August 2024

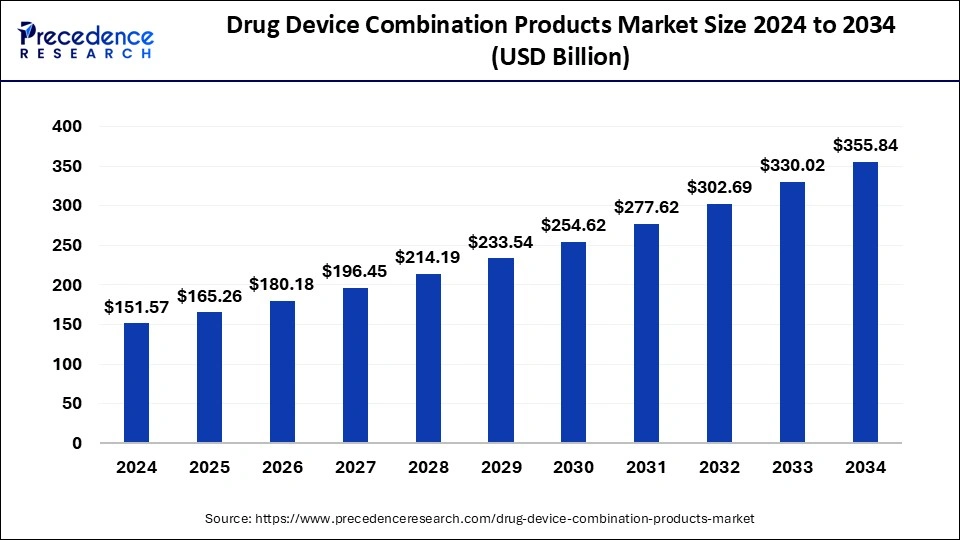

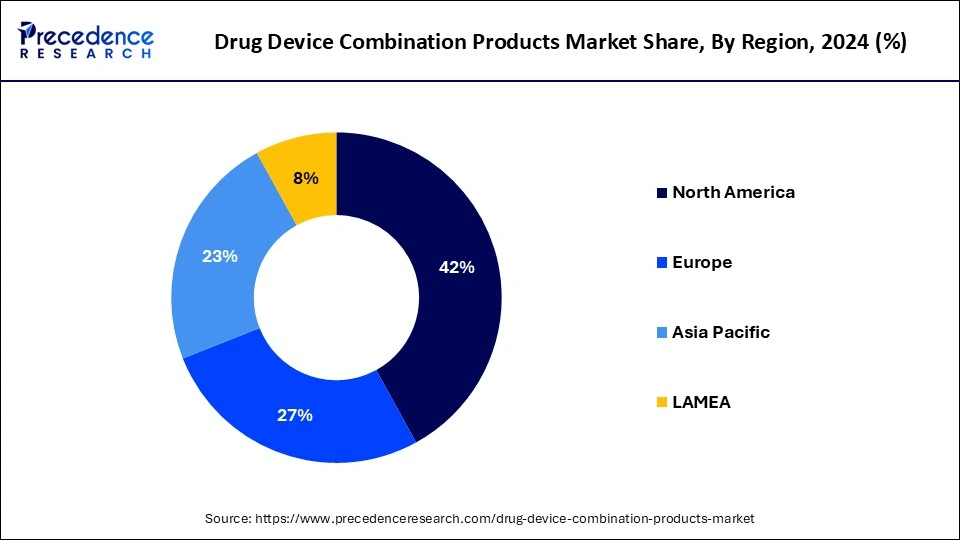

The global drug device combination products market size is calculated at USD 165.26 billion in 2025 and is forecasted to reach around USD 355.84 billion by 2034, accelerating at a CAGR of 8.91% from 2025 to 2034. The North America drug device combination products market size surpassed USD 63.66 billion in 2024 and is expanding at a CAGR of 8.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global drug device combination products market size was estimated at USD 151.57 billion in 2024 and is predicted to increase from USD 165.26 billion in 2025 to approximately USD 355.84 billion by 2034, expanding at a CAGR of 8.91% from 2025 to 2034. The need for combination products that are easy to use is increased by the trend towards home-based healthcare services, particularly in the aftermath of the COVID-19 epidemic.

