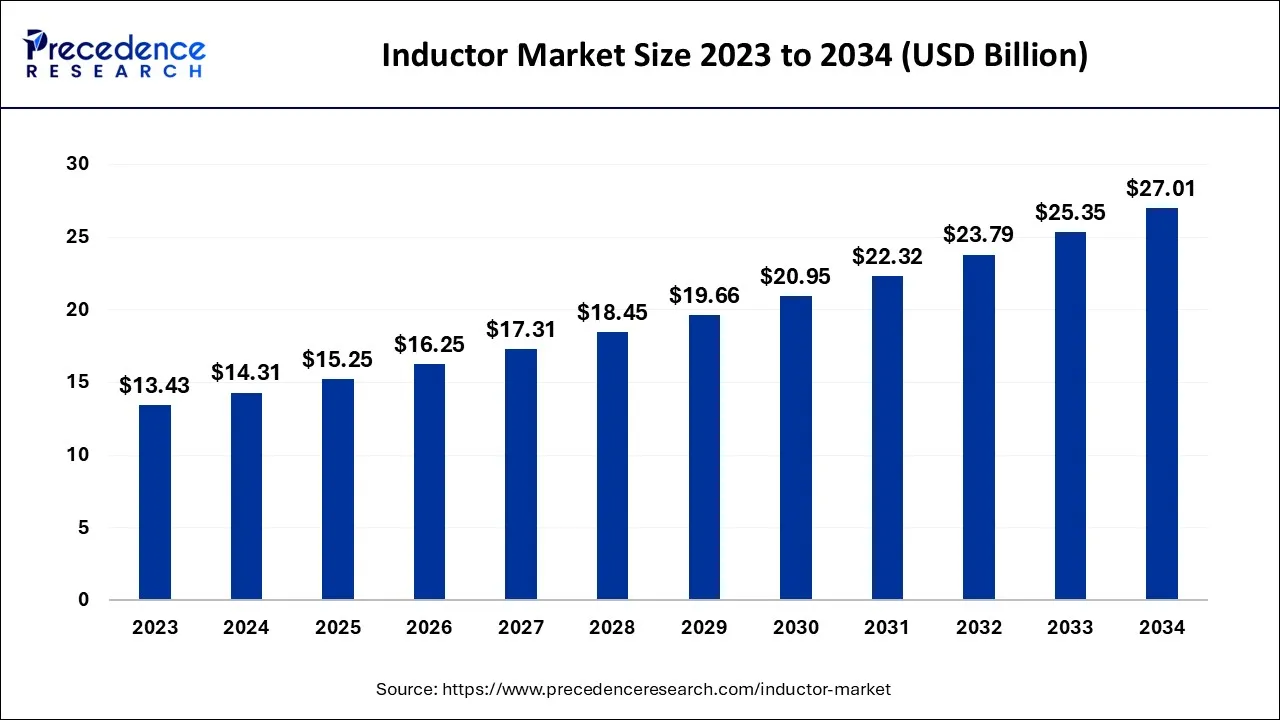

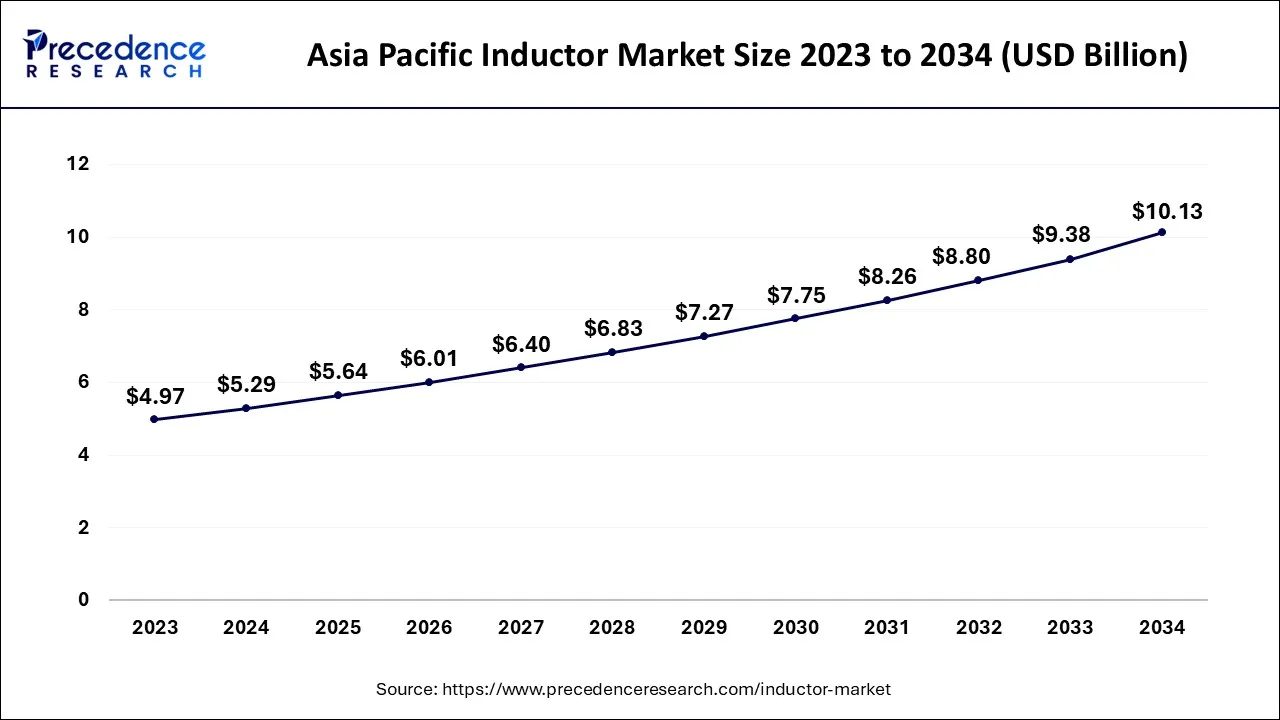

The global inductor market size accounted for USD 14.31 billion in 2024, grew to USD 15.25 billion in 2025 and is expected to be worth around USD 27.01 billion by 2034, registering a CAGR of 6.56% between 2024 and 2034. The Asia Pacific inductor market size is calculated at USD 5.29 billion in 2024 and is estimated to grow at a CAGR of 6.7% during the forecast period.

The global inductor market size is calculated at USD 14.31 billion in 2024 and is projected to surpass around USD 27.01 billion by 2034, growing at a CAGR of 6.56% from 2024 to 2034.

The Asia Pacific inductor market size is exhibited at USD 5.29 billion in 2024 and is projected to be worth around USD 10.13 billion by 2034, growing at a CAGR of 6.7% from 2024 to 2034.

