January 2025

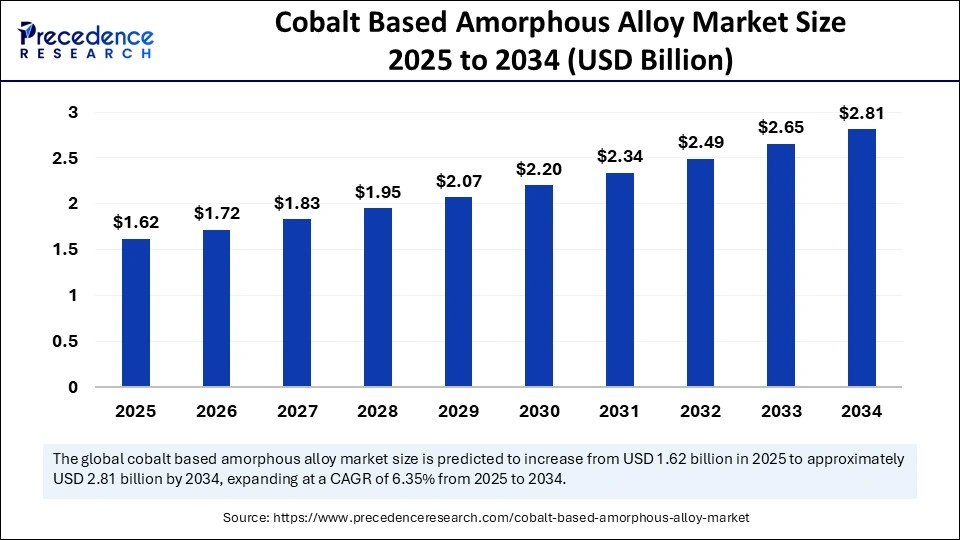

The global cobalt based amorphous alloy market size is calculated at USD 1.62 billion in 2025 and is forecasted to reach around USD 2.81 billion by 2034, accelerating at a CAGR of 6.35% from 2025 to 2034. Asia Pacific market size surpassed USD 547.2 million in 2024 and is expanding at a CAGR of 6.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cobalt based amorphous alloy market size accounted for USD 1.52 billion in 2024 and is predicted to increase from USD 1.62 billion in 2025 to approximately USD 2.81 billion by 2034, expanding at a CAGR of 6.35% from 2025 to 2034. The market growth is attributed to increasing demand for high-performance magnetic materials in energy-efficient systems, advanced electronics, and next-generation transportation solutions. Furthermore, the growing demand for cobalt in end-users, including EVs, storage technologies, and other industries in the coming years.

The advancement of the cobalt based amorphous alloy market relies on artificial intelligence to enhance material transformations from development through production and final application stages because of its capability to improve design, process optimization, and quality management. Algorithms based on machine learning evaluate extensive data arrays to generate predictions about alloys featuring enhanced mechanical characteristics, along with outstanding thermal properties and corrosion resistance, thus eliminating conventional trial-and-error approaches. Artificial Intelligence simulations at their advanced stage speed up research operations through the discovery of perfect production parameters, the reduction of defects, and enhanced operational effectiveness.

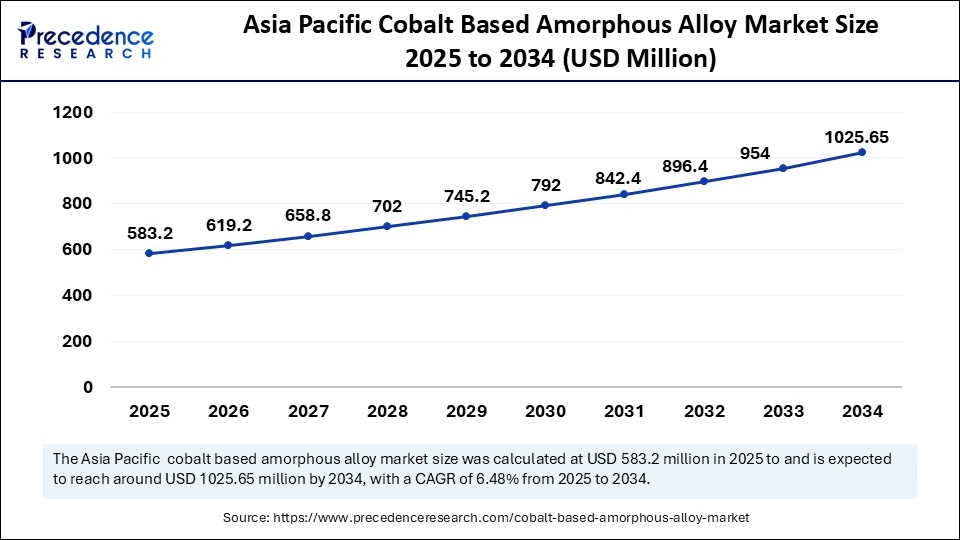

Asia Pacific cobalt based amorphous alloy market size was exhibited at USD 547.2 million in 2024 and is projected to be worth around USD 1025.65 million by 2034, growing at a CAGR of 6.48% from 2025 to 2034.

