Clinical Trial Supplies Market Size and Forecast 2025 to 2034

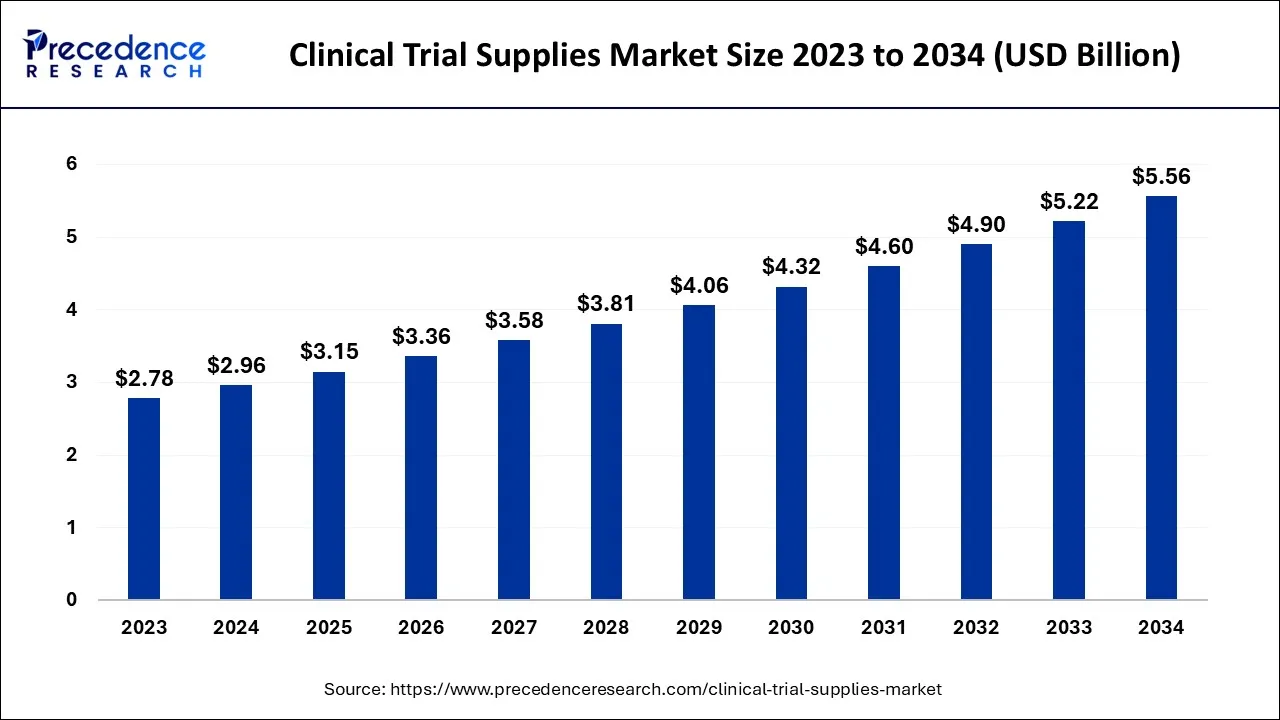

The global clinical trial supplies market size was calculated at USD 2.96 billion in 2024, and is anticipated to hit around USD 3.15 billion by 2025, and is projected to surpass around USD 5.56 billion by 2034, growing at a CAGR of 6.51% from 2025 to 2034.

Clinical Trial Supplies Market Key Takeaways

- In terms of revenue, the market is valued at $3.15 billion in 2025.

- It is projected to reach $5.56 billion by 2034.

- The market is expected to grow at a CAGR of 6.51% from 2025 to 2034.

