January 2025

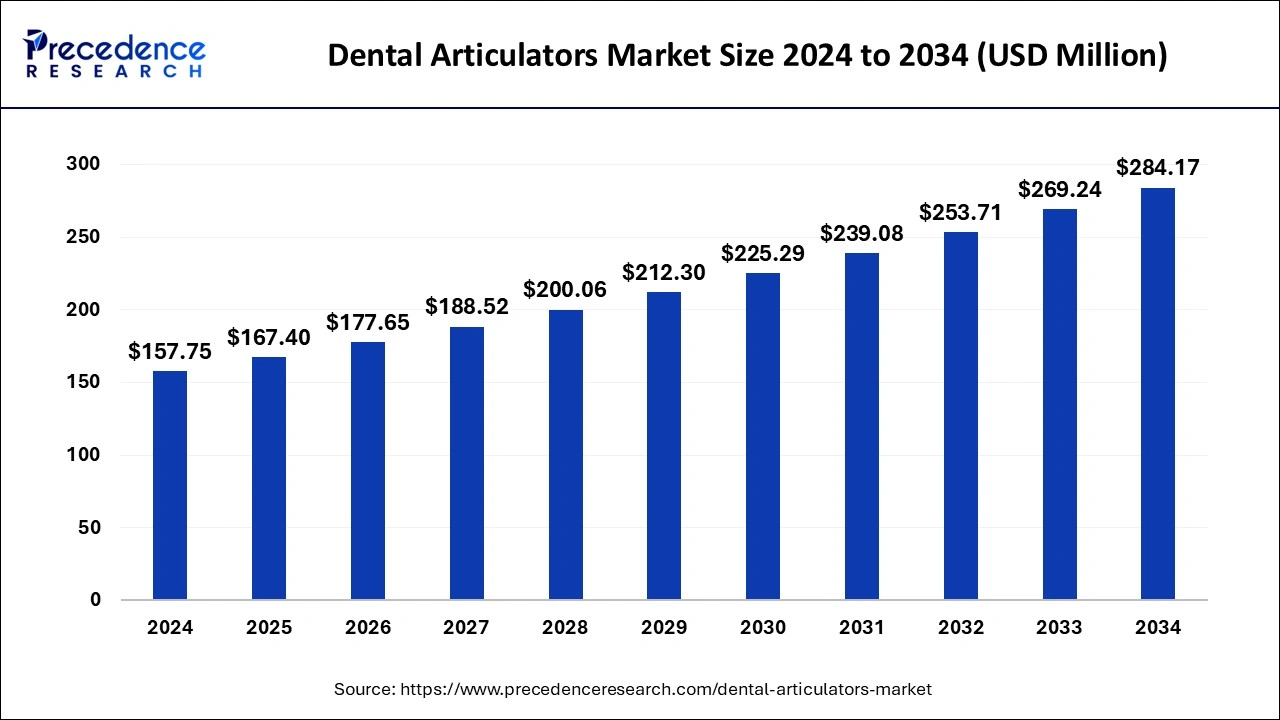

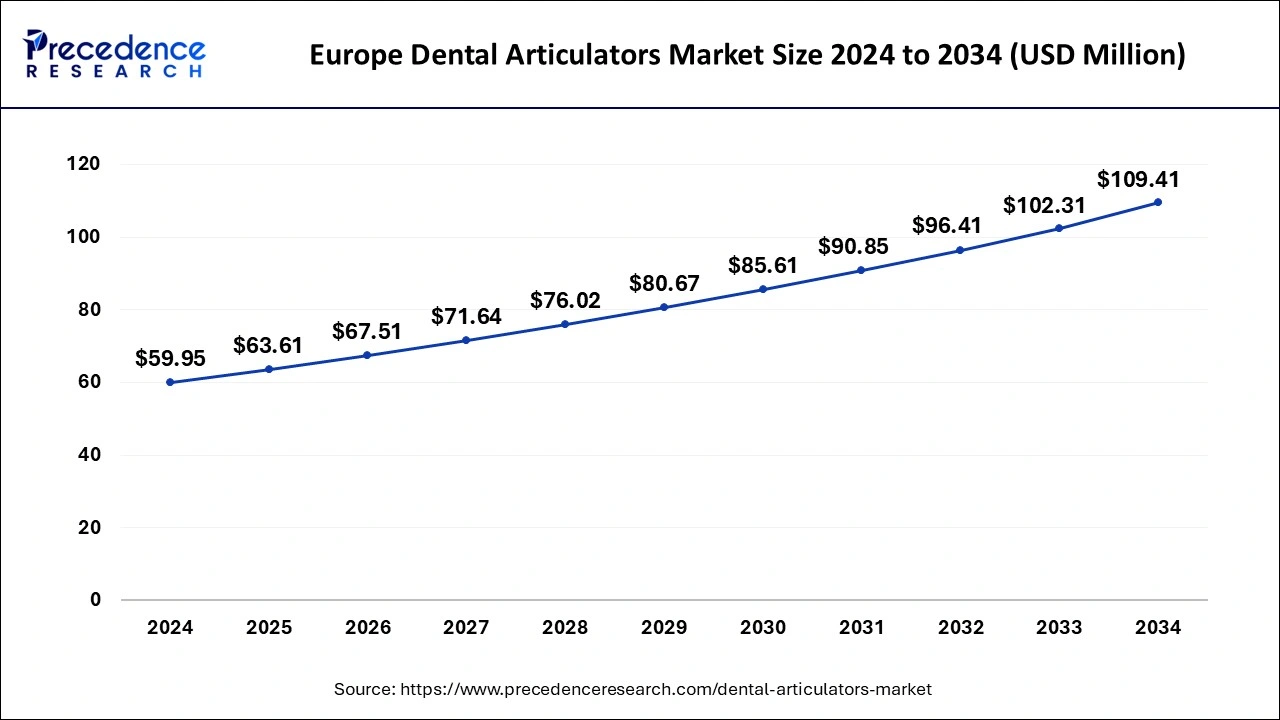

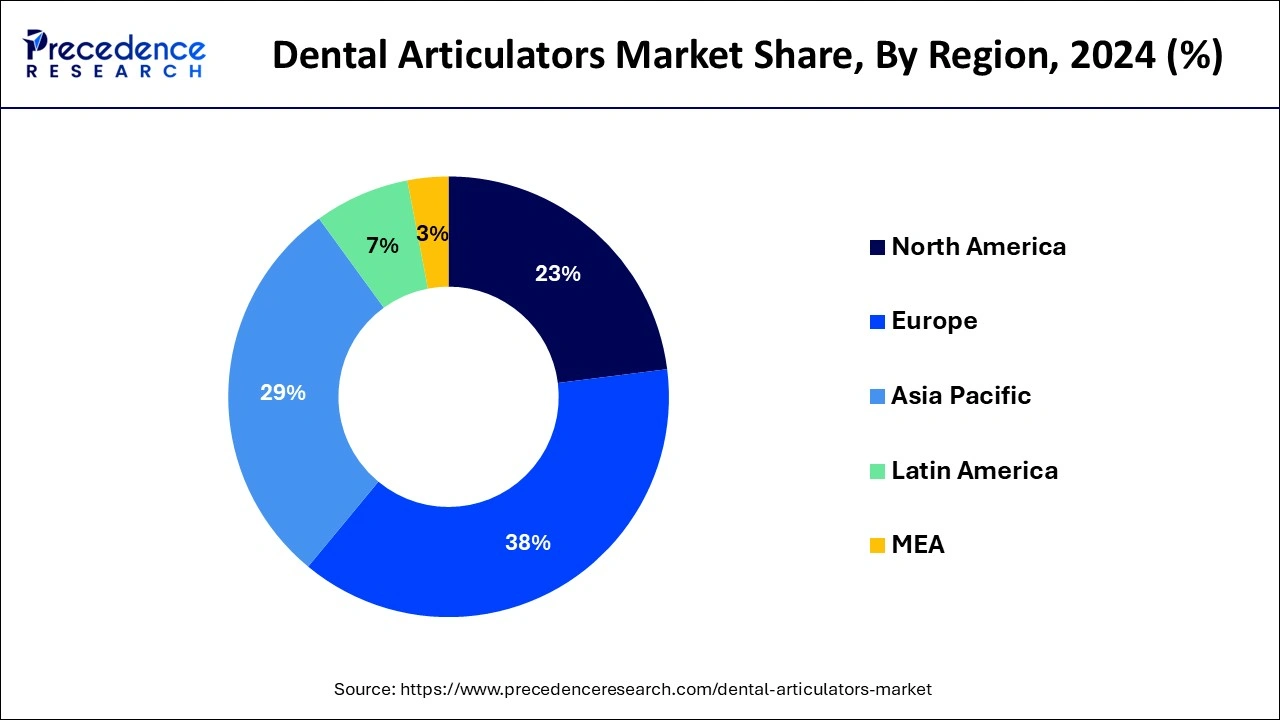

The global dental articulators market size is accounted at USD 167.40 million in 2025 and is forecasted to hit around USD 284.17 million by 2034, representing a CAGR of 6.06% from 2025 to 2034. The Europe market size was estimated at USD 59.95 million in 2024 and is expanding at a CAGR of 6.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental articulators market size was calculated at USD 157.75 million in 2024 and is predicted to increase from USD 167.40 million in 2025 to approximately USD 284.17 million by 2034, expanding at a CAGR of 6.06% from 2025 to 2034. As dental technology continues to progress, more advanced articulators with improved features—like CAD/CAM system interoperability and configurable settings—are being developed, drawing in users and professionals alike.

The Europe dental articulators market size was exhibited at USD 59.95 million in 2024 and is projected to be worth around USD 109.41 million by 2034, growing at a CAGR of 6.20% from 2025 to 2034.

Europe dominated the global dental articulators market in 2024. Dental tourism was starting to gain popularity in several European nations, especially those in Eastern Europe. This pattern was pushing the market for dental equipment, such as articulators, by increasing the demand for dental operations. Throughout Europe, there was a growing need for cosmetic dentistry procedures. In order to achieve accurate occlusion and aesthetics during restorative and cosmetic dental operations, dental articulators are essential.

