November 2024

The global DNA synthesis market size is accounted at USD 5.93 billion in 2025 and is forecasted to hit around USD 29.98 billion by 2034, representing a CAGR of 19.73% from 2025 to 2034. The North America market size was estimated at USD 1.97 billion in 2024 and is expanding at a CAGR of 19.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global DNA synthesis market size accounted for USD 4.97 billion in 2024 and is predicted to increase from USD 5.93 billion in 2025 to approximately USD 29.98 billion by 2034, expanding at a CAGR of 19.73% from 2025 to 2034.

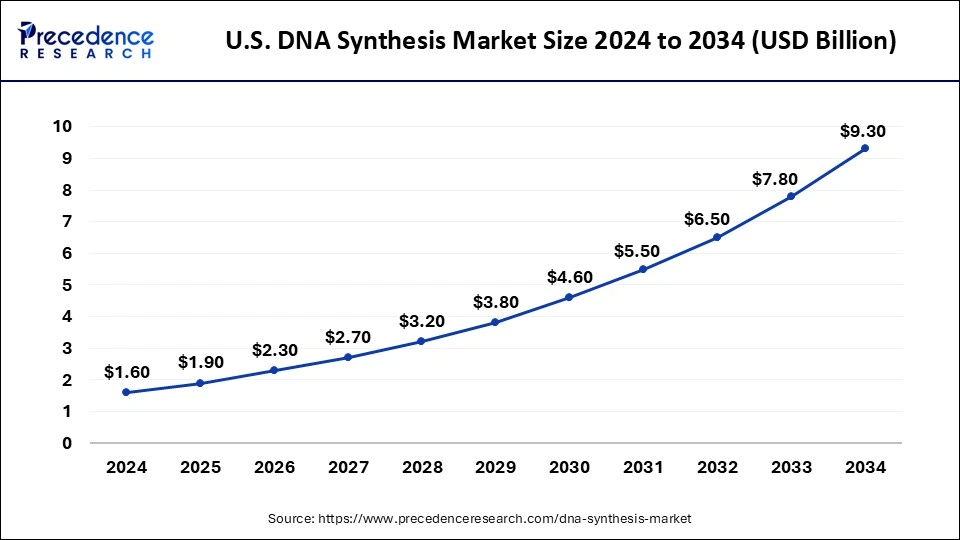

The U.S. DNA synthesis market size was exhibited at USD 1.60 billion in 2024 and is projected to be worth around USD 9.30 billion by 2034, growing at a CAGR of 19.10% from 2025 to 2034.

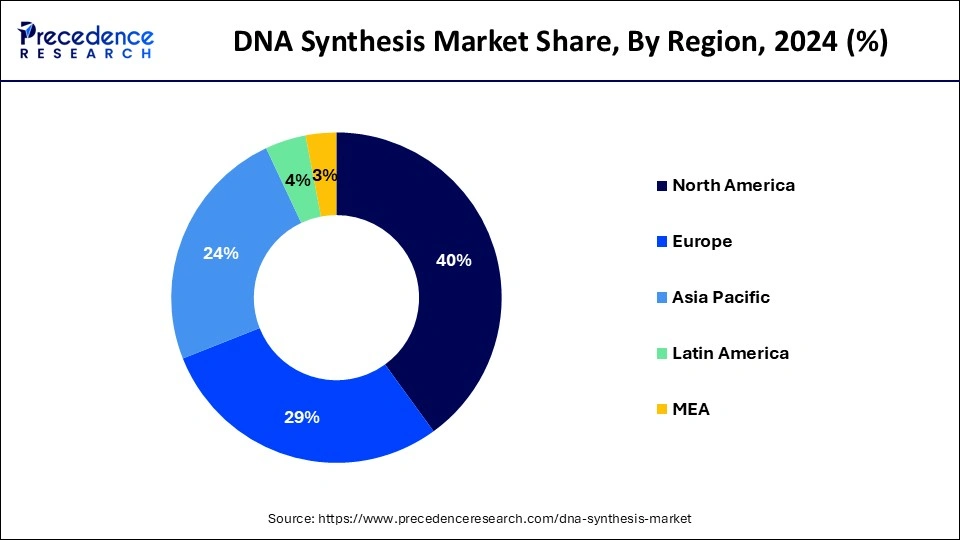

North America is leading the DNA synthesis market as it has a strong research and development infrastructure, which is crucial for DNA synthesis. The presence of leading research institutions, universities, and biotech companies in the region has created a favorable environment for the growth of the DNA synthesis market. The demand for synthetic genes is increasing rapidly in North America, driven by the need for new drugs, vaccines, and biologics.

