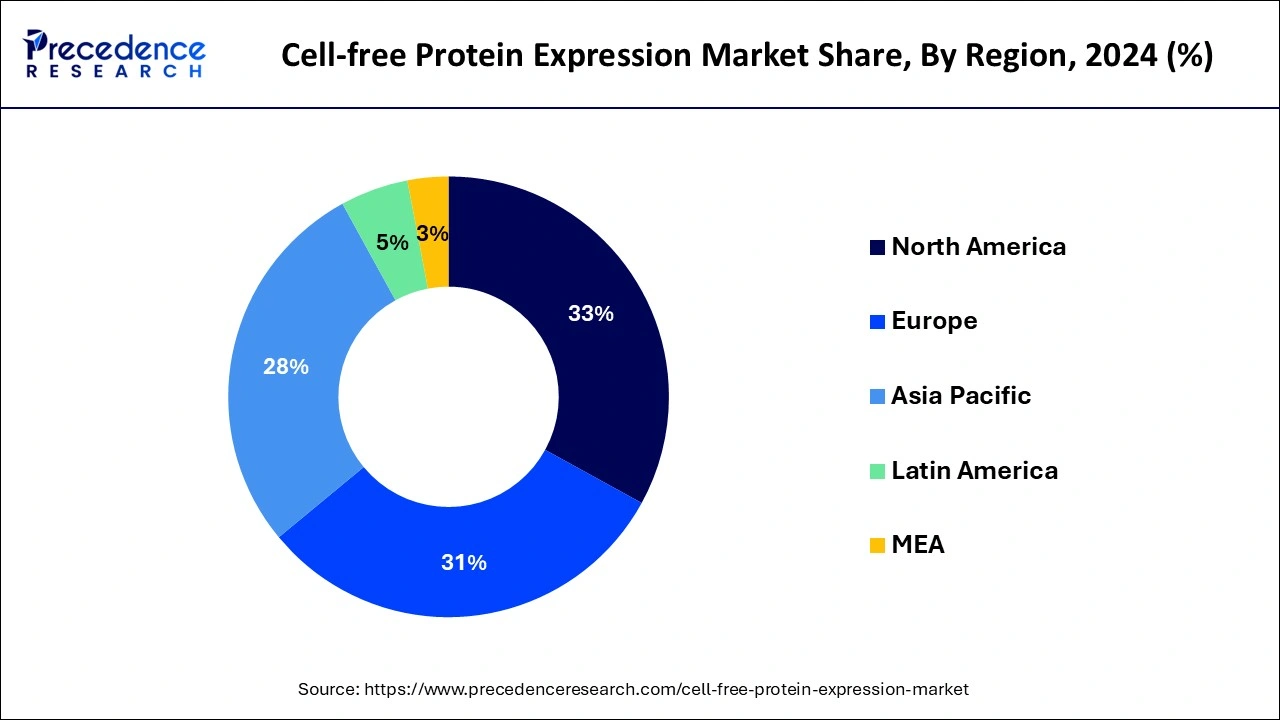

The global cell-free protein expression market size is calculated at USD 290.63 million in 2025 and is predicted to surpass around USD 585.10 million by 2034, accelerating at a CAGR of 8.07% from 2025 to 2034. The North America cell-free protein expression market size surpassed USD 88.89 million in 2024 and is expanding at a CAGR of 8.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell-free protein expression market size was estimated at USD 269.35 million in 2024 and is predicted to increase from USD 290.63 million in 2025 to approximately USD 585.10 million by 2034, expanding at a CAGR of 8.07% from 2025 to 2034.