The significance of appropriate occlusion and bite alignment in dental treatments was becoming more and more apparent to dental practitioners. The introduction of sophisticated articulators that provide accurate occlusion and exact articulation was fueled by this awareness. Market dynamics were influenced by adherence to regulatory requirements and norms pertaining to dental equipment. The manufacturers prioritized making sure that the articulators they produced complied with safety and quality regulations.

Asia Pacific is expected to host the fastest-growing dental articulators market during the forecast period. The Asia Pacific dental articulators market has been expanding due to many factors. The need for accuracy and precision in dental operations, such as occlusion analysis and prosthetic manufacture, is growing as dental technology develops. This tendency fuels the need for articulators and other cutting-edge dental tools and technologies to offer top-notch dental care to patients from around the world.

Dental care costs have increased as a result of growing awareness of oral health issues and rising disposable income in several Asia Pacific nations. In order to improve treatment results and patient happiness, dentists are investing in cutting-edge equipment, such as articulators.

In order to replicate jaw motions and maintain dental casts in the proper locations for a variety of operations, such as crown and bridge work, orthodontics, and prosthodontics, dental articulators are essential instruments in the field of dentistry. Dental operations are becoming more accurate and efficient because of the development of sophisticated articulators with digital features, including virtual articulation, CAD/CAM integration, and compatibility with 3D printing.

