January 2025

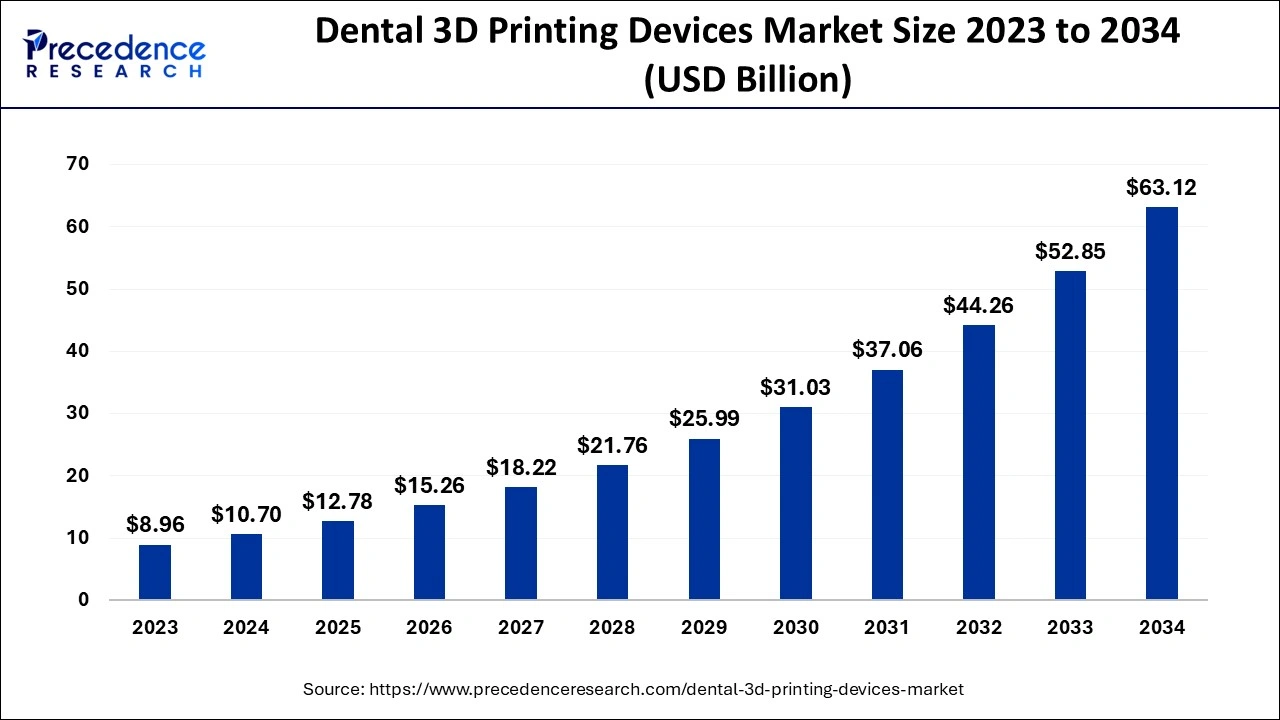

The global dental 3D printing devices market size is calculated at USD 10.70 billion in 2024, grew to USD 12.78 billion in 2025 and is predicted to hit around USD 63.12 billion by 2034, expanding at a healthy CAGR of 19.42% between 2024 and 2034.

The global dental 3D printing devices market size is worth around USD 10.70 billion in 2024 and is anticipated to reach around USD 63.12 billion by 2034, growing at a double-digit CAGR of 19.42% from 2024 to 2034. The growth of the dental 3D printing devices market is attributed to a potential footprint and the combination of state-of-art technology. The development and designs of advanced products, including delivery positioning, advanced fabrication to provide an aesthetic look, and invisible aligners, are the major factors increasing the adoption and demand for dental 3D printers.

Dental 3D printing devices are revolutionizing the field of dentistry by enabling customizable, efficient, and precise solutions for several dental procedures. Dental 3D printers can create accurate and detailed surgical guides, dentures, bridges, crowns, and dental models, using advanced additive manufacturing technologies. The process begins with digital scans of a patient’s mouth, which are then utilized to design a 3D model via specialized software.

How Artificial Intelligence is Changing the Dental 3D Printing Devices Market?

3D printing allows dental professionals to develop highly accurate dental appliances, which include bridges, implants, crowns, and guards. The dental 3D printing devices market appliances are designed and manufactured using digital scans and AI technology instead of traditional molds. Artificial Intelligence helps ensure that dental restorations and aids in analyzing data are tailored precisely to the individual’s needs. There are various advantages of 3D printing devices and AI in dental treatments, such as personalization, reduced weight times, increased accuracy, greater comfort and restorations, and prosthetics. 3D printing devices allow accurate and faster production of dentures, bridges, and crowns. AI can help in designing restorations that fit the patient’s bite and anatomy.

| Report Coverage | Details |

| Market Size by 2034 | USD 63.12 Billion |

| Market Size in 2024 | USD 10.70 Billion |

| Market Size in 2025 | USD 12.78 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment, Technology, Material, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing awareness and training about 3D printing devices

Dental associations and educational establishments are incorporating 3D printing technology into their curricula as dental practitioners grow increasingly conscious of the uses and benefits of this technology. Technicians and dentists can better capture 3D printing devices’ advantages and capabilities over conventional processes by participating in certification programs, webinars, and workshops. Dental professionals can share their knowledge more easily via online forums, professional associations, and social media groups. By allowing practitioners to exchange best practices, learn from one another, and talk about their experiences, these devices provide more possibilities for training and raising awareness.