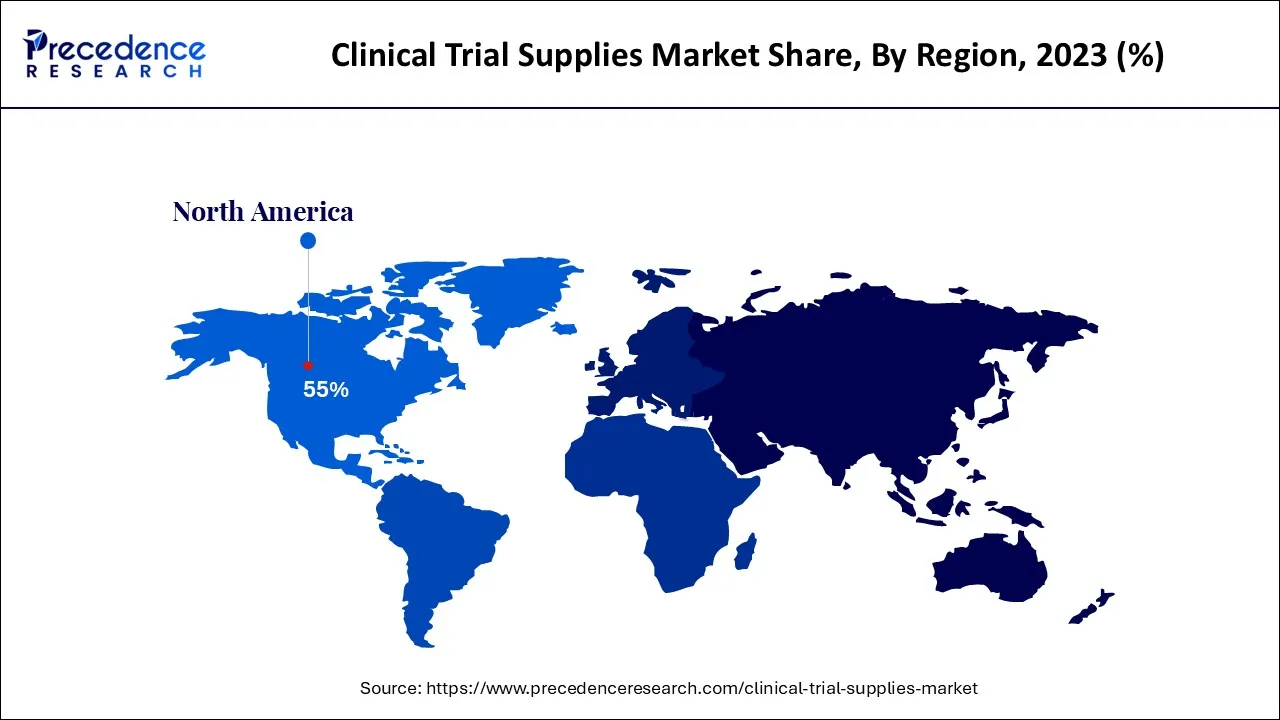

- North America region generates to the maximum market share of around 55% in 2024.

- By Phases, the phase III segment has generated revenue share of around 53% in 2024.

- By Services, the supply chain management segment captured to largest market share of around 46.8% in 2024.

- By End User, the pharma and biotech segment dominated the market with revenue share of 42.5% in 2024.

- By Therapeutic Area, oncology segment accounted revenue share of around 38.6% in 2024.