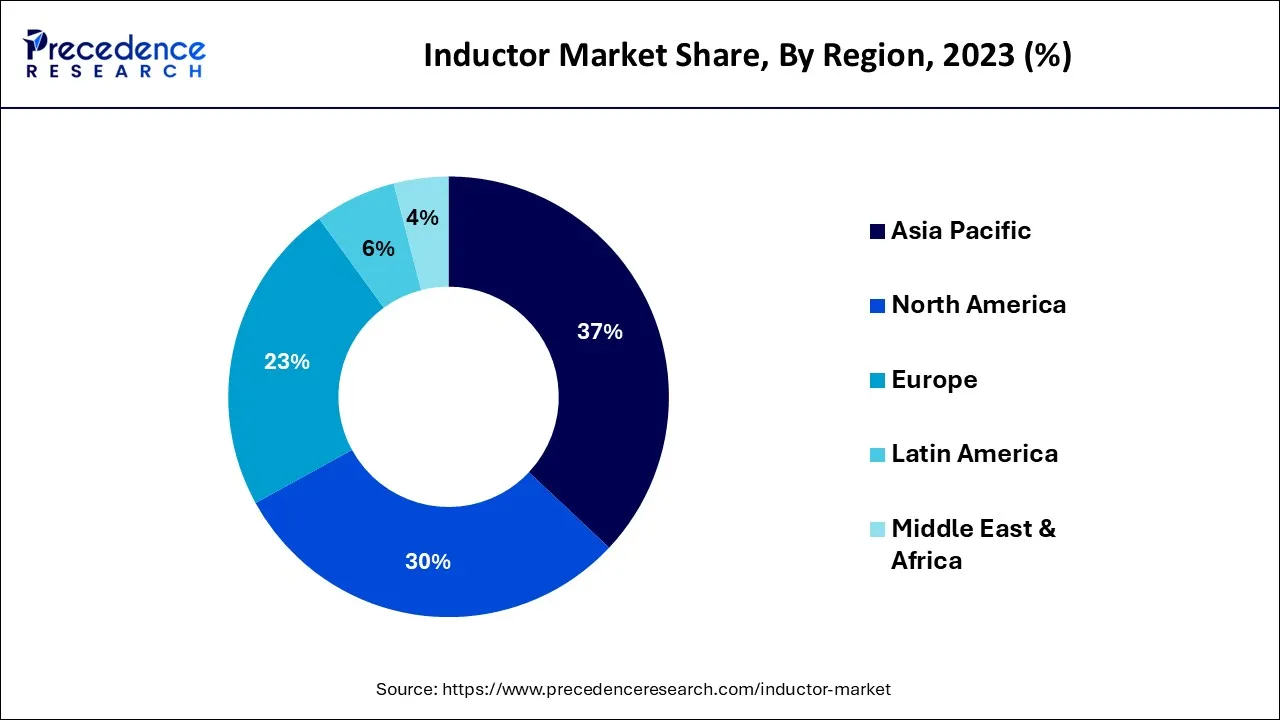

Asia-Pacific accounted for a sizeable portion of the global market, roughly 37% in the regional analysis of the worldwide inductor market. Furthermore, it is anticipated that the Asian market will likely maintain its dominance for a predetermined amount of time. This area is renowned for housing a sizable concentration of consumer electronics producers.

Additionally, these inductors are crucial in producing consumer devices and automobiles. Due to increased investment in the consumer automotive and electronics industries by nations like China, South Korea, India, and Japan, the inductor market in this region has seen a significant increase in demand for its products.

The North American inductor market, which accounts for roughly 28.93% of global sales, is the second-largest after the Asia-Pacific region. The rapid expansion of industrial automation, the rising adoption of smartphones and tablets & tablets, and the existence of an already well-established ICT industry are the main factors propelling the increase in the target market in this region.

Regional revenue generation consists of significant infrastructure, economic growth and financial development. Additionally, export and import, domestic production, and consumption patterns have aided market participants in identifying and seizing opportunities. The quantitative and qualitative parameters included in the report, with in-depth analysis, also highlight the market's motivating and inhibiting factors.

The increase in developments and innovations in consumer electronic products are significant factors anticipated to propel the expansion of the inductor market during the forecast period. Further expected growth drivers for the inductor market include the popularity of smart homes and smart city homes, which call for energy-efficient electronic and electrical systems. Additionally, it is predicted that advancements in telecommunication and chip integration will temper market growth for inductors. On the other hand, it is further anticipated that variations in the price of raw materials, particularly copper, will impede the expansion of the inductor market during the timeline period.

Additionally, as the demand for wireless and connected devices rises, there may be more chances for the inductor market to expand in the years to come. The future expansion of the inductor market, however, may be further hampered by the increased complexity brought on by inductors' miniaturisation.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.31 Billion |

| Market Size by 2034 | USD 27.01 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.56% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Inductance, By Core Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Consumer electronic products are developing and innovating more frequently.

Consumer electronics is a dynamic industry and is changing quickly, with increasing levels of market competitors in the market and game-changing technological advancements. The features and quality of buyer electronic device products are improving thanks to these technological advancements and innovations. Additionally, they are anticipated to increase the overall volume of inductors used in the consumer electronics sector.

Due to their small size, power inductors, high current capacity, and favourable DC characteristics are used more frequently in consumer electronics. The consumer electronics industry uses other inductor types, including air-core inductors, RF inductors, and multi-layered inductors. The adoption of inductors has been accelerated by manufacturers' increased focus on new technologies and the popularity of key emerging technologies like the Internet of Things (loT) and artificial intelligence (AI). The expansion of the inductor market has also been fueled by the incorporation of network technologies like GSM, LTE, 3G, 4G, and 5G in numerous electronic products.

Raw materials' fluctuating costs, particularly those of copper

Due to characteristics like high electrical connectivity and significant power losses, inductors are typically constructed from iron, copper, and ferrite. Copper has excellent mechanical and thermal properties, which is why copper coils are used. The production of inductors frequently uses this as a raw material.

The copper line thickness must be kept to a minimum, and the metal pattern density must be as consistent as possible when producing inductors. Any hiccups in a region's mining operations can significantly impact copper prices worldwide. Landslides and other natural disasters are relatively common in mining regions, as are frequent mine worker strikes. Weather, season, political unrest, and transportation problems can reduce regional supplies and raise copper prices.