This has led to an increase in the number of companies offering DNA synthesis services and products in the region. The government of North America has implemented several policies to support the development of the biotech industry, including DNA synthesis. This has created a favorable regulatory environment for the growth of the DNA synthesis market in the region.

As the Asia-Pacific region is home to some of the world's most populous countries, including China and India, it is a significant market for the DNA synthesis industry. The growth in biotechnology and life sciences research in the region has also contributed to the increasing demand for DNA synthesis products and services. The Asia-Pacific region has seen significant investments in research and development, especially in genomics and personalized medicine, which has increased the demand for DNA synthesis technologies. Additionally, the increasing awareness of genetic diseases and their diagnosis and treatment has further contributed to the growth of the DNA synthesis market in the region. Moreover, the growing number of research collaborations and partnerships among academic and industry players in the Asia-Pacific region has facilitated the development of innovative DNA synthesis technologies and services.

The DNA synthesis market refers to the industry that is involved in the production and sale of synthetic DNA, which is also known as artificial or engineered DNA. Synthetic DNA is created by chemical synthesis, rather than by natural biological processes, and is used in a wide range of applications, including genetic research, drug discovery, and the development of new biotechnology products. The DNA synthesis market is expected to grow in the coming years, as advances in synthetic biology and gene editing techniques drive the development of new applications for synthetic DNA.

The market is highly competitive and dominated by a few key players such as Twist Bioscience Corporation, Integrated DNA Technologies, Eurofins Scientific, and GenScript Biotech Corporation. These companies are constantly investing in R&D to develop new technologies and expand their product portfolios, which is expected to drive the growth of the market in the coming years.

Advances in DNA synthesis technology have enabled faster and more efficient synthesis of DNA sequences. This has led to increased demand for DNA synthesis services and products. For instance, companies such as Twist Bioscience and GenScript are investing heavily in developing advanced DNA synthesis platforms that can create synthetic genes up to several thousand base pairs in length.

Many governments around the world have been investing heavily in genomics research, which has increased the demand for DNA synthesis services and products.

The use of synthetic DNA in personalized medicine is an emerging field. With the increasing focus on personalized medicine, the demand for custom DNA sequences and synthetic genes is expected to grow. Synthetic DNA can be used to create personalized treatments for individuals based on their genetic makeup, which can improve the efficacy of treatments and reduce the risk of side effects. For instance, three next-generation sequencing (NGS) targeted enrichment panels have been released, according to a joint announcement by Twist Bioscience Corporation and Centogene N.V., to aid in the study of uncommon diseases, hereditary cancers, and diagnostics.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.93 Billion |

| Market Size by 2034 | USD 29.98 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.73% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Application, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for synthetic genes and DNA sequences

With advancements in synthetic biology and genetic engineering, the demand for synthetic genes and DNA sequences has been increasing rapidly. Synthetic genes and DNA sequences can be used to create new enzymes, proteins, and other molecules with specific properties, which can be used in various applications. Moreover, advances in DNA synthesis technology have made it easier and cheaper to synthesize genes and DNA sequences. This has led to an increase in demand for synthetic genes and DNA sequences, as well as a decrease in the cost of DNA synthesis. These synthetic genes and DNA sequences are used in a variety of applications, such as gene therapy, drug development, and agricultural biotechnology. For instance, Evonetix describes DNA synthesizer technology that will speed development across multiple therapeutic modalities.

Growing Applications in the Agriculture and Food Industry

DNA synthesis is used in agriculture for the improvement of crops, including the development of genetically modified organisms (GMOs), gene stacking, and trait introgression. DNA synthesis is used to engineer genetically modified (GM) crops with desirable traits, such as increased yield, enhanced disease resistance, improved nutritional content, and tolerance to environmental stresses. By synthesizing specific DNA sequences and introducing them into plant genomes, scientists develop crops with targeted genetic modifications. Furthermore, many farming operations such as crop cultivation cause alterations in DNA gene expression. DNA technology is used to detect the changes in levels that assist in the regulation of crop development and growth.