Dental tourism is being driven by rising globalization and the cost of dental procedures in emerging economies, which is increasing demand for dental articulators in areas like Asia Pacific and Latin America. The need for dental services, such as restorative and prosthetic dentistry, is being fueled by the aging population, especially in developed nations. This is driving the demand for dental articulators.

The dental articulators market is growing as a result of an increase in dental treatments carried out worldwide, as well as growing awareness of oral health and the value of dental care, together with attempts to educate consumers and professionals. Lockdowns and limitations on non-essential procedures were the initial causes of the COVID-19 pandemic's disruptions in the dentistry sector.

However, once safety procedures were put in place and limitations loosened, the market started to rebound, and there was an increasing emphasis on infection control methods in dental offices. Dental articulators are subject to strict restrictions that impact market dynamics. Manufacturers must adhere to guidelines and criteria established by regulatory bodies in various locations.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.06% |

| Market Size in 2025 | USD 167.40 Million |

| Market Size in 2024 | USD 157.75 Million |

| Market Size by 2034 | USD 284.17 Million |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of digital dentistry

It's true that digital dentistry is becoming more and more popular, and this has an effect on many aspects of dentistry, including the usage of dental articulators. In order to reproduce the patient's occlusion, dental articulators are essential instruments in the field of dentistry. They work by modeling the movements of the mandible and maxilla. Digital articulators and other aspects of digital dentistry are becoming more and more popular, which is indicative of a larger trend in the dental sector toward digital transformation.