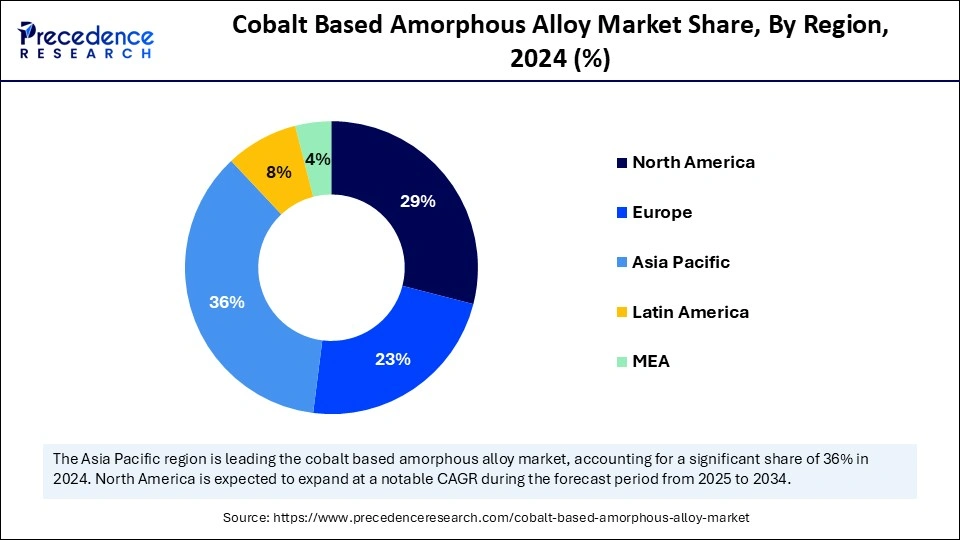

Asia Pacific held the largest share of the cobalt based amorphous alloy market in 2024 and is seen to maintain the position in the coming years. Solar cells and personal computers require advanced materials, due to the rapid industrial growth and urbanization taking place in China and India. Officials are driving sustainable energy adoption by implementing initiatives together with manufacturing sector development, which accelerates cobalt-based amorphous alloy adoption in the region.

Lithium-ion battery production at the International Agency for Research on Cancer (IARC) continues to increase its usage of cobalt, while this material remains critical for renewable energy storage and electric vehicles. Furthermore, the region is expected to grow in cobalt-based amorphous alloy markets, as it leads the effort to advance clean energy technologies.

North America is observed to grow at the fastest rate during the forecast period, due to its strong technological capabilities and significant research and development funding. The aerospace defense and medical devices industries heavily use cobalt-based amorphous alloys, as these materials possess outstanding properties, such as exceptional strength together with corrosion resistance.

Major manufacturers operating within this region, together with strong innovation activities, created additional growth conditions for the market. Furthermore, the endorsement proves the material's reliability, which resulted in its wide acceptance throughout healthcare facilities covering the entirety of North America.

Medical device security and performance achieved recognition from the U.S. Food and Drug Administration (FDA) when they approved cobalt-chromium alloys in 2022 for surgical instruments and implants.