U.S. Clinical Trial Supplies Market Size and Growth 2025 to 2034

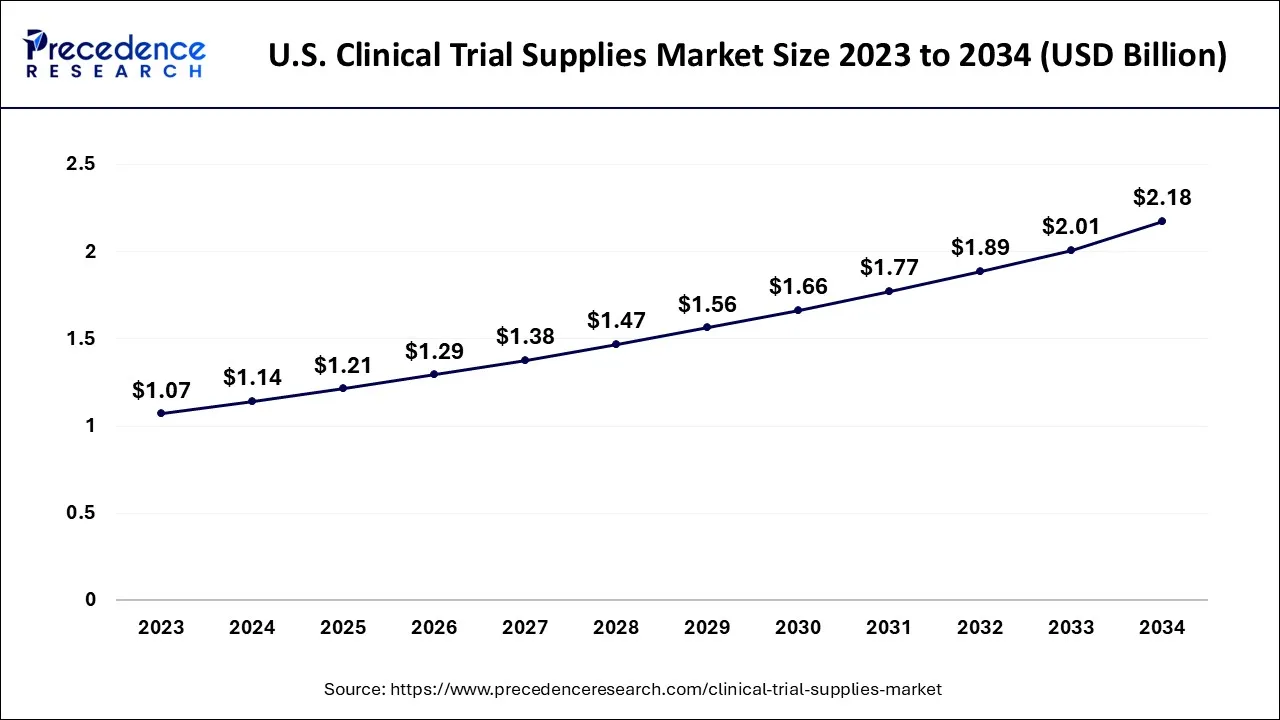

The U.S. clinical trial supplies market size was exhibited at USD 1.14 billion in 2024 and is projected to be worth around USD 2.18 billion by 2034, growing at a CAGR of 6.68% from 2025 to 2034.

North America region dominated the market in 2024

The clinical trial supply market is divided into four regions: North America, Europe, Asia Pacific, and the Rest of the World. North America was estimated to have the largest market for clinical trial supply in 2024. The presence of many CROs has driven the clinical trial supply market in North America, as has the growing number of registered clinical trials. Pharmaceutical companies such as Pfizer, Abbott Labs, and Johnson & Johnson are present in North America and supply most of the regional market.

In February 2025, Selkirk Pharma, Inc., a privately held U.S. pharmaceutical manufacturer specializing in the fill and finish of injectable drugs, including vaccines and biological therapeutics, announced the launch of ClinFAST™, a paradigm-shifting service designed to assist clinical-stage biotech and pharma companies with a rapid fill/finish process for clinical trial supplies.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. North America dominates the market and conducts the most significant number of clinical trials of any region. The increasing number of healthcare firms conducting clinical trials in the area, supportive government legislation, and the availability of cost-effective products contribute to this growth. Asia Pacific is expected to be one of the world's fastest-growing regions.

Clinical research is expected to drive regional market growth, contributing to overall market growth. The low cost per patient in Asia Pacific countries and the presence of a diverse group of patients who are easy to recruit are the primary factors driving the growth of clinical research in these regions.

Clinical Trial Supplies Market Growth Factors

Increased clinical trials influence the market, and the rising number of biologics and biosimilar drugs is attributed to the market growth. The number of biologics and temperature-sensitive medications in clinical trials has increased significantly. Currently, 38.0% of pharmaceutical drugs are temperature-sensitive, and biologics account for 35.0% of late-phase pharmaceutical drugs. This figure is expected to rise as the demand for biologics grows due to their lower adverse effects compared to traditional ties for temperature-sensitive drug storage.

As a result, the increased number of biologics in clinical trials is expected to increase demand for cold chain facilities. By 2024, 8 of the top 10 biopharmaceutical products will likely require cold chain facilities. The high demand for biosimilars in developing and developed economies is expected to boost cold chain supply even further, contributing to market growth over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.56 Billion |

| Market Size in 2025 | USD 3.15 Billion |

| Market Size in 2024 | USD 2.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.51% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phases, Services, End User, Therapeutic Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase incidences of chronic and infectious diseases driving the market growth

Globally, chronic diseases have a high prevalence due to the rapidly increasing population and infections among people. These diseases play a significant role in the clinical trial field for drug development. The drug must pass all standard clinical phases to be available for human consumption. As a result, to treat these chronic diseases in humans, the drug must be safe.