Traditional articulators are still useful, particularly in practices with well-established processes, but more practitioners and laboratories are choosing to transition to digital alternatives due to their advantages. Future developments in digital dentistry should completely change the field of dental articulation and prosthetic manufacture as technology progresses.

Limited standardization

Dental articulators made by several manufacturers might not work together in the absence of standardization. For dentists who have to incorporate new equipment into their current setup or switch between multiple articulators, this can provide difficulties. Standardized tools would offer a consistent framework for occlusion and dental prosthodontics education and learning. Because of the lack of compatibility, dentists may have to pay more to maintain several articulators or purchase proprietary components. Standardization could lower these costs by encouraging manufacturer competitiveness and interoperability. Without defined criteria, regulatory agencies may find it difficult to develop uniform recommendations for assessing the performance and safety of dental articulators.

Rising demand for dental restorative procedures

Improvements in dental technology, such as the use of dental articulators, are frequently correlated with an increase in the need for restorative dentistry procedures. Dental prostheses, including crowns, bridges, and dentures, can be more easily fabricated with the use of dental articulators, which are tools that mimic jaw movements and positions. The dental articulators market is anticipated to grow along with the demand for these restorative operations, which is expected to rise due to factors such as an aging population, increased awareness of dental health, and advancements in materials and processes. Globally, the frequency of dental conditions such as tooth decay, periodontal infections, and tooth loss is rising, especially in older populations. The market is stimulated by this trend, which increases demand for restorative dental procedures.

The semi-adjustable segment held the largest share of the dental articulators market in 2024. The dental business segment that focuses on tools used by dentists and dental technicians to mimic the movement of the temporomandibular joint (TMJ) and the jaws is known as the semi-adjustable dental articulators market. These articulators are essential instruments in orthodontics and dental prostheses for precisely placing dental casts and organizing treatments. Semi-adjustable articulators provide a harmony between personalization and ease of use. They are not as complicated or customizable as fully adjustable articulators, but they can be adjusted to replicate different jaw movements and occlusal connections. When selecting an articulator, dental professionals take into account features including precision, ease of use, longevity, and compatibility with other dental equipment.

The fully adjustable segment is expected to grow at a significant rate in the dental articulators market. In the dental articulators industry, "fully adjustable" usually refers to articulators that provide dental professionals with a wide range of customization possibilities. With the use of these articulators, it is possible to precisely alter the jaw movements and occlusal connections of the patient. For dental articulators to accurately replicate a patient's natural bite and jaw movements during operations, including crown, bridge, and denture fittings, adjustability is essential.

It is usually possible to modify condylar inclination, Bennett angle, centric relation, and intercondylar distance using a fully adjustable articulator. Dental restorations that are highly adjustable are guaranteed to fit comfortably and perform as intended inside the patient's mouth cavity. Dental practitioners can attain greater patient satisfaction and more precise results with this degree of customization.

The aluminum segment held the largest share of the dental articulators market in 2024. In the dental business, aluminum is now frequently used in dental articulators. Dental technicians and dentists employ dental articulators, which are devices that mimic the movement of the jaws and temporomandibular joints to recreate a patient's bite precisely. Compared to conventional articulators constructed of steel or plastic, aluminum articulators have a number of advantages. Aluminum has strength and durability despite being a lightweight material. Aluminum offers the strength required to maintain stability and accuracy during dental treatments when articulators must tolerate high pressure and strain. Since aluminum is regarded as biocompatible, it is unlikely to react negatively with biological tissues. In dental applications, where patient comfort and safety are top priorities, this is essential.

The stainless-steel segment is expected to grow rapidly in the dental articulators market over the forecast period. In dentistry, articulators are tools that mimic the motions of the temporomandibular joints. They help to precisely depict the movements of the patient's jaw, which is necessary for a number of dental operations, including orthodontics, prosthodontics, and dental implantology. Because of its capacity to resist corrosion, stainless steel is a great material choice for these kinds of applications because it ensures longevity and durability. Dental articulators must be able to endure mechanical pressures and frequent use. Because stainless steel is so strong and resilient, the articulators will continue to have their structural integrity throughout time. Stainless steel makes it simple to uphold hygienic standards in dental settings since it can tolerate high temperatures and a variety of sterilizing techniques, including autoclaving.