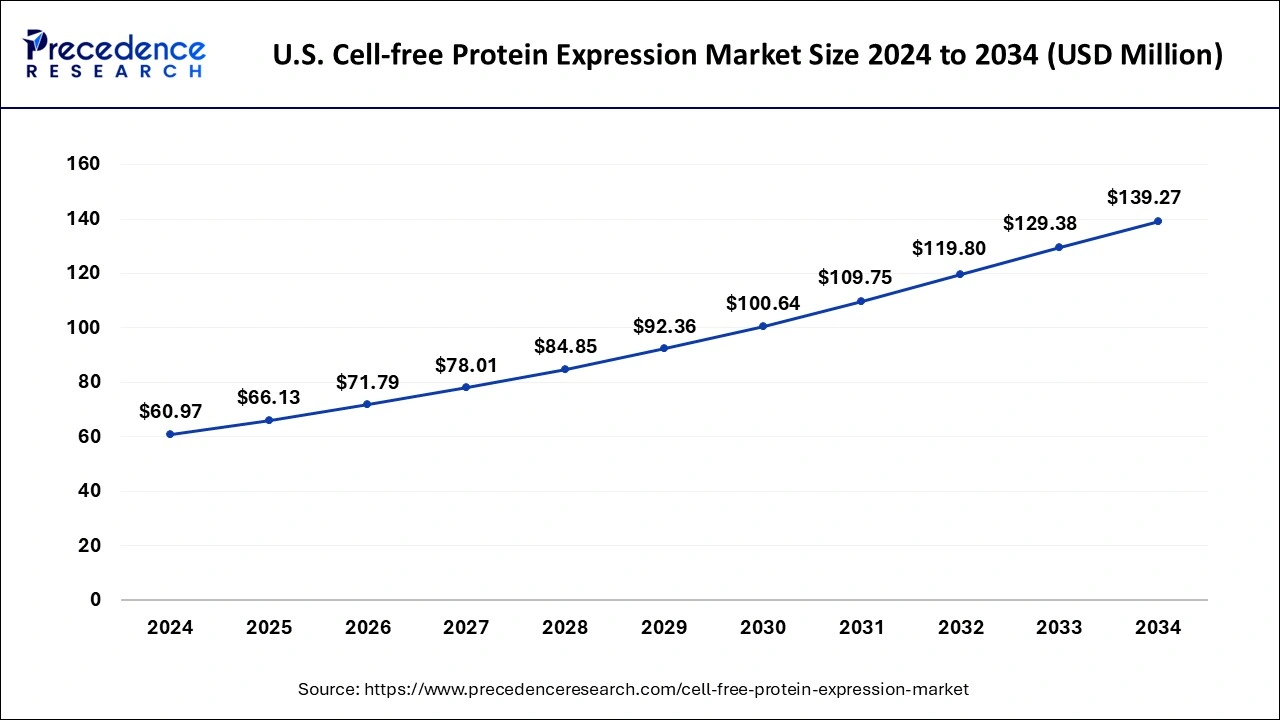

The U.S. cell-free protein expression market size accounted for USD 60.97 million in 2024 and is estimated to reach around USD 139.27 million by 2034, growing at a CAGR of 8.61% from 2025 to 2034.

North America dominated the market in 2024. The growth of the market in the region can be attributed to the substantial number of pharmaceutical companies and research centers present in countries, especially in the United States. The availability of venture capital, government grants and funding agencies that support biotechnology research and development in North America has played a crucial role in the growth of the cell-free protein expression market.

The region has strong intellectual property laws and a supportive regulatory environment, which encourages companies to invest in developing and commercializing cell-free protein expression technologies. North America fosters collaboration among industry and government agencies, leading to the exchange of knowledge and expertise in protein expression technologies.

Asia Pacific is expected to witness the fastest rate of growth during the forecast period. Collaborations between local and international biotech companies and academic institutions have fostered knowledge transfer and technology adoption, contributing to the growth of the cell-free protein expression market. Asia Pacific carries a well-educated and skilled workforce in the fields of biotechnology and molecular biology, making it easier for companies and research institutions to adopt and optimize cell-free protein expression technologies.

Countries such as Singapore, Japan and South Korea have actively supported biotechnology and biopharmaceutical sectors through funding, infrastructure and regulatory incentives. This has further stimulated the growth of the cell-free protein expression market.

Protein expression is the process in which the proteins are synthesized, modified, and managed in living organisms. The in-vitro process of protein by the use of transaction and compatible extraction of whole cell is known as the cell-free protein expression. It allows the production of target protein without use of living cells. The process of cell-free protein expression is done by researchers for manufacturing and expressing small quantities of functional proteins rapidly.