Additionally, it is also utilized in the food industry to produce enzymes, flavors, and food additives through metabolic engineering approaches. DNA synthesis is used in the development of functional foods which are enriched with specific nutrients and proactive or bioactive compounds. DNA synthesis enables the development of synthetic DNA standards for use in food safety testing. These standards are able to be used to verify the accuracy and reliability of molecular detection methods, such as polymerase chain reaction (PCR), in detecting allergens, contaminants, and genetically modified organisms (GMOs) in food products. Synthetic DNA is also used to develop reference materials for quality control and proficiency testing programs. DNA synthesis contributes to sustainable agriculture practices. For instance, synthetic DNA is used to engineer microorganisms capable of fixing atmospheric nitrogen, reducing the need for synthetic fertilizers. Along with this, DNA synthesis decreases the use of chemical pesticides, which impact the environment by developing biopesticides, which are derived from natural sources.

An investment of USD 178 million was made by the U.S. Department of Energy for various bioenergy projects to advance sustainable technology, which helps to enhance public health. Along with this, it also aids in improving the production of agriculture and food as well as developing a more robust supply chain.

Technological Advancements

Various technological advancements are going on in the DNA synthesis market. Investors and firms are mainly benefiting from the advancement in DNA synthesis. These innovations are made to expand the capabilities and reduce the cost. Some high-throughput DNA synthesis platforms are developed to develop DNA at a larger scale and faster rate. Next-generation synthesis methods, such as microarray-based synthesis, massively parallel synthesis, and enzymatic synthesis, have enabled high-throughput production of DNA sequences. The platforms produce thousands of DNA sequences simultaneously. Additionally, the current DNA synthesis technologies include error correction techniques to improve the accuracy of DNA sequences. For instance, methods such as overlap assembly assist in the removal or elimination of errors and increase reliability.

Furthermore, Next-Generation Sequencing technologies have changed DNA synthesis by enabling high-throughput sequencing at a lower price. Along with this, these sequencing platforms have improved the accuracy and speed of DNA synthesis, which accelerates research in genomics. Numerous DNA assembly techniques, such as Gibson assembly, have emerged to accelerate the construction of larger DNA sequences and genetic structures. Along with this, the advancement in DNA synthesis has also contributed to the development of DNA nanotechnology. This helps in drug delivery systems, biosensors, and nanoelectronics. For instance, the patent was granted to the thermal control technology by Evontix Ltd. for DNA synthesis in April 2022.

Some technologies, such as CRISPR technology, provide better precision in gene editing tools which are able to alter DNA in animals, bacteria, and plants. This is highly efficient in implementing and identifying therapies for diseases such as Alzheimer, cancer, etc. Furthermore, DNA has the ability to encode vast amounts of data in the form of dense groups of oligonucleotides. The advanced technology CRISPR uses DNA synthesis to develop modified DNA which helps to correct genetic defects. Along with this, DNA synthesis is used in other fields like drug development, agriculture, research, and biotechnology.

Increasing Accessibility

DNA synthesis is an artificial construction of DNA molecules using laboratory techniques. DNA sequencing has become an important tool in various sectors, such as molecular biology, biotechnology, genetic engineering, and synthetic biology. DNA synthesis technology is easily accessible and is available to a broad range of customers or users, such as researchers, scientists, and others. DNA sequencing develops user-friendly platforms and software for ordering and designing DNA. Along with this, open-source initiatives and protocols are also anticipated to fuel the market of DNA synthesis. Various training programs, workshops, and educational resources are provided on DNA synthesis techniques which are able to empower researchers and scientists with skills to utilize DNA synthesis.

Furthermore, there is continuous advancement in DNA synthesis technologies, such as higher throughput, which leads to a reduction in cost. These platforms synthesize multiple DNA sequences simultaneously, reducing the time required for large-scale DNA synthesis. For instance, a variety of next-generation sequencing and DNA microarray technologies have been developed to significantly increase the efficiency of DNA synthesis. Additionally, the government is providing financial support and research funding to scientists to promote more projects utilizing DNA synthesis technology. A variety of transgenic techniques are used to enhance the quality and yield of synthetic DNA.