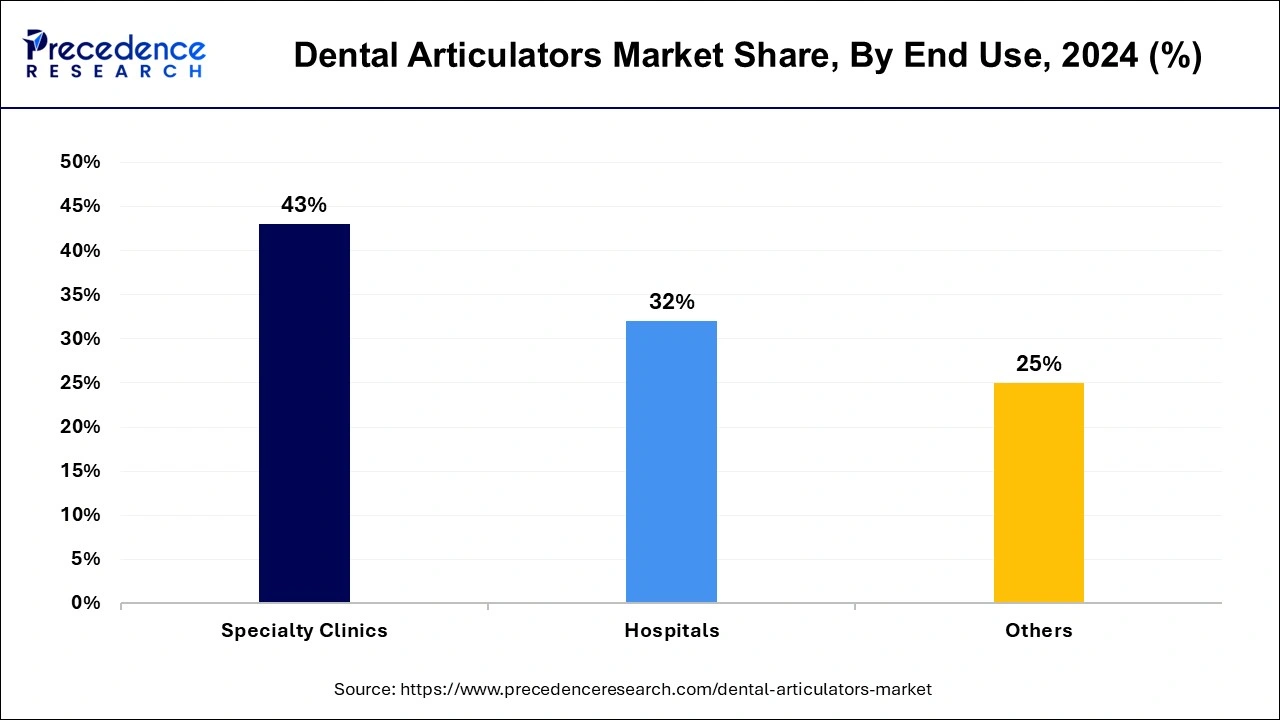

The specialty clinics segment dominated the dental articulators market in 2024. Specialty clinics frequently have a significant impact on the dental articulator industry. These dental clinics are specialist establishments that target certain patient demographics or concentrate on particular facets of dental care. Teeth replacement and restoration are the areas of expertise for prosthodontic clinics. For duties like occlusal analysis, making dental prostheses, and making sure dental restorations are properly aligned, they frequently use dental articulators extensively. The main concerns of orthodontic clinics are the identification, avoidance, and treatment of misaligned jaws and teeth. In these clinics, dental articulators are utilized for orthodontic appliance fabrication (such as braces), model analysis, and treatment planning.

The hospitals segment is expected to grow rapidly in the dental articulators market. Dental articulators are usually located in departments that specialize in dentistry, prosthodontics, or oral and maxillofacial surgery in a hospital setting. Articulators can be used in these departments to plan orthognathic surgery, place dental implants, and make prosthetics. Dental articulators are essential instruments in a variety of dental operations, including restorative and prosthetic dentistry, because they are mostly employed in dental laboratories and clinics to simulate jaw movements. Hospitals may still use dental articulators in their dental departments for particular situations or procedures, even though they might not be the main buyers of these devices.

By Product

By Material

By End-use

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023