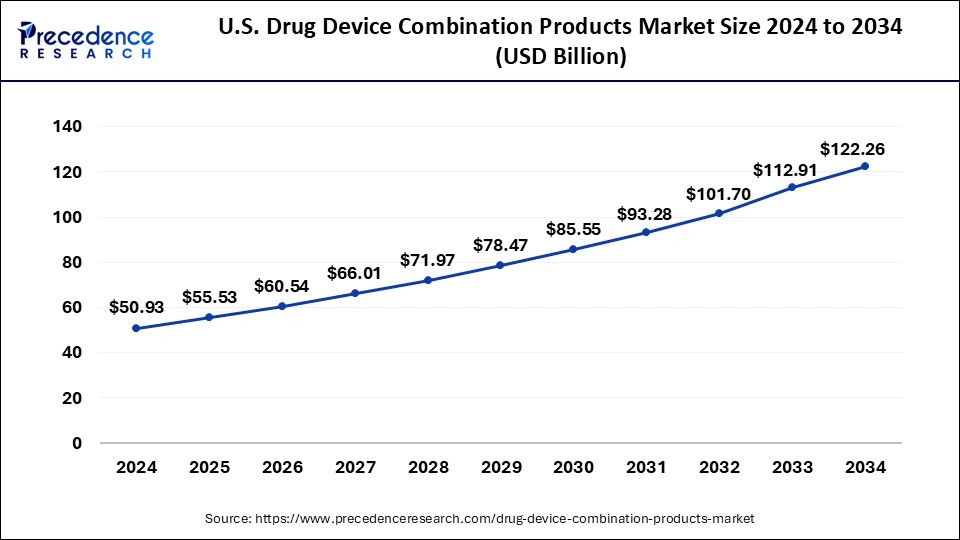

The U.S. drug device combination products market size was exhibited at USD 50.93 billion in 2024 and is projected to be worth around USD 122.26 billion by 2034, poised to grow at a CAGR of 9.15% from 2025 to 2034.

North America held the largest share of the drug device combination products drug device combination products market in 2024. The market for drug device combinations in North America is expanding at a rapid pace, mostly due to the increased occurrence of chronic illnesses like diabetes, cancer, and cardiovascular diseases. New product development and launch are aided by the U.S. FDA's efficient approval processes and strict quality standards. This trend is demonstrated by recent approvals, such as the BD Alaris Infusion System and Biocorp's Mallya diabetes treatment device. The growing prevalence of chronic illnesses needs effective management strategies. For instance, 38.4 million Americans suffer from diabetes, which highlights the need for cutting-edge insulin delivery devices like infusion pumps and auto-injectors.

Asia Pacific is expected to host the fastest-growing drug device combination products market during the projected period. In the upcoming years, the Asia-Pacific region's market for drug-device combination goods is expected to increase significantly. The market is being pushed by a rise in the prevalence of chronic diseases, rising healthcare spending, and increased healthcare professionals' awareness of the benefits of these products. This rise is attributed to the region's enormous population as well as the growing acceptance of cutting-edge medical technologies. The market is also being driven by the increasing prevalence of chronic illnesses like diabetes, cardiovascular diseases, and respiratory ailments, as well as the need for tailored therapy. Regulatory regimes that expedite product approvals and the creation of novel combination goods contribute to the market's expansion.

Therapeutic and diagnostic products that mix pharmaceuticals, devices, and/or biological components are known as drug-device combination products. Because these products can improve therapy efficacy and safety, their popularity is growing. They are frequently used to treat conditions like diabetes, respiratory issues, cardiovascular illness, and more. An increase in the prevalence of respiratory illnesses, cardiovascular ailments, and diabetes

Stents are frequently used in cardiovascular conditions and release medication to stop artery blockage. The largest drug device combination products market is a result of a vast patient base, significant healthcare spending, and sophisticated healthcare infrastructure. Growth in customized drug-device combo products that are made to meet the demands of each patient individually.

The drug device combination products market is expected to develop significantly due to factors like aging populations, increased chronic disease prevalence, and technological advancements. Even though there are obstacles in the way, continued innovation and supportive regulations should drive the sector forward. To address the changing demands of the healthcare industry, major firms are concentrating on creating cutting-edge, customized solutions.

IoT and AI integration for more intelligent and effective medication delivery systems. Accelerating the creation of wearable technology to give drugs continuously. The drug device combination products market access may be impacted by regional variations in reimbursement laws. The fastest-growing region is being driven by population growth, rising healthcare spending, and expanding awareness of cutting-edge medical treatments.

| Report Coverage | Details |

| Market Size by 2034 | USD 355.84 Billion |

| Market Size in 2025 | USD 165.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Personalized medicine

Precision medicine, another name for personalized medicine, adjusts medical care to each patient's unique needs. This strategy is revolutionizing the market for drug-device combo goods by combining tailored medicines with cutting-edge diagnostic technologies. Finding biomarkers is critical to personalized medicine. These biomarkers are found by diagnostic technologies, which makes it possible to tailor medication regimens.

Companion diagnostics can assess a patient's likelihood of benefiting from a specific targeted medication. Treatment regimens can be modified in real-time thanks to the constant patient data collection provided by wearable technology and mobile health applications. Treatments are dynamically adapted to the patient's present state according to this data-driven method.

Supply chain vulnerabilities

There are multiple supply chain vulnerabilities in the drug device combination products market. Goods include products like transdermal patches, pre-filled syringes, inhalers, and drug-coated stents. These weaknesses may have a major effect on these essential healthcare goods' costs, quality, and availability. It can be difficult and time-consuming to ensure compliance with rules regarding both drugs and medical devices, which could cause delays.