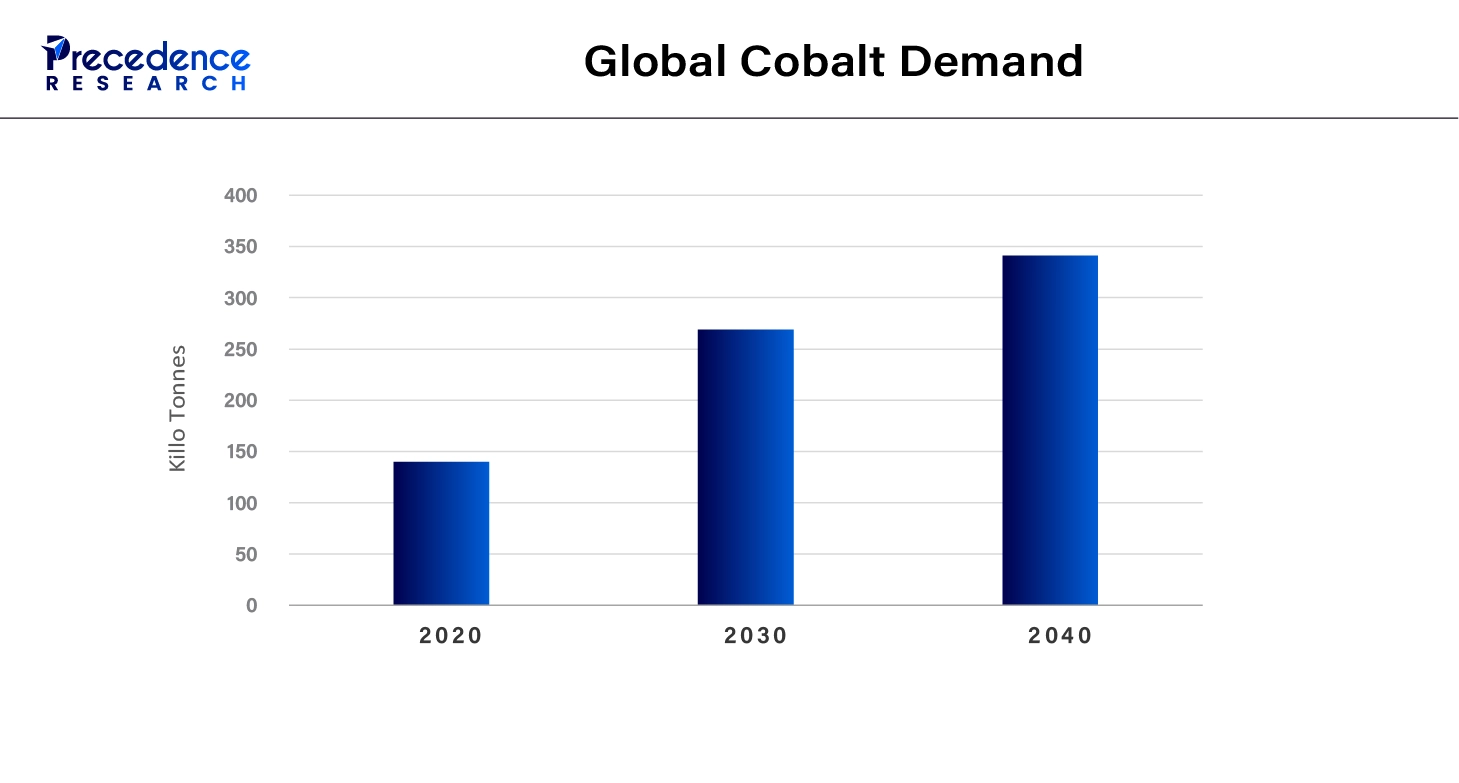

High market demand for energy-efficient technologies drives substantial growth in the cobalt based amorphous alloy market. Non-crystalline alloys possess excellent magnetic qualities and high strength along with corrosion resistance properties, which enable transformer, inductor, and electric motor applications. The market growth receives support from improved production methods that enable low-cost manufacturing of top-quality amorphous alloys. The increasing attention to greenhouse gas emission reduction combined with investments in sustainable technologies supports global sustainability efforts, as these materials' use.Cobalt demand rose 70% from 2017 to 2022 as the energy sector kept growing, and clean energy applications comprised 40% of total cobalt usage in 2022, based on reports from the International Energy Agency (IEA).

| Report Coverage | Details |

| Market Size by 2034 | USD 2.81 Billion |

| Market Size in 2025 | USD 1.62 Billion |

| Market Size in 2024 | USD 1.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End Use, Distribution Channel and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for high-performance materials in several sectors

Growing demand for high-performance materials in aerospace, automotive, and electronics industries is anticipated to drive the cobalt based amorphous alloy market. Advancements in cobalt-based amorphous alloys occur from increasing demands for high-performance materials in aerospace, alongside the automotive and electronics industries. The aerospace sector achieved an unexpected rapid recovery after COVID in 2023, leading to a new all-time high global military spending, which supported cobalt usage in its largest non-battery application.

Cobalt-based alloys demonstrate outstanding chemical resistance alongside both weight-efficient construction and superior magnetic capabilities that enable transformer-core production, along with sensor use and structural component deployment. These materials have become the choice of manufacturers due to their capabilities to improve product durability and operational efficiency at reduced maintenance expenses.

