January 2025

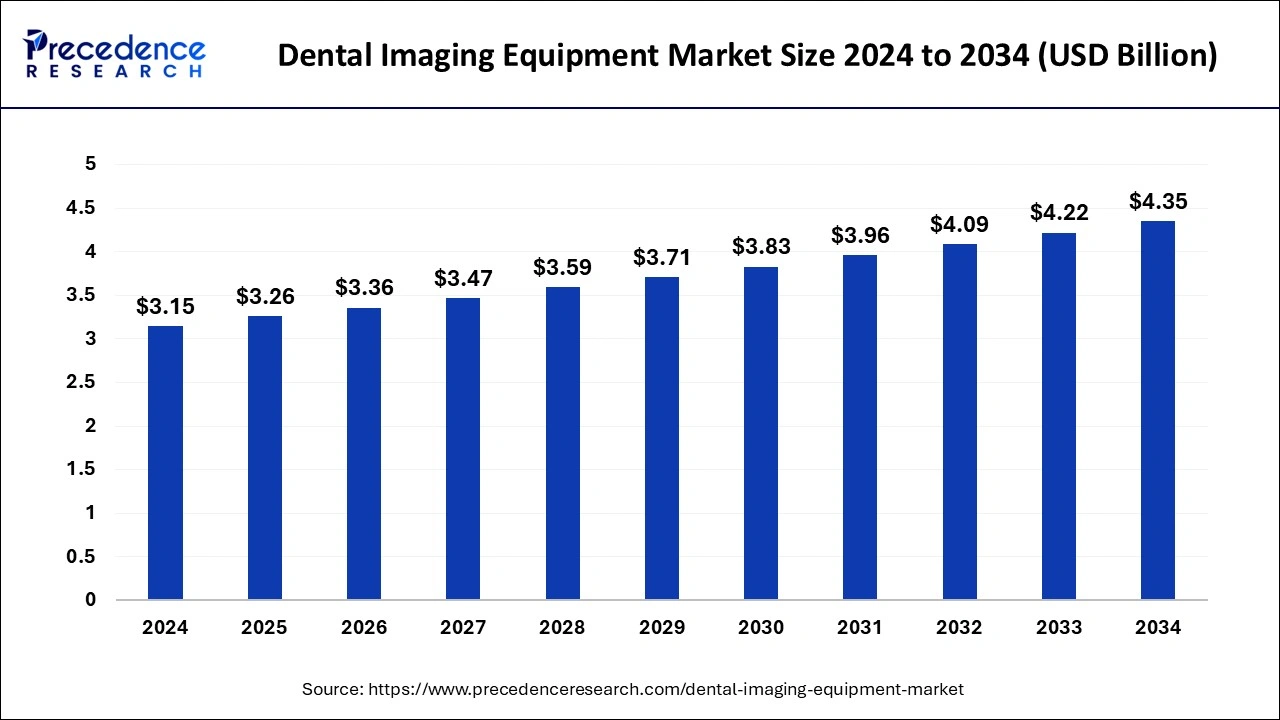

The global dental imaging equipment market size is accounted at USD 3.26 billion in 2025 and is forecasted to hit around USD 4.35 billion by 2034, representing a CAGR of 3.28% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental imaging equipment market size accounted for USD 3.15 billion in 2024 and is predicted to increase from USD 3.26 billion in 2025 to approximately USD 4.35 billion by 2034, expanding at a CAGR of 3.28% from 2025 to 2034. Technological innovations that improve patient comfort and diagnostic capabilities, like intraoral scanners, digital radiography, and cone beam computed tomography (CBCT), are propelling the expansion of the market.

A variety of technologies and tools utilized in dentistry diagnosis, treatment planning, and patient communication are included in the dental imaging equipment market. This market comprises software solutions for image processing and analysis, as well as a variety of imaging modalities such as intraoral, extraoral, and handheld devices. Due to reasons such as the increased incidence of dental problems, the growing demand for cosmetic dentistry, and technological developments in imaging modalities, the market for dental imaging equipment has been growing steadily.

The dental imaging equipment market has advanced recently, with an emphasis on workflow efficiency, radiation exposure reduction, picture quality improvement, and integration with other dental systems like CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing). Individual teeth and the structures around them can be seen in great detail thanks to intraoral X-ray devices and sensors. They are frequently employed to measure bone levels, examine dental roots, and find cavities. Cone beam computed tomography (CBCT), cephalometric X-rays, and panoramic X-rays are examples of extraoral imaging modalities. These methods offer more comprehensive views of the entire mouth, jaw, and skull, which makes them helpful for detecting temporomandibular joint disorders (TMJ), placing implants, and organizing orthodontic treatment. Particularly when used in mobile dentistry clinics or in spaces with restricted space, portable X-ray machines, and handheld intraoral cameras provide flexibility and convenience.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.26 Billion |

| Market Size in 2024 | USD 3.15 Billion |

| Market Size by 2034 | USD 4.35 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.28% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased awareness and focus on oral health

The dental imaging equipment market has expanded as a result of growing awareness of and emphasis on oral health. Advanced diagnostic technologies in dentistry are in higher demand as individuals realize how important it is to practice preventative dentistry and maintain good oral hygiene. As dental conditions, including cavities, periodontal diseases, and oral cancer, become more common, there is an increasing demand for accurate diagnostic imaging technologies to support early identification and successful treatment. For intricate dental treatments, including the placement of dental implants, orthodontics, and endodontics, computed tomography (CBCT) equipment is indispensable because it provides three-dimensional imaging with minimal radiation exposure.