The rising prevalence of chronic diseases such as HIV, epilepsy, and cancer propels the clinical trial supplies market forward. Increased emphasis on determining the level of toxicity during the early stages of drug discovery, as well as growing demand for drug discovery outsourcing services, contribute to the growth of the clinical trial supplies market. Aside from that, increased life sciences research and government funding to develop new drugs drive growth in the clinical trial supplies market. Clinical trials for the treatment of HIV and cancer are increasingly assisting in developing novel drug delivery systems.

- In February 2024, FedEx Express, one of the world's largest express transportation companies, launched its ‘FedEx Life Science Center' in Mumbai, setting a benchmark in the clinical trial supply chain in India and globally. The new capability will meet and support the clinical trial storage and logistics needs of healthcare customers both within the Indian market and those shipping to India from around the world.

Retrain

unwanted waste generated from a clinical trial restrain the market growth

Clinical trials are experiencing a high level of waste, with approximately 150-200 percent of clinical supply waste resulting in unanticipated cost escalation and increased inventory. It impacts how pharma and biotech companies use their internal resources. According to a recent analysis, most of it, 25%-30% of total waste - was material available in depots.

The following category is the largest, accounting for 15% - 20% of whole waste material that expires on site. On the other hand, Product manufacturers focus on maximizing resource utilization for product manufacturing and packaging to reduce waste and improve cost factors. Emerging contract research organizations impact the clinical trial supplies market (CRO).

Opportunity

Technological advancement future for clinical tails supplies

The pharmaceutical industry's transformation is being driven by technology. It is altering healthcare, and medical practice, how pharmaceutical innovations reach patients, and how the industry communicates with its patients. Technology increases the capacity of the sector to innovate.

Because of improved technologies and access to real-time data, we anticipate a significant increase in the efficiency and effectiveness of the next wave of clinical trials. Remote clinical trials, and possibly virtual clinical trials, will quickly transition from a future trend to a real-life industry-standard scenario. Remote patient monitoring and real-time patient data access will usher in the next big wave of innovation in the Life Sciences industry.

- In March 2025, TC BioPharm (TCBP) announced initiatives to outsource several functions, moving to a more decentralized model, resulting in a reduction in its workforce. The initiatives focus on moving to a CDMO model for production to accommodate larger production demand for future clinical trials.

Phases Insights

The Phase III segment will dominate the market in 2024

Clinical trials have been divided into phases: phase I, II, and III. However, due to the high demand for supply chain management in this phase, the phase III segment dominated the market. Even though the phase I clinical trials segment is expected to grow the fastest due to increased R&D activities in the biotechnology space, the phase III segment is expected to dominate the market during the forecast period. Clinical trials in Phase III are more complicated than those in earlier stages. Although the number of drugs in this phase is low, its complexity is the greatest.

The failure rate is highest in this phase because the sample size and study design necessitate complex dosing at an optimal level. Failure causes both human and financial loss, and most failures are caused by noncompliance with safety and efficacy standards. Such a scenario may increase demand for an efficient supply chain and logistics, which is expected to boost industry growth. The phase I segment is expected to grow at the fastest rate during the forecast period as of 2024. This is due to increased phase I trials for COVID-19 treatment and prevention.

Services Insights

Supply chain management dominated the market in2024

The supply chain management segment had the largest market share in2024. This scenario exists in most regions worldwide, except the United States, where the manufacturing sector is also expected to increase. The pandemic has widely highlighted the scenario of a disrupted supply chain and its impact on the lives of a country's citizens. This has propelled the United States to become even more self-sufficient, eventually focusing on manufacturing services. This market's product and service segment includes a variety of processes, ranging from drug development to logistics to distribution.

Life science companies and CROs are expected to increase their demand for supply chain management systems as clinical trials become more global, and the number of clinical sites grows. Mobile and supply chain management technology adoption is expected to be a driving factor in segment growth. According to a Sonoco Thermosafe survey, respondents used interactive response systems, and microsoft office tools are significant technologies, accounting for 25.0% and 24.0%, respectively.