High Cost

DNA synthesis involves complex chemical reactions and requires advanced equipment. Various steps are involved in the synthesis process, such as nucleotide coupling, purification, and deprotection. These multiple steps are time-consuming and require a large number of resources. Along with this, the DNA synthesis process is dependent on the availability of high-quality raw materials such as reagents and enzymes. The cost of raw materials contributes to the overall cost of the process. Additionally, continuous advancements in DNA synthesis technologies require substantial investment in research and development (R&D). Companies invest heavily in improving synthesis methods, increasing yield, and developing new chemistries, all of which add to the cost.

The cost per base pair of synthesized DNA decreases with scale. Larger-scale production is able to take advantage of economies of scale, reducing the cost per unit. However, smaller-scale custom synthesis or specialized applications may still incur higher costs due to lower volume and more specific requirements. Furthermore, enzymatic DNA synthesis is still in its initial stage, and optimization is essential before use. A deoxynucleotidyl transferase (TdT) method is commonly used to improve the procedure and avoid the production of waste. However, the low accuracy, as well as the high cost associated with this method, acts as a barrier in in-vitro DNA synthesis. Along with this, it is a complex procedure as more reagents are added to develop the target sequence. As per a survey, the standard cost of the base is 10 cents. Hence the total cost to build a gene will be approximately $300. This means the synthesis of one small molecule might cost up to $200,000.

Synthesis Errors and Quality Control

The process of DNA synthesis is not free of errors, and errors might take place. These errors result in the production of DNA sequences that differ from the intended design, which leads to inaccuracies in the final product. Maintaining high-quality control standards and minimizing synthesis errors are ongoing hindrances for DNA synthesis companies. Ensuring accurate synthesis becomes necessary, especially for applications like gene therapy or DNA-based diagnostics. Manufacturers verify the accuracy of synthesized DNA sequences by performing DNA sequencing. This involves comparing the synthesized sequence with the intended design to identify any discrepancies. The quantity of synthesized DNA is determined using various methods such as UV spectroscopy or quantitative PCR (qPCR). This ensures that the desired amount of DNA is synthesized. In addition to sequence verification, manufacturers may perform functional tests to assess the performance of synthesized DNA. These tests involve cloning the DNA into a host organism and evaluating its functionality in various assays. Even though purification is done, some errors which remain in the DNA synthesis process will be carried out during the assembly procedure. Errors may also take place due to mis-hybridization or polymerase elongation.

Growing Demand for Personalized Medicine

DNA synthesis assists in the development of life-saving drugs. Personalized medicine is a drug that is specific therapeutics suited to a patient. It is based on pharmacogenomics, pharmacogenetics, pharmacometabolomic, and pharmacoproteomic information. It helps in enhancing the early detection and prevention of various disorders and monitoring therapy. Personalized medicine is also defined as improved healthcare by implementing preventive medicine, rational drug development, monitoring of therapy, and early detection of disease. Scientists are using gene synthesis to develop personalized medicine for patients with specific genetic variations and mutations. DNA synthesis plays a vital role in the development of DNA-based diagnostic tests. These tests utilize synthetic DNA probes or primers to detect specific genetic sequences associated with diseases, pathogens, or genetic variations. The increasing demand for personalized medicine and precision diagnostics has driven the growth of DNA-based diagnostics.

Furthermore, the development of gene therapies is a growing field that requires the synthesis of DNA for the delivery of therapeutic genes. The need for synthetic DNA for gene therapy is anticipated to increase considerably during the forecasted years. Synthetic DNA is utilized in forensic science to develop synthetic DNA samples that are able to be used to validate analytical procedures and calibrate forensic equipment. The demand for DNA synthesis in forensic science is predicted to rise as the technology is more widely used. Researchers are using gene synthesis to design custom DNA chains that are used to design personalized treatments for patients with specific genetic variations or mutations. For instance, scientists are able to target cancer antigens specific to each patient by employing gene synthesis to produce personalized cancer vaccines. As per the National Center for Biotechnology Information (NCBI), 9.4% of pediatric patients suffered from genetic disorders, of which approximately 44.7% were newborns. Additionally, almost 13.17 million patients suffer from genetic disorders in the U.S.

The segment that had the biggest share was oligonucleotide DNA synthesis. A strand of nucleotides is used to selectively create oligonucleotides with base pairs. They are most frequently utilized as biological process primers and probes. The oligonucleotide synthesis method is a quick and affordable way to create the oligonucleotide sequences that you want. Also, businesses are launching unique items through strategic initiatives, which are predicted to drive the industry.