Supply chain instability

Supply chain instability for cobalt sourcing challenges is anticipated to create disruptions in the production of cobalt-based amorphous alloys, thus further hindering the market. Major mining regions that face political instability, combined with labor disputes and changing regulations, affect supply availability to manufacturers. Manufacturers must pay higher production expenses, as they need to manage ethical procurement requirements along with strict environmental standards. Organizations dedicate resources toward recycling programs and substitute material exploration to reduce their cobalt consumption.

Rising investments in advanced manufacturing technologies

Rising investments in advanced manufacturing technologies are anticipated to enhance the production efficiency and scalability of cobalt-based amorphous alloys, thus further creating immense opportunities for the players competing in the cobalt based amorphous alloy market. Advancements in cobalt-based amorphous alloys occur from increasing demands for high-performance materials in aerospace, alongside the automotive and electronics industries. Research teams dedicate their efforts to refining alloy compounds to satisfy demanding operational needs across different industrial application fields. Cobalt-based amorphous alloys remain essential to fulfill industry requirements for advanced materials, as the production needs further boost the market.

The thin film amorphous alloys segment held a dominant presence in the cobalt based amorphous alloy market in 2024, as they find extensive application in transformer cores and inductors alongside electronic components. Modern electrical infrastructure depends heavily on its excellent magnetic qualities coupled with affordable production costs. The quick expansion of EV production leads to increased requirements for effective electronic components, which drives up the demand for thin film amorphous alloys in the market.

The powder form amorphous alloys segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to their ability to work with advanced manufacturing approaches, including 3D printing (additive manufacturing). The production versatility of these alloys enables their application in aerospace applications and medical implant manufacturing, along with automotive systems. The unique properties, such as the high strength and corrosion resistance of these materials, satisfy the strict requirements found in aerospace, medical implant, and automotive industries. Furthermore, the rising demand for powder form amorphous alloys within industries actively implements advanced manufacturing techniques.

The magnetic components segment dominated the global cobalt based amorphous alloy market in 2024. The exceptional characteristics of soft magnetism in these alloys made them optimal for transformer use, inductor designs, and magnetic sensor operations. Such materials became more in demand as societies worldwide pushed for energy-efficient systems and reduced electrical power waste.

The energy storage systems segment is projected to grow at the fastest rate in the future years, as these systems need stable power management to compensate for intermittent energy generation. Cobalt-based amorphous alloys present excellent magnetic and electrical characteristics for their deployment in advanced battery technologies, along with inductive components in modern energy storage facilities. Modern energy storage technologies create a tremendous growth opportunity for cobalt-based amorphous alloys, as they strengthen the fundamental role power grids play in the future.

In 2024, the electronics and electrical segment led the global cobalt based amorphous alloy market. The magnetic exceptional properties of these alloys guaranteed their dominance in industries that manufacture transformer cores and inductors effectively. The pursuit of energy-efficient power distribution systems worldwide has increased the market need for materials that reduce energy losses. Amorphous metal transformers utilizing cobalt-based amorphous alloys turn out to be more successful due to their capacity to minimize core losses below the typical silicon steel transformer standards. Furthermore, the quick expansion of renewable energy infrastructure demanded superior electrical components.

The automotive segment is projected to expand rapidly in the coming years, owing to the rising adoption of electric vehicles (EVs) requiring materials that improve energy efficiency alongside performance benefits. The superior magnetic properties of cobalt-based amorphous alloys make them perfect for use in EV powertrains and charging systems, with their low coercivity and high magnetic permeability. The automotive industry powers advanced material demand, which positions it as a fundamental growth sector for the future years.

The direct sales segment accounted for a considerable share of the cobalt based amorphous alloy market in 2024. The direct sales approach remains preferred by manufacturers, as they use it to control prices and standards of quality alongside customer relationships, particularly when working with big industrial customers from the aerospace and automotive sectors. Manufacturers apply customized solutions and confirm industry standards through this approach.

The online platforms segment is anticipated to grow with the highest CAGR in the market during the studied years. Both suppliers and buyers adopt online platforms as their preferred choice, as digital procurement processes and e-commerce growth have made these platforms interesting. Online platforms provide small to medium-sized enterprises (SMEs) with advantageous conditions, as they offer broad access and affordable services. Online platforms used for material sourcing show a strong upward trend in demand, as industries are rapidly adopting digital transformation.

By Type

By Application

By End Use

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

August 2024

April 2025