Increasing use of electric vehicles

The production of electric vehicles has increased significantly in recent years and is anticipated to do so even more in the years to come. The rate of electronic vehicle development has also increased considerably. Since more people are driving electric cars, advanced driver assistance systems and connected vehicles will become more common, expanding the usage of electronic components.

Many significant automakers and recently emerging automakers have increased the volume of electric vehicle production in response to increasingly stringent environmental regulations, which are anticipated to increase the requirement for passive components. These electric cars run on Al and loT and are outfitted with cutting-edge technology. In the upcoming years, it is anticipated that demand for inductors will rise as electric vehicles become more widely used.

Growing complexity as a result of inductors' miniaturisation

The products' dimensions are shrinking steadily, and their corresponding functions are improving. The shape of mobile devices that offer sophisticated, complex processes is continuously decreasing. Reduced shape and thickness are required for these devices, including smartwatches, wristband-style wearables, and loT devices like sensor network devices. These devices also need highly efficient power supply circuits for longer operating times.

Wearables like smartwatches are becoming smaller and thinner, which has resulted in a rise in the usage of multi-core processors and faster processors for better performance. This makes it possible for all components, including inductors, to become smaller. Therefore, it is also necessary to reduce the size of multi-layered chip inductors while maintaining high Q ratings. However, keeping tolerances dimensional and long-term reliability gets more complicated as feature sizes decrease.

PDAs, Wireless handsets, and other portable electronic devices are continuously getting smaller and more complicated to use. As a result, they present design difficulties because the originally rated current and DC resistance must remain unchanged when an inductor's size is reduced.

However, it becomes more challenging to maintain long-term reliability and dimensional tolerances as feature sizes decrease.

Many stacked coils that are wound around the core make up multilayer inductors. These inductors have a high inductance level because there are many layers of insulation separating them, which raises demand for the product based on different use cases and increases sales of the product.

Inductors will increasingly be used in automotive electronics, and demand for passive electronic components will rise quickly. On the other hand, this market will experience slow growth due to factors like inconsistent raw material price changes. Variable inductors' advantages of lightweight and compact size have increased their popularity inside TVs and radios, which has ultimately opened up a potential application for them and will create new market opportunities.

The Fixed Inductor is a passive electronic component for magnetic field-based energy storage. The turns are fixed in position for one another due to the way the coils are wound in the fixed inductor.

To separate different frequency signals, fixed inductors are used in electronic filters. They are also combined with capacitors to create tuned circuits that tune TV receivers and radios. These parts are widely used in many sectors, including the power, military & defence sector, automotive, consumer electronics, and Radio Frequency & telecommunication.

Iron core and air core inductors have the low-frequency operation, higher losses, and low inductance. However, they have high permeability, fixed value, and high inductance, ferrite core inductors. As a result, ferrite core inductors are widely used and regarded as a superior solution to overcome this issue.

The rise of hybrid and battery-powered technologies in the automotive sector can be used to justify the demand for power inductors because these advancements would necessitate more ECUs. The power inductors' excellent packaging and saturation properties are ideal for supplying the growing demand for powertrain technology. Computers, Mobile phones, and telecommunications equipment can all use the newly released power inductors from the Lmax series. The market for power inductors will increase due to their numerous applications across numerous industry sectors.

For general circuits, various kinds of inductors are utilised. Filters and oscillators are standard components in circuits. Car audio systems, Car navigation systems, and body control equipment like wipers and power windows are additional examples of general circuits. Analog circuit filters and signal processing filters are frequently made with inductors, resistors, and capacitors. An inductor alone can function as a low-pass filter because its impedance rises as a signal's frequency increases. Combining capacitors and inductors can be used to create oscillators. The LC oscillator is one of the most popular oscillator types, producing a continuous periodic waveform. Since they are simple to use and have excellent phase noise characteristics, LC oscillators are frequently utilised in radio-frequency circuits.

Automotive inductors are constructed from a coil winding with two terminals through which flux is passed. The inductive current is a function of the flux density through the coil. A current is induced in the coil by flux passing through it, causing a voltage drop around the coil. One of the key factors driving the market growth for automotive inductors is their current regulation feature, which stabilises the electric circuits in cars. The design of high-end inductors that function under harsh temperature conditions without suffering appreciable downtime represents an important development in the market for automotive inductors. As a result, the market for automotive grade induction will experience rapid growth. This raises the productivity level of the vehicle parts.

By Type

By Inductance

By Core Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client