Technological complexity

Complex software is frequently needed for the dental 3D printing devices market to construct and create dental structures. Software platform compatibility issues may cause mistakes and inconsistencies. Dental businesses are subject to 3D-printed goods, and stringent regulations have to address health requirements and safety. Navigating these regulations might take a lot of complexity and effort. Standards for safety and quality are predicted to change as the market develops, making it challenging for practices to stay up to date without ongoing investments in training and equipment.

Increasing awareness and accessibility

The usage of dental 3D printing devices market has the capacity to increase dental care accessibility to underserved regions and remote areas where conventional dental services and laboratories may be restricted. The development of cost-effective and portable 3D printer devices in various locations can improve the on-site fabrication of dental devices, thereby driving access to vital dental care. In addition, the expeditious production of physical prototypes by dental professionals allows prompt refinement and evaluation, thereby decreasing the time-to-market and accelerating development cycles for novel dental devices.

The 3D scanner segment held the largest dental 3D printing devices market share in 2023. 3D scanners are pieces of hardware that capture 3D shapes utilizing projected lasers or light and cameras. 3D scanners can be used in a clinical laboratory, chairside setting, or dentistry. There are types of 3D scanners in dental 3D printing devices such as intraoral 3D scanners and desktop 3D scanners. Intraoral 3D dental scanners are handheld applications that 3D scan directly inside a patient’s mouth, and desktop dental scanners are stationary devices utilized for efficiently scanning items such as models and impressions. Various major manufacturers of 3D dental scanners, such as Medit, Shining 3D, Dental Wings, and 3Shape, offer both desktop and intraoral scanners.

The stereolithography segment dominated the dental 3D printing devices market in 2023. It is often referred to as ‘SLA printing’ and has rapidly become the most widely adopted 3D printing technology across the dentistry field. This prevalence is due to its exceptional ability, versatility, and precision to produce high-quality dental prosthetics and restorations. Unlike other 3D printing devices, SLA uses a laser to cure liquid resin layer by layer, resulting in highly intricate, accurate models. The dental industry has adopted SLA printing for a variety of applications, such as creating orthodontic appliances, surgical guides, dentures, bridges, and crowns. The technology's capability to produce complex geometries with fine details is instrumental in crafting restorations that seamlessly integrate with patients’ surrounding tissues and natural teeth. In addition, SLA’s efficiency and speed have significantly streamlined the fabrication process, enabling improved patient satisfaction and faster turnaround times.

The orthodontics segment held the largest share of the dental 3D printing devices market in 2023. Advancements have enhanced the aesthetics and functionality of orthodontic devices in biocompatible materials, including dental resins explicitly created for orthodontic uses. These materials are accurate for personalized solutions since they are appropriate, flexible, and strong for long-period intraoral use. Orthodontists can improve patient communication and involvement with the ability to graphically display patients' treatment progress. Patient trust and loyalty have increased due to being able to offer accurate, faster treatments.

The prosthodontics segment is expected to grow rapidly in the dental 3D printing devices market during the forecast period. Dental prostheses such as dentures, bridges, crowns, and veneers are fitted and designed by prosthodontists. 3D printing device technology, which is necessary in prosthodontics, makes high degrees of customization possible. Despite conventional techniques, 3D printing devices enable the production of personalized prosthetics that are anatomically suited to each patient and improve functioning, comfort, and fitness.

The dental segment dominated the dental 3D printing devices market in 2023. Dental laboratories are innovative When creating personalized dental prostheses, such as implants, dentures, bridges, and crowns. There is a great demand for individualized solutions, and 3D printing technology makes it possible to precisely create, fit, and customize patient-specific designs that are complex to develop with conventional techniques. High production capabilities can be achieved by printing many parts at once, which is very useful for large laboratories that manage a large number of cases regularly. Due to its scalability, labs can make dental restorations faster than ever without reducing quality.

The dental clinics segment is expected to grow significantly in the dental 3D printing devices market during the forecast period. The dentistry sector is witnessing a transition to digital operations, with 3D printing devices at its center. Digital dentistry enhances patient care by enabling a smooth transition from diagnostic to treatment creation and planning. Insurance companies' refund policies have been gradually enhancing as they become aware of the benefits of 3D-printed dental device items. This assistance motivates clinic adoption by increasing patient access to 3D-printed treatments and reducing costs.

North America dominated the global dental 3D printing devices dental 3D printing devices market in 2023. Technicians and dentists proficient in utilizing advanced technologies are broadly available in the U.S. and Canada. Integrating and adopting 3D printing devices in dental practices is contingent upon having a skilled workforce. The dentists in the region had an early benefit in the market since they were the first to use 3D printing devices for orthodontic products, dental implants, dentures, bridges, and crowns.

Asia Pacific is expected to grow at the fastest rate in the dental 3D printing devices market during the forecast period. The market growth in the region is enhanced by increased investments in 3D printing technology research and development from the private and public sectors. South Korea and Japan are two countries making significant investments in 3D printing devices for dentistry and other medical industries. Cosmetic dentistry is becoming more and more popular in the area as people become more aware of their appearance. Dental 3D printing technology is essential to provide visually beautiful and accurate dental restorations.

Latest Announcement by Industry Players

By Equipment

By Technology

By Material

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023