Concerns about radiation exposure

Radiation exposure must be kept to a minimum for patient safety. Dental practitioners should adhere to stringent policies and procedures to guarantee that patients get the least amount of radiation required for diagnostics. Dental practitioners must have the appropriate education and training in order to comprehend the hazards of radiation exposure and how to reduce them. This covers methods to minimize needless radiation scatter, such as employing suitable collimation, shielding, and placement. Dental offices should set up procedures for routinely assessing the radiation doses given to employees and patients. This makes it possible to make modifications as needed and helps guarantee that radiation exposure stays below safe limits.

Increasing dental disorders

The dental imaging equipment market may expand as a result of the increase in dental problems. Accurate diagnosis and treatment planning are more important as dental problems grow more common. These processes frequently rely significantly on sophisticated imaging technology like intraoral scanners, digital X-rays, and cone beam computed tomography (CBCT). With the use of these technologies, dentists may more accurately plan treatments, identify issues early on, and effectively track patient progress. There is a growing need for dental imaging services as more people seek preventive dental treatment and become more conscious of oral health issues. This trend is especially apparent in older populations since dental issues tend to grow more prevalent.

The intraoral X-ray systems segment held the largest share of the dental imaging equipment market and is expected to continue this dominance during the forecast period. Dental professionals rely heavily on intraoral X-ray devices to take precise pictures of the teeth, gums, and surrounding tissues. They are frequently employed in the diagnosis of dental conditions such as gum disease, cavities, and tooth trauma. Intraoral X-ray devices are in high demand due to the prevalence of dental ailments such as cavities and periodontal diseases. Intraoral X-rays and other diagnostic technologies are becoming more and more necessary as the population ages and knowledge of oral health issues rises. Comprehensive diagnostics is becoming more and more important to dentists when it comes to treatment planning and patient care. The need for sophisticated imaging technology, such as intraoral X-ray devices, is fueled by this growth.

The extraoral X-ray systems segment is expected to gain a significant share during the forecast period. Dental imaging technology is incomplete without extraoral X-ray systems, which provide dentists with a wider picture of a patient's oral anatomy. Typically, the entire mouth, jaw, and surrounding structures are imaged using these devices. They are especially helpful in the detection of impacted teeth, TMJ evaluations, and orthodontic assessments. Extraoral X-ray systems serve a range of purposes in dental offices, from tiny clinics to big dental hospitals, according to the dental imaging equipment industry. Numerous modalities, including cone-beam computed tomography (CBCT) scans, cephalometric X-rays, and panoramic X-rays, are frequently included with these systems. Technological developments, rising dental care costs, and the global increase in dental problems all have an impact on the extraoral X-ray systems market.

The hospital segment dominated the dental imaging equipment market. The segment includes a range of imaging technologies that are utilized for diagnosis and treatment planning in hospitals and dental clinics. Even while dental imaging isn't usually done in hospitals, some larger hospitals do have special dental clinics or departments where they provide dental services, including imaging. With minimal radiation exposure, CBCT scanners offer precise 3D images of the teeth, jawbone, nerves, and other components. These devices take precise pictures of individual teeth or tiny areas of the mouth, which are helpful for evaluating the structure of teeth and spotting cavities. For a more thorough diagnosis, these devices take pictures of the complete head, including the teeth, jaws, and skull.

The ambulatory surgical centers segment is expected to obtain a notable share during the forecast period. Ambulatory surgery centers, or ASCs, are becoming more and more important in the healthcare industry, especially in niche fields like dental imaging. Compared to traditional hospital settings, ASCs provide outpatient surgical operations, including dental surgery, in a more convenient and economical setting. ASCs' emphasis on performance, patient satisfaction, and cost-effectiveness has made them important clients. Dental imaging devices, like intraoral cameras, panoramic X-ray machines, and cone beam computed tomography (CBCT) machines, are critical diagnostic and therapeutic tools for a variety of dental disorders. ASCs look for affordable options that provide superior imaging to satisfy their patients' demands and be profitable.

North America led the global dental imaging equipment market in 2024 and is expected to hold its position over the forecast period. The rising incidence of dental problems, the development of imaging technologies, and the rising demand for cosmetic dentistry were the main drivers of the dental imaging equipment market's continuous expansion in North America.

Cone beam computed tomography (CBCT) systems were becoming more and more common because, in contrast to conventional CT scans, they could produce high-resolution 3D images with less radiation exposure. The use of digital imaging technology, such as intraoral scanners and digital X-ray systems, resulted from a growing trend of digitalization in dentistry. These technologies provide advantages like more effective workflow, better image quality, and simpler patient data storage and retrieval.

Asia Pacific is also expected to grow at the fastest CAGR during the forecast period. The region's dental imaging equipment market has grown significantly in the last several years. The market is expanding due to factors including a growing geriatric population, rising dental tourism, increased awareness of oral health, and technical developments in imaging modalities.

The Asia Pacific dental imaging equipment market is expanding thanks in large part to the efforts of nations like Australia, South Korea, Japan, China, and India. Due to their vast populations and rising disposable incomes, these nations have an increased need for dental equipment and services. The industry is growing even faster thanks to the growing use of sophisticated software solutions for picture analysis and diagnostics. Efficient image processing, analysis, and interpretation are made possible by these software tools, which improve treatment planning and diagnostic precision.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023