Products must adhere to the regulatory standards set forth by the agencies that oversee medical devices and pharmaceuticals, which may differ greatly. Getting regulatory body permission can be a drawn-out procedure that causes delays in product release. Quick technical progress can make current items outdated, necessitating ongoing investment in new technology.

Digital health integration

A major step forward in healthcare is represented by digital health integration in the drug device combination products market, which aims to enhance patient outcomes, adherence, and overall healthcare efficiency. Digital health technology (such as Bluetooth, sensors, and mobile apps) can be integrated into these items to improve their functionality.

Sensors can track consumption and dose, giving patients and medical professionals access to real-time data. By tracking adherence, informing patients of possible problems, and serving as a reminder for medicine take-home, digital health technologies can increase patient adherence rates. With easy access to their health data and real-time feedback, patients take a more active role in their own care.

The transdermal delivery system segment led the global drug device combination products market in 2024. Many drugs, such as painkillers, hormone replacement therapy, nicotine replacement therapy, and prescriptions for ailments like motion sickness and hypertension, are delivered via transdermal patches. Transdermal administration methods have a number of benefits over oral drugs, such as regulated drug release, fewer adverse effects, avoiding the liver's first-pass metabolism, and longer-lasting drug action.

It is anticipated that the market for transdermal medication delivery will keep expanding due to reasons such as an aging population, a rise in the incidence of chronic illnesses, and improvements in drug formulation and delivery technologies. Transdermal delivery methods have advantages, but they also have drawbacks, including the requirement for specialized formulation and manufacturing procedures, skin irritation or sensitization, and limited drug penetration through the skin.

The inhaler segment is expected to grow at a significant rate in the drug device combination products market during the forecast period. Due to a number of factors, including the rising prevalence of respiratory conditions like asthma and COPD (chronic obstructive pulmonary disease), advancements in inhaler technology, and the growing need for practical and efficient drug delivery systems, the market for inhalers within drug-device combination products has been experiencing significant growth.

The market for inhalers is expanding due to the move toward environmentally friendly propellants as well as the creation of smart inhalers with sensors and networking features for data analysis and real-time monitoring. With the growing need for more effective treatments for respiratory illnesses and the development of more sophisticated and effective inhaler devices due to technological improvements, the market for medication device combination products is expected to increase in the inhaler segment.

The respiratory problem segment dominated the drug device combination products market in 2024. It can be difficult to develop and obtain regulatory approval for drug-device combination solutions, particularly in the respiratory market. In the U.S., regulatory organizations such as the FDA have strict guidelines pertaining to quality control, safety, and efficacy. It could be challenging to guarantee patient adherence to treatment plans, even with cutting-edge medication delivery systems. Unsatisfactory treatment results could result from things like soreness, inconvenience, and using the wrong technique. Cost-effectiveness is an important consideration, particularly in light of the chronic nature of respiratory disorders. For producers, striking a balance between innovation, quality, and price can be difficult. Drug-device combination products with intricate supply chains may have logistical difficulties in maintaining inventory and guaranteeing timely component availability.

The antimicrobial segment is expected to grow rapidly in the drug device combination products market in the upcoming years. The use of antimicrobials in drug-device combination products is essential for reducing the risk of infections brought on by medical equipment. Combination products are becoming more and more common in a number of medical specialties, including wound care, orthopedics, cardiovascular treatments, and urology.

They usually consist of a medical device and a pharmaceutical component (such as medicines or biologics). These goods contain a variety of antimicrobial compounds, such as antiseptics, antibiotics, and antimicrobial coatings. These agents could be coated on the device, released gradually, or integrated into the material of the device itself. Notwithstanding the advantages, there are drawbacks to using antibiotics in medical devices, including the rise in antibiotic resistance and legal restrictions.

The hospitals & clinics segment held the largest share of the drug device combination products market in 2024. The pharmaceutical and medical sectors should both place a strong emphasis on the hospital and clinic section of the drug-device combo goods market. Products in this category combine medication and medical equipment in an effort to enhance the convenience, safety, and effectiveness of treatments given in hospital settings. The market for combination goods is driven by rising rates of diseases like diabetes, cardiovascular disorders, and respiratory ailments. The need for cutting-edge medical therapies that drug-device combos can offer is growing as the world's population ages. To be approved for the market, a product must undergo comprehensive clinical trials and adhere to Good Manufacturing Practices (GMP).

The ambulatory surgical center segment is expected to grow at a notable rate in the drug device combination products market during the forecast period. Within the market for drug-device combination goods, the ambulatory surgery center (ASC) segment is a substantial and expanding market. ASCs are medical establishments dedicated to offering same-day surgical care, including examinations and prophylactic treatments. There is a growing trend toward less invasive procedures, which frequently call for sophisticated drug-device combo solutions. These goods improve the efficiency and security of the processes carried out in ASCs. Because ASCs are more affordable than hospital-based outpatient operations, they draw more patients and increase the market for novel drug-device combinations. Complicated regulatory processes associated with combining medications and devices might cause delays in product approvals and market entry.

By Application

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

June 2023

January 2025

November 2024