Throughout the forecast period, it is anticipated that gene DNA synthesis will increase dramatically. Bespoke gene synthesis gets around the drawbacks of PCR-based methods.

It produces DNA constructions with confirmed sequences that are trustworthy, secure, and economical. Moreover, gene engineering provides a dependable, affordable technique for producing extremely accurate, personalized DNA constructions. Modern biology has been altered by DNA synthesis, a potent molecular biology technique that is gradually taking control of the scientific process.

| Service | 2022 | 2023 | 2024 |

| Oligonucleotide Synthesis | 1,371.2 | 1,649.8 | 1,986.4 |

| Gene Synthesis | 2,128.8 | 2,518.7 | 2,982.5 |

Research and Development (R&D) holds the largest market globally, its activities in the biotechnology and pharmaceutical industries often require large quantities of custom DNA sequences for various applications such as gene expression analysis, drug discovery, and vaccine development. DNA synthesis companies cater to these needs by offering custom DNA synthesis services that allow researchers to design and order specific DNA sequences tailored to their research needs.

Moreover, the growing interest in synthetic biology has led to increased R&D efforts in this field, with many researchers working on developing novel biological systems using synthetic DNA. This has further fueled the demand for DNA synthesis services, as custom-designed DNA sequences are required for the construction of synthetic biological systems. Overall, the R&D segment of the DNA synthesis market is expected to continue to grow as research activities in biotechnology, pharmaceuticals, and synthetic biology continue to expand.

| Application | 2022 | 2023 | 2024 |

| Research & Development | 1,584.3 | 1,880.5 | 2,234.0 |

| Therapeutics | 1,216.8 | 1,453.3 | 1,737.3 |

| Diagnostics | 698.9 | 834.6 | 997.5 |

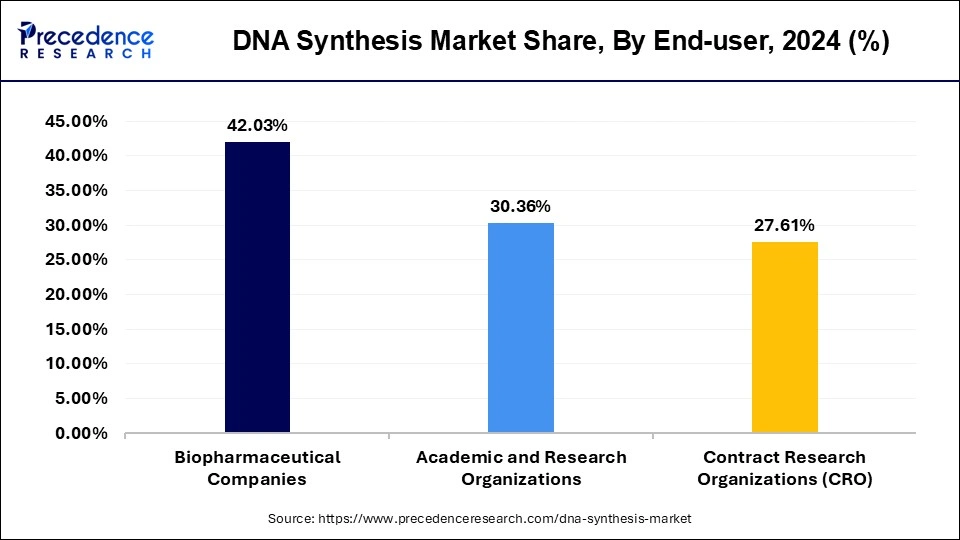

Biopharmaceutical companies are leading the DNA synthesis market. One key area is in the production of synthetic genes, which are used in the development of gene therapies and vaccines. These companies have invested in state-of-the art DNA synthesis technologies that allow for the rapid and efficient production of high-quality synthetic genes. Biopharmaceutical companies often have extensive intellectual property portfolios, which include proprietary DNA sequences.

By controlling the production of these sequences through in-house or partner DNA synthesis capabilities, they can protect their intellectual property and maintain a competitive advantage. Many biopharmaceutical companies have formed strategic partnerships with DNA synthesis companies to access the latest technologies and expertise in the field. This allows them to stay at the forefront of the industry and develop innovative new treatments.

By Service

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

February 2025

March 2025