End User Insights

Pharma biotech companies dominated the market in2024

The pharmaceutical and biotech segment dominated the market in2024 and it is expected to grow at a remarkable CAGR during the forecast period. Clinical trial supplies are used in pharmaceuticals, biologics, medical device trials, and other research applications. These segments are responsible for procuring, manufacturing, storing, and distributing clinical trial supplies.

Although pharmaceutical drugs account for most drugs in clinical trials, the growing number of biological drugs is likely to impact this figure. On the other hand, the demand for safe, effective, and cost-effective medicines is expected to fuel the development of improved pharmaceutical drugs, propelling segment growth.

Therapeutic area Insights

The oncology segment expected to grow in the forecast period

Oncology is expected to be the fastest and most dominant therapeutic use segment over the forecast period. This is due to the presence of a large oncology drug R&D pipeline. Because most oncology drugs require temperature-sensitive distribution, the demand for cold chain distribution is expected to rise. Oncology, central nervous system disorders, cardiovascular diseases, infectious diseases, metabolic disorders, and others are the major categories in this segment. On the other hand, cardiovascular diseases are the leading cause of death worldwide.

According to the American Heart Association, approximately 92.1 million people in the United States were living with some form of cardiovascular disease in 2018. This disease is the leading cause of death in the country compared to cancer and other chronic diseases. It also stated that approximately 2,300 people die in the United States each day due to cardiovascular disease, equating to one death every 38 seconds. As a result, such factors are expected to drive segment growth during the forecast period.

Clinical Trial Supplies Market Companies

- Thermos Fischer Scientific, Inc.

- Sharp Packaging Services

- Catalent Pharma Solutions

- Piramal Pharma Solutions

- UDG Healthcare

- PAREXEL International Corporation

- Almac Group Ltd.

- Movianto GmbH

- Patheon, Inc.

- Biocair International Ltd.

- PCI Services

Recent Development

- In January 2025, Kwality Pharmaceuticals (KPL) secured approval from the Review Committee on Genetic Manipulation (RCGM) to commence pre-clinical toxicity studies for its recombinant Erythropoietin product, 10,000 1U/mL, developed in its Biologics Unit. Erythropoietin is a critical therapeutic used to treat anemia associated with chronic kidney disease (CKD).

- In March 2023, Calyx, the eClinical and Regulatory solutions and services provider relied on for solving complex data challenges in clinical research, announced the availability of Calyx Supply Simulation, a clinical trial supply forecasting service available through Calyx's in-house expert statistical design and trial supplies consultants.

- In July 2023, Almac Group opened a custom-built GMP warehouse and dispatch hub in the UK. The facility aimed to support all the manufacturing and laboratory activities of API from drug development to commercialization. Such expansion strengthened and broadened the company's offerings in the market.

- In 2022,Thermo Fisher Scientific Inc. is developing a decentralized clinical trial (DCT) solution to deliver clinical trials to patients in collaboration with the PPD clinical research division and Matrix Clinical Trials, a service of Matrix Medical Network.

- In 2021,Thermo Fisher announced plans to acquire PPD to expand its clinical research services and clinical trial support.

- In 2021,Parexel collaborated with Veeva Systems to improve clinical trial delivery processes and Veeva's cloud technology.

- In 2021,ICON plc announced in November 2021 that a new partnership with six research sites spread across four countries has expanded the scope and capabilities of its Accellacare Site Network.

Segments Covered in the Report

By Phases

- Phase I

- Phase II

- Phase III

- Phase IV

By Services

- Logistics & distribution

- Storage & Retention

- Supply Chain Management

- Packaging, labeling, and blinding

- Manufacturing

- Comparator sourcing

By End User

- Pharma & Biotech companies

- Contract Research Organization (CRO)

- Medical Device Companies

By Therapeutic Area

- Oncology

- CNS & mental disorders

- Cardiovascular

- Digestive disorders

- Infectious diseases

- Metabolic disorders

- Immunology

- Blood disorders

- Other therapeutic areas (dermatological disorders, rare diseases, ENT diseases, Nephrology)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344