Cell-free protein expression market offers techniques for protein engineering and synthesis for biopharmaceutical and molecular biology sectors. Proteins are made frequently in these processes and are well-maintained compared to the conventional ones. Cell-free protein expression is a time-saving process for the development of proteins. Cell-free protein synthesis helps revolutionize the healthcare sector by transforming the manufacturing of medicinal products.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.07% |

| Market Size in 2025 | USD 290.63 Million |

| Market Size by 2034 | USD 585.10 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, By Method, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cell-free protein synthesis (CFPS) methods have advanced from being lab-scale research tools to being used to manufacture biopharmaceuticals at a scale that adheres to good manufacturing practices (GMPs). With CFPS-based products, numerous clinical trials on humans are currently underway. Additionally, CFPS research applications have developed significantly over time and are now crucial to the discovery and development of new biopharmaceutical products.

The distinct and open character of CFPS has made it possible for non-natural amino acids (nnAA) to be effectively incorporated into protein products, broadening the pool of biotherapeutics that can be taken into account for innovative treatments. As the pharmaceutical industry expands in the upcoming period along with the rising requirement for novel therapeutics, the market for cell-free protein expression is observed to grow.

Cell-free protein expression requires specific reagents and equipment, which can be expensive. Limited access to funding or resources can hinder research and development efforts in this field. Operating and optimizing cell-free expression systems requires knowledge and expertise. A shortage of skilled researchers and professionals can limit the market’s expansion. Expanding cell-free protein expression from research to industrial-scale production can be resource-intensive. Scaling up often requires significant investments in infrastructure and resources. Thereby, limited resources for the technique act as a major restraint for the market.

Personalized medicine often requires the development of specific therapeutic proteins, such as personalized cancer vaccines or patient-specific antibodies. Cell-free protein expression systems offer the flexibility to rapidly produce customized proteins, aligning perfectly with the individualized nature of personalized medicine. Cell-free protein expression enables quick and efficient production of proteins, reducing the time needed to develop personalized treatments. This aligns with the need for timely interventions in personalized medicine, where treatment decisions must be made promptly based on a patient’s unique genetic profile. The emphasis on personalized medicine creates a definite opportunity for the cell-free protein expression market as it aligns with the tailored protein production essential for advancing personalized therapeutic approaches and diagnostics.

The expression system dominated the market in 2024. In the expression system, the E. coli system expression sub-segment carried the leading position. E. coli is one of the highly used expression systems for artificial protein production. The major advantages of E. coli for protein expression are high expression levels, lower cost, short turnaround time, and ease of scaling. E. coli is suitable for producing a large variety of proteins.

On the other hand, the wheat germ cell-free protein expression system sub-segment is expected to grow at a significant rate. In protein research, the wheat germ is a preferred choice which includes options like protein labeling and the expression of proteins like membrane proteins and multiple protein complexes. The wheat germ cell-free protein expression is used in a variety of expression studies such as the production of labeled proteins for protein mass spectroscopy and structural genomics, screening of enzymatic activities, and automated protein synthesis.

The enzyme engineering system segment dominated the market in 2024, the segment will continue to generate significant growth during the forecast period. Enzyme engineering systems have been optimized to improve protein expression efficiency. This allows researchers to produce higher yields of target proteins, making it a preferred choice for applications requiring large quantities of proteins, such as drug development and biotechnology.

Enzyme engineering systems offer versatility in terms of the types of proteins that can be expressed. They can accommodate a wide range of protein targets, including complex and difficult-to-express proteins, making them suitable for a broad array of research and industrial applications.

The high throughput production system segment is expected to register the highest CAGR during the forecast period. Researchers can tailor high throughput cell-free systems to specific protein expression needs, optimizing conditions for individual proteins or applications.

The transcription and translation system segment is expected to grow at a significant rate, the segment held a dominating share in 2024. Cell-free systems can produce proteins with fewer containments, as there are no living cells that could contribute unwanted biomolecules to the final product. Transcription and translation systems are amendable to incorporating modified amino acids, isotopic labels and other post-translational modifications, making them valuable for various research applications.

The pharmaceutical & biotechnology companies segment dominated the market in 2024, the segment is expected to sustain the position throughout the forecast period. These companies often require customized protein production for their research and development efforts. Cell-free systems offer flexibility and scalability, allowing for tailored protein expression, which is crucial in drug development.

Pharmaceutical and biotechnology companies demand high-quality protein for their research and clinical trials. Cell-free expression systems can produce proteins with high-purity and functionality, meeting these stringent requirements. Therefore, the segment is expected to continue to grow throughout the forecast period.

By Product

By Application

By Method

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

November